|

市場調查報告書

商品編碼

1740995

蜂窩車聯網 (C-V2X) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cellular Vehicle-to-Everything (C-V2X) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

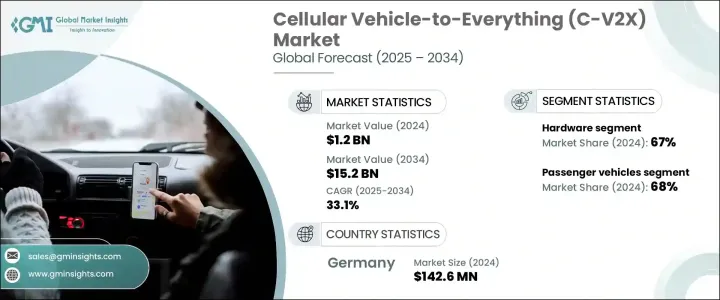

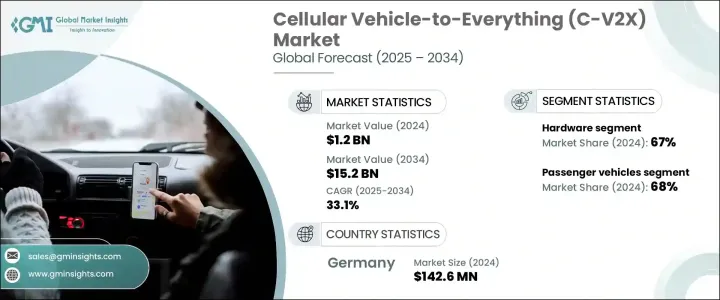

2024 年全球蜂窩車聯網市場規模達 12 億美元,預計到 2034 年將以 33.1% 的複合年成長率成長,達到 152 億美元。這項快速擴張主要得益於對先進道路安全技術日益成長的需求,以及對高效能智慧交通管理系統日益成長的需求。由於道路交通事故仍然是全球關注的重大議題,C-V2X 技術的採用激增。這項創新促進了車輛、基礎設施和行人之間的即時通訊,有助於降低碰撞風險並簡化交通流量。隨著城市中心轉向更智慧、更安全的交通解決方案,C-V2X 在實現互聯交通生態系統、提高安全性和便利性方面正變得不可或缺。它在自動駕駛汽車的發展中也發揮著關鍵作用,確保它們在日益複雜的環境中安全且有效率地運作。

C-V2X 是自動駕駛汽車和網路連線汽車的基礎。透過允許車輛交換有關其位置、速度和意圖的即時資料,它支援更安全、更協調的駕駛體驗。這種持續的資料傳輸對於自動駕駛汽車的安全運行至關重要,有助於其應對路況、危險以及視線範圍之外的周邊交通狀況。僅靠雷達和攝影機等傳統感測器無法達到這種環境感知水準。 C-V2X 可以實現更平穩的車道變換、更安全的交叉路口導航和最佳化路線。它甚至可以減少交通堵塞,尤其是在複雜的城市或高速公路環境中。該市場的快速成長反映了汽車產業對更高自動化程度的追求以及對增強車輛安全性日益成長的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 152億美元 |

| 複合年成長率 | 33.1% |

就組件而言,C-V2X 市場分為硬體和軟體兩部分,其中硬體在 2024 年佔據 67% 的主導市場佔有率。這個細分市場之所以如此突出,是因為硬體在實現 V2X 功能方面發揮著至關重要的作用。車載單元、感測器、天線和路邊基礎設施等設備對於即時資料交換至關重要。汽車製造商擴大將這些技術融入車輛,以提高自動化、導航和安全性。公共和私營部門對互聯基礎設施的持續投資正在推動硬體細分市場的成長。

乘用車在2024年佔68%的市場佔有率,引領市場,預計複合年成長率將達到33.5%。高級駕駛輔助系統 (ADAS) 在乘用車中的廣泛應用是推動 C-V2X 技術需求的關鍵因素。這些系統利用 C-V2X 提供的額外資料來增強危險偵測、提升態勢感知能力,並增強車輛整體安全性。

在德國,C-V2X 市場規模達 1.426 億美元,2024 年佔 27%。德國在市場上的領先地位得益於其先進的汽車生態系統、廣泛的 5G 部署以及政府大力推動智慧交通系統的舉措。這些政策,加上汽車和電信業的協同創新,使德國成為歐洲大規模 C-V2X 測試的首選。

市場的主要參與者包括英特爾、羅伯特·博世、高通、ATandT、華為技術、是德科技、英飛凌科技、大陸集團、中興通訊和電裝。為了保持競爭力,這些公司專注於與汽車製造商、電信營運商和基礎設施公司建立策略合作夥伴關係。他們在 5G 整合、智慧城市試點計畫以及參與標準化計畫的投資,是加速 C-V2X 系統商業化的關鍵。此外,各公司正大力投入研發,以降低延遲、提高覆蓋範圍並增強互通性,同時不斷擴展產品線,以滿足乘用車和商用車平台的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- C-V2X硬體供應商

- C-V2X軟體供應商

- 汽車原廠設備製造商

- 電信服務供應商

- 最終用途

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 汽車OEM

- 電信設備供應商

- 半導體和模組供應商

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 全球道路交通事故數量不斷上升

- 自動駕駛汽車的普及率不斷提高

- 對更安全的道路交通的需求不斷成長

- 車輛遠端資訊處理日益普及

- 產業陷阱與挑戰

- 網路安全和隱私問題

- 缺乏蜂窩訊號覆蓋

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依通訊方式,2021 - 2034 年

- 主要趨勢

- 車對人 (V2P)

- 車輛到基礎設施 (V2I)

- 車對網路(V2N)

- 車對車 (V2V)

第6章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 車載單元 (OBU)

- 路邊單元 (RSU)

- 天線

- 通訊模組

- 軟體

- 交通管理軟體

- 車隊管理系統

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 車隊管理

- 自動駕駛

- 避免碰撞

- 智慧交通系統

- 停車管理系統

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- AT&T

- Autotalks

- Cohda Wireless

- Commsignia

- Continental

- Denso

- Ficosa International

- Huawei Technologies

- Infineon Technologies

- Intel

- Keysight Technologies

- Nokia

- NTT DOCOMO

- Qualcomm

- Quectel Wireless Solutions

- Robert Bosch

- Rohde & Schwarz

- Savari

- Shenzhen Genvict Technologies

- ZTE Corporation

The Global Cellular Vehicle-To-Everything Market was valued at USD 1.2 billion in 2024 and is projected to grow at a CAGR of 33.1% to reach USD 15.2 billion by 2034. This rapid expansion is primarily driven by the increasing demand for advanced road safety technologies and the growing need for efficient, intelligent traffic management systems. With road accidents remaining a significant concern worldwide, the adoption of C-V2X technology has surged. This innovation facilitates real-time communication between vehicles, infrastructure, and pedestrians, helping to reduce collision risks and streamline traffic flow. As urban centers shift toward smarter, safer transportation solutions, C-V2X is becoming integral in enabling a connected transport ecosystem that enhances both safety and convenience. It also plays a critical role in the evolution of autonomous vehicles, ensuring they operate safely and efficiently within increasingly complex environments.

C-V2X is foundational for both autonomous and connected vehicles. By allowing vehicles to exchange real-time data regarding their position, speed, and intent, it supports safer and more coordinated driving experiences. This continuous data transmission is vital for the safe operation of autonomous vehicles, helping them respond to road conditions, hazards, and surrounding traffic far beyond the line of sight. Traditional sensors like radar and cameras alone can not achieve this level of environmental awareness. C-V2X facilitates smoother lane changes, safer intersection navigation, and optimized routing. It can even reduce congestion, particularly in complex urban or highway settings. The market's rapid growth reflects the broader automotive industry's push toward increased automation and the evolving need for enhanced vehicle safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $15.2 Billion |

| CAGR | 33.1% |

In terms of components, the C-V2X market is divided into hardware and software, with hardware holding a dominant 67% market share in 2024. This segment's prominence is due to the essential role that hardware plays in enabling V2X functionality. Devices such as on-board units, sensors, antennas, and roadside infrastructure are integral for real-time data exchange. Automotive manufacturers are increasingly incorporating these technologies into vehicles to improve automation, navigation, and safety. The continued investment in connected infrastructure by both public and private sectors is fueling the growth of the hardware segment.

Passenger vehicles led the market with a 68% share in 2024 and are expected to grow at a CAGR of 33.5%. The widespread adoption of advanced driver-assistance systems (ADAS) in passenger cars has been a key factor driving demand for C-V2X technology. These systems leverage the additional data provided by C-V2X to enhance hazard detection, improve situational awareness, and strengthen overall vehicle safety.

In Germany, the C-V2X market generated USD 142.6 million, holding a 27% share in 2024. The country's leadership in the market can be attributed to its advanced automotive ecosystem, widespread 5G deployment, and robust government initiatives promoting intelligent transportation systems. These policies, alongside collaborative innovation across the automotive and telecommunications sectors, make Germany a prime location for large-scale C-V2X testing in Europe.

Key players in the market include Intel, Robert Bosch, Qualcomm, ATandT, Huawei Technologies, Keysight Technologies, Infineon Technologies, Continental, ZTE, and Denso. To stay competitive, these companies focus on strategic partnerships with automakers, telecom providers, and infrastructure firms. Their investments in 5G integration, smart city pilot projects, and participation in standardization initiatives are key to accelerating the commercialization of C-V2X systems. Additionally, significant RandD efforts are being made to enhance latency, coverage, and interoperability while companies continue to expand their product offerings to cater to both passenger and commercial vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 C-V2X hardware suppliers

- 3.2.2 C-V2X software suppliers

- 3.2.3 Automotive OEMs

- 3.2.4 Telecom service providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.3.1 Automotive OEM

- 3.4.3.2 Telecom equipment providers

- 3.4.3.3 Semiconductor and module suppliers

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising number road accidents across the globe

- 3.9.1.2 Growing adoption of autonomous vehicles

- 3.9.1.3 Rising demand for safer road travel

- 3.9.1.4 Growing popularity of vehicle telematics

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Network security and privacy issues

- 3.9.2.2 Lack of cellular coverage

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Vehicle-to-Person (V2P)

- 5.3 Vehicle-to-Infrastructure (V2I)

- 5.4 Vehicle-to-Network (V2N)

- 5.5 Vehicle-to-Vehicle (V2V)

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 On-Board Units (OBUs)

- 6.2.2 Roadside Units (RSUs)

- 6.2.3 Antennas

- 6.2.4 Communication modules

- 6.3 Software

- 6.3.1 Traffic management software

- 6.3.2 Fleet management systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Fleet management

- 8.3 Autonomous driving

- 8.4 Collision avoidance

- 8.5 Intelligent traffic systems

- 8.6 Parking management systems

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 AT&T

- 10.2 Autotalks

- 10.3 Cohda Wireless

- 10.4 Commsignia

- 10.5 Continental

- 10.6 Denso

- 10.7 Ficosa International

- 10.8 Huawei Technologies

- 10.9 Infineon Technologies

- 10.10 Intel

- 10.11 Keysight Technologies

- 10.12 Nokia

- 10.13 NTT DOCOMO

- 10.14 Qualcomm

- 10.15 Quectel Wireless Solutions

- 10.16 Robert Bosch

- 10.17 Rohde & Schwarz

- 10.18 Savari

- 10.19 Shenzhen Genvict Technologies

- 10.20 ZTE Corporation