|

市場調查報告書

商品編碼

1741010

圓形連接器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Circular Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

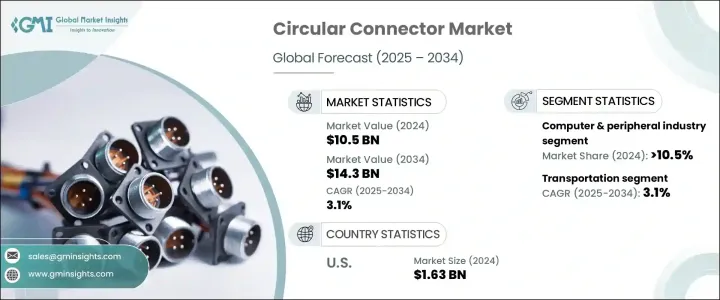

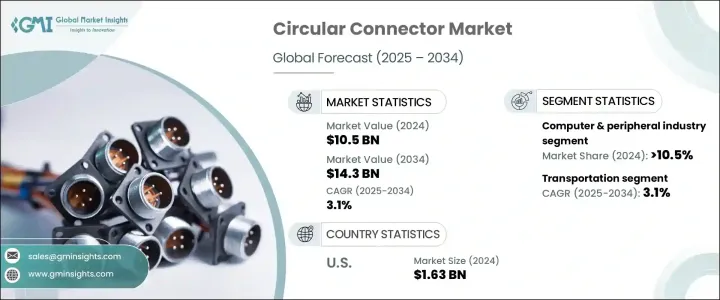

2024年,全球圓形連接器市場規模達105億美元,預計到2034年將以3.1%的複合年成長率成長,達到143億美元。這一成長軌跡凸顯了圓形連接器在確保資料訊號和電力穩定高效傳輸方面日益重要的作用,尤其是在嚴苛的環境中。隨著全球工業自動化和數位轉型的持續加速,這些連接器正成為在各種應用中實現無縫安全運作的關鍵組件。圓形連接器具有高可靠性、堅固耐用的設計以及卓越的耐環境性能——這些特性在當今的高性能工業和電子系統中變得不可或缺。

智慧製造的蓬勃發展、工業 4.0 的發展以及嵌入式系統的進步,都加劇了對圓形連接器的需求。從機器人和工廠自動化到航太和國防,圓形連接器正成為不間斷連結的支柱。此外,隨著邊緣運算、物聯網和即時分析的興起,系統面臨越來越大的無故障傳輸大量資料的壓力,這提升了對穩健連接器技術的需求。數位基礎設施擴張、組件小型化以及對系統可靠性日益成長的關注等全球趨勢,進一步鞏固了圓形連接器在現代創新生態系統中不可或缺的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 105億美元 |

| 預測值 | 143億美元 |

| 複合年成長率 | 3.1% |

隨著自動化技術在各個領域的應用,圓形連接器在實現複雜機械的即時通訊和無縫操作方面發揮關鍵作用。工業的快速成長和智慧基礎設施(例如工廠自動化和製程控制系統)的擴張直接推動了市場需求。電信、汽車系統和軍事裝備領域的持續創新也推動了對高耐用性、高精度和高性能互連解決方案的需求。

5G基礎設施的持續部署以及高速資料傳輸能力的日益整合已成為推動其應用的主要驅動力。現代通訊網路要求連接器即使在高頻負載下也能保持完整性和效能,而圓形連接器的獨特設計能夠滿足這些嚴格的要求。此外,國防工業仍然是市場成長的重要貢獻者,這得益於其對耐候、防震和高可靠性組件的持續需求,這些組件可在極端操作環境下正常運作。

然而,市場確實面臨一些挑戰。全球貿易政策的轉變和關稅結構的波動擾亂了供應鏈的連續性,造成了暫時的短缺,迫使製造商探索區域化生產策略。雖然這種轉變有助於長期穩定,但有效實施也需要大量的資本投入和更長的時間。

2024年,交通運輸業在圓形連接器市場中展現出顯著的成長動能。預計到2034年,該產業的複合年成長率將穩定維持在3.1%,其成長主要得益於電動車(EV)基礎設施投資的激增。政府大力支持在全國範圍內部署高速充電網路,這刺激了對能夠承受高電壓、惡劣天氣和頻繁使用的連接器的需求。圓形連接器憑藉其堅固的結構、高效的電力傳輸能力以及與快速充電技術的兼容性,正成為電動車充電站和車載系統的重要組成部分。

依最終用途細分市場,可以發現其應用範圍廣泛,涵蓋電信、工業自動化、軍事、汽車、電腦及周邊設備、交通運輸等細分領域。 2024年,電腦及周邊設備市場將佔據10.5%的市場佔有率,這得益於智慧型手機、筆記型電腦、伺服器和路由器等設備對高速可靠資料傳輸的需求不斷成長。雲端運算、先進資料中心和物聯網技術的廣泛應用將繼續推動該領域的需求。

2024年,美國圓形連接器市場規模達16.3億美元,這得益於公共和私營部門對永續交通和電動車基礎設施的大量投資。隨著消費者對更清潔、科技賦能的出行解決方案的需求日益成長,對堅固耐用、高性能圓形連接器的需求也日益成長,這使得美國成為全球市場擴張的主要驅動力。

全球圓形連接器領域的主要參與者包括矢崎、纜普集團、Fischer Connectors、Mencom、泰科電子、安費諾、莫仕、安波福、AVX、菲尼克斯電氣、GTK、廣瀨電機、3M、日本航空電子、羅森伯格、阿美特克、富士康和立示精密。這些公司正致力於擴大產能,投資下一代產品的研發,並建立跨產業的策略聯盟。許多公司也正在尋求收購,以獲取創新技術並拓展產品線。向區域製造的強力轉型也正在獲得越來越多的關注,旨在最大限度地降低供應鏈風險,並以更快、更有效率的方式滿足本地市場需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 對貿易的影響

- 展望與未來考慮

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 電信

- 運輸

- 汽車

- 工業的

- 電腦及周邊設備

- 軍隊

- 其他

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- 3M

- Ametek

- Amphenol

- Aptiv

- AVX

- Fischer Connectors

- Foxconn

- GTK

- Hirose Electric

- Japan Aviation Electronics

- Lapp Group

- Luxshare Precision

- Mencom

- Molex

- Phoenix Contact

- Rosenberger

- TE Connectivity

- Yazaki

The Global Circular Connector Market was valued at USD 10.5 billion in 2024 and is estimated to expand at a CAGR of 3.1% to reach USD 14.3 billion by 2034. This growth trajectory underscores the increasing importance of circular connectors in ensuring stable and efficient transmission of data signals and electrical power, particularly in harsh and demanding environments. As industrial automation and digital transformation continue to accelerate worldwide, these connectors are emerging as crucial components in enabling seamless and secure operations across a variety of applications. Circular connectors offer high reliability, rugged design, and superior resistance to environmental challenges-traits that are becoming indispensable in today's high-performance industrial and electronic systems.

The surge in smart manufacturing, growth of Industry 4.0, and advancements in embedded systems are all contributing to the heightened demand. From robotics and factory automation to aerospace and defense, circular connectors are providing the backbone for uninterrupted connectivity. Furthermore, with the rise of edge computing, IoT, and real-time analytics, systems are under increasing pressure to transmit larger volumes of data without failure, elevating the need for robust connector technologies. Global trends such as digital infrastructure expansion, miniaturization of components, and the rising focus on system reliability further solidify the integral role of circular connectors in modern innovation ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 3.1% |

As automation technologies gain ground across sectors, circular connectors are playing a key role in enabling real-time communication and seamless operation of complex machinery. Rapid industrial growth and the expansion of intelligent infrastructure-such as factory automation and process control systems-are directly fueling market demand. Continuous innovation in telecommunications, automotive systems, and military equipment is also driving the need for highly durable, precise, and high-performance interconnect solutions.

The ongoing rollout of 5G infrastructure and the growing integration of high-speed data transmission capabilities have emerged as major drivers of adoption. Modern communication networks demand connectors that can maintain integrity and performance even under high-frequency loads, and circular connectors are uniquely engineered to meet these stringent requirements. In addition, the defense industry remains a significant contributor to market growth, propelled by its consistent need for weather-resistant, shock-proof, and highly reliable components that perform in extreme operational settings.

However, the market does face certain challenges. Shifting global trade policies and fluctuating tariff structures have disrupted supply chain continuity, causing temporary shortages and compelling manufacturers to explore regionalized production strategies. While such a shift supports long-term stability, it also requires substantial capital investments and longer timelines to implement effectively.

In 2024, the transportation sector demonstrated notable momentum within the circular connector market. With projections estimating a steady CAGR of 3.1% through 2034, growth in this sector is driven largely by surging investments in electric vehicle (EV) infrastructure. Strong government support for the nationwide deployment of high-speed charging networks is fueling demand for connectors capable of handling high voltages, harsh weather, and frequent use. Circular connectors are becoming essential components of EV charging stations and onboard systems due to their robust build, efficient power transfer capabilities, and compatibility with fast-charging technology.

Segmenting the market by end-use highlights a broad range of applications spanning telecom, industrial automation, military, automotive, computers and peripherals, transportation, and other niche sectors. In 2024, the computer and peripherals segment captured a 10.5% market share, driven by growing demand for high-speed and dependable data transfer in devices like smartphones, laptops, servers, and routers. The widespread adoption of cloud computing, advanced data centers, and IoT technologies continues to boost demand in this segment.

The United States Circular Connector Market generated USD 1.63 billion in 2024, propelled by significant public and private investments in sustainable transportation and electric mobility infrastructure. As consumers increasingly demand cleaner, tech-enabled mobility solutions, the need for rugged and high-performance circular connectors is rising-positioning the U.S. as a major driver of global market expansion.

Key players in the global circular connector space include Yazaki, Lapp Group, Fischer Connectors, Mencom, TE Connectivity, Amphenol, Molex, Aptiv, AVX, Phoenix Contact, GTK, Hirose Electric, 3M, Japan Aviation Electronics, Rosenberger, Ametek, Foxconn, and Luxshare Precision. These companies are focusing on expanding production capacity, investing in R&D for next-gen product development, and forming strategic alliances across multiple industries. Many are also pursuing acquisitions to access innovative technologies and broaden their offerings. A strong pivot toward regional manufacturing is also gaining traction, aimed at minimizing supply chain risks and catering to local market demands with greater speed and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use, 2021 - 2034 (Million Units, USD Billion)

- 5.1 Key trends

- 5.2 Telecom

- 5.3 Transportation

- 5.4 Automotive

- 5.5 Industrial

- 5.6 Computer & peripherals

- 5.7 Military

- 5.8 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (Million Units, USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 3M

- 7.2 Ametek

- 7.3 Amphenol

- 7.4 Aptiv

- 7.5 AVX

- 7.6 Fischer Connectors

- 7.7 Foxconn

- 7.8 GTK

- 7.9 Hirose Electric

- 7.10 Japan Aviation Electronics

- 7.11 Lapp Group

- 7.12 Luxshare Precision

- 7.13 Mencom

- 7.14 Molex

- 7.15 Phoenix Contact

- 7.16 Rosenberger

- 7.17 TE Connectivity

- 7.18 Yazaki