|

市場調查報告書

商品編碼

1741029

變頻驅動器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Variable Frequency Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

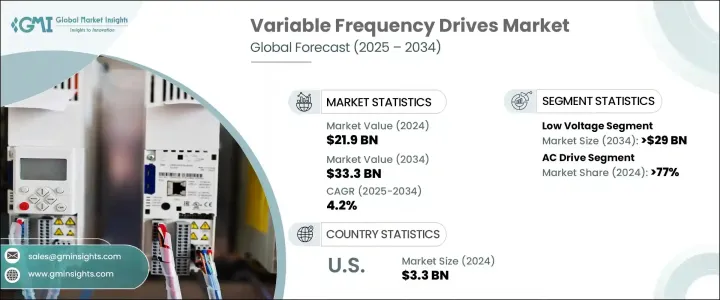

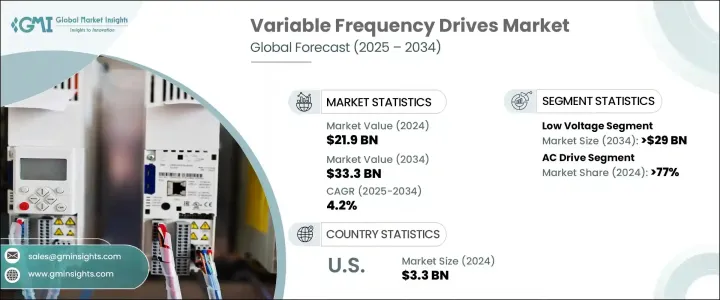

2024年,全球變頻驅動器市場規模達219億美元,預計到2034年將以4.2%的複合年成長率成長,達到333億美元。這一成長趨勢主要歸因於人們對永續性和節能日益成長的重視。全球許多政府正在加強環境政策,敦促各行各業遵守最新的能源效率法規。這些法規,加上鼓勵採用節能技術的激勵措施,正在推動製造商和工廠實現營運現代化。因此,變頻器已成為這些轉型的關鍵組成部分,有助於降低能耗並減少工業排放。

在日益數位化和自動化的世界裡,物聯網和機器學習功能與工業運作的融合,在重塑變頻器(VFD)的使用方式方面發揮關鍵作用。這些智慧技術能夠實現即時監控、故障檢測和預測性維護,從而提高營運效率並減少停機時間。如今,各行各業都要求變頻器解決方案具備更高的精度、適應性和可靠性。隨著企業尋求更智慧、更快回應的能源控制系統,這種轉變正在為市場開闢新的成長途徑。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 219億美元 |

| 預測值 | 333億美元 |

| 複合年成長率 | 4.2% |

歷史資料顯示,全球變頻器 (VFD) 市場持續保持年成長,2022 年市場規模為 207 億美元,2023 年為 211 億美元,2024 年為 219 億美元。依電壓細分,市場主要分為兩大類:低電壓變頻器和中壓變頻器。其中,低壓變頻器預計將在預測期內保持主導地位,預計到 2034 年收入將超過 290 億美元。該領域持續保持領先地位的驅動力源於自動化技術的廣泛應用、對節能的日益重視以及全行業向經濟高效的性能提升的轉變。緊湊、高效且易於整合的系統日益受到青睞,這使得低壓變頻器成為多個行業的理想選擇。

市場進一步細分,根據驅動器類型分類,包括交流驅動器、直流驅動器和伺服驅動器。交流驅動器目前佔據最大佔有率,到2024年將貢獻全球77%以上的市場佔有率。預計其受歡迎程度將保持強勁,到2034年預計將成長至260億美元。交流驅動器的持續需求源自於持續的技術改進,這些改進融合了智慧功能,提升了其整體性能,並增強了其在廣泛應用中的吸引力。這些驅動器提供卓越的能量控制,使其非常適合效率和自動化至關重要的現代工業環境。

從地區來看,美國仍然是全球市場收入的重要貢獻者。美國變頻器市場規模在2022年及2023年均為32億美元,2024年將達33億美元。製造業、工業自動化和氣候控制系統等領域廣泛應用節能解決方案,推動了市場穩定成長。這些地區的企業正在大力投資有助於降低營運成本並滿足環保合規目標的技術,這進一步刺激了對先進變頻器系統的需求。

市場競爭態勢持續加劇,領導企業合計佔超過30%的市佔率。其中,知名企業包括羅克韋爾自動化、丹佛斯、ABB、西門子和三菱電機。這些產業領導者正致力於透過推出創新產品線和建立策略聯盟來擴大市場覆蓋範圍。他們採取的措施包括合資企業、合作夥伴關係和技術合作,旨在增強品牌影響力並贏得更大的客戶群。

產品創新、營運效率和能源最佳化仍然是變頻器製造商的核心關注領域。為了滿足日益成長的市場需求,許多公司正在擴大生產能力,並推出能夠無縫整合到數位生態系統的下一代產品。隨著各國政府持續推行嚴格的環境政策,變頻器在減少碳足跡和增強永續性方面的作用將日益增強,為產業的長期發展奠定基礎。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- 低的

- 中等的

第5章:市場規模及預測:按驅動力,2021-2034

- 主要趨勢

- 交流電

- 直流

- 伺服

第6章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 泵浦

- 扇子

- 輸送帶

- 壓縮機

- 擠出機

- 其他

第7章:市場規模及預測:依最終用途,2021-2034

- 主要趨勢

- 石油和天然氣

- 發電

- 採礦和金屬

- 紙漿和造紙

- 海洋

- 其他

第8章:市場規模及預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 丹麥

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- Beckhoff Automation

- Bosch Rexroth

- Danfoss

- Eaton

- Emerson Electric

- Fuji Electric

- GE Vernova

- Hiconics Eco-energy Technology

- Hitachi Industrial Equipment Systems

- Honeywell International

- Invertek Drives

- Johnson Controls

- Mitsubishi Electric

- Nidec Motor

- Rockwell Automation

- Schneider Electric

- Siemens

- WEG

- Yaskawa Electric

The Global Variable Frequency Drives Market was valued at USD 21.9 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 33.3 billion by 2034. This upward trend is primarily attributed to the growing importance placed on sustainability and energy conservation. Many governments around the world are reinforcing environmental policies, prompting industries to comply with updated energy efficiency regulations. These regulations, combined with incentives for adopting energy-saving technologies, are pushing manufacturers and facilities to modernize their operations. As a result, VFDs have become a critical part of these transitions, helping reduce energy consumption and curb industrial emissions.

In an increasingly digital and automated world, the integration of IoT and machine learning capabilities into industrial operations is playing a key role in reshaping how VFDs are used. These smart technologies enable real-time monitoring, fault detection, and predictive maintenance, which enhance operational efficiency and reduce downtime. Industries are now demanding VFD solutions that offer higher levels of precision, adaptability, and reliability. This shift is opening up new growth avenues for the market as enterprises look for smarter and more responsive energy control systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.9 Billion |

| Forecast Value | $33.3 Billion |

| CAGR | 4.2% |

Historical data highlights consistent year-over-year growth, with the global VFD market valued at USD 20.7 billion in 2022, USD 21.1 billion in 2023, and USD 21.9 billion in 2024. Market segmentation based on voltage reveals two main categories: low voltage and medium voltage drives. Among these, low voltage VFDs are expected to remain dominant through the forecast period, with revenue projected to surpass USD 29 billion by 2034. This segment's continued leadership is driven by the widespread adoption of automation technologies, a growing focus on energy savings, and an industry-wide shift toward cost-effective performance enhancements. The increasing preference for compact, efficient, and easy-to-integrate systems makes low voltage drives an ideal fit across multiple sectors.

The market is further divided based on drive types, which include AC drives, DC drives, and servo drives. AC drives currently account for the largest share, contributing over 77% of the global market in 2024. Their popularity is expected to remain strong, with projections indicating growth to USD 26 billion by 2034. The sustained demand for AC drives stems from ongoing technological improvements that incorporate smart functionality, which has enhanced their overall performance and increased their appeal across a broad range of applications. These drives offer superior energy control, which makes them well-suited for modern industrial environments where efficiency and automation are paramount.

Regionally, the United States remains a significant contributor to global market revenue. The U.S. VFD market stood at USD 3.2 billion in both 2022 and 2023, and reached USD 3.3 billion in 2024. The steady rise is driven by widespread implementation of energy-efficient solutions across sectors such as manufacturing, industrial automation, and climate control systems. Businesses in these areas are investing heavily in technologies that help lower operational costs while meeting environmental compliance goals, further bolstering demand for advanced VFD systems.

Competitive dynamics in the market continue to intensify, with leading players collectively holding more than 30% of the total market share. Prominent companies include Rockwell Automation, Danfoss, ABB, Siemens, and Mitsubishi Electric Corporation. These industry leaders are focusing on expanding their market reach through the introduction of innovative product lines and strategic alliances. Efforts include joint ventures, partnerships, and technology collaborations aimed at strengthening brand presence and capturing a larger customer base.

Product innovation, operational efficiency, and energy optimization remain the core focus areas for VFD manufacturers. To address growing market needs, many companies are scaling up production capabilities and introducing next-generation products that integrate seamlessly into digital ecosystems. As governments continue enforcing stringent environmental policies, the role of VFDs in reducing carbon footprints and enhancing sustainability will only grow stronger, setting the stage for long-term industry advancement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Market Size and Forecast, By Voltage, 2021 - 2034, ('000 Units & USD Million)

- 4.1 Key trends

- 4.2 Low

- 4.3 Medium

Chapter 5 Market Size and Forecast, By Drive, 2021 - 2034, ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 AC

- 5.3 DC

- 5.4 Servo

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Pump

- 6.3 Fan

- 6.4 Conveyor

- 6.5 Compressor

- 6.6 Extruder

- 6.7 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034, ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Power generation

- 7.4 Mining & metals

- 7.5 Pulp & paper

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034, ('000 Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Beckhoff Automation

- 9.3 Bosch Rexroth

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 Emerson Electric

- 9.7 Fuji Electric

- 9.8 GE Vernova

- 9.9 Hiconics Eco-energy Technology

- 9.10 Hitachi Industrial Equipment Systems

- 9.11 Honeywell International

- 9.12 Invertek Drives

- 9.13 Johnson Controls

- 9.14 Mitsubishi Electric

- 9.15 Nidec Motor

- 9.16 Rockwell Automation

- 9.17 Schneider Electric

- 9.18 Siemens

- 9.19 WEG

- 9.20 Yaskawa Electric