|

市場調查報告書

商品編碼

1750263

化妝品軟管包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cosmetic Tube Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

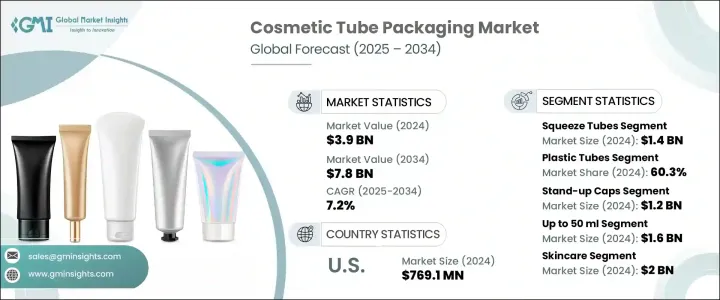

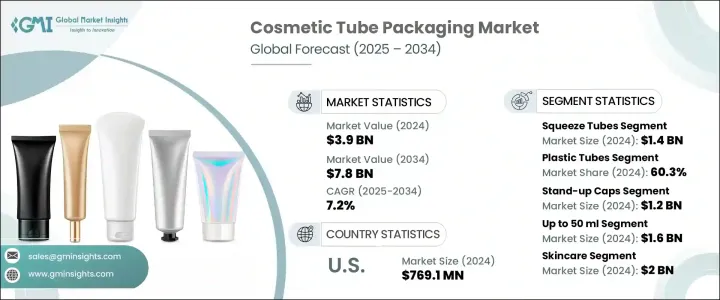

2024年,全球化妝品軟管包裝市場價值39億美元,預計到2034年將以7.2%的複合年成長率成長,達到78億美元。這主要得益於護膚品和個人護理產品需求的不斷成長、電子商務的擴張以及對功能性和永續包裝的日益重視。隨著消費者越來越關注護膚品,包括保濕霜、精華液和防曬霜等產品,對能夠確保產品安全性、便利性和便攜性的包裝的需求也日益強烈。此外,向永續解決方案的轉變促使製造商採用環保材料。高階保養品和清潔美容產品日益流行,促使各大品牌專注於打造兼具視覺吸引力和環保意識的包裝。

為了滿足日益成長的永續解決方案需求,製造商開始轉向使用環保材料進行化妝品包裝。這種轉變在化妝品產業尤其明顯,高階護膚品和清潔美容產品的流行促使各大品牌打造兼具美觀和環保的包裝。隨著消費者環保意識的增強,兼具功能性和永續性的包裝正成為人們的優先事項。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 78億美元 |

| 複合年成長率 | 7.2% |

擠壓管是該市場中最大的細分市場,2024 年市場規模達 14 億美元。這類管子因其易用性、多功能性和成本效益而備受青睞。它們特別受個人護理產品歡迎,因為它們提供衛生的包裝,並可容納液體和半固體製劑。擠壓管還支援先進的裝飾方法,增強產品的視覺吸引力,使其對消費者更具吸引力。另一個值得注意的趨勢是,隨著消費者和製造商越來越重視永續性,對單一材料可回收管的需求日益成長,尤其是在高階品牌中。

2024年,塑膠管市場佔了60.3%的市場。其柔韌性、輕質特性和相對較低的生產成本使其成為各種化妝品的理想選擇。隨著永續發展的勢頭強勁,對高密度聚乙烯(HDPE)和消費後樹脂(PCR)等環保塑膠的需求也不斷成長。這些材料有助於減少塑膠垃圾,對於那些希望順應包裝永續性發展趨勢的品牌來說,它們是一個相當吸引人的選擇。

由於護膚品和清潔美容產品需求激增,美國化妝品軟管包裝市場在2024年的價值達到7.691億美元。此外,人們對真空軟管和防篡改軟管等功能性包裝解決方案的日益青睞,也推動了市場擴張。嚴格的監管框架和消費者日益增強的環保意識,正促使品牌轉向單一材料、可回收軟管,進一步加速市場的成長。

全球化妝品軟管包裝產業的主要參與者包括 Albea SA、Berry Global Inc.、Hoffmann Neopac AG、Amcor Ltd. 和 Essel Propack Limited。這些公司正積極提升其市場地位,專注於永續性、推出創新包裝解決方案並擴展產品組合以滿足消費者不斷變化的需求。為了鞏固市場地位,Amcor Ltd. 和 Berry Global Inc. 等公司正專注於開發永續包裝解決方案,例如環保軟管和單一材料包裝。 Albea SA 正在增加對先進軟管技術的投資,強調可回收材料。同時,Essel Propack Limited 和 Hoffmann Neopac AG 正在擴大其生產能力,以滿足對真空和防篡改軟管日益成長的需求,順應消費者安全和產品完整性日益成長的趨勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 護膚品和個人護理產品需求激增

- 電子商務和直接面對消費者的管道的成長

- 具有增值功能的功能性包裝的興起

- 管線製造技術不斷進步

- 高階和小眾化妝品品牌的擴張

- 產業陷阱與挑戰

- 原物料價格波動

- 嚴格的環境法規和對塑膠使用的嚴格審查

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 擠壓管

- 扭管

- 棒管

- 無氣管

- 其他

第6章:市場估計與預測:依材料類型,2021-2034 年

- 主要趨勢

- 塑膠管

- 鋁管

- 層壓管

- 紙管

第7章:市場估計與預測:依容量類型,2021-2034

- 主要趨勢

- 直立式帽

- 噴嘴蓋

- 土耳其氈帽

- 翻蓋瓶蓋

- 其他

第8章:市場估計與預測:依產能,2021-2034

- 主要趨勢

- 最多 50 毫升

- 51毫升至100毫升

- 101毫升至150毫升

- 150毫升以上

第9章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 保養品

- 護髮

- 化妝品

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Albea Group

- ALPLA Group

- Aluminum Packaging Group (APG)

- Amcor plc

- APC Packaging

- Berlin Packaging

- Berry Global Group

- CCL Industries Inc.

- Cosmogen

- Cosmopak Corp.

- CTL Packaging

- Essel Propack Ltd.

- FusionPKG

- HCP Packaging

- HCT Packaging

- Hoffmann Neopac AG

- Huhtamaki Oyj

- Libo Cosmetics Co. Ltd.

- Mpack Poland Sp. z oo

- PR Packagings Ltd

- Prutha Packaging Pvt.Ltd..

- Quadpack Industries

- Tubex

- UKPACKCHINA

- VisiPak Inc.

The Global Cosmetic Tube Packaging Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 7.8 billion by 2034, driven by the rising demand for skincare and personal care products, the expansion of e-commerce, and a growing emphasis on functional and sustainable packaging. As consumers become increasingly focused on skincare, including products like moisturizers, serums, and sunscreens, the need for packaging that ensures product safety, convenience, and portability has intensified. Furthermore, the shift toward sustainable solutions pushes manufacturers to adopt eco-friendly materials. The increasing popularity of high-end skincare and clean beauty products has led brands to focus on creating visually appealing and environmentally responsible packaging.

In response to the growing demand for sustainable solutions, manufacturers turn to eco-friendly materials for cosmetic packaging. This shift is particularly evident in the cosmetic industry, where the popularity of high-end skincare and clean beauty products is prompting brands to create packaging that is both aesthetically appealing and environmentally responsible. As consumers become more eco-conscious, packaging that combines function and sustainability is becoming a priority.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 7.2% |

The squeeze tubes segment is the largest in this market, accounting for USD 1.4 billion in 2024. These tubes are favored for their ease of use, versatility, and cost-effectiveness. They are particularly popular for personal care products because they offer hygienic packaging and can accommodate liquid and semi-solid formulations. Squeeze tubes also allow for advanced decorating methods that enhance the visual appeal of products, making them more attractive to consumers. Another notable trend is the increasing demand for mono-material recyclable tubes, particularly among premium brands, as consumers and manufacturers prioritize sustainability.

The plastic tubes segment held a 60.3% share in 2024. Their flexibility, lightweight nature, and relatively low production costs make them ideal for a wide range of cosmetic products. As sustainability efforts gain momentum, the demand for eco-friendly plastics, such as HDPE and post-consumer resin (PCR), is rising. These materials help reduce plastic waste, making them an attractive option for brands aiming to align with the growing trend of sustainability in packaging.

U.S. Cosmetic Tube Packaging Market was valued at USD 769.1 million in 2024 due to the surge in demand for skincare and clean beauty products. Additionally, the increasing preference for functional packaging solutions, such as airless and tamper-proof tubes, is driving market expansion. Strict regulatory frameworks and growing consumer awareness regarding environmental issues are encouraging brands to transition to mono-material, recyclable tubes, further accelerating the growth of the market.

Key players in the Global Cosmetic Tube Packaging Industry include Albea S.A., Berry Global Inc., Hoffmann Neopac AG, Amcor Ltd., and Essel Propack Limited. These companies are actively enhancing their market positions by focusing on sustainability, introducing innovative packaging solutions, and expanding their product portfolios to meet the changing demands of consumers. To strengthen their market position, companies like Amcor Ltd. and Berry Global Inc. are focusing on the development of sustainable packaging solutions, such as eco-friendly tubes and mono-material packaging. Albea S.A. is increasing its investment in advanced tube technologies, emphasizing recyclable materials. Meanwhile, Essel Propack Limited and Hoffmann Neopac AG are expanding their production capabilities to meet the growing demand for airless and tamper-proof tubes, aligning with the rising trend of consumer safety and product integrity.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for skincare and personal care products

- 3.7.1.2 Growth in e-commerce and direct-to-consumer channels

- 3.7.1.3 Rise of functional packaging with value-added features

- 3.7.1.4 Increasing technological advancements in tube manufacturing

- 3.7.1.5 Expansion of premium and niche cosmetic brands

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in the prices of raw materials

- 3.7.2.2 Stringent environmental regulations and rising scrutiny on plastic usage

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Squeeze tubes

- 5.3 Twist-up tubes

- 5.4 Stick tubes

- 5.5 Airless tubes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Plastic tubes

- 6.3 Aluminum tubes

- 6.4 Laminate tubes

- 6.5 Paper-based tubes

Chapter 7 Market Estimates & Forecast, By Cap Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Stand-up caps

- 7.3 Nozzle caps

- 7.4 Fez caps

- 7.5 Flip-top caps

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Up to 50 ml

- 8.3 51 ml to 100 ml

- 8.4 101 ml to 150 ml

- 8.5 Above 150 ml

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Skincare

- 9.3 Haircare

- 9.4 Makeup

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Albea Group

- 11.2 ALPLA Group

- 11.3 Aluminum Packaging Group (APG)

- 11.4 Amcor plc

- 11.5 APC Packaging

- 11.6 Berlin Packaging

- 11.7 Berry Global Group

- 11.8 CCL Industries Inc.

- 11.9 Cosmogen

- 11.10 Cosmopak Corp.

- 11.11 CTL Packaging

- 11.12 Essel Propack Ltd.

- 11.13 FusionPKG

- 11.14 HCP Packaging

- 11.15 HCT Packaging

- 11.16 Hoffmann Neopac AG

- 11.17 Huhtamaki Oyj

- 11.18 Libo Cosmetics Co. Ltd.

- 11.19 Mpack Poland Sp. z o.o.

- 11.20 P.R. Packagings Ltd

- 11.21 Prutha Packaging Pvt.Ltd..

- 11.22 Quadpack Industries

- 11.23 Tubex

- 11.24 UKPACKCHINA

- 11.25 VisiPak Inc.