|

市場調查報告書

商品編碼

1740969

自動注射器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Autoinjectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

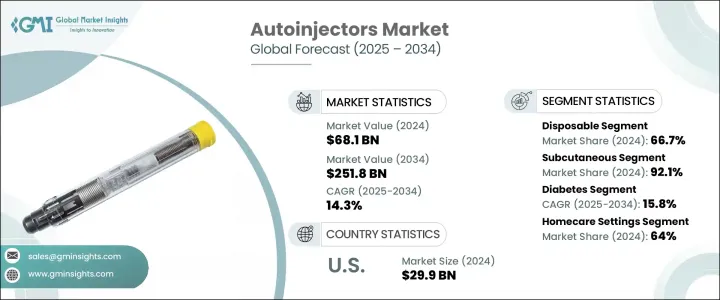

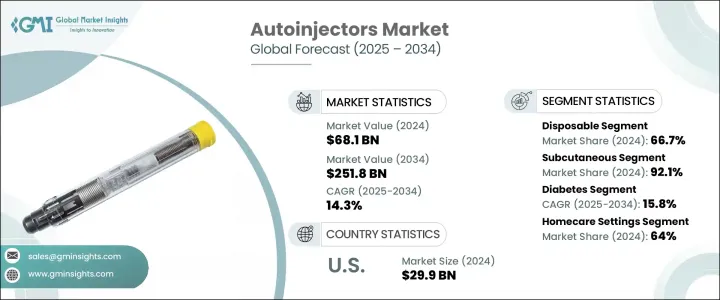

2024年,全球自動注射器市場規模達681億美元,預計到2034年將以14.3%的複合年成長率成長,達到2,518億美元。推動這一成長的主要因素包括糖尿病和過敏反應等慢性疾病的盛行率上升,以及仿製自動注射器供應的增加。這些醫療設備對於快速可靠地注射救命藥物至關重要,而這對於管理糖尿病和嚴重過敏反應等疾病至關重要。

全球糖尿病病例(尤其是第1型和第2型糖尿病)的增加是推動自動注射器需求的關鍵因素之一。這些裝置提供了一種高效且患者友好的胰島素輸送方法,使其成為需要定期注射的糖尿病患者的首選。除糖尿病外,過敏反應(通常由過敏原引發)的發生率不斷上升,這顯著增加了對用於輸送腎上腺素的自動注射器的需求。自動注射器的便攜性、易用性和精準的劑量控制能力使其在快速緊急治療中發揮重要作用。隨著這些疾病發病率的上升,預計自動注射器市場也將隨之擴大。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 681億美元 |

| 預測值 | 2518億美元 |

| 複合年成長率 | 14.3% |

市場分為一次性自動注射器和可重複使用自動注射器。一次性自動注射器佔據主導地位,2024 年的市佔率為 66.7%。這些一次性設備因其便捷易用而格外引人注目。它們幾乎無需維護,無需患者俱備特殊知識或技能即可操作。這些自動注射器設計為一次性使用,也降低了感染或污染的風險,確保了病患的安全。疫情過後,人們開始轉向居家護理,尤其是糖尿病患者。這種變化進一步推動了人們對一次性自動注射器的偏好,因為患者更重視其便攜性和在家中自行給藥的易用性。

另一個重要因素是給藥途徑。皮下自動注射器在2024年佔據92.1%的市場佔有率,佔據市場主導地位。皮下注射比肌肉注射疼痛小,並且可以在家中自行注射,非常適合糖尿病等慢性疾病的患者。皮下注射也常用於生物製劑,包括胰島素和單株抗體,這進一步推動了對這些設備的需求。

市場也根據療法進行細分,其中糖尿病領域預計將實現最高成長率,預測期內複合年成長率達15.8%。這一成長歸因於全球糖尿病病例的不斷增加,這需要持續治療。自動注射器提供了一種更舒適、更方便的胰島素注射方法,促進了其廣泛應用。此外,胰島素輸送設備的進步,例如劑量精度更高、追蹤功能更完善的智慧自動注射器,正在提高患者的依從性,並支持該領域的成長。

就終端用戶而言,家庭護理環境佔據市場主導地位,2024年將佔據64%的市場。病人自主性驅動的自我給藥需求不斷成長,是促成此轉變的主要因素。自動注射器使慢性病患者能夠在家中管理治療,從而減少頻繁前往醫療機構的需求。此外,遠距醫療和遠端監控的興起使患者在家中使用自動注射器變得更加便捷,醫護人員可以遠端提供指導和支援。

2024年,美國以約299億美元的收入領先北美市場。這主要是因為美國糖尿病和類風濕性關節炎等慢性病發生率高。隨著越來越多的患者尋求自我治療方案,自動注射器已成為管理這些疾病的日益流行的解決方案。

自動注射器市場競爭激烈,全球和地區性公司提供一系列解決方案,以滿足日益成長的自我給藥設備需求。主要參與者佔據市場主導地位,約佔整體市場佔有率的60%。這些公司不斷創新以維持市場地位,推出旨在改善患者體驗和提高治療依從性的新產品和解決方案。此外,隨著價格承受能力成為新興市場的關鍵考量,本地製造商紛紛進軍提供經濟高效的替代方案,迫使國際公司調整定價策略,同時確保產品安全和合規性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 標靶治療需求不斷成長

- 全球通用自動注射器的供應情況

- 糖尿病和過敏性休克發生率不斷上升

- 患者越來越傾向自行服藥

- 產業陷阱與挑戰

- 替代治療方案的可用性

- 自動注射器定價過高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 一次性的

- 可重複使用的

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 皮下

- 肌肉注射

第7章:市場估計與預測:按療法,2021 - 2034 年

- 主要趨勢

- 類風濕關節炎

- 多發性硬化症

- 過敏反應

- 糖尿病

- 其他療法

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 居家照護環境

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Amgen

- Antares Pharma

- Becton, Dickinson and Company

- Eli Lilly and Company

- GlaxoSmithKline

- Halozyme

- Johnson & Johnson

- Mylan

- Novo Nordisk

- Owen Mumford

- SHL Medical

- Teva pharmaceuticals

- West Pharmaceutical Services

- Ypsomed

The Global Autoinjectors Market was valued at USD 68.1 billion in 2024 and is estimated to grow at a CAGR of 14.3% to reach USD 251.8 billion by 2034. The primary factors contributing to this growth include the rising prevalence of chronic conditions such as diabetes and anaphylaxis, as well as the increased availability of generic autoinjectors. These medical devices are essential for the quick and reliable administration of life-saving medications, which is crucial for managing conditions like diabetes and severe allergic reactions.

The increase in the number of diabetes cases worldwide, particularly type 1 and type 2, is one of the key drivers for the demand for autoinjectors. These devices offer an efficient and patient-friendly method for insulin delivery, making them a preferred option for people with diabetes who need regular injections. Alongside diabetes, the growing occurrence of anaphylactic reactions, typically triggered by allergens, has significantly boosted the demand for autoinjectors that deliver epinephrine. The portability, ease of use, and precise dosing capabilities of autoinjectors have made them invaluable in providing rapid emergency treatment. As the incidence of these conditions rises, the market for autoinjectors is expected to expand accordingly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.1 Billion |

| Forecast Value | $251.8 Billion |

| CAGR | 14.3% |

The market is categorized into disposable and reusable autoinjectors. Disposable autoinjectors are the dominant segment, holding a market share of 66.7% in 2024. These single-use devices are particularly appealing due to their convenience and ease of use. They require minimal maintenance, which eliminates the need for patients to have special knowledge or skills to operate them. The fact that these autoinjectors are designed for one-time use also reduces the risk of infection or contamination, ensuring patient safety. Following the pandemic, there has been a shift toward home-based care, particularly for diabetic patients. This change has further driven the preference for disposable autoinjectors, as patients value portability and ease of use in self-administering their medications at home.

Another important factor is the route of administration, with subcutaneous autoinjectors leading the market with a share of 92.1% in 2024. Subcutaneous injections are less painful than intramuscular ones, and they can be self-administered at home, making them highly suitable for patients managing chronic diseases like diabetes. Subcutaneous injections are also commonly used for biologics, including insulin and monoclonal antibodies, further driving the demand for these devices.

The market is also segmented based on therapy, with the diabetes segment expected to see the highest growth rate, reaching a CAGR of 15.8% during the forecast period. This growth is attributed to the increasing number of diabetes cases globally, which necessitate ongoing treatment. Autoinjectors offer a more comfortable and user-friendly method for insulin administration, promoting their widespread use. Moreover, advancements in insulin delivery devices, such as smart autoinjectors with improved dosing accuracy and tracking features, are enhancing patient adherence and supporting the growth of this segment.

When it comes to end users, homecare settings dominate the market, accounting for 64% of the market share in 2024. The rising demand for self-administration, driven by patient independence, is a major factor contributing to this shift. Autoinjectors allow patients with chronic conditions to manage their treatment at home, reducing the need for frequent visits to healthcare facilities. Additionally, the rise of telemedicine and remote monitoring has made it easier for patients to use autoinjectors at home, with healthcare professionals providing guidance and support from a distance.

In 2024, the U.S. led the North American market with a revenue of approximately USD 29.9 billion. This is largely due to the high incidence of chronic diseases, including diabetes and rheumatoid arthritis, in the country. As more patients seek self-administered treatment options, autoinjectors have become an increasingly popular solution for managing these conditions.

The autoinjectors market is highly competitive, with global and regional companies offering a range of solutions to meet the growing demand for self-administration devices. Key players dominate the market, contributing approximately 60% of the overall market share. These companies continually innovate to maintain their market position, introducing new products and solutions designed to improve patient experience and treatment adherence. Furthermore, as affordability becomes a key concern in emerging markets, local manufacturers are stepping in to offer cost-effective alternatives, forcing international companies to adjust their pricing strategies while ensuring product safety and regulatory compliance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for targeted therapies

- 3.2.1.2 Availability of generic autoinjectors globally

- 3.2.1.3 Increasing incidence of diabetes and anaphylaxis

- 3.2.1.4 Rising patient preference towards self-administration of medication

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative treatment options

- 3.2.2.2 High pricing of the autoinjectors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Disposable

- 5.3 Reusable

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Subcutaneous

- 6.3 Intramuscular

Chapter 7 Market Estimates and Forecast, By Therapy, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Rheumatoid arthritis

- 7.3 Multiple sclerosis

- 7.4 Anaphylaxis

- 7.5 Diabetes

- 7.6 Other therapies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital and clinics

- 8.3 Homecare settings

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Antares Pharma

- 10.4 Becton, Dickinson and Company

- 10.5 Eli Lilly and Company

- 10.6 GlaxoSmithKline

- 10.7 Halozyme

- 10.8 Johnson & Johnson

- 10.9 Mylan

- 10.10 Novo Nordisk

- 10.11 Owen Mumford

- 10.12 SHL Medical

- 10.13 Teva pharmaceuticals

- 10.14 West Pharmaceutical Services

- 10.15 Ypsomed