|

市場調查報告書

商品編碼

1740957

微生物組治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Microbiome Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

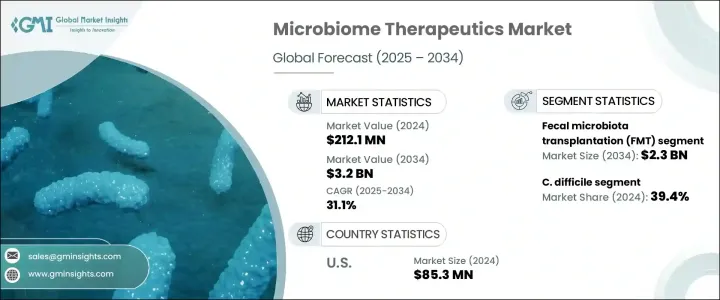

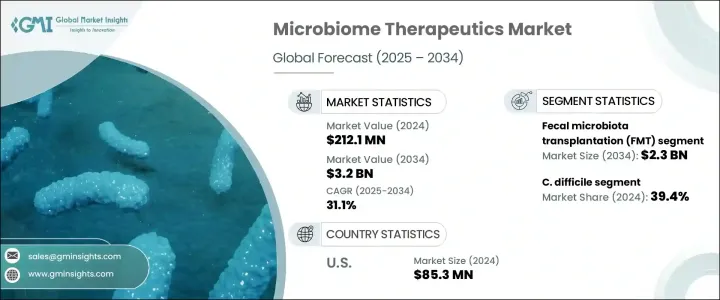

2024 年全球微生物組治療市場價值為 2.121 億美元,預計到 2034 年將以 31.1% 的複合年成長率成長至 32 億美元。該領域的顯著成長主要得益於研發投入的增加、針對先進藥物開發的合作夥伴關係的加強以及個人化醫療的更廣泛推動。有利的監管途徑(包括加速的藥物核准機制)也促成了這一上升趨勢。此外,在理解微生物與人類宿主之間複雜相互作用方面的科學進步促進了有針對性的治療方案的開發。允許深入了解微生物生態系統的技術使開發更精準的治療方法成為可能,這反過來又帶來了更好的診斷能力和更精細的治療方法。隨著診斷方法的發展,為患者匹配合適的基於微生物組的解決方案的能力變得更加高效,這進一步刺激了對這些療法的需求。

微生物組療法利用工程微生物、活體生物療法藥物和微生物組調節化合物來治療一系列慢性疾病。這些方法包括微生物組藥物和糞便微生物移植 (FMT)。其治療應用涵蓋免疫調節、胃腸道健康、代謝失衡以及癌症相關疾病。隨著公眾意識的提升和臨床益處的日益顯現,這些治療模式在醫療領域正得到更廣泛的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.121億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 31.1% |

按類型細分,市場分為糞便微生物組移植 (FMT) 和微生物組藥物。 2024 年,FMT 領域佔據市場主導地位,創造了 1.583 億美元的收入。預計到 2034 年,該領域將達到 23 億美元,並保持領先地位,預測期內的複合年成長率為 30.7%。 FMT 因其有效性而獲得廣泛認可,尤其是在治療常規抗生素無法產生持久療效的持續性胃腸道感染方面。其在臨床實踐中日益成長的可信度促使其在醫院和門診環境中的使用率不斷上升。隨著醫療機構的推廣應用,對基於 FMT 的療法的需求持續攀升。

從應用角度來看,市場細分為發炎性腸道疾病 (IBD)、癌症、糖尿病、艱難梭菌 (C. difficile) 和其他適應症。其中,艱難梭菌領域成為最大貢獻者,2024 年佔 39.4% 的市佔率。預計 2025 年至 2034 年期間,該領域的複合年成長率將達到 31.6%。艱難梭菌感染的嚴重程度通常會導致嚴重的健康併發症,例如結腸炎和敗血症,這使其成為醫療保健提供者的主要擔憂。作為一種常見的院內感染,尤其是在長期照護環境中,它給醫療保健系統帶來了沉重的負擔。鑑於傳統抗生素治療的高復發率(估計介於 25% 至 30% 之間),迫切需要更有效、更永續的解決方案。基於微生物組的療法透過恢復腸道菌群和增強免疫反應來滿足這一需求,使其成為既經濟有效又具有臨床價值的替代方案。

就區域而言,美國在2024年的微生物組治療收入為8,530萬美元。美國市場預計在2025年至2034年間的複合年成長率將達到30.1%。胃腸道和代謝疾病發病率的上升顯著促進了這一成長。艱難梭菌等感染仍然普遍存在,尤其是在免疫系統受損的人身上。因此,對能夠比傳統療法更有效地解決這些問題的創新治療方案的需求持續成長。

領先的生物技術公司在微生物組藥物開發領域擁有強大的研發管線,這是美國市場另一個關鍵的成長動力。這些公司處於創新的前沿,大力投資臨床試驗,並建立策略聯盟,將新型療法推向市場。法規核准也日益簡化,進一步使公司能夠更有效率地推出尖端解決方案。在競爭激烈、持續進步和合作的環境下,微生物組治療市場預計將在未來幾年持續擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病負擔加重

- 微生物組研究進展

- 增加藥物開發的投資和合作

- 產業陷阱與挑戰

- 監管和臨床挑戰

- 發展中地區供應有限

- 成長動力

- 成長潛力分析

- 管道分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 糞便微生物移植(FMT)

- 微生物組藥物

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 發炎性腸道疾病(IBD)

- 癌症

- 艱難梭菌(C. difficile)

- 糖尿病

- 其他應用

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Aardvark Therapeutics

- AOB Pharma

- Enterome

- Ferring Pharmaceuticals

- Finch

- Inlife

- Intralytix

- LNC Therapeutics

- MaaT Pharma

- OPENBIOME

- Seres Therapeutics

- VEDANATA Biosciences

The Global Microbiome Therapeutics Market was valued at USD 212.1 million in 2024 and is estimated to grow at a CAGR of 31.1% to reach USD 3.2 billion by 2034. The remarkable growth in this field is largely driven by heightened investment in research and development, increased partnerships targeting advanced drug development, and a broader push toward personalized medicine. Favorable regulatory pathways, including accelerated drug approval mechanisms, have also contributed to this upward trend. In addition, scientific progress in understanding the complex interactions between microbes and the human host has enhanced the development of targeted therapeutic solutions. Technologies allowing for deeper insights into microbial ecosystems are making it possible to develop more precise treatments, which, in turn, have led to better diagnostic capabilities and more refined therapies. As diagnostic methods evolve, the ability to match patients with appropriate microbiome-based solutions becomes more efficient, further boosting the demand for these therapies.

Microbiome therapeutics utilize engineered microorganisms, live biotherapeutics, and microbiome-modulating compounds to address a range of chronic conditions. These approaches include both microbiome drugs and fecal microbiota transplantation (FMT). The therapeutic applications cover immune regulation, gastrointestinal health, metabolic imbalances, and cancer-related conditions. As public awareness grows and the clinical benefits become more evident, these treatment modalities continue to see broader adoption across medical settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $212.1 Million |

| Forecast Value | $3.2 Billion |

| CAGR | 31.1% |

When broken down by type, the market is categorized into fecal microbiota transplantation (FMT) and microbiome drugs. In 2024, the FMT segment dominated the market by generating USD 158.3 million in revenue. This segment is projected to reach USD 2.3 billion by 2034, maintaining its leading position with an expected CAGR of 30.7% over the forecast period. FMT has earned widespread recognition for its effectiveness, particularly in treating persistent gastrointestinal infections where conventional antibiotics fail to yield lasting results. Its growing credibility in clinical practice has contributed to its increasing usage in both hospital and outpatient settings. With expanding implementation across healthcare institutions, the demand for FMT-based therapeutics continues to climb.

From an application standpoint, the market is segmented into inflammatory bowel disease (IBD), cancer, diabetes, Clostridioides difficile (C. difficile), and other indications. Among these, the C. difficile segment emerged as the top contributor, capturing a 39.4% market share in 2024. This segment is expected to grow at a CAGR of 31.6% between 2025 and 2034. The severity of C. difficile infections often leads to critical health complications such as colitis and sepsis, making it a major concern for healthcare providers. As a common hospital-acquired infection, particularly in long-term care environments, it poses a considerable burden on healthcare systems. Given the high recurrence rates associated with traditional antibiotic treatment-estimated between 25% to 30%-there is a pressing need for more effective and sustainable solutions. Microbiome-based therapies address this need by restoring gut flora and enhancing immune response, which positions them as both cost-effective and clinically valuable alternatives.

In the regional landscape, the United States accounted for USD 85.3 million in microbiome therapeutics revenue in 2024. The US market is forecast to grow at a CAGR of 30.1% from 2025 to 2034. Rising incidences of gastrointestinal and metabolic disorders have significantly contributed to this growth. Infections such as C. difficile remain prevalent, particularly among individuals with compromised immune systems. As a result, demand continues to rise for innovative therapeutic options that can address these issues more effectively than traditional treatments.

The presence of leading biotechnology firms with robust pipelines in microbiome drug development is another key growth driver in the US market. These companies are at the forefront of innovation, investing heavily in clinical trials and forming strategic alliances to bring novel therapies to market. Regulatory approvals are also becoming more streamlined, further enabling companies to introduce cutting-edge solutions with greater efficiency. With a highly competitive landscape marked by continuous advancements and collaborations, the microbiome therapeutics market is poised for sustained expansion in the years ahead.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising burden of chronic diseases

- 3.2.1.2 Advancements in microbiome research

- 3.2.1.3 Increasing investment and partnerships for drug development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and clinical challenges

- 3.2.2.2 Limited availability in developing areas

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fecal microbiota transplantation (FMT)

- 5.3 Microbiome drugs

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Inflammatory bowel disease (IBD)

- 6.3 Cancer

- 6.4 Clostridioides difficile (C. difficile)

- 6.5 Diabetes

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aardvark Therapeutics

- 8.2 AOB Pharma

- 8.3 Enterome

- 8.4 Ferring Pharmaceuticals

- 8.5 Finch

- 8.6 Inlife

- 8.7 Intralytix

- 8.8 LNC Therapeutics

- 8.9 MaaT Pharma

- 8.10 OPENBIOME

- 8.11 Seres Therapeutics

- 8.12 VEDANATA Biosciences