|

市場調查報告書

商品編碼

1750262

汽車鑰匙連鎖電纜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Key Interlock Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

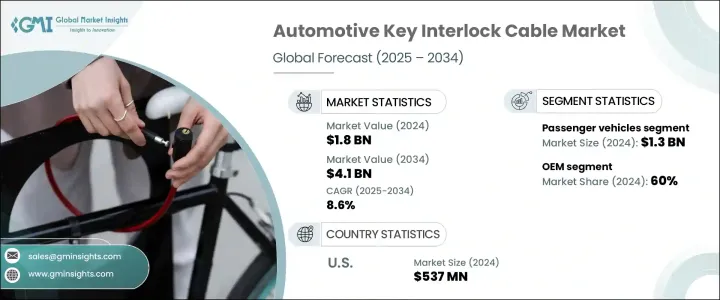

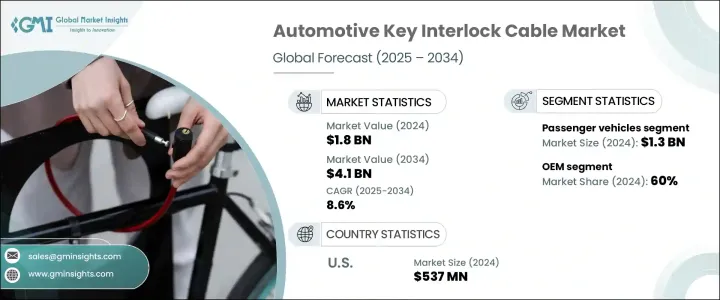

2024年,全球汽車鑰匙連鎖線纜市場規模達18億美元,預計到2034年將以8.6%的複合年成長率成長,達到41億美元。這得益於汽車安全預期的提高、自動變速箱系統整合度的不斷提升以及汽車行業安全法規的日益嚴格。汽車製造商正在將先進的聯鎖系統嵌入車輛,以防止意外換檔,從而提高安全性並滿足合規性要求。隨著車輛設計日益複雜,這些線纜已成為確保駕駛員控制的關鍵部件,尤其是在必須將換檔操作與點火狀態綁定的系統中。商用車和乘用車(包括電動車)對此類線纜的採用率都在增加。

隨著汽車在先進駕駛輔助技術和半自動駕駛系統方面的不斷發展,對高性能、緊湊耐用的鑰匙聯鎖解決方案的需求也日益成長。這些線纜能夠可靠地控制換檔功能,並減少潛在的駕駛失誤,使其成為安全關鍵型汽車系統的關鍵部件。製造商也專注於增強抗張強度和耐惡劣環境條件等特性,使線纜能夠在各種應力條件下高效運作。聯鎖系統已成為各種平台現代車輛架構的基石。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 8.6% |

2024年,乘用車市場規模達到13億美元,這得益於電動自行車、電動滑板車和小型電動車等緊湊型出行解決方案需求的不斷成長,其中許多解決方案都配備了聯鎖線纜以增強安全性。輕便、可折疊的車輛尤其受到尋求實用、安全出行方式的城市居民和行動辦公人士的青睞。這些連鎖電纜在車輛不使用時起到至關重要的作用,可以防止車輛移動,並提供額外的防盜保護,尤其是在共享空間內。

從銷售管道來看,受對增強車輛安全性和技術複雜性日益成長的需求推動,原始設備製造商 (OEM) 在 2024 年佔據了 60% 的市場佔有率。 OEM 處於這項創新的前沿,將關鍵的連鎖拉索作為整合組件整合到各種車型中。它們能夠與現有系統無縫相容,並確保可靠的性能,使其成為現代車輛設計的重要組成部分。連鎖技術的不斷進步,包括智慧和自動鎖定機制的開發,正促使OEM提供的拉索越來越受到青睞。

由於強勁的汽車行業、嚴格的安全法規以及電動車和自動駕駛汽車的高普及率,美國汽車鑰匙聯鎖電纜市場在2024年實現了5.37億美元的產值。隨著市場的不斷擴張,美國製造商正在大力投資研發,以打造更先進、更耐用、更有效率的連鎖系統。持續的技術創新,加上旨在提高車輛安全性的監管力度的加強,確保了美國將繼續在汽車鑰匙連鎖電纜市場中保持領先地位。

Suprajit、Orscheln、HI-Lex、Linamar、DURA、Ficosa、Kongsberg、Cablecraft、Kuster 和 Kongsberg(已刪除重複)等主要參與者正透過專注於策略合作、產品客製化和擴大生產規模來鞏固其市場地位。這些公司投資研發,以提高產品壽命及其與不斷發展的車輛架構的兼容性,同時利用與原始設備製造商的合作夥伴關係來確保長期供應協議。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 監管格局

- 價格趨勢

- 地區

- 電纜

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 日益重視車輛安全法規

- 自動變速箱車輛的普及率增加

- 電動車和自動駕駛汽車的成長

- 電纜設計的技術進步

- 產業陷阱與挑戰

- 高度依賴汽車產業週期

- 原料成本上漲

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 商用車

- 輕型商用車

- 平均血紅素 (MCV)

- 丙型肝炎病毒

第6章:市場估計與預測:依功能分類,2021 - 2034 年

- 主要趨勢

- 自動鑰匙聯鎖

- 手動鑰匙聯鎖

- 遙控鑰匙聯鎖

第7章:市場估計與預測:按電纜,2021 - 2034

- 主要趨勢

- 機械電纜

- 電纜

- 混合電纜

- 智慧電纜

- 客製化電纜

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 汽車安全系統

- 點火系統

- 傳動系統

- 其他

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aisin Seiki

- AutoCable

- Cablecraft Motion

- Curtiss-Wright

- DURA

- Shiloh

- Ficosa

- HI-Lex

- JOPP Automotive

- Kongsberg

- Kuster

- Linamar

- Ningbo Gaofa.

- Orscheln

- Shanghai Jinyi

- Sila Group

- Suprajit

- TOKAIRIKA

- Yazaki

- Zhejiang Sinyuan

The Global Automotive Key Interlock Cable Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 4.1 billion by 2034, fueled by heightened vehicle safety expectations, the growing integration of automatic transmission systems, and stricter safety regulations in the automotive sector. Automakers are embedding advanced interlock systems into vehicles to prevent unintended gear shifts, enhancing safety and meeting compliance demands. As vehicle design becomes more sophisticated, these cables serve as crucial components for ensuring driver control, especially in systems where gear operation must be tied to ignition status. The adoption of these cables is growing in both commercial and passenger vehicle segments, including electric vehicles.

As vehicles continue to evolve with advanced driver-assist technologies and semi-autonomous systems, the demand for high-performance, compact, and durable key interlock solutions is accelerating. These cables offer reliable control over gear shift functions and reduce potential driver error, making them essential for safety-critical automotive systems. Manufacturers are also focusing on features such as enhanced tensile strength and resistance to harsh environmental conditions, allowing cables to operate efficiently under variable stresses. Interlock systems have become a cornerstone in modern vehicle architectures across various platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 8.6% |

The passenger vehicles segment generated USD 1.3 billion in 2024, driven by the rising demand for compact mobility solutions such as e-bikes, electric scooters, and small electric cars-many of which feature interlock cables for enhanced safety. Lightweight, foldable vehicles have become particularly popular among urban dwellers and mobile workers seeking practical, secure transportation. These interlock cables play a crucial role by preventing vehicle movement when not in use and offering additional theft protection, especially in shared spaces.

From a sales channel perspective, original equipment manufacturers (OEMs) held 60% of the market share in 2024, driven by the growing demand for enhanced vehicle safety and technological sophistication. OEMs are at the forefront of this innovation, integrating key interlock cables as integral components in a wide range of vehicle models. Their ability to provide seamless compatibility with existing systems and ensure reliable performance makes them an essential part of modern vehicle design. The constant advancements in interlock technology, including the development of smart and automated locking mechanisms, are contributing to the increased preference for OEM-supplied cables.

United States Automotive Key Interlock Cable Market generated USD 537 million in 2024 due to its strong automotive sector, rigorous safety regulations, and high adoption rates of electric and autonomous vehicles. As the market continues to expand, U.S. manufacturers are heavily investing in research and development to create more advanced, durable, and efficient interlock systems. This ongoing technological innovation, coupled with increased regulatory enforcement aimed at improving vehicle safety, ensures that the U.S. will remain a leader in the automotive key interlock cable market.

Key players such as Suprajit, Orscheln, HI-Lex, Linamar, DURA, Ficosa, Kongsberg, Cablecraft, Kuster, and Kongsberg (duplicate removed) are reinforcing their market position by focusing on strategic collaborations, product customization, and expanding their production footprint. These companies invest in research to improve product longevity and compatibility with evolving vehicle architectures while leveraging partnerships with OEMs to secure long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Price trend

- 3.6.1 Region

- 3.6.2 Cable

- 3.7 Cost breakdown analysis

- 3.8 Key news & initiatives

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising emphasis on vehicle safety regulations

- 3.9.1.2 Increased adoption of automatic transmission vehicles

- 3.9.1.3 Growth in electric and autonomous vehicles

- 3.9.1.4 Technological advancements in cable design

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High dependence on automotive industry cycles

- 3.9.2.2 Rising raw material costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicle

- 5.3 Commercial vehicles

- 5.3.1 LCV

- 5.3.2 MCV

- 5.3.3 HCV

Chapter 6 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Automatic key interlock

- 6.3 Manual key interlock

- 6.4 Remote key interlock

Chapter 7 Market Estimates & Forecast, By Cable, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Mechanical cables

- 7.3 Electrical cables

- 7.4 Hybrid cables

- 7.5 Smart cables

- 7.6 Customized cables

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Automotive security system

- 8.3 Ignition system

- 8.4 Transmission system

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 AutoCable

- 11.3 Cablecraft Motion

- 11.4 Curtiss-Wright

- 11.5 DURA

- 11.6 Shiloh

- 11.7 Ficosa

- 11.8 HI-Lex

- 11.9 JOPP Automotive

- 11.10 Kongsberg

- 11.11 Kuster

- 11.12 Linamar

- 11.13 Ningbo Gaofa.

- 11.14 Orscheln

- 11.15 Shanghai Jinyi

- 11.16 Sila Group

- 11.17 Suprajit

- 11.18 TOKAIRIKA

- 11.19 Yazaki

- 11.20 Zhejiang Sinyuan