|

市場調查報告書

商品編碼

1741042

生物危害袋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biohazard Bags Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

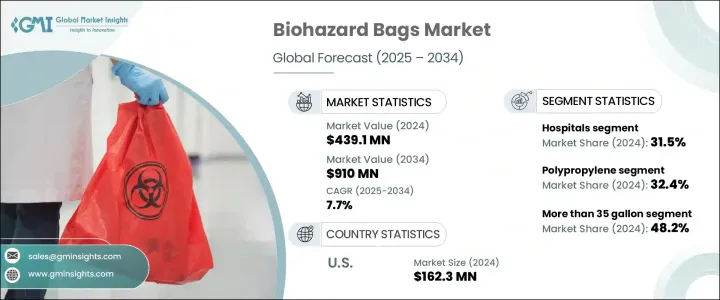

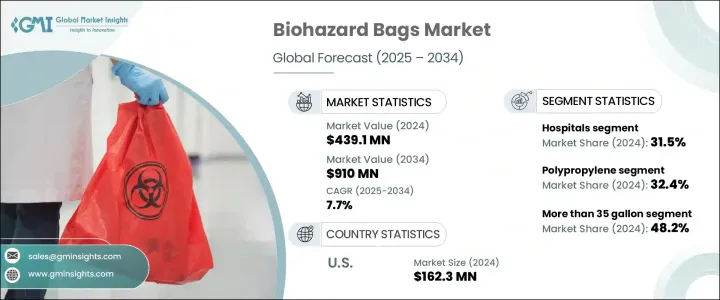

2024 年全球生物危害袋市場價值為 4.391 億美元,預計到 2034 年將以 7.7% 的複合年成長率成長至 9.1 億美元。這一成長得益於對安全廢物處理解決方案日益成長的需求以及嚴格的全球廢物管理協議的實施。隨著醫療和實驗室廢棄物產量的增加,世界各地的醫療保健系統越來越依賴生物危害袋。從常規醫療程序到複雜的診斷測試,都會產生大量的生物危害廢棄物,這推動了對可靠遏制解決方案的持續需求。許多地區都加強了有關傳染性和危險廢棄物安全處置的法規,迫使設施採用標準化、合規的廢棄物處理方法。這些規則透過強制使用經過認證的袋子來安全容納生物和化學污染物,直接支持了市場擴張。僅醫療保健行業就對這一需求做出了巨大貢獻,該行業每天產生大量必須安全管理的受污染物品。隨著設施的現代化和擴大,對能夠承受粗暴處理和化學物質暴露的生物危害袋的需求不斷增加。

2024 年,容量超過 35 加侖的生物危害袋佔據最大佔有率,佔整個市場的 48.2%。這些大容量袋子受到廢物產量高的設施的青睞,因為它們可以更有效地收集和運輸。減少使用小袋子的數量不僅可以降低材料成本,還可以簡化物流流程。它們處理大宗廢棄物的能力使其在營運效率至關重要的大規模作業中尤其有用。產生大量受污染物質(例如手術器械使用的個人防護裝備 (PPE) 和實驗室廢物)的設施嚴重依賴這種尺寸的袋子來保持符合衛生和安全標準。大容量袋的廣泛偏好也受到其在簡化廢物處理和最大限度地減少廢物收集頻率方面的作用的影響。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.391億美元 |

| 預測值 | 9.1億美元 |

| 複合年成長率 | 7.7% |

依材質分類,聚丙烯袋佔據市場主導地位,2024 年其市佔率為 32.4%。這種材料因其高耐用性、耐化學性和出色的抗壓強度而備受青睞。聚丙烯袋在需要滅菌的情況下尤其適用,因為它們能夠承受高壓滅菌中常用的高溫。其耐化學性使其成為在不損害結構完整性的情況下容納生物危害的理想選擇。除了高效率之外,這些袋子的生產成本低廉,可廣泛應用於每日大量消費的環境。它們耐穿刺和耐生物物質侵蝕的特性也使其成為醫療保健和研究機構的首選。隨著對可靠合規處置方法的需求日益成長,聚丙烯在滿足行業標準的同時,也能支援注重預算的採購決策。

從終端用途來看,醫院在2024年成為主要消費市場,佔31.5%的市場。這些機構持續處理患者,產生各種類型的感染性廢棄物,必須依照嚴格的規定進行處置。醫院每天都會收集用過的注射器、受污染的手套、繃帶和其他醫療用品,因此高性能生物危害袋至關重要。在這些環境中,必須對廢棄物進行明確的分類和管理,以避免健康風險和環境危害。由於醫院不斷產生各種廢棄物,每種廢棄物都需要符合安全準則的專門解決方案,因此對生物危害袋的需求持續高漲。由於醫院需要一致、安全的廢棄物管理,因此成為生物危害袋市場的主要驅動力。

就區域表現而言,美國在2024年引領北美市場,貢獻了約1.623億美元的收入。該國完善的醫療基礎設施和嚴格執行的醫療廢物處置法規是其主導的關鍵因素。國內指南確保所有生物危害材料均採用經批准的容器進行處置,這推動了醫院、診所和實驗室的需求。隨著醫療機構數量的不斷成長,對可靠處置方法的需求也在成長。全國醫療介入的高頻率進一步推動了對安全合規廢棄物管理系統的需求,使得生物危害袋成為各機構的必備品。

市場競爭依然激烈,國內外品牌紛紛推出客製化解決方案,以滿足不斷變化的垃圾處理需求。產業領導者目前合計佔據約40%的市場佔有率,他們在產品品質、合規性和價格效率方面競爭。新興經濟體的本土製造商正在推動全球企業提供價格實惠且可靠的產品,以保持市場競爭力。客製化、材料創新和競爭性定價將繼續左右該領域主要參與者的策略方向。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球對生物危害袋的需求不斷成長

- 有利於有效廢棄物管理的監管指南

- 醫療保健產業日益發展,尤其是在發展中國家

- 產業陷阱與挑戰

- 缺乏對醫療廢棄物相關健康危害的認知

- 缺乏正確處理醫療廢棄物的培訓

- 成長動力

- 成長潛力分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業價值鏈分析

- 原料分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭儀錶板

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按容量類型,2021 - 2034 年

- 主要趨勢

- 少於15加侖

- 15至35加侖

- 超過 35 加侖

第6章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 聚丙烯

- 聚乙烯

- 塑膠

- HDPE(高密度聚乙烯)

- 其他材料類型

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 實驗室和研究中心

- 製藥和生物技術公司

- 診所和診斷中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 波蘭

- 瑞士

- 瑞典

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 印尼

- 泰國

- 越南

- 拉丁美洲

- 墨西哥

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 哥倫比亞

- 秘魯

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 伊拉克

- 以色列

第9章:公司簡介

- Abdos Labtech

- Action Health

- Bel-Art Products

- Cole-Parmer Instrument Company

- Desco Medical

- Heathrow Scientific

- Lithey

- Medegen Medical Products

- Sharps Compliance

- Stericycle

- ThermoFisher Scientific

- Tilak Polypack

- Transcendia

- TUFPAK

- VWR International

The Global Biohazard Bags Market was valued at USD 439.1 million in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 910 million by 2034. This growth is being fueled by a rising demand for secure waste disposal solutions and the implementation of strict global waste management protocols. Healthcare systems worldwide are becoming more reliant on biohazard bags as medical and laboratory waste production increases. From routine medical procedures to complex diagnostic testing, biohazardous waste is being generated in substantial quantities, driving the consistent need for reliable containment solutions. Regulations around the safe disposal of infectious and hazardous waste have tightened in many regions, compelling facilities to adopt standardized, compliant waste-handling practices. These rules directly support the market's expansion by enforcing mandatory usage of certified bags to contain biological and chemical contaminants safely. The healthcare sector alone contributes significantly to this demand, generating massive volumes of contaminated items daily that must be securely managed. As facilities modernize and expand, the need for biohazard bags that can withstand rough handling and chemical exposure continues to rise.

In 2024, the segment for biohazard bags with a capacity of more than 35 gallons held the largest share, accounting for 48.2% of the total market. These large-capacity bags are preferred by facilities with high waste output, as they allow for more efficient collection and transportation. Reducing the number of smaller bags used not only cuts material costs but also simplifies logistical processes. Their ability to handle bulk waste makes them especially useful in large-scale operations where operational efficiency is critical. Facilities producing significant volumes of contaminated material such as surgical tools used PPE, and laboratory waste rely heavily on bags of this size to maintain compliance with hygiene and safety standards. The widespread preference for larger-capacity bags is also influenced by their role in streamlining waste handling and minimizing the frequency of waste collection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $439.1 Million |

| Forecast Value | $910 Million |

| CAGR | 7.7% |

When categorized by material, the market is dominated by polypropylene-based bags, which accounted for a 32.4% share in 2024. This material is favored for its high durability, chemical resistance, and exceptional strength under pressure. Polypropylene bags are especially useful in situations requiring sterilization, as they can withstand high temperatures commonly used in autoclaving. Their chemical resistance makes them ideal for containing biohazards without compromising structural integrity. In addition to being highly effective, these bags are cost-efficient to produce, allowing widespread use in environments where large quantities are consumed daily. Their ability to resist punctures and exposure to biological substances also makes them a go-to option for healthcare and research settings. As demands grow for reliable and compliant disposal methods, polypropylene continues to meet industry standards while supporting budget-conscious purchasing decisions.

From an end-use perspective, hospitals emerged as the leading consumers in 2024, representing 31.5% of the market. These facilities handle a constant influx of patients, generating various types of infectious waste that must be disposed of according to stringent regulations. Items such as used syringes, contaminated gloves, bandages, and other medical supplies are collected daily, making it essential for hospitals to rely on high-performance biohazard bags. In these settings, waste must be clearly segregated and managed to avoid health risks and environmental hazards. The demand from hospitals remains high due to the continuous generation of diverse waste streams, each requiring specialized containment solutions in compliance with safety guidelines. With their need for consistent, secure waste management, hospitals are the primary drivers of volume in the biohazard bags market.

In terms of regional performance, the United States led the North American market in 2024, with a revenue contribution of approximately USD 162.3 million. The country's comprehensive healthcare infrastructure and strict enforcement of medical waste disposal laws are key contributors to this dominance. Domestic guidelines ensure that all biohazardous materials are disposed of in approved containers, pushing demand across hospitals, clinics, and labs. As the number of healthcare establishments continues to grow, so does the need for dependable disposal methods. The high frequency of medical interventions across the nation further fuels the requirement for secure and compliant waste management systems, making biohazard bags a staple across facilities.

Market competition remains strong, with a mix of international and domestic brands offering tailored solutions to meet evolving waste disposal needs. Industry leaders currently hold a combined market share of about 40%, competing on product quality, regulatory compliance, and price efficiency. Local manufacturers in emerging economies are pushing global players to provide affordable yet reliable products to retain market relevance. Customization, material innovation, and competitive pricing will continue to shape the strategic direction of key players in this sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for biohazard bags globally

- 3.2.1.2 Favorable regulatory guidelines for effective waste management

- 3.2.1.3 Growing healthcare industry especially in developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness regarding health hazards associated with medical waste

- 3.2.2.2 Lack of training for proper disposal of medical waste

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Industry value chain analysis

- 3.6 Raw material analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive dashboard

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Capacity Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Less than 15 gallon

- 5.3 15 to 35 gallon

- 5.4 More than 35 gallon

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polypropylene

- 6.3 Polyethylene

- 6.4 Plastic

- 6.5 HDPE (high-density polyethylene)

- 6.6 Other material types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Laboratories and research centers

- 7.4 Pharmaceutical and biotech companies

- 7.5 Clinics and diagnostic centers

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Poland

- 8.3.7 Switzerland

- 8.3.8 Sweden

- 8.3.9 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Thailand

- 8.4.8 Vietnam

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Mexico

- 8.5.4 Argentina

- 8.5.5 Chile

- 8.5.6 Colombia

- 8.5.7 Peru

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Iran

- 8.6.5 Iraq

- 8.6.6 Israel

Chapter 9 Company Profiles

- 9.1 Abdos Labtech

- 9.2 Action Health

- 9.3 Bel-Art Products

- 9.4 Cole-Parmer Instrument Company

- 9.5 Desco Medical

- 9.6 Heathrow Scientific

- 9.7 Lithey

- 9.8 Medegen Medical Products

- 9.9 Sharps Compliance

- 9.10 Stericycle

- 9.11 ThermoFisher Scientific

- 9.12 Tilak Polypack

- 9.13 Transcendia

- 9.14 TUFPAK

- 9.15 VWR International