|

市場調查報告書

商品編碼

1741020

檸檬草油市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Lemongrass Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

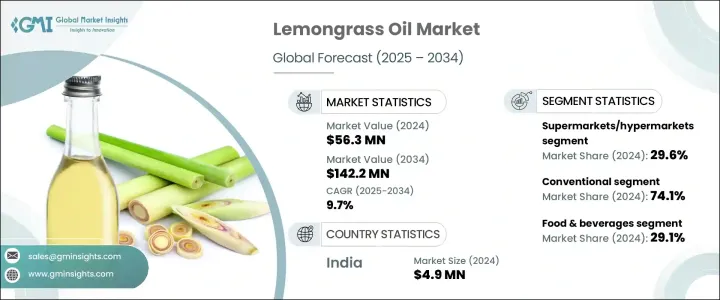

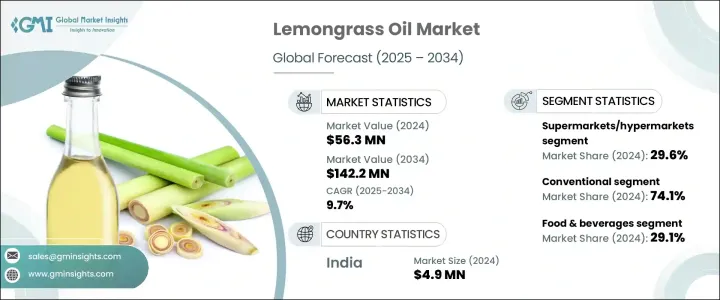

2024年,全球檸檬草油市場價值為5,630萬美元,預計到2034年將以9.7%的複合年成長率成長,達到1.422億美元。這得歸功於檸檬草油在化妝品和個人護理產品中日益普及,其抗菌、抗真菌和抗炎特性備受推崇。隨著消費者對有機和植物成分的需求不斷成長,檸檬草油已成為護膚、身體護理和護髮產品中備受追捧的成分。清潔美容運動的興起以及無化學替代品的流行趨勢進一步推動了這一需求,促使大型化妝品公司將檸檬草油納入其產品線。

檸檬草油在潔面乳、爽膚水和保濕霜等美容產品中的應用日益廣泛。檸檬草油以其控製油脂分泌、減少痤瘡和煥活肌膚的功效而聞名。它的抗氧化特性也被用於抗衰老產品中,保護皮膚免受自由基的侵害。在護髮方面,檸檬草油因其滋養頭皮、去除頭皮屑和強韌髮質的功效,常用於洗髮精和護髮素中。此外,其清新的柑橘香味使其成為沐浴露和除臭劑的熱門成分。消費者對植物性美容產品的日益青睞推動了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5630萬美元 |

| 預測值 | 1.422億美元 |

| 複合年成長率 | 9.7% |

市場分為傳統和有機兩類,其中傳統類型在2024年佔74.1%的佔有率。傳統檸檬草油供應更廣泛,採用傳統耕作方法生產。它服務於化妝品、食品、藥品和芳香療法等多個行業。印度、中國和印尼等國家在檸檬草油生產方面處於領先地位,其強大的供應鏈確保了檸檬草油的全球供應。其高檸檬醛含量使其成為香水、驅蟲劑和食品調味劑中備受青睞的成分,並因此得到了廣泛的應用。

食品飲料產業仍是檸檬草油的最大消費領域,佔29.1%,緊隨其後的是快速發展的製藥業。檸檬草油因其抗菌特性而備受推崇,使其成為各種食品的理想添加劑,例如涼茶、湯、醬汁和糖果。除了柑橘風味外,檸檬草油還具有促進消化和抗氧化的功效,這使其在食品和飲料配方中越來越受歡迎。隨著越來越多的消費者尋求天然且有益健康的成分,檸檬草油在烹飪和保健應用方面的多功能性將繼續推動該行業的需求。

2024年,印度檸檬草油市場產值達490萬美元,其中印度是主要的檸檬草油生產國。美國和歐洲各國是檸檬草油的最大進口國,佔全球需求的很大一部分。這些地區嚴重依賴種植檸檬草的熱帶國家進行精油萃取。隨著國際市場認知到這種用途廣泛的精油在烹飪和保健產品中的益處,全球對檸檬草油的需求持續成長。隨著市場的擴張,印度和其他生產國已準備好滿足日益成長的全球需求,進一步鞏固其在全球檸檬草油供應鏈中的地位。

檸檬草油行業的領先公司包括 Young Living Essential Oils、Edens Garden、Mountain Rose Herbs、NOW Foods 和 Aura Cacia。這些公司專注於產品創新,擴大全球影響力,並加強消費者對檸檬草油益處的教育。他們也正在探索永續的農業實踐,與供應商建立策略合作夥伴關係,並增強產品供應,以滿足消費者對有機和環保產品日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 供給側影響(原料)

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國(2021-2024年)

- 主要進口國(2021-2024年)

註:以上貿易統計僅針對重點國家。

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 其他地區

- 衝擊力

- 成長動力

- 天然精油需求不斷成長

- 擴大化妝品和個人護理產品的應用

- 食品飲料業的成長

- 產業陷阱與挑戰

- 來自合成替代品的激烈競爭

- 原料供應有限

- 成長動力

- 萃取和加工技術

- 傳統方法

- 現代萃取技術

- 供應鏈結構與動態

- 原物料採購

- 生產加工

- 分銷管道

- 成本結構分析

- 生產成本

- 加工成本

- 分銷和行銷成本

- 消費者行為

- 消費者人口統計與偏好

- 購買決策因素

- 品質和純度考慮

- 價格敏感度

- 環境影響評估

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

- 針對市場利害關係人的策略建議

- 對製造商和供應商的建議

- 對分銷商和零售商的建議

- 對最終用途產業的建議

- 策略舉措與最新發展

- 合併與收購

- 夥伴關係與合作

- 產品發布和創新

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 傳統的

- 有機的

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 個人護理和化妝品

- 製藥

- 芳香療法

- 家用清潔產品

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 網路零售

- 超市/大賣場

- 專賣店

- 直銷

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- AG Organica

- Aura Cacia

- doTERRA

- Edens Garden

- Mountain Rose Herbs

- NOW Foods

- Phoenix Aromas & Essential Oils, LLC

- Plant Therapy Essential Oils

- The Lebermuth Company

- Young Living Essential Oils

The Global Lemongrass Oil Market was valued at USD 56.3 million in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 142.2 million by 2034, driven by the growing popularity of lemongrass oil in cosmetics and personal care products, where it is valued for its antibacterial, antifungal, and anti-inflammatory properties. With increasing consumer demand for organic and plant-based ingredients, lemongrass oil has become a sought-after component in skincare, body care, and hair care products. The rise of the clean beauty movement and the trend toward chemical-free alternatives have fueled this demand, encouraging large cosmetics companies to integrate lemongrass oil into their product lines.

The use of lemongrass oil in beauty products such as cleansers, toners, and moisturizers is expanding. Oil is known for its ability to control excess oil production, reduce acne, and rejuvenate the skin. Its antioxidant properties are also utilized in anti-aging products to protect the skin from free radicals. In hair care, lemongrass oil is popular in shampoos and conditioners for its ability to nourish the scalp, fight dandruff, and strengthen hair. Additionally, its refreshing citrus scent has made it a popular ingredient in body washes and deodorants. This increasing consumer preference for plant-based beauty products drives the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.3 Million |

| Forecast Value | $142.2 Million |

| CAGR | 9.7% |

The market is divided into conventional and organic types, with the conventional segment holding 74.1% share in 2024. Conventional lemongrass oil is more widely available and is produced through traditional farming methods. It serves various industries, including cosmetics, food, pharmaceuticals, and aromatherapy. Countries like India, China, and Indonesia lead in production, and their robust supply chains ensure the availability of lemongrass oil globally. Its high citral content makes it a favored ingredient in fragrances, insect repellents, and food flavorings, contributing to its widespread use.

The food and beverage industry remains the largest consumer of lemongrass oil, capturing a share of 29.1%, followed closely by the rapidly expanding pharmaceutical sector. Lemongrass oil is prized for its antibacterial properties, which make it an ideal addition to various food products such as herbal teas, soups, sauces, and confectioneries. Beyond its citrusy flavor, the oil offers digestive and antioxidant benefits, contributing to its growing popularity in food and beverage formulations. As more consumers seek natural and health-promoting ingredients, lemongrass oil's versatility in both culinary and wellness applications continues to drive demand within the sector.

India Lemongrass Oil Market generated USD 4.9 million in 2024, with India being a key oil producer. The United States and various European countries are the largest importers of lemongrass oil, accounting for a significant share of global demand. These regions rely heavily on the tropical countries where lemongrass is grown for essential oil extraction. The global demand for lemongrass oil continues to grow as international markets recognize the benefits of this versatile oil in both culinary and wellness products. As the market expands, India and other producing countries are poised to meet the increasing global demand, further solidifying their positions in the global lemongrass oil supply chain.

Leading companies in the lemongrass oil industry include Young Living Essential Oils, Edens Garden, Mountain Rose Herbs, NOW Foods, and Aura Cacia. These companies are focusing on product innovation, expanding their global presence, and increasing consumer education about the benefits of lemongrass oil. They are also exploring sustainable farming practices, building strategic partnerships with suppliers, and enhancing their product offerings to meet growing consumer demand for organic and eco-friendly products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Trump Administration Tariffs

- 3.4.1 Impact on Trade

- 3.4.1.1 Trade Volume Disruptions

- 3.4.1.2 Retaliatory Measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-Side Impact (Raw Materials)

- 3.4.2.1.1 Price Volatility in Key Materials

- 3.4.2.1.2 Supply Chain Restructuring

- 3.4.2.1.3 Production Cost Implications

- 3.4.2.1 Supply-Side Impact (Raw Materials)

- 3.4.3 Demand-Side Impact (Selling Price)

- 3.4.3.1 Price Transmission to End Markets

- 3.4.3.2 Market Share Dynamics

- 3.4.3.3 Consumer Response Patterns

- 3.4.4 Key Companies Impacted

- 3.4.5 Strategic Industry Responses

- 3.4.5.1 Supply Chain Reconfiguration

- 3.4.5.2 Pricing and Product Strategies

- 3.4.5.3 Policy Engagement

- 3.4.6 Outlook and Future Considerations

- 3.4.1 Impact on Trade

- 3.5 Trade statistics (HS Code)

- 3.5.1 Major Exporting Countries, 2021-2024 (Kilo Tons)

- 3.5.2 Major Importing Countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Other Regions

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing demand for natural essential oils

- 3.7.1.2 Expanding applications in cosmetics & personal care

- 3.7.1.3 Growth in food & beverage industry

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Intense competition from synthetic alternatives

- 3.7.2.2 Limited availability of raw materials

- 3.7.1 Growth drivers

- 3.8 Extraction and Processing Technologies

- 3.8.1 Traditional Methods

- 3.8.2 Modern Extraction Technologies

- 3.9 Supply Chain Structure and Dynamics

- 3.9.1 Raw Material Sourcing

- 3.9.2 Production and Processing

- 3.9.3 Distribution Channels

- 3.10 Cost Structure Analysis

- 3.10.1 Production Costs

- 3.10.2 Processing Costs

- 3.10.3 Distribution and Marketing Costs

- 3.11 Consumer Behavior

- 3.11.1 Consumer Demographics and Preferences

- 3.11.2 Purchase Decision Factors

- 3.11.2.1 Quality and Purity Considerations

- 3.11.2.2 Price Sensitivity

- 3.12 Environmental Impact Assessment

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Strategic Recommendations for Market Stakeholders

- 4.5.1 Recommendations for Manufacturers and Suppliers

- 4.5.2 Recommendations for Distributors and Retailers

- 4.5.3 Recommendations for End Use Industries

- 4.6 Strategic Initiatives and Recent Developments

- 4.6.1 Mergers and Acquisitions

- 4.6.2 Partnerships and Collaborations

- 4.6.3 Product Launches and Innovations

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Organic

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Personal care & cosmetics

- 6.4 Pharmaceuticals

- 6.5 Aromatherapy

- 6.6 Household cleaning products

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online retail

- 7.3 Supermarkets/hypermarkets

- 7.4 Specialty stores

- 7.5 Direct sales

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AG Organica

- 9.2 Aura Cacia

- 9.3 doTERRA

- 9.4 Edens Garden

- 9.5 Mountain Rose Herbs

- 9.6 NOW Foods

- 9.7 Phoenix Aromas & Essential Oils, LLC

- 9.8 Plant Therapy Essential Oils

- 9.9 The Lebermuth Company

- 9.10 Young Living Essential Oils