|

市場調查報告書

商品編碼

1740951

PEF(聚呋喃甲酸乙二醇酯)市場機會、成長動力、產業趨勢分析及2025-2034年預測PEF (Polyethylene Furanoate) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

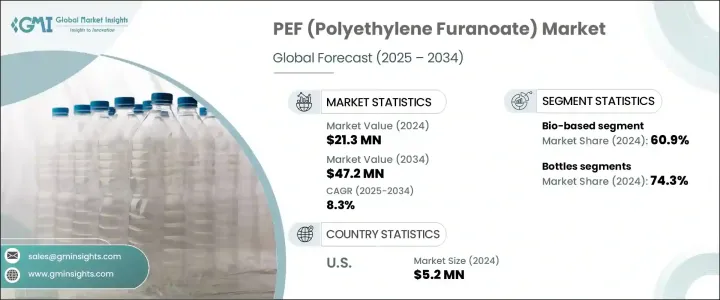

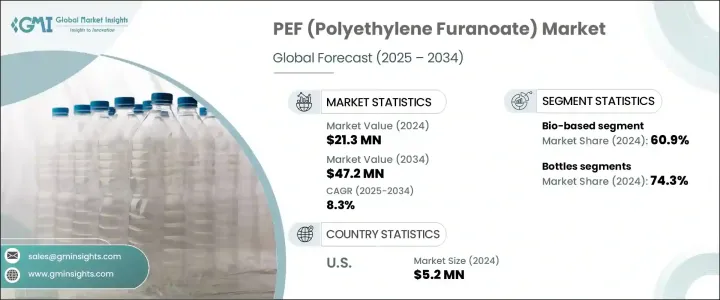

2024年,全球PEF(聚呋喃甲酸乙二醇酯)市值為2,130萬美元,預計到2034年將以8.3%的複合年成長率成長,達到4,720萬美元。 PEF是一種新一代生物基聚酯,其原料主要來自植物糖等再生原料。作為傳統石油基塑膠(例如聚對苯二甲酸乙二酯 (PET))的環保替代品,PEF因消費者和監管機構日益轉向永續性而備受青睞。市場成長主要得益於對環保包裝解決方案日益成長的需求、旨在減少塑膠垃圾的更嚴格法規,以及PEF固有的材料特性(這些特性使其比PET等傳統塑膠更具優勢)。

全球對永續包裝的日益重視是推動PEF市場擴張的關鍵因素之一。消費者、企業和政府都越來越關注減少包裝對環境的影響,而源自可再生植物的PEF則提供了一個極具前景的解決方案。這種聚酯纖維不僅比傳統塑膠減少了碳足跡,而且由於可生物分解,也有助於減少廢物累積。此外,其卓越的阻隔性能,包括比PET(聚對苯二甲酸乙二醇酯)更優異的抗氧、抗二氧化碳和抗水蒸氣性能,使其在食品和飲料包裝等產品品質和保存期限至關重要的領域尤為重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2130萬美元 |

| 預測值 | 4720萬美元 |

| 複合年成長率 | 8.3% |

隨著對PEF的需求持續成長,全球各地企業對該市場的興趣也日益濃厚。尤其是PEF瓶,佔了最大的市場佔有率,佔PEF總用量的74.3%。這得歸功於PEF先進的阻隔性能,能夠更長時間地保持飲料的新鮮度。在產品壽命至關重要的飲料產業,從傳統塑膠轉向生物基替代品不僅是一種趨勢,更是必然。此外,消費者對環境永續性的意識日益增強,也促使飲料製造商採用這些更環保的材料。隨著各國政府對塑膠廢棄物和碳排放的監管愈發嚴格,飲料業的主要企業正在轉向PEF等生物基塑膠。

全球PEF市場也分為兩大類:生物基和植物性。生物基市場佔據主導地位,由於生物基原料的多功能性,到2024年將佔60.9%的市場。與通常依賴特定作物的植物性原料不同,生物基生產方法允許製造商使用各種原料,例如農業副產品、工業殘留物和富含糖分的生質能。這種靈活性不僅保障了供應鏈的安全,還增強了PEF生產的可擴展性和韌性,確保其在需求成長的同時持續成長。

美國是PEF市場的重要參與者,2024年其PEF市場規模達520萬美元。推動這一成長的主要因素是政府支持採用生物基材料的措施。旨在推廣可再生塑膠使用的計劃,尤其是透過聯邦採購授權,為PEF創造了有利的市場環境。這些措施不僅有助於減少對環境的影響,也為PEF在包裝、紡織品和薄膜等多種應用領域開闢了機會。透過營造有利於永續塑膠發展的環境,美國正在確立其在全球轉型為環保材料的領先地位。

為了抓住這一快速成長的市場機會,PEF 產業的主要參與者正在採取一系列策略,包括擴大產能、與其他產業領導者建立策略合作夥伴關係,以及大力投資研發以改善 PEF 生產方法並提升其材料效能。巴斯夫 SE、Avantium、安姆科、Alpla 集團和東洋紡等公司走在這項創新的前沿,將自己定位為環保包裝市場的關鍵參與者。透過採用永續解決方案並利用政府激勵措施,這些公司力求在快速發展的包裝行業中保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 主要製造商

- 經銷商

- 整個產業的利潤率

- 供應中斷

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 全球對永續和生物基包裝材料的需求不斷成長

- 減少塑膠垃圾和碳排放的監管壓力不斷增加

- PEF 相比 PET 具有更高的性能,例如更好的阻隔性和機械強度

- 產業陷阱與挑戰

- 依賴原料的可用性,例如果糖衍生的 2,5-呋喃二甲酸 (FDCA)

- 來自 PLA 和生物 PET 等其他生物基聚合物的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按來源,2021-2034

- 主要趨勢

- 植物性

- 生物基

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 瓶子

- 纖維

- 電影

- 其他

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 包裝

- 紡織品

- 電子產品

- 製藥

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Alpla Group

- Amcor

- AVA Biochem

- Avantium

- BASF SE

- Origin Materials

- Sulzer

- Swicofil

- Toyobo

The Global PEF (Polyethylene Furanoate) Market was valued at USD 21.3 million in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 47.2 million by 2034. PEF is a next-generation, bio-based polyester derived from renewable feedstocks, primarily derived from plant-based sugars. As an eco-friendly alternative to traditional petroleum-based plastics, such as polyethylene terephthalate (PET), PEF has been gaining significant traction due to the increasing consumer and regulatory shift toward sustainability. The market growth is largely fueled by the rising demand for environmentally friendly packaging solutions, stricter regulations aimed at reducing plastic waste, and the inherent material properties of PEF, which offer superior advantages over conventional plastics like PET.

The growing global push toward sustainable packaging is one of the key factors driving the expansion of the PEF market. Consumers, companies, and governments alike are increasingly focused on reducing the environmental footprint of packaging, and PEF, derived from renewable plant sources, offers a promising solution. This polyester not only reduces the carbon footprint compared to traditional plastics but also contributes to less waste accumulation, as PEF is biodegradable. Moreover, its superior barrier properties, which include better resistance to oxygen, carbon dioxide, and water vapor compared to PET, make it particularly valuable in sectors such as food and beverage packaging, where product quality and shelf life are crucial.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Million |

| Forecast Value | $47.2 Million |

| CAGR | 8.3% |

As demand for PEF continues to rise, the market is seeing increased interest from companies across the globe. PEF bottles, in particular, have captured the largest share of the market, accounting for 74.3% of the overall PEF usage. This is due to PEF's advanced barrier capabilities, which preserve the freshness of beverages for longer periods. In the beverage industry, where product longevity is vital, the shift from traditional plastics to bio-based alternatives is not just a trend but a necessity. Furthermore, the growing consumer awareness surrounding environmental sustainability is pushing beverage manufacturers to adopt these more eco-friendly materials. With governments enforcing stricter regulations on plastic waste and carbon emissions, major corporations in the beverage industry are making the switch to bio-based plastics like PEF.

The global PEF market is also divided into two primary categories: bio-based and plant-based sources. The bio-based segment is dominant, holding a 60.9% share in 2024, thanks to the versatility of bio-based feedstocks. Unlike plant-based sources, which often rely on specific crops, bio-based production methods allow manufacturers to use a wide range of raw materials, such as agricultural byproducts, industrial residues, and sugar-rich biomass. This flexibility not only secures supply chains but also strengthens the scalability and resilience of PEF production, ensuring its continued growth as demand increases.

The United States is a significant player in the PEF market, generating USD 5.2 million in 2024. A major driver of this growth has been government initiatives that support the adoption of bio-based materials. Programs designed to promote the use of renewable plastics, particularly through federal procurement mandates, have created a favorable landscape for PEF. These initiatives not only help reduce the environmental impact but also open up opportunities for PEF across diverse applications, including packaging, textiles, and films. By fostering an environment conducive to the growth of sustainable plastics, the U.S. is establishing itself as a leader in the global shift toward eco-friendly materials.

To capitalize on this rapidly growing market, key players in the PEF sector are employing a range of strategies, including expanding their production capacities, forming strategic partnerships with other industry leaders, and investing heavily in research and development to improve PEF production methods and enhance its material properties. Companies such as BASF SE, Avantium, Amcor, Alpla Group, and Toyobo are at the forefront of this innovation, positioning themselves as key players in the eco-friendly packaging market. By embracing sustainable solutions and leveraging government incentives, these companies aim to stay ahead of the curve in the fast-evolving packaging industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply disruptions

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries

- 3.3.2 Major Importing Countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising global demand for sustainable and bio-based packaging materials

- 3.7.1.2 Increasing regulatory pressure to reduce plastic waste and carbon emissions

- 3.7.1.3 High performance properties of PEF compared to PET, such as better barrier resistance and mechanical strength

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Dependency on feedstock availability such as fructose-derived 2,5-Furandicarboxylic acid (FDCA)

- 3.7.2.2 Competition from other bio-based polymers such as PLA and bio-PET

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant based

- 5.3 Bio-based

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Fibres

- 6.4 Film

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Packaging

- 7.3 Textiles

- 7.4 Electronics

- 7.5 Pharmaceuticals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpla Group

- 9.2 Amcor

- 9.3 AVA Biochem

- 9.4 Avantium

- 9.5 BASF SE

- 9.6 Origin Materials

- 9.7 Sulzer

- 9.8 Swicofil

- 9.9 Toyobo