|

市場調查報告書

商品編碼

1740975

建築修補複合材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Construction Repair Composites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

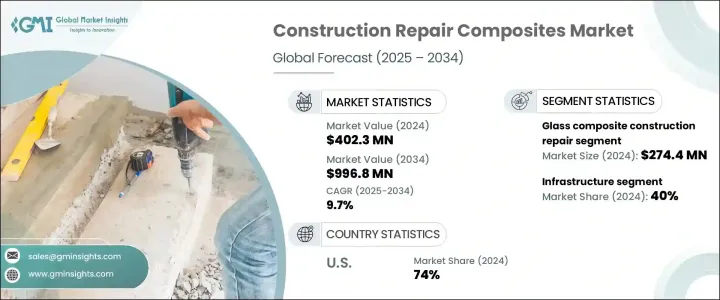

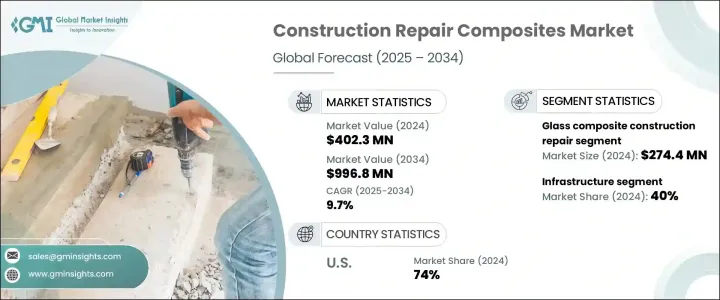

2024年,全球建築修復複合材料市場規模達4.023億美元,預計到2034年將以9.7%的複合年成長率成長,達到9.968億美元,這主要得益於影響全球建築趨勢的幾個關鍵因素。由於對永續建築材料的投資不斷增加、複合材料製造技術的進步以及老化基礎設施修復力度的加大,該市場正呈現強勁成長動能。隨著城市發展加速,永續性成為首要任務,複合材料正逐漸成為建築環境修復應用的首選解決方案。

隨著對耐用且經濟高效的解決方案的需求日益成長,複合材料已成為傳統建築材料的重要替代品。其在強度、耐腐蝕性和使用壽命方面的卓越性能日益受到建築業的認可。在許多基礎設施老化的地區,複合材料明顯轉向使用修復和加固老化結構。發展中國家快速的城市擴張也加劇了市場需求,因為它不僅帶來了新建基礎設施的壓力,也帶來了升級現有基礎設施的壓力。此外,智慧城市的發展使先進材料成為優先事項,複合材料在旨在降低長期維護成本和提高永續性的現代修復應用中發揮著至關重要的作用。政府對公共基礎設施更新的投資進一步推動了複合材料的應用,尤其是在那些需要在嚴苛環境條件下維持長期性能的領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.023億美元 |

| 預測值 | 9.968億美元 |

| 複合年成長率 | 9.7% |

依纖維類型分類,建築修補複合材料市場可分為碳纖維、玻璃纖維和其他纖維。 2024年,玻璃纖維佔據市場主導地位,營收達2.744億美元,預計到2034年複合年成長率約為9.9%。玻璃纖維複合材料因其兼具經濟實惠、耐用性和機械強度等優勢,持續受到市場青睞。這類複合材料通常用於加固和修復各種建築構件,與傳統材料相比,可延長使用壽命並減少維護需求。

玻璃纖維複合材料廣泛應用於梁、柱和地基等結構構件的修復,其優異的強度和彈性使其在實際應用上具有顯著優勢。樹脂灌注和拉擠等製造技術的進步,提升了這些材料的結構性能,使其更加可靠,並能滿足各種建築修復需求。其輕量特性也簡化了安裝,降低了人工成本並縮短了專案工期。這使得玻璃纖維成為商業和住宅修復應用的理想選擇,尤其是在結構完整性和長期耐用性至關重要的情況下。

從應用角度來看,建築修復複合材料市場可分為住宅建築、商業建築、工業設施和基礎設施。其中,基礎設施領域在2024年佔據了約40%的市場。關鍵基礎設施的修復和加固是推動該領域複合材料應用的主要驅動力。複合材料擴大被應用於修復項目中,以增強結構彈性並延長老化系統的使用壽命。

在基礎設施網路成熟的地區,在不損害舊結構完整性的情況下進行修復的需求推動了高效能複合材料的使用。尤其是碳纖維複合材料,在要求高抗張強度和輕量化的專案中,其需求日益成長。這些特性使其成為加固必須承受巨大荷載同時保持結構效率的部件的理想選擇。其防腐蝕性能也使其適用於經常暴露於潮濕或化學物質的環境。

北美仍然是建築修復複合材料市場的領先地區,其中美國在2024年約佔該地區74%的市場佔有率,創造約1.03億美元的收入。美國市場受益於聯邦政府透過以修復和永續性為重點的政策措施對基礎設施現代化的大力支持。旨在振興基礎設施的立法努力正在轉化為對兼具強度和耐用性的先進修復材料的需求成長。

複合材料因其能夠滿足基礎設施更新的技術要求,同時又符合環保目標而備受青睞。從交通網路到公共事業,人們越來越傾向於選擇能夠最大程度減少停機時間並延長結構壽命的解決方案。這種日益成長的偏好正在推動纖維增強複合材料在全國範圍內的創新和廣泛應用。

全球建築修補複合材料市場的主要參與者包括 Chomarat、巴斯夫、Creative Composites、陶氏、Fosroc、Dextra、漢高、馬貝、歐文斯科寧、Rockwool、Master Builders Solutions、聖戈班、Simpson Strong-Tie、西卡和 Sireg Geotech。這些公司專注於材料創新、拓展產品線並建立策略合作夥伴關係,以鞏固其在競爭日益激烈、品質導向的市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 基礎設施老化,需翻新

- 城市化和基礎設施的快速發展

- 產業陷阱與挑戰

- 極端條件下的性能變化

- 來自傳統材料的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依纖維類型,2021 - 2034 年

- 主要趨勢

- 玻璃纖維

- 碳纖維

- 其他(芳綸纖維等)

第6章:市場估計與預測:按樹脂類型,2021 - 2034

- 主要趨勢

- 熱固性樹脂

- 聚酯纖維

- 環氧樹脂

- 乙烯基酯

- 聚氨酯

- 其他(酚類等)

- 熱塑性樹脂

- 聚丙烯

- 聚醯胺

- 聚碳酸酯

- 其他(聚醚醚酮等)

第7章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 紡織品/布料

- 盤子

- 鋼筋

- 網

- 其他(黏合劑等)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 住宅建築

- 商業建築

- 工業設施

- 基礎設施

- 橋樑

- 道路和高速公路

- 隧道

- 管道和供水系統

- 其他(海洋基礎建設等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- BASF

- Chomarat

- Creative Composites

- Dextra

- Dow

- Fosroc

- Henkel

- Mapei

- Master Builders Solutions

- Owens Corning

- Rockwool

- Saint-Gobain

- Sika

- Simpson Strong-Tie

- Sireg Geotech

The Global Construction Repair Composites Market was valued at USD 402.3 million in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 996.8 million by 2034, driven by several key factors shaping global construction trends. The market is witnessing strong momentum due to growing investments in sustainable construction materials, technological progress in composite manufacturing, and increasing efforts to rehabilitate aging infrastructure. As urban development accelerates and sustainability becomes a top priority, composite materials are emerging as a preferred solution for repair applications in the built environment.

The rising need for durable and cost-efficient solutions has positioned composites as a valuable alternative to traditional construction materials. Their superior performance in terms of strength, corrosion resistance, and longevity is increasingly recognized across the construction industry. In many regions with aging infrastructure, there is a clear shift toward the use of composite materials to repair and reinforce deteriorating structures. Rapid urban expansion in developing countries also contributes to market demand, as it creates pressure to not only build new infrastructure but also upgrade existing ones. Additionally, the shift toward smart city development has made advanced materials a priority, with composites playing a vital role in modern repair applications aimed at reducing long-term maintenance costs and improving sustainability. Government investments in public infrastructure renewal are further fueling the adoption of composites, especially in sectors that require long-term performance under challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $402.3 Million |

| Forecast Value | $996.8 Million |

| CAGR | 9.7% |

By fiber type, the construction repair composites market is segmented into carbon fiber, glass fiber, and others. In 2024, the glass fiber segment dominated the market, accounting for USD 274.4 million in revenue, and is projected to grow at a CAGR of around 9.9% through 2034. Glass fiber composites continue to gain traction because they offer a combination of affordability, durability, and mechanical strength. These composites are commonly used to reinforce and repair a wide range of construction components, providing extended service life and reduced maintenance compared to conventional options.

Glass fiber composites are widely applied in repairing structural elements such as beams, columns, and foundations, where their strength and resilience offer a practical advantage. Advancements in fabrication techniques, including resin infusion and pultrusion, have improved the structural performance of these materials, making them more reliable and adaptable to diverse construction repair needs. Their lightweight nature also simplifies installation, cutting down labor costs and project timeframes. This makes glass fiber a compelling choice for both commercial and residential repair applications, particularly when structural integrity and long-term durability are critical.

In terms of application, the construction repair composites market is divided into residential buildings, commercial buildings, industrial facilities, and infrastructure. Among these, the infrastructure segment held a substantial share of around 40% in 2024. Repair and strengthening of critical infrastructure are primary drivers of composite adoption in this category. Composite materials are increasingly integrated into repair projects to enhance structural resilience and extend the operational lifespan of aging systems.

In regions with mature infrastructure networks, the need to rehabilitate old structures without compromising their integrity is pushing the use of high-performance composites. Carbon fiber composites, in particular, are experiencing rising demand in projects requiring high tensile strength and minimal weight. These characteristics make them ideal for reinforcing components that must bear substantial loads while remaining structurally efficient. Their non-corrosive properties also make them suitable for environments where exposure to moisture or chemicals is common.

North America remains a leading region in the construction repair composites market, with the United States accounting for roughly 74% of the regional market share in 2024 and generating about USD 103 million in revenue. The U.S. market is benefiting from strong federal support for infrastructure modernization through policy initiatives focused on rehabilitation and sustainability. Legislative efforts aimed at infrastructure revitalization are translating into heightened demand for advanced repair materials that deliver both strength and durability.

Composite materials are being embraced for their ability to meet the technical requirements of infrastructure renewal while also aligning with environmental goals. From transportation networks to public utilities, there is a growing preference for solutions that minimize downtime and extend structure lifespans. This growing preference is fueling innovation and wider adoption of fiber-reinforced composites across the country.

Key players operating in the global construction repair composites market include Chomarat, BASF, Creative Composites, Dow, Fosroc, Dextra, Henkel, Mapei, Owens Corning, Rockwool, Master Builders Solutions, Saint-Gobain, Simpson Strong-Tie, Sika, and Sireg Geotech. These companies are focusing on material innovation, expanding product lines, and forging strategic partnerships to strengthen their position in a market that is becoming increasingly competitive and quality-driven.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Aging infrastructure and need for renovation

- 3.6.1.2 Urbanization and rapid infrastructure development

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Performance variability in extreme conditions

- 3.6.2.2 Competition from traditional materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Glass fiber

- 5.3 Carbon fiber

- 5.4 Others (aramid fiber etc.)

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Thermoset resins

- 6.2.1 Polyester

- 6.2.2 Epoxy

- 6.2.3 Vinyl ester

- 6.2.4 Polyurethane

- 6.2.5 Others (phenolic etc.)

- 6.3 Thermoplastic resins

- 6.3.1 Polypropylene

- 6.3.2 Polyamide

- 6.3.3 Polycarbonate

- 6.3.4 Others (polyetheretherketone etc.)

Chapter 7 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Textile/fabric

- 7.3 Plate

- 7.4 Rebar

- 7.5 Mesh

- 7.6 Others (adhesive etc.)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential buildings

- 8.3 Commercial buildings

- 8.4 Industrial facilities

- 8.5 Infrastructure

- 8.5.1 Bridges

- 8.5.2 Roads and highways

- 8.5.3 Tunnels

- 8.5.4 Pipes and water systems

- 8.5.5 Others (marine Infrastructure etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 BASF

- 11.2 Chomarat

- 11.3 Creative Composites

- 11.4 Dextra

- 11.5 Dow

- 11.6 Fosroc

- 11.7 Henkel

- 11.8 Mapei

- 11.9 Master Builders Solutions

- 11.10 Owens Corning

- 11.11 Rockwool

- 11.12 Saint-Gobain

- 11.13 Sika

- 11.14 Simpson Strong-Tie

- 11.15 Sireg Geotech