|

市場調查報告書

商品編碼

1740978

骨科支撐系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Orthopedic Support Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

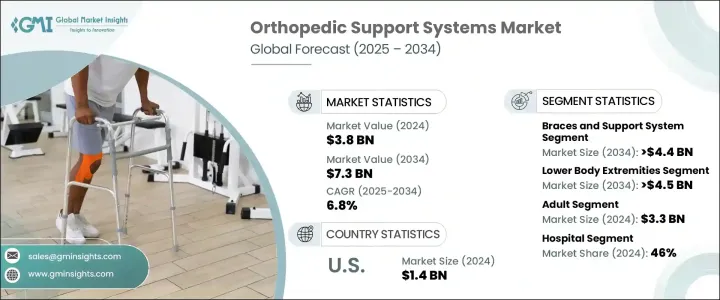

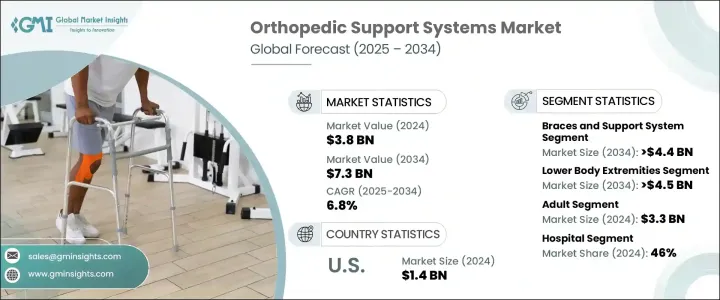

2024 年全球骨科支撐系統市場規模達 38 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長至 73 億美元。這一成長趨勢主要源於肌肉骨骼和運動傷害數量的增加,以及需要持續骨科護理和行動輔助的老年人口的成長。人們也更重視預防性醫療保健,包括使用支撐設備以降低受傷風險。隨著支撐系統技術的進步,包括更方便用戶使用、適應性更強和透氣性更好的材料,市場規模持續擴大。這些創新使產品更適合長期佩戴,並提高了用戶的依從性。人們對早期干預以及未治療的關節和肌肉損傷的長期影響的認知不斷提高,導致了文化的轉變。許多人,尤其是那些正在從體力活動或復原中恢復的人,現在都積極使用骨科支撐作為日常保健的一部分。這種行為變化反映了人們對預防和復健後醫療實踐的更廣泛接受。

按產品類型細分,骨科支撐系統市場包括支架和支撐件、夾板、繃帶和護套以及綁帶。其中,支架和支撐件類別預計將推動主要成長。預計該細分市場的複合年成長率將達到 6.6%,到 2034 年市場規模將超過 44 億美元。這些設備因其多功能性和在治療各種肌肉骨骼疾病方面的廣泛應用而佔據主導地位。它們旨在支撐特定的身體部位,有助於穩定關節、緩解不適,並有助於術後或創傷後的癒合。各年齡層的損傷和退化性關節問題日益增多,導致對此類解決方案的需求日益成長。此外,現代製造技術的融合也為產品設計帶來了顯著改進。從客製化的貼合選項到可調節的綁帶和更輕的材料,這些創新提升了整體舒適度並提高了每台設備的有效性,從而進一步推動了市場需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 38億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 6.8% |

按應用細分,市場涵蓋上肢和下肢器械。預計下肢器械市場將成為強勁的成長動力,預計到2034年其市場規模將超過45億美元,複合年成長率為6.7%。這項需求源自於膝蓋、臀部和腳踝等部位的損傷頻率。許多人因為頻繁參與體育活動和運動而患上這些部位的疾病。這些損傷通常需要有針對性的矯形解決方案來緩解疼痛、穩定和癒合。專為下肢設計的支撐器材不僅用於治療,還可用於預防,尤其適用於近期接受過手術或患有退化性疾病的患者。預防性醫療保健和矯形復健的興起,使得這些產品的應用範圍遠遠超出了傳統的復健領域。

根據患者人口統計數據,市場分為成人和兒童兩部分。 2024年,成人佔據了市場的大多數,創造了33億美元的收入。成人肌肉骨骼疾病的發生率較高,部分原因是體力勞動、體適能習慣以及與生活方式相關的健康問題。肥胖和糖尿病等疾病往往會加劇關節勞損和損傷的可能性。骨科支撐系統已成為成人管理慢性疼痛、術後恢復或應對與年齡相關的退化性疾病的必備工具。由於穿戴式骨科設備等非侵入性治療手段的普及以及其益處的認知度不斷提高,這類治療手段在這群人中越來越受歡迎。

就最終用途而言,市場細分為醫院、骨科中心、復健中心和其他機構。 2024年,醫院佔最大佔有率,收入達18億美元,佔整個市場的46%。預計到2034年,該細分市場的複合年成長率將達到6.9%。醫院仍然是急性骨科護理的主要場所,涵蓋從手術到術後復健的各個環節。醫院擁有專業的醫護人員和先進的醫療設備,是提供全面支援解決方案的理想場所。隨著全球骨科手術數量的持續成長,對輔助患者復健的支援設備的需求也在成長。

在美國,骨科支撐系統市場規模在2024年達到14億美元,未來幾年呈現強勁成長動能。該地區的成長得益於運動傷害、慢性病的高發性以及發達的醫療基礎設施。美國廣泛採用的復健方案和先進的醫療技術支撐了對這些系統的持續需求。此外,領先製造商的強勁市場參與鞏固了美國在該領域的主要地位。

全球約40%的市佔率由前五的公司佔據,這些公司在研發、產品創新和策略合作方面投入大量資金。這些公司正朝著更個人化、數位化和以數據為中心的解決方案邁進,並將穿戴式感測器等技術融入其產品中。這一方向確保了其持續發展,並使它們在不斷發展的骨科領域中保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 骨科疾病和病症的盛行率不斷上升

- 運動和事故相關傷害案件增加

- 公眾預防保健意識不斷增強

- 技術進步

- 產業陷阱與挑戰

- 設備成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 報銷場景

- 技術格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 支架和支撐

- 夾板

- 繃帶和袖套

- 帶子

第6章:市場估計與預測:按應用 2021 - 2034

- 主要趨勢

- 下肢

- 膝蓋/大腿

- 臀部、脊椎和背部

- 踝

- 腳

- 其他下肢

- 上肢

- 手和腕部

- 彎頭

- 肩膀

- 其他上肢

第7章:市場估計與預測:按患者,2021 - 2034 年

- 主要趨勢

- 成人

- 兒科

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 骨科中心

- 復健中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 3M

- ALCARE

- aspen medical

- BAUERFEIND

- Bird & Cronin

- BREG

- DeRoyal

- Enovis

- essity

- HELY & WEBER

- MCDAVID

- medi

- OSSUR

- ottobock

- ZIMMER BIOMET

The Global Orthopedic Support Systems Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.3 billion by 2034. This rising trend is largely driven by the increasing number of musculoskeletal and athletic injuries, along with a growing elderly population that requires ongoing orthopedic care and mobility assistance. People are also paying more attention to preventive healthcare, which includes the use of support devices to reduce injury risks before they occur. The market continues to expand thanks to advancements in support system technologies, which include more user-friendly, adaptive, and breathable materials. These innovations make the products more comfortable for long-term wear and increase user adherence. Growing awareness around early intervention and the long-term effects of untreated joint and muscular injuries has led to a cultural shift. Many individuals, especially those recovering from physical activity or rehabilitation, now actively use orthopedic supports as part of their daily health routine. This behavioral change reflects a broader acceptance of preventive and post-rehabilitation medical practices.

Segmented by product type, the orthopedic support systems market includes braces and supports, splints, bandages and sleeves, and straps. Among these, the braces and supports category is projected to drive a major portion of the growth. This segment is expected to expand at a CAGR of 6.6%, reaching over USD 4.4 billion by 2034. These devices dominate due to their versatility and extensive use in managing various musculoskeletal conditions. Designed to support specific body areas, they help stabilize joints, alleviate discomfort, and assist in healing during post-surgical or post-trauma phases. A rising number of injuries and degenerative joint issues across all age groups has led to an increased need for such solutions. Moreover, the integration of modern manufacturing techniques has brought significant improvements in product design. From customized fitting options to adjustable straps and lighter materials, these innovations boost overall comfort and improve the effectiveness of each device, thereby driving further market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 6.8% |

When broken down by application, the market includes devices for upper and lower body extremities. The lower body extremities segment is anticipated to be a strong growth driver, with projections indicating it will reach over USD 4.5 billion by 2034, growing at a CAGR of 6.7%. This demand stems from the frequency of injuries involving the knees, hips, and ankles. Many individuals suffer from conditions in these regions due to increased involvement in physical activities and sports. These injuries often require targeted orthopedic solutions for pain relief, stability, and healing. Support devices tailored for the lower body are used not only for treatment but also for prevention, especially in patients who have recently undergone surgery or who suffer from degenerative diseases. The rise of preventive healthcare and orthopedic rehabilitation has expanded the use of these products far beyond traditional recovery settings.

Based on patient demographics, the market is divided into adult and pediatric segments. Adults made up the majority of the market in 2024, generating USD 3.3 billion in revenue. Adults face a higher incidence of musculoskeletal conditions, partly due to physically demanding jobs, fitness routines, and lifestyle-related health problems. Conditions such as obesity and diabetes often compound the likelihood of joint strain and injuries. Orthopedic support systems have become essential tools for adults managing chronic pain, recovering from surgery, or dealing with age-related degenerative issues. Non-invasive treatment options, such as wearable orthopedic devices, have gained popularity among this group, thanks to improved accessibility and greater awareness of the benefits.

In terms of end use, the market is segmented into hospitals, orthopedic centers, rehabilitation centers, and other facilities. Hospitals held the largest share in 2024, accounting for USD 1.8 billion in revenue and 46% of the total market. This segment is also projected to grow at a CAGR of 6.9% by 2034. Hospitals continue to be the primary setting for acute orthopedic care, from surgeries to post-operative rehabilitation. The availability of specialized staff and advanced medical equipment makes hospitals ideal for providing comprehensive support solutions. As the number of orthopedic surgeries continues to rise globally, so does the demand for support devices that aid in patient recovery.

In the United States, the orthopedic support systems market reached USD 1.4 billion in 2024, showing strong signs of expansion in the years ahead. Growth in this region is fueled by a high occurrence of sports-related injuries, chronic conditions, and a well-developed healthcare infrastructure. The country's extensive adoption of rehabilitation protocols and advanced medical technology supports ongoing demand for these systems. Furthermore, strong market participation from leading manufacturers reinforces the US's position as a major player in this field.

Around 40% of the global market is held by the top five companies, which are heavily investing in research, product innovation, and strategic partnerships. These companies are moving toward more personalized, digital, and data-focused solutions, incorporating technologies such as wearable sensors into their offerings. This direction ensures continuous development and positions them to remain competitive in the evolving orthopedic landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of orthopedic diseases and disorders

- 3.2.1.2 Rise in cases of sports and accident-related injuries

- 3.2.1.3 Growing public awareness of preventive care

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Braces and support

- 5.3 Splint

- 5.4 Bandage and sleeves

- 5.5 Strap

Chapter 6 Market Estimates and Forecast, By Application 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lower body extremities

- 6.2.1 Knee/thigh

- 6.2.2 Hip, spine, and back

- 6.2.3 Ankle

- 6.2.4 Foot

- 6.2.5 Other lower body extremities

- 6.3 Upper body extremities

- 6.3.1 Hand and Wrist

- 6.3.2 Elbow

- 6.3.3 Shoulder

- 6.3.4 Other upper body extremities

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital

- 8.3 Orthopedic centers

- 8.4 Rehabilitation centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 ALCARE

- 10.3 aspen medical

- 10.4 BAUERFEIND

- 10.5 Bird & Cronin

- 10.6 BREG

- 10.7 DeRoyal

- 10.8 Enovis

- 10.9 essity

- 10.10 HELY & WEBER

- 10.11 MCDAVID

- 10.12 medi

- 10.13 OSSUR

- 10.14 ottobock

- 10.15 ZIMMER BIOMET