|

市場調查報告書

商品編碼

1741050

熱界面材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Thermal Interface Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

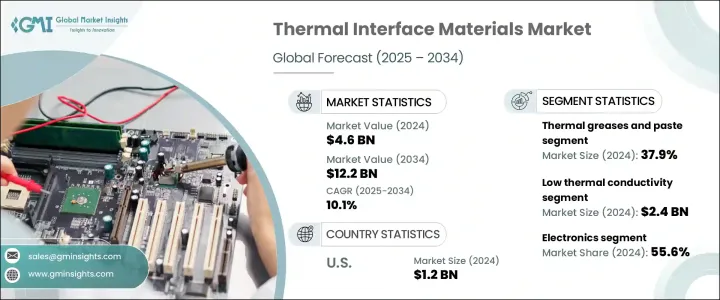

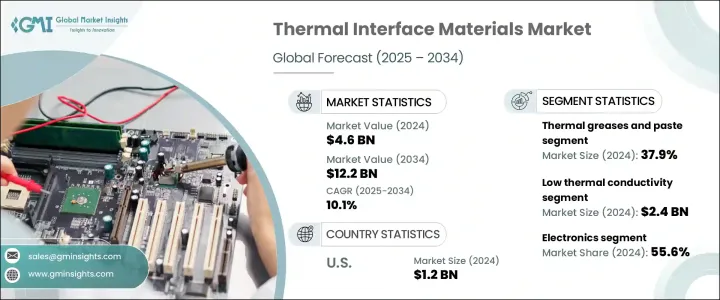

2024 年全球熱界面材料市場價值為 46 億美元,預計到 2034 年將以 10.1% 的複合年成長率成長,達到 122 億美元,這得益於多個行業(尤其是汽車、電子和工業製造)應用的不斷擴展。隨著各行各業競相發展小型化、電氣化和智慧化技術,對可靠的熱管理解決方案的需求激增。新時代汽車、連網設備、雲端運算和智慧製造都需要能夠承受更高熱負荷且效能不下降的元件。熱界面材料 (TIM) 已成為這種情況下的關鍵推動因素,支援系統效率、耐用性和安全性。對能源效率和系統最佳化的日益重視,以及永續發展趨勢,已將 TIM 置於各行業創新的中心。隨著企業對電動車、人工智慧基礎設施和高性能電子產品的投資,TIM 在重塑全球技術格局方面發揮關鍵作用。

隨著現代電動車設計整合了緊湊型組件、高輸出電池和輕量化結構,汽車電氣化推動了對高效熱管理系統的強勁需求。隨著系統發熱越來越大、空間越來越狹窄,高性能熱界面材料 (TIM) 有助於控制溫度並確保使用壽命。在不斷發展的汽車領域,人們對自動駕駛技術的興趣日益濃厚,進一步推動了對先進熱管理材料的需求,因為感測器密集系統會產生大量的熱負荷。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46億美元 |

| 預測值 | 122億美元 |

| 複合年成長率 | 10.1% |

同時,消費性電子、工業自動化和電信業不斷突破性能界限。對高效能運算和緊湊型智慧型裝置的日益依賴,提高了功率密度,也加劇了對可靠散熱解決方案的需求。隨著人工智慧和雲端運算的擴展,資料中心大力投資下一代TIM,以保護其基礎設施。

市場對導熱矽脂和導熱膏的需求明顯成長,憑藉其卓越的導熱性、多功能性和便捷的使用方式,它們在2024年佔據了37.9%的市場佔有率。這些材料在消費性電子和工業電子產品中廣受歡迎,因為它們能夠消除發熱元件和散熱器之間的氣隙,從而實現高效的散熱。其柔韌性使其能夠貼合微觀表面缺陷,改善接觸性能並降低熱阻。與固態TIM不同,導熱矽脂能夠長期保持其有效性,不會硬化或開裂,使其成為動態熱環境和頻繁進行熱循環的設備的理想選擇。

依熱導率分析,熱界面材料市場可分為低導熱率、中導熱率和高導熱率類型。低導熱率材料市值在2024年達到24億美元,預計到2034年將以10.5%的複合年成長率成長,這得益於其在空間受限的電子產品中的廣泛應用,在這些電子產品中,軟性、經濟高效且導熱性適中的材料就已足夠。這些材料因其在熱性能、機械柔順性和經濟可行性方面的出色平衡而被廣泛採用——這些因素是緊湊型消費設備、資訊娛樂系統和車載汽車電子設備等應用的關鍵因素。

北美熱界面材料市場在2024年將達到17億美元,複合年成長率達11%,這得益於其在先進製造、半導體生產以及電動車和5G基礎設施快速擴張方面的穩固地位。北美擁有眾多高性能電子、自動駕駛系統和電信行業的關鍵參與者,這些行業對高效的熱管理解決方案的需求日益成長,因此北美市場受益匪淺。此外,再生能源技術和邊緣運算領域投資的不斷成長也進一步支撐了該地區的成長,因為這兩個領域都需要穩定的溫度控制,以最大限度地延長系統正常運行時間和提高組件的耐用性。

全球熱界面材料市場的主要參與者包括 3M、霍尼韋爾國際公司、派克漢尼汾公司、漢高股份公司和信越化學株式會社。為了保持競爭優勢,領先企業正在大力投資研發,以開發專為下一代電子產品和電動車量身定做的創新高性能熱界面材料 (TIM),擴大產能,並與原始設備製造商 (OEM) 建立戰略聯盟,以獲得重大項目的早期授權。企業也正在進行併購交易,以多元化產品組合併加速技術應用。此外,為了符合永續發展目標,增強品牌吸引力並確保在全球市場的合規性,企業正在大力推廣環保材料。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 不斷發展的汽車產業

- 不斷發展的電子產業

- 技術進步

- 產業陷阱與挑戰

- 開發成本高

- 材料選擇和相容性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 導熱油脂和導熱膏

- 導熱墊及導熱膜

- 相變材料

- 熱黏合劑

- 熱敏膠帶

- 填縫劑

第6章:市場規模及預測:依熱導率,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 電子產品

- 汽車

- 電信

- 工業的

- 航太和國防

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Honeywell International

- 3M

- Henkel AG

- Parker Hannifin

- Shin-Etsu Chemical

- Momentive Performance Materials

- Wakefield-Vette

- Indium

- Panasonic

- Arctic Silver

- Fujipoly America

- Master Bond

The Global Thermal Interface Materials Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 12.2 billion by 2034, driven by expanding applications across multiple industries, particularly automotive, electronics, and industrial manufacturing. As industries race toward miniaturization, electrification, and smarter technologies, the need for reliable thermal management solutions has surged. New-age vehicles, connected devices, cloud computing, and smart manufacturing all demand components that can withstand higher heat loads without performance degradation. Thermal interface materials (TIMs) have become critical enablers in this scenario, supporting system efficiency, durability, and safety. The growing emphasis on energy efficiency and system optimization, along with sustainability trends, has placed TIMs at the center of innovation across sectors. As companies invest in EVs, AI infrastructure, and high-performance electronics, TIMs are playing a pivotal role in reshaping the global technology landscape.

Electrification in vehicles has fueled a strong demand for efficient heat management systems, as modern EV designs integrate compact components, high-output batteries, and lightweight structures. As systems become more heat-intensive and confined, high-performance TIMs help manage temperatures and ensure operational longevity. In the evolving automotive landscape, rising interest in self-driving technologies has further boosted demand for advanced thermal management materials, as sensor-intensive systems generate substantial heat loads.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 10.1% |

At the same time, consumer electronics, industrial automation, and telecommunications continue to push performance boundaries. The growing reliance on high-performance computing and compact smart devices has increased power densities, escalating the need for reliable heat dissipation solutions. As artificial intelligence and cloud computing expand, data centers invest heavily in next-gen TIMs to safeguard their infrastructure.

The market has shown a clear inclination toward thermal greases and pastes, which captured a 37.9% share in 2024 due to their exceptional thermal conductivity, versatility, and ease of application. These materials are widely favored in consumer and industrial electronics because they offer highly effective heat dissipation by eliminating air gaps between heat-generating components and heat sinks. Their pliability allows them to conform to microscopic surface imperfections, improving contact and reducing thermal resistance. Unlike solid-state TIMs, thermal greases maintain their effectiveness over time without hardening or cracking, making them ideal for dynamic thermal environments and devices that undergo frequent thermal cycling.

When analyzed by thermal conductivity, the thermal interface materials market is segmented into low, medium, and high conductivity types. Low thermal conductivity materials, valued at USD 2.4 billion in 2024, are expected to grow at a CAGR of 10.5% through 2034 due to their significant use in space-constrained electronics where flexible, cost-effective, and moderately conductive materials are sufficient. These materials are commonly selected for their excellent balance of thermal performance, mechanical compliance, and economic viability-key factors in applications like compact consumer devices, infotainment systems, and onboard automotive electronics.

North America Thermal Interface Materials Market generated USD 1.7 billion in 2024 to grow at a CAGR of 11% driven by its strong foothold in advanced manufacturing, semiconductor production, and the rapid scaling of electric vehicles and 5G infrastructure. North America benefits from being home to several key players in high-performance electronics, autonomous systems, and telecommunications-industries that demand increasingly efficient thermal management solutions. Moreover, rising investments in renewable energy technologies and edge computing further support the region's growth, as both segments require stable temperature control for maximum system uptime and component durability.

Key industry players in the Global Thermal Interface Materials Market include 3M, Honeywell International Inc., Parker Hannifin Corporation, Henkel AG, and Shin-Etsu Chemical Co., Ltd. To maintain their competitive edge, leading companies are investing heavily in R&D to develop innovative, high-performance TIMs tailored for next-gen electronics and EVs, expanding production capacities, and forming strategic alliances with OEMs to gain early access to major projects. Firms are also entering into M&A deals to diversify their portfolio and accelerate technology adoption. Additionally, there is a push toward eco-friendly materials to align with sustainability goals, enhancing brand appeal and ensuring compliance in global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing automotive industry

- 3.7.1.2 Growing electronics industry

- 3.7.1.3 Technology advancement

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High development costs

- 3.7.2.2 Material selection and compatibility

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Material Type, 2021 – 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Thermal greases and paste

- 5.3 Thermal pads and films

- 5.4 Phase change materials

- 5.5 Thermal adhesives

- 5.6 Thermal tapes

- 5.7 Gap fillers

Chapter 6 Market Size and Forecast, By Thermal Conductivity, 2021 – 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Electronics

- 7.3 Automotive

- 7.4 Telecommunications

- 7.5 Industrial

- 7.6 Aerospace and defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Honeywell International

- 9.2 3M

- 9.3 Henkel AG

- 9.4 Parker Hannifin

- 9.5 Shin-Etsu Chemical

- 9.6 Momentive Performance Materials

- 9.7 Wakefield-Vette

- 9.8 Indium

- 9.9 Panasonic

- 9.10 Arctic Silver

- 9.11 Fujipoly America

- 9.12 Master Bond