|

市場調查報告書

商品編碼

1741006

家庭能源管理系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Home Energy Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

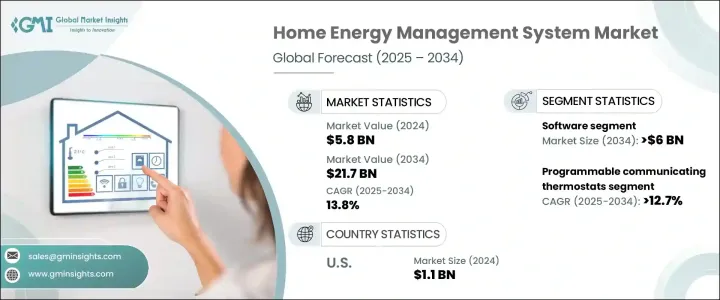

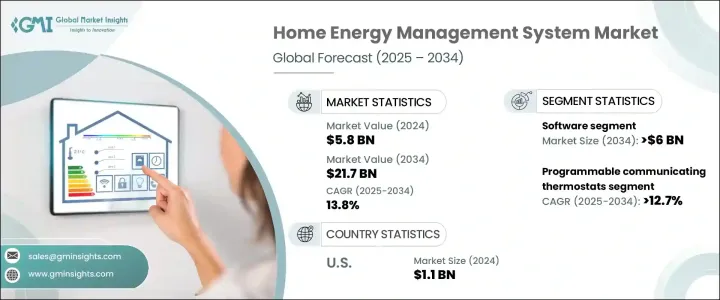

2024年,全球家庭能源管理系統市場規模達58億美元,預計年複合成長率將達13.8%,到2034年將達到217億美元,這得益於智慧家庭技術的普及和日益成長的環境永續關注。全球減少碳排放的趨勢、節能技術的進步以及再生能源融入家庭等許多因素正在推動市場擴張。物聯網和人工智慧技術的採用在增強家庭能源管理系統(HEMS)方面發揮了重要作用,使用戶能夠自動執行節能操作,例如根據使用模式調整溫度設定以及在高峰時段減少能耗。人工智慧系統進一步個人化了節能建議,從而提高了整體系統效率。

政府推出的節能項目和法規也在加速家庭能源管理解決方案的普及方面發揮了關鍵作用。世界各國政府提供的各種獎勵措施和補貼,鼓勵消費者投資節能技術。嚴格的能源使用法規,加上雄心勃勃的氣候目標,正推動消費者投資能夠最佳化能源消耗的智慧家庭解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 58億美元 |

| 預測值 | 217億美元 |

| 複合年成長率 | 13.8% |

2024年,家庭能源管理系統市場規模將達58億美元。不斷上漲的公用事業價格和日益成長的環境問題促使消費者尋求能夠降低能源成本和碳足跡的替代方案。恆溫器、照明系統和電動車 (EV) 充電器等智慧型設備日益融入家庭,加速了家庭能源管理系統 (HEMS) 的普及。隨著對能源效率的需求不斷成長,越來越多的家庭正在採用智慧家庭技術。

可程式通訊恆溫器市場預計將大幅成長,到2034年複合年成長率將達到12.7%。這些恆溫器配備了預設調度、遠端溫度調節和即時監控等先進功能,可顯著降低能耗並降低水電費。因此,它們在注重永續性和成本效益的消費者中越來越受歡迎。透過讓屋主更好地控制家中的供暖和製冷系統,這些設備可以最佳化能源使用,使其成為日益成長的節能住宅趨勢中不可或缺的一部分。

2024年,美國家庭能源管理系統市場規模達11億美元,並可望持續成長。智慧家庭技術的廣泛應用為家庭能源管理系統市場奠定了堅實的基礎,因為消費者擴大尋求互聯互通的解決方案來更有效地管理家庭能源使用。智慧恆溫器、照明控制器和其他支援物聯網的設備無縫整合到集中式能源管理系統中,使用戶能夠即時掌控能源消耗。

全球家庭能源管理系統市場的主要公司包括西門子、東芝、霍尼韋爾、施耐德電氣和江森自控。這些公司專注於智慧技術創新、客戶互動策略和策略合作夥伴關係,以增強其市場影響力。許多公司也投資於永續解決方案並擴展其產品組合,以滿足對節能家庭管理系統日益成長的需求。此外,策略併購和合作也是擴大市場覆蓋範圍和增強技術能力的常見策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 計量和現場設備

- 硬體

- 軟體

- 網路裝置

- 控制系統

- 感應器

- 其他

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 照明控制

- 自我監控系統和服務

- 可程式通訊恆溫器

- 先進的中央控制器

- 智慧暖通空調控制器

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Eaton

- Emerson Electric

- ENGIE Impact

- General Electric

- GridPoint

- Honeywell

- Johnson Controls

- Kenmore

- Optimum Energy

- Schneider Electric

- Siemens

- Telkonet

- Toshiba

The Global Home Energy Management System Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 13.8% to reach USD 21.7 billion by 2034 driven by the increasing adoption of smart home technologies and growing environmental sustainability concerns. Several factors, such as the global shift toward reducing carbon emissions, advancements in energy-efficient technologies, and the integration of renewable energy sources into homes, are fueling market expansion. The adoption of IoT and AI technologies has played a significant role in enhancing HEMS, enabling users to automate energy-saving actions such as adjusting temperature settings based on usage patterns and reducing consumption during peak hours. AI-powered systems further personalize energy-saving recommendations, improving the overall system efficiency.

Government programs and regulations promoting energy efficiency have also played a pivotal role in accelerating the adoption of home energy management solutions. Various incentives and rebates offered by governments worldwide encourage consumers to invest in energy-saving technologies. Stringent energy usage regulations, coupled with ambitious climate targets, are pushing consumers toward investing in smart home solutions that optimize energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 13.8% |

The home energy management system market was valued at USD 5.8 billion by 2024. Rising utility prices and increasing environmental concerns motivate consumers to seek alternatives that reduce energy costs and carbon footprint. The growing integration of smart devices such as thermostats, lighting systems, and electric vehicle (EV) chargers into homes accelerates the adoption of HEMS. As the demand for energy efficiency continues to rise, more households are adopting smart home technologies.

The programmable communicating thermostat segment is anticipated to drive substantial growth, expanding at a CAGR of 12.7% through 2034. These thermostats are designed with advanced features like preset scheduling, remote temperature adjustments, and real-time monitoring, which significantly reduce energy consumption and lower utility bills. As a result, they are becoming increasingly popular among consumers who are prioritizing sustainability and cost efficiency. By allowing homeowners to have better control over their home's heating and cooling systems, these devices optimize energy use, making them an integral part of the growing trend toward energy-efficient homes.

United States Home Energy Management System Market reached USD 1.1 billion in 2024 and is poised for continued growth due to the widespread adoption of smart home technologies is creating a solid foundation for the HEMS market as consumers increasingly seek interconnected solutions to manage their home's energy use more effectively. Smart thermostats, lighting controls, and other IoT-enabled devices are seamlessly integrated into centralized energy management systems, offering users real-time control over their energy consumption.

Major companies in the Global Home Energy Management System Market include Siemens, Toshiba, Honeywell, Schneider Electric, and Johnson Controls. These companies are focusing on innovations in smart technologies, customer engagement strategies, and strategic partnerships to strengthen their presence in the market. Many companies are also investing in sustainable solutions and expanding their product portfolios to meet the growing demand for energy-efficient home management systems. Additionally, strategic mergers, acquisitions, and collaborations are common strategies to expand market reach and enhance technological capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Metering & field equipment

- 5.3 Hardware

- 5.4 Software

- 5.5 Networking device

- 5.6 Control systems

- 5.7 Sensors

- 5.8 Others

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Lighting controls

- 6.3 Self-monitoring systems & services

- 6.4 Programmable communicating thermostats

- 6.5 Advanced central controllers

- 6.6 Intelligent HVAC controllers

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Eaton

- 8.3 Emerson Electric

- 8.4 ENGIE Impact

- 8.5 General Electric

- 8.6 GridPoint

- 8.7 Honeywell

- 8.8 Johnson Controls

- 8.9 Kenmore

- 8.10 Optimum Energy

- 8.11 Schneider Electric

- 8.12 Siemens

- 8.13 Telkonet

- 8.14 Toshiba