|

市場調查報告書

商品編碼

1740965

結構性心臟設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Structural Heart Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

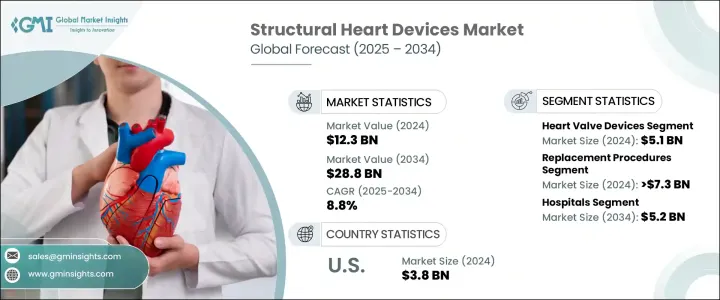

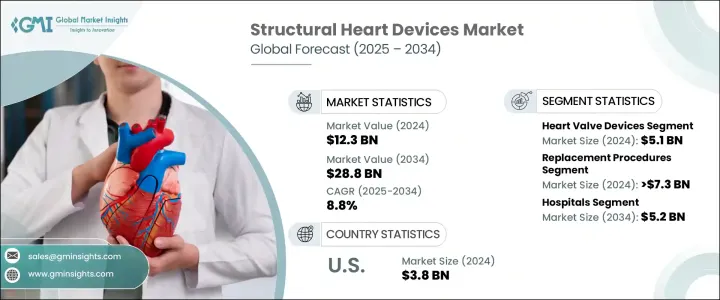

2024年,全球結構性心臟器材市場規模達123億美元,預計到2034年將以8.8%的複合年成長率成長,達到288億美元。心血管疾病發病率的上升、醫療服務可近性的擴大以及微創治療技術的廣泛應用,共同推動了這一持續成長。隨著全球老化人口的增加,高血壓和糖尿病等慢性疾病日益普遍,直接導致結構性心臟疾病患者數量不斷增加。尤其是瓣膜相關問題、先天性心臟缺陷以及影響心臟結構的疾病,其發生率不斷上升,加劇了對先進治療方案的需求。此外,認知度的提高、早期診斷和技術的進步,也顯著改變了心血管領域的患者護理。

2023年,全球市場規模達113億美元,呈現上升趨勢。在所有產品類型中,心臟瓣膜裝置在2024年創造了最高的收入,價值51億美元。這一成長可歸因於現代耐用型裝置的日益普及,這些裝置旨在恢復正常的心臟瓣膜功能,同時最大限度地減少開胸手術的需求。其他主要產品領域包括瓣環成形環、封堵器和輸送系統,以及各種支援結構性介入的輔助技術。隨著創新不斷提升這些工具的安全性和有效性,臨床醫生擁有更多選擇,可以根據患者的個人需求量身定做治療方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 123億美元 |

| 預測值 | 288億美元 |

| 複合年成長率 | 8.8% |

結構性心臟病,例如心肌病變和瓣膜疾病,需要立即有效的治療,因此人們高度重視設備性能和手術技巧的技術改進。微創方法的發展帶來了變革性的影響,尤其是在經導管瓣膜置換術等手術中,它縮短了患者的恢復時間和住院時間。隨著這些方法的日益精進,患者的預後正在改善,併發症也在減少,推動了醫療體系的廣泛採用。尖端材料、即時成像功能以及更符合人體工學的設計的融合也提高了醫生在複雜干預過程中的準確性,從而實現了更好的治療效果。

從手術角度來看,市場細分為修復手術和置換手術。 2024年,置換手術佔據了該細分市場的主導地位,收入超過73億美元。非手術和機器人輔助技術的不斷進步,提高了手術的精準度並降低了手術風險,促使人們對置換手術日益青睞。這些改進推動了治療模式的轉變,轉向專注於長期療效和改善患者生活品質的療法。置換手術也受益於臨床研究和真實世界資料,這些研究和數據驗證了其有效性,從而鼓勵醫療保健提供者更廣泛地應用。

從終端用途來看,醫院在2024年成為結構性心臟器械的最大消費者,預計到預測期末將產生52億美元的市場規模。醫院擁有技術精湛的醫護人員、現代化的心臟科室和診斷能力,能夠處理大量的心血管手術。隨著結構性心臟治療的日益複雜,醫院在使用最先進的工具和系統提供全面護理方面繼續發揮核心作用。它們也是轉診和術後護理的主要中心,進一步鞏固了其在市場中的地位。

2024年,美國市場收入達38億美元,預計2025年至2034年期間的複合年成長率將達到7.7%。美國市場主導地位主要得益於其先進的醫療基礎設施、對新型醫療技術的早期應用以及結構性干預措施的優惠報銷政策。心臟瓣膜疾病病例的增多,尤其是在老年人群中,正在推動對微創瓣膜置換療法的需求。此外,主要市場參與者的強勁表現以及設備設計和手術流程的持續創新,將繼續推動美國市場的成長。

全球結構性心臟器材市場競爭激烈,五大公司佔約 75% 的市場。這些領先公司持續投入研發,以提升產品性能並簡化複雜的干涉措施。從增強即時視覺化到簡化手術工作流程,製造商致力於為醫生提供直覺、高效且對患者友好的解決方案,從而最佳化治療效果並提高臨床生產力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病負擔日益加重

- 技術進步

- 有利的報銷方案

- 微創手術日益受到青睞

- 產業陷阱與挑戰

- 嚴格的監理政策

- 潛在併發症和不良事件

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 報銷場景

- 2024年定價分析

- 技術格局

- 未來市場趨勢

- 波特的分析

- 差距分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 公司市佔率分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 心臟瓣膜裝置

- 外科心臟瓣膜

- 經導管心臟瓣膜

- 瓣環成形環

- 封堵器和輸送系統

- 其他產品

第6章:市場估計與預測:按程序,2021 - 2034 年

- 主要趨勢

- 更換程序

- 外科主動脈瓣置換術(SAVR)

- 經導管主動脈瓣置換術(TAVR)

- 經導管二尖瓣置換術(TMVR)

- 其他更換程序

- 修復程式

- 左心耳封堵術(LAAC)

- 經導管二尖瓣修復術(TMVr)

- 經導管三尖瓣修復術(TTVr)

- 瓣膜成形術

- 其他修復程式

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 心導管實驗室

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- AtriCure

- BIOMERICS

- Boston Scientific

- BRAILE

- CryoLife

- Edwards

- JENAVALVE

- LEPU MEDICAL

- LivaNova

- Medtronic

- NUMED

The Global Structural Heart Devices Market was valued at USD 12.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 28.8 billion by 2034. This consistent growth is fueled by the increasing incidence of cardiovascular diseases, expanding access to healthcare services, and the widespread adoption of minimally invasive treatment techniques. As aging populations rise globally, chronic health conditions such as hypertension and diabetes become more prevalent, directly contributing to the increasing number of patients diagnosed with structural heart disorders. In particular, valve-related issues, congenital heart defects, and conditions impacting the heart's structure are becoming more frequent, intensifying the demand for advanced treatment solutions. Moreover, greater awareness, early diagnosis, and technological advances have significantly transformed patient care in the cardiovascular segment.

In 2023, the global market stood at USD 11.3 billion, reflecting its upward trajectory. Among the product types, heart valve devices generated the highest revenue in 2024, valued at USD 5.1 billion. This growth can be attributed to the increasing use of modern, durable devices designed to restore proper heart valve function while minimizing the need for open-heart surgery. Other key product segments include annuloplasty rings, occluders, and delivery systems, along with various supportive technologies that enable structural interventions. As innovation continues to enhance the safety and effectiveness of these tools, clinicians have more options for customizing treatment to individual patient needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $28.8 Billion |

| CAGR | 8.8% |

Structural heart conditions such as cardiomyopathies and valve diseases demand immediate and efficient management, which has led to a strong emphasis on technological enhancements in device performance and procedural techniques. The development of minimally invasive approaches has had a transformative effect, especially with procedures such as transcatheter valve replacements that reduce recovery time and hospital stays. As these methods become more refined, patient outcomes are improving and complications are decreasing, driving greater adoption across healthcare systems. The integration of cutting-edge materials, real-time imaging capabilities, and more ergonomic designs have also elevated physician accuracy during complex interventions, allowing for better therapeutic results.

From a procedural standpoint, the market is segmented into repair and replacement procedures. Replacement procedures dominated the segment in 2024, accounting for more than USD 7.3 billion in revenue. The increasing preference for replacement methods stems from ongoing advances in non-surgical and robotic-assisted techniques that offer enhanced precision and reduced procedural risks. These improvements have supported a shift in treatment paradigms toward therapies that prioritize long-term durability and improved quality of life for patients. Replacement procedures also benefit from clinical studies and real-world data that validate their effectiveness, encouraging broader use among healthcare providers.

In terms of end use, hospitals emerged as the largest consumers of structural heart devices in 2024 and are projected to generate USD 5.2 billion by the end of the forecast period. Hospitals are well-equipped with skilled personnel, modern cardiac units, and diagnostic capabilities, enabling them to handle high volumes of cardiovascular procedures. With the increasing complexity of structural heart treatments, hospitals continue to play a central role in delivering comprehensive care using state-of-the-art tools and systems. They are also the primary hubs for referrals and post-surgical care, further strengthening their position in the market.

The United States accounted for USD 3.8 billion in market revenue in 2024 and is expected to grow at a CAGR of 7.7% between 2025 and 2034. The country's dominance is largely supported by its advanced healthcare infrastructure, early adoption of novel medical technologies, and favorable reimbursement policies for structural interventions. Rising cases of heart valve disorders, especially among older adults, are increasing the demand for less invasive valve replacement therapies. Additionally, the strong presence of key market players and ongoing innovation in device design and procedural workflows continue to drive market growth across the country.

The global structural heart devices market is characterized by high competition, with five major companies holding approximately 75% of the total market share. These leading firms are continuously investing in research and development to improve product performance and simplify complex interventions. From enhancing real-time visualization to streamlining surgical workflows, manufacturers are focused on supporting physicians with intuitive, efficient, and patient-friendly solutions that optimize outcomes and boost clinical productivity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing burden of cardiovascular diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Favorable reimbursement scenario

- 3.2.1.4 Rising preference for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 Potential complications and adverse events

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.8 Technology landscape

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 GAP analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Heart valve devices

- 5.2.1 Surgical heart valves

- 5.2.2 Transcatheter heart valves

- 5.3 Annuloplasty rings

- 5.4 Occluders and delivery systems

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Replacement procedures

- 6.2.1 Surgical aortic valve replacement (SAVR)

- 6.2.2 Transcatheter aortic valve replacement (TAVR)

- 6.2.3 Transcatheter mitral valve replacement (TMVR)

- 6.2.4 Other replacement procedures

- 6.3 Repair procedures

- 6.3.1 Left atrial appendage closure (LAAC)

- 6.3.2 Transcatheter mitral valve repair (TMVr)

- 6.3.3 Transcatheter tricuspid valve repair (TTVr)

- 6.3.4 Valvuloplasty

- 6.3.5 Other repair procedures

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Cardiac catheterization labs

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 AtriCure

- 9.3 BIOMERICS

- 9.4 Boston Scientific

- 9.5 BRAILE

- 9.6 CryoLife

- 9.7 Edwards

- 9.8 JENAVALVE

- 9.9 LEPU MEDICAL

- 9.10 LivaNova

- 9.11 Medtronic

- 9.12 NUMED