|

市場調查報告書

商品編碼

1741049

自動停車系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automated Parking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

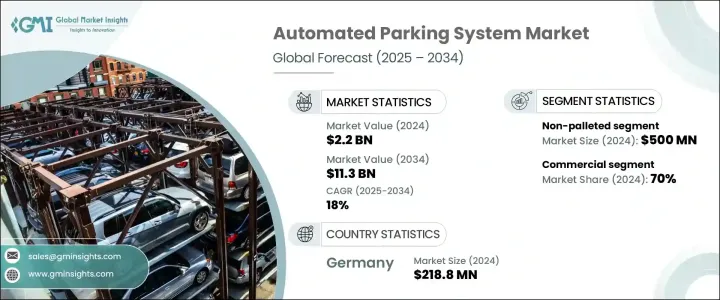

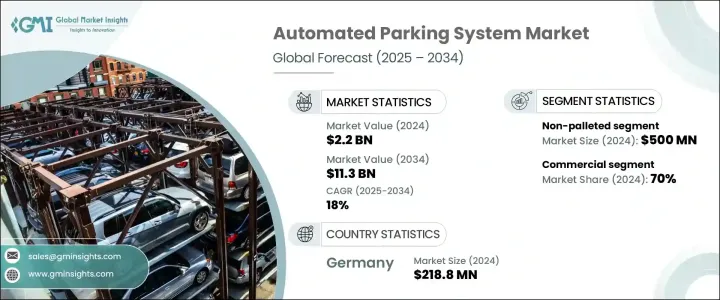

2024 年全球自動停車系統市場價值為 22 億美元,預計到 2034 年將以 18% 的複合年成長率成長至 113 億美元。受快速城市化、人口稠密城市停車位有限以及對智慧節省空間基礎設施日益成長的需求的推動,該行業正在經歷顯著成長。隨著汽車數量的增加和房地產的萎縮,城市面臨越來越大的壓力,需要更有效地管理空間。自動停車系統正在成為一種前瞻性的解決方案,它透過最佳化土地利用、簡化交通流量和減少碳排放來應對這些挑戰。這些系統提供了一種緊湊、高效的車輛存放方法,減少了對人工干預的依賴。因此,它們的部署正在擴展到各種城市應用領域——從住宅和商業開發項目到醫院和交通樞紐。

自動停車系統因其能夠增強安全性、提高空間利用率並最大限度地減少環境影響而日益普及。它們融合了先進的自動化和機器人技術,實現了車輛的智慧移動和儲存。多層堆疊、自動車輛處理和車位管理等功能使這些系統既省時又環保。越來越多的開發商和物業經理開始採用這些系統,以降低營運成本、在有限的空間內增加停車容量,並為用戶提供優質的體驗。隨著永續城市基礎設施和智慧城市計畫的日益關注,這些系統也進一步刺激了需求,因為這些系統與全球致力於實現更清潔、更有效率的城市交通的努力相契合。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 113億美元 |

| 複合年成長率 | 18% |

就平台而言,市場細分為托盤式和非托盤式系統。非托盤式系統在2024年以約5億美元的收入佔據市場主導地位。該細分市場的主導地位歸功於其節省空間的設計和更快的車輛檢索能力,這在交通繁忙的大都市地區尤其重要。與托盤式系統不同,非托盤系統無需支撐平台,而是使用機器人和傳送帶系統直接移動車輛,從而簡化了機械設置,並允許在狹窄的城市佈局中靈活安裝。商業建築、機場和高層住宅開發項目對高吞吐量解決方案的需求正在成長。

從終端用戶的角度來看,市場分為住宅和商業應用兩大類別。 2024年,商業領域佔據了70%的市場佔有率,這主要得益於辦公大樓、零售中心、醫院和飯店場所的採用。自動停車能夠提升容量、緩解堵塞,並在繁忙環境中提供更快的車輛出入,這些場所將受益匪淺。城市擁擠和高昂的土地成本正促使企業投資垂直或地下停車場,以充分利用有限的空間。此外,自動停車與智慧建築技術和增強型安防系統的融合,使其成為商業開發商眼中極具吸引力的選擇。

市場也按類型分類,其中半自動化系統在2024年佔據主要佔有率。其吸引力在於成本效益、快速設定和易用性,適用於住宅和商業領域的各種應用。這些系統在全自動和手動控制之間實現了平衡,無需像全自動系統那樣進行高額的前期投資,即可提供增強的使用者體驗。其低維護要求和方便用戶使用的功能使其廣受歡迎。

在系統結構方面,自動導引車 (AGV) 細分市場在 2024 年引領全球市場,創造了最大的收入佔有率。 AGV 系統適應性強,能夠精準導航複雜的佈局,是擁擠的城市環境和大型商業項目的理想選擇。 AGV 系統能夠無縫整合到現有基礎設施中,同時提供高度的自動化和靈活性,使其成為應對現代停車挑戰的首選解決方案。 AGV 尤其適用於那些對吞吐量和空間利用率最大化至關重要的環境。

就產品供應而言,硬體在2024年佔據了自動停車系統市場的主導地位,佔據了全球收入的最大佔有率。這是因為感測器、升降機、自動導引車(AGV)和傳送系統等實體組件至關重要,它們構成了任何自動停車操作的核心。隨著系統日益複雜,對耐用、高性能硬體的需求持續成長,尤其是在需要長期可靠性和高容量處理的專案中。

從地區來看,德國以2024年2.188億美元的收入領先歐洲市場,預計到2034年複合年成長率將達到16.9%。德國強大的汽車工業、對智慧城市項目的投資以及先進的城市基礎設施,為其在該領域的領先地位做出了重要貢獻。此外,全球各地的企業都在透過投資研發、策略合作夥伴關係和尖端製造技術來擴大其影響力。市場領導者專注於模組化系統設計、能源效率以及人工智慧和物聯網技術的整合,以提升用戶體驗和環境績效。這些創新為下一代智慧永續停車解決方案奠定了基礎。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 硬體提供者

- 軟體供應商

- 服務提供者

- 技術提供者

- 最終用途

- 利潤率分析

- 供應商格局

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 北美和歐洲的自動駕駛汽車數量不斷增加

- 都市化進程快速成長

- 亞太和中東地區智慧城市計畫不斷湧現

- 停車系統技術進步日新月異

- 產業陷阱與挑戰

- 開發成本高

- 維護複雜且停機風險

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 全自動

- 半自動化

第6章:市場估計與預測:依結構,2021 - 2034 年

- 主要趨勢

- AGV系統

- 筒倉系統

- 塔式系統

- 軌道引導車(RGC)系統

- 謎題系統

- 穿梭系統

第7章:市場估計與預測:依供應量,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第8章:市場估計與預測:依平台,2021 - 2034 年

- 主要趨勢

- 托盤

- 非托盤

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AutoMotion Parking

- City Lift Parking

- Dayang Parking

- EITO&GLOBAL

- Fata Automation

- IHI

- Klaus Multiparking

- Lodgie

- MHE Demag

- Park Assist

- Parkmatic

- ParkPlus

- Robotic Parking

- Serva Transport

- Skyline Parking

- Stolzer Parking

- TAPS

- Unitronics

- Westfalia Parking

- Wohr Parking

The Global Automated Parking System Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 18% to reach USD 11.3 billion by 2034. The industry is experiencing a significant surge, driven by rapid urbanization, limited availability of parking in densely populated cities, and a growing need for smart, space-saving infrastructure. With rising vehicle numbers and shrinking real estate, cities are facing mounting pressure to manage space more efficiently. Automated parking systems are emerging as a forward-thinking solution that tackles these challenges by optimizing land usage, streamlining traffic flow, and reducing carbon emissions. These systems provide a compact, highly efficient approach to vehicle storage with reduced reliance on human intervention. As a result, their deployment is expanding across a wide range of urban applications-from residential and commercial developments to hospitals and transport hubs.

Automated parking systems are gaining popularity due to their ability to enhance safety, improve space utilization, and minimize environmental impact. They incorporate advanced automation and robotics, allowing for intelligent vehicle movement and storage. Features such as multi-level stacking, automated vehicle handling, and slot management make these systems both time-efficient and environmentally friendly. Developers and property managers are increasingly turning to these systems to reduce operational costs, increase parking capacity in a confined footprint, and offer a premium experience to users. The rising focus on sustainable urban infrastructure and smart city initiatives is further fueling demand, as these systems align with global efforts toward cleaner, more efficient urban mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $11.3 Billion |

| CAGR | 18% |

In terms of platform, the market is segmented into palleted and non-palleted systems. The non-palleted category led the market with approximately USD 500 million in revenue in 2024. This segment's dominance is attributed to its space-saving design and quicker vehicle retrieval capabilities, which are especially important in high-traffic metropolitan areas. Unlike palleted systems, non-palleted ones eliminate the need for a supporting platform and use robotics and conveyor systems to move vehicles directly, simplifying the mechanical setup and allowing for flexible installation in tight urban layouts. Demand is growing in commercial buildings, airports, and high-rise residential developments where high-throughput solutions are essential.

From an end-user perspective, the market is split between residential and commercial applications. In 2024, the commercial segment held a substantial 70% market share, driven by adoption in office buildings, retail centers, hospitals, and hospitality venues. These settings benefit immensely from automated parking's ability to enhance capacity, reduce congestion, and provide quicker access to vehicles in busy environments. Urban congestion and the high cost of land are pushing businesses to invest in vertical or underground parking structures that make the most of limited space. Furthermore, the integration of automated parking with smart building technologies and enhanced security systems makes it an attractive option for commercial developers.

The market is also categorized by type, with semi-automated systems accounting for the majority share in 2024. Their appeal lies in cost efficiency, quick setup, and ease of use, making them suitable for diverse applications across both residential and commercial segments. These systems offer a balance between full automation and manual control, providing enhanced user experience without the high upfront investment of fully automated alternatives. Their low maintenance requirements and user-friendly features contribute to their widespread acceptance.

Among system structures, the Automated Guided Vehicle (AGV) segment led the global market in 2024, generating the largest revenue share. AGV systems are highly adaptable and can navigate complex layouts with precision, making them ideal for crowded urban settings and large commercial projects. Their ability to integrate seamlessly into existing infrastructure while delivering high levels of automation and flexibility has made them a preferred solution for modern parking challenges. AGVs are particularly well-suited for environments where maximizing throughput and space utilization is critical.

In terms of offerings, hardware dominated the automated parking system market in 2024, accounting for the largest share of global revenue. This is due to the essential nature of physical components such as sensors, lifts, AGVs, and conveyor systems, which form the core of any automated parking operation. As systems become more sophisticated, demand for durable, high-performance hardware continues to grow, especially in projects that require long-term reliability and high-volume handling.

Regionally, Germany led the European market with USD 218.8 million in revenue in 2024 and is forecasted to grow at a CAGR of 16.9% through 2034. The country's strong automotive industry, investment in smart city projects, and advanced urban infrastructure contribute significantly to its leadership in this sector. Additionally, companies across the globe are scaling their presence by investing in research and development, strategic partnerships, and cutting-edge manufacturing techniques. Market leaders are focusing on modular system designs, energy efficiency, and integration of AI and IoT technologies to enhance both user experience and environmental performance. These innovations are setting the stage for the next generation of smart, sustainable parking solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Hardware providers

- 3.1.1.2 Software providers

- 3.1.1.3 Service providers

- 3.1.1.4 Technology providers

- 3.1.1.5 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing autonomous vehicles in north america and europe

- 3.8.1.2 The rapid increase in urbanization

- 3.8.1.3 Rising smart city projects in asia pacific and middle east

- 3.8.1.4 Increasing technological advancements in parking systems

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High development cost

- 3.8.2.2 Complex maintenance and downtime risk

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Fully automated

- 5.3 Semi-automated

Chapter 6 Market Estimates & Forecast, By Structure, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 AGV system

- 6.3 Silo system

- 6.4 Tower system

- 6.5 Rail Guided Cart (RGC) system

- 6.6 Puzzle system

- 6.7 Shuttle system

Chapter 7 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Hardware

- 7.3 Software

- 7.4 Services

Chapter 8 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Palleted

- 8.3 Non-palleted

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AutoMotion Parking

- 11.2 City Lift Parking

- 11.3 Dayang Parking

- 11.4 EITO&GLOBAL

- 11.5 Fata Automation

- 11.6 IHI

- 11.7 Klaus Multiparking

- 11.8 Lodgie

- 11.9 MHE Demag

- 11.10 Park Assist

- 11.11 Parkmatic

- 11.12 ParkPlus

- 11.13 Robotic Parking

- 11.14 Serva Transport

- 11.15 Skyline Parking

- 11.16 Stolzer Parking

- 11.17 TAPS

- 11.18 Unitronics

- 11.19 Westfalia Parking

- 11.20 Wohr Parking