|

市場調查報告書

商品編碼

1740983

鋰鈦氧化物市場機會、成長動力、產業趨勢分析及2025-2034年預測Lithium Titanium Oxide Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

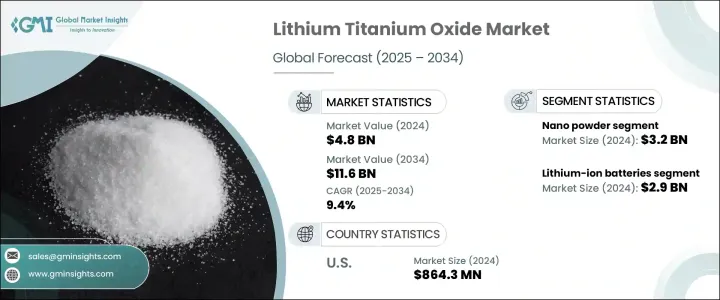

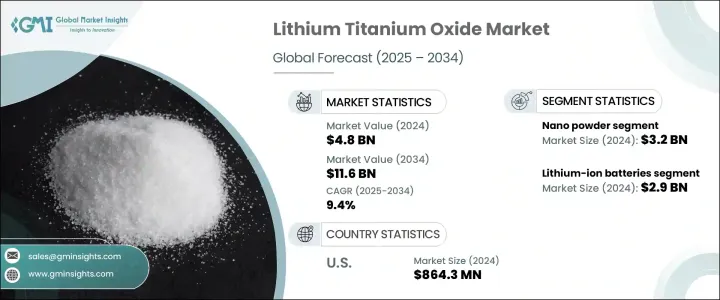

2024年,全球鋰鈦氧化物市場規模達48億美元,預計到2034年將以9.4%的複合年成長率成長,達到116億美元,這得益於儲能系統(ESS)和電動車(EV)需求的激增。隨著全球各行各業轉向清潔能源和高效儲能解決方案,鋰鈦氧化物市場正呈現強勁成長動能。鈦酸鋰電池以其超快速充電能力、長循環壽命和卓越的熱穩定性而備受認可,在消費性電子產品、電網儲能和汽車應用領域也日益受到青睞。

隨著再生能源的加速普及,對穩定高效的電網儲存系統的需求空前高漲,這使得鈦酸鋰電池成為全球能源基礎設施現代化的關鍵組成部分。隨著各國政府實施更嚴格的碳中和目標,各行各業也更加重視脫碳,對高性能、永續電池技術的需求正為鈦酸鋰電池製造商創造巨大的機會。人們對安全性、使用壽命和快速充電的日益重視,進一步提升了鈦酸鋰電池在航太、國防和重型運輸等領域的吸引力。市場參與者正在迅速擴大生產規模、投資研發並建立策略聯盟,以充分利用鈦酸鋰電池不斷擴大的商業應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 116億美元 |

| 複合年成長率 | 9.4% |

此外,汽車產業在推動鈦酸鋰電池市場發展方面發揮著重要作用,尤其是在電動車產量快速擴張的背景下。鈦酸鋰電池憑藉其快速充電能力、卓越的熱穩定性和更長的使用壽命,日益被視為電動車應用中的可靠替代品,尤其適用於在嚴苛條件下保持穩定性能的高性能和商用電動車。隨著全球汽車製造商加強對脫碳和永續創新的關注,鈦酸鋰電池正成為車隊、公車和城市出行平台的實用解決方案。鈦酸鋰電池能夠承受數千次充放電循環,且性能衰減極小,這透過降低長期營運成本,同時符合環境和經濟目標,帶來了顯著的價值。

鈦酸鋰 (LTO) 市場根據等級和電池類型進行細分。奈米粉末鈦酸鋰 (LTO) 在 2024 年佔據市場主導地位,貢獻了 32 億美元的市場規模。奈米粉末的使用提高了鈦酸鋰 (LTO) 電池的表面積與體積之比,從而增強了其電化學性能,例如容量、循環穩定性和充電速率。奈米粉末具有更高的導電性和均勻的粒度分佈,使其成為儲能系統和電動車的理想材料選擇。

市場也按電池類型分類,其中鋰離子電池佔最大佔有率。 2024年,鋰離子電池市場規模達29億美元,佔59.6%。雖然鈦酸鋰電池在安全性、壽命和快速充電方面表現出色,但與傳統鋰離子電池相比,其能量密度較低且成本較高,限制了其廣泛應用。然而,由於其獨特的優勢,其需求持續成長。

受各行各業對高性能儲能需求不斷成長的推動,美國鋰鈦氧化物市場規模在2024年達到8.643億美元。鈦酸鋰(LTO)電池因其出色的可靠性、安全性以及在極端溫度下運行的能力而備受青睞,成為汽車、航太和再生能源領域的理想選擇。

全球鋰鈦氧化物產業的主要參與者包括貝特瑞新材料集團、NEI株式會社、微宏控股、奧西拉和SAT奈米技術材料。這些公司不斷創新製造程序,增強應用技術,擴大研發投入,並建立策略合作夥伴關係,以鞏固其在快速成長的鋰鈦氧化物市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動車和清潔能源解決方案的需求不斷成長

- LTO電池性能優越、循環壽命長

- LTO 在儲能系統中的應用日益廣泛

- 產業陷阱與挑戰

- 與傳統鋰離子電池相比生產成本較高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 奈米粉末

- 微米粉

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 鋰離子電池

- 鈦酸鋰電池

- 其他

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- BTR New Material Group

- Microvast Holdings

- NEI Corporation

- Ossila

- SAT Nano Technology Material

- Stanford Advanced Materials

- Tokyo Chemical Industry India

- Xiamen AOT Electronics Technology

- Xiamen TOB New Energy Technology

- Xiamen Tmax Battery Equipments

The Global Lithium Titanium Oxide Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 11.6 billion by 2034, fueled by surging demand from energy storage systems (ESS) and electric vehicles (EVs). The market is experiencing strong momentum as industries worldwide pivot toward clean energy and efficient storage solutions. LTO batteries, recognized for their ultra-fast charging capabilities, long cycle life, and superior thermal stability, are becoming increasingly favored for their performance in consumer electronics, grid storage, and automotive applications.

As renewable energy adoption accelerates, the need for stable and efficient grid storage systems has never been greater, positioning LTO batteries as a critical component in modernizing global energy infrastructure. With governments implementing stricter carbon neutrality goals and industries focusing on decarbonization, the demand for high-performance, sustainable battery technologies is creating massive opportunities for LTO manufacturers. The growing emphasis on safety, longevity, and quick turnaround charging further boosts the appeal of LTO across sectors like aerospace, defense, and heavy-duty transportation. Market players are rapidly scaling production, investing in research, and forging strategic alliances to leverage the expanding commercial applications of LTO batteries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 9.4% |

Moreover, the automotive sector is playing a major role in driving the LTO market forward, especially with the rapid expansion of electric vehicle production. LTO batteries are increasingly seen as a reliable alternative in EV applications due to their fast-charging capabilities, excellent thermal stability, and extended life cycles, making them highly suitable for high-performance and commercial electric vehicles that demand consistent performance under rigorous conditions. As global automakers intensify their focus on decarbonization and sustainable innovation, LTO batteries are emerging as a practical solution for fleets, buses, and urban mobility platforms. Their ability to endure thousands of charge-discharge cycles with minimal degradation adds significant value by reducing long-term operational costs, aligning with both environmental and economic goals.

The LTO market is segmented based on grade and battery type. Nano powder LTO dominated the market in 2024, contributing USD 3.2 billion. The use of nanopowders improves the surface area-to-volume ratio of LTO batteries, enhancing their electrochemical properties such as capacity, cycle stability, and charge/discharge rates. Improved conductivity and uniform particle size distribution make nanopowders an ideal material choice for energy storage systems and electric vehicles.

The market is also categorized by battery type, with lithium-ion batteries holding the largest share. In 2024, the lithium-ion battery segment accounted for USD 2.9 billion, representing a 59.6% share. While LTO batteries excel in safety, longevity, and fast charging, their lower energy density and higher cost compared to conventional lithium-ion batteries limit widespread adoption. However, their demand continues to rise due to their distinct advantages.

The U.S. Lithium Titanium Oxide Market reached USD 864.3 million in 2024, propelled by rising demand for high-performance energy storage across industries. LTO batteries are gaining strong traction due to their outstanding reliability, safety, and ability to operate under extreme temperatures, making them ideal for the automotive, aerospace, and renewable energy sectors.

Key players in the Global Lithium Titanium Oxide Industry include BTR New Material Group, NEI Corporation, Microvast Holdings, Ossila, and SAT Nano Technology Material. These companies are continuously innovating manufacturing processes, enhancing application technologies, expanding R&D investments, and forging strategic partnerships to strengthen their position in the rapidly growing LTO market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries

- 3.3.2 Major Importing Countries

- 3.4 Profit margin analysis

- 3.5 Key news and initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for electric vehicles and clean energy solutions

- 3.7.1.2 Superior performance and long cycle life of LTO batteries

- 3.7.1.3 Increasing adoption of LTO in energy storage systems

- 3.7.2 Industry pitfalls and challenges

- 3.7.2.1 High production costs compared to conventional lithium-ion batteries

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Nano powder

- 5.3 Micron powder

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lithium-ion batteries

- 6.3 Lithium-titanate battery

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BTR New Material Group

- 8.2 Microvast Holdings

- 8.3 NEI Corporation

- 8.4 Ossila

- 8.5 SAT Nano Technology Material

- 8.6 Stanford Advanced Materials

- 8.7 Tokyo Chemical Industry India

- 8.8 Xiamen AOT Electronics Technology

- 8.9 Xiamen TOB New Energy Technology

- 8.10 Xiamen Tmax Battery Equipments