|

市場調查報告書

商品編碼

1740943

數位面板儀表市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Digital Panel Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

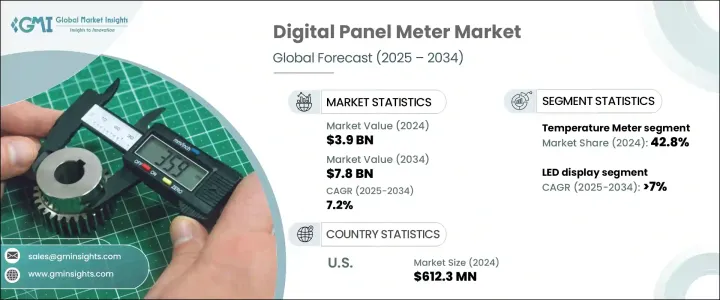

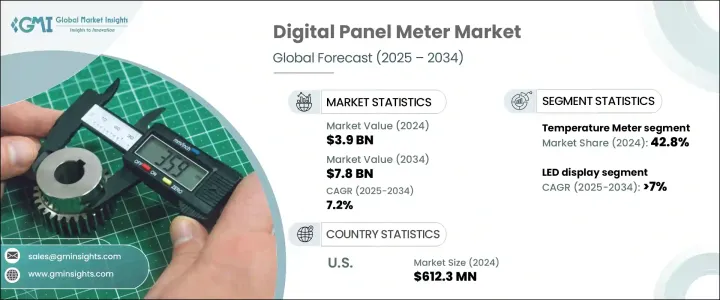

2024年,全球數位面板儀表市場規模達39億美元,預計2034年將以7.2%的複合年成長率成長,達到78億美元。這得益於智慧製造系統的快速發展,其中即時電氣參數監控已變得至關重要。隨著各行各業持續向工業4.0標準轉型,對更高的精度、更快的資料讀取速度和即時系統分析的需求不斷成長,數位面板儀表的發展勢頭強勁。各行各業的公司都在大力投資智慧工廠、節能設施和智慧基礎設施,這使得數位面板儀表成為不可或缺的工具。

最佳化營運效率、最大程度減少停機時間並滿足嚴格監管框架的壓力日益增大,促使企業採用高精度監控儀器。對自動化和數位化的日益依賴,進一步使數位面板儀表成為能源管理、配電和先進控制系統的核心要素。緊湊型和可自訂設備的趨勢與製造業、醫療保健、資料中心、公用事業和再生能源行業對靈活性的現代需求相契合。持續向永續製造實踐和環保技術整合的轉變,也正在塑造全球市場的未來成長軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 78億美元 |

| 複合年成長率 | 7.2% |

隨著工業自動化日益複雜,精確快速讀數的需求也日益成長。數位面板儀表在商業基礎設施和建築管理系統中的應用日益廣泛,這對加速市場擴張至關重要。觸控螢幕介面整合和微控制器技術進步等技術升級正在提升儀表的精度和整體性能。物聯網和人工智慧在工業環境中的應用正在提高營運效率、系統智慧化和網路可擴展性,使數位面板儀表成為智慧系統的重要推動者。這些儀表擴大部署在資料中心用於能源追蹤,以及太陽能和風能發電裝置中用於即時電力資料採集。緊湊的設計創新和方便用戶使用的客製化選項正在提升其在多個領域的多功能性。製造商也轉向符合能源效率規範和永續發展法規的環保生產實踐,從而增強消費者信任並滿足全球環保期望。

市場按顯示器類型細分為LED和LCD。預計到2034年,基於LED的數位面板儀表將以7%的複合年成長率成長,這得益於其卓越的亮度、快速的響應時間以及在弱光或工業環境中的高可視性。這些特性使其成為控制面板、手持式診斷工具和工廠自動化系統的理想選擇,因為這些系統即時監控至關重要。其節能和長壽命進一步增強了其在注重可靠性和低維護的領域的吸引力。隨著智慧製造系統的發展,模組化儀表和集中監控中心對LED儀表的需求正在成長。

在應用方面,數位電壓面板表市場預計將以6.5%的複合年成長率成長,直至2034年,因為它們在電網管理中發揮著越來越重要的作用。這些儀表提供精確的即時電壓資料,以防止過載、維持電能品質並確保能源效率。它們與風能和太陽能等再生能源系統的整合正變得越來越先進,有助於最佳化發電和輸出調節。此外,它們在變電站和控制中心的應用也得到了增強,並具備分析功能,與智慧電網的發展同步。

2024年,美國數位面板儀表市場規模達6.123億美元,持續維持全球領先地位。聯邦政府和各州政府在數位化、能源監控和工業自動化領域不斷成長的投資,為這一成長勢頭提供了支撐。公共基礎設施的升級,加上私部門對高效率能源管理工具日益成長的需求,正在增強市場應用。工業4.0的興起和對智慧能源系統的推動,進一步鞏固了美國在市場中的主導地位。

全球數位面板儀表市場的主要參與者包括西門子、Selec Controls、Lascar Electronics、Cebeo、Secure Meters、Phoenix Contact、LUMEL、Powertrac Meters、Trumeter、施耐德電氣、Omega Engineering、Autonics Corporation、BEEMET、田田板、村造所、歐姆龍公司製作所、歐姆龍公司 Electricalxn Electricalxic, TTOx、村製作和霍尼韋爾國際。為了確保競爭優勢,各公司正專注於介面設計和連接方面的創新,使儀表與智慧電網和自動化平台相容。研發投資旨在提高準確性和耐用性,同時降低製造成本。與科技公司、區域分銷商和自動化解決方案提供商的策略合作正在擴大其全球影響力。企業也擴大透過採用綠色生產方法來符合環境標準,從而吸引了具有永續發展意識的客戶和監管機構。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 溫度計

- 電壓表

- 電流表

- 功率計

- 多功能儀表

第6章:市場規模及預測:依顯示類型,2021 - 2034

- 主要趨勢

- LED顯示器

- LCD顯示幕

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 工業自動化

- 能源管理

- 過程控制

- 再生能源系統

- HVAC 系統

- 資料中心

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Autonics Corporation

- BEEMET

- Cebeo

- Himel

- Honeywell International

- Jewell Instruments

- Lascar Electronics

- Lauritz Knudsen Electrical & Automation

- LUMEL

- Murata Manufacturing

- Omega Engineering

- OMRON Corporation

- Phoenix Contact

- Powertrac Meters

- Schneider Electric

- Secure Meters

- Selec Controls

- Siemens

- TE Connectivity

- Trumeter

The Global Digital Panel Meter Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 7.8 billion by 2034, propelled by the rapid evolution of smart manufacturing systems where real-time monitoring of electrical parameters has become essential. Digital panel meters are gaining remarkable momentum as industries continue transitioning toward Industry 4.0 standards, demanding enhanced accuracy, faster data readouts, and real-time system analysis. Companies across sectors are investing heavily in smart factories, energy-efficient facilities, and intelligent infrastructure, making digital panel meters indispensable tools.

Growing pressure to optimize operational efficiency, minimize downtime, and meet stringent regulatory frameworks is encouraging enterprises to adopt high-precision monitoring instruments. Increasing dependence on automation and digitization is further making digital panel meters a core element in energy management, power distribution, and advanced control systems. The trend toward compact and customizable devices aligns with modern needs for flexibility across manufacturing, healthcare, data centers, utilities, and renewable energy industries. The ongoing shift toward sustainable manufacturing practices and eco-conscious technology integration is also shaping the future growth trajectory of the market worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 7.2% |

As industrial automation becomes more complex, the need for precise and fast readouts continues to climb. The increasing use of digital panel meters in commercial infrastructure and building management systems plays a critical role in accelerating market expansion. Technological upgrades such as the integration of touchscreen interfaces and microcontroller advancements are enhancing meter accuracy and overall performance. The adoption of IoT and AI in industrial settings is improving operational efficiency, system intelligence, and network scalability, positioning digital panel meters as vital enablers of smart systems. These meters are increasingly deployed in data centers for energy tracking and in solar and wind power installations for live power data collection. Compact design innovations and user-friendly customization options are boosting their versatility across multiple sectors. Manufacturers are also moving toward eco-conscious production practices that comply with energy efficiency norms and sustainability regulations, strengthening consumer trust and meeting global environmental expectations.

The market is segmented by display type into LED and LCDs. LED-based digital panel meters are forecasted to grow at a CAGR of 7% by 2034, driven by their superior brightness, quick response time, and high visibility in low-light or industrial environments. These features make them ideal for control panels, handheld diagnostic tools, and factory automation systems where real-time monitoring is critical. Their energy efficiency and longevity further add to their appeal in sectors prioritizing reliability and low maintenance. As smart manufacturing systems evolve, the demand for LED meters in modular instrumentation and centralized monitoring hubs is on the rise.

In terms of application, the voltage digital panel meter segment is set to grow at a 6.5% CAGR through 2034, as they play an increasingly vital role in managing electrical networks. These meters provide accurate, real-time voltage data for preventing overloads, maintaining power quality, and ensuring energy efficiency. Their integration into renewable power systems, such as wind and solar installations, is becoming more advanced, helping optimize generation and output regulation. Additionally, their usage in substations and control centers is enhanced with analytics-enabled features, aligning with smart grid developments.

The U.S. Digital Panel Meter Market recorded USD 612.3 million in 2024, maintaining its position as a leading revenue generator globally. This momentum is supported by growing federal and state investments in digitization, energy monitoring, and industrial automation. Public infrastructure upgrades, coupled with increasing private sector demand for efficient energy management tools, are strengthening market adoption. The rise of Industry 4.0 and the push for smarter energy systems are further reinforcing the country's dominant market role.

Top global Digital Panel Meter Market players include Siemens, Selec Controls, Lascar Electronics, Cebeo, Secure Meters, Phoenix Contact, LUMEL, Powertrac Meters, Trumeter, Schneider Electric, Omega Engineering, Autonics Corporation, BEEMET, Jewell Instruments, Murata Manufacturing, OMRON Corporation, TE Connectivity, Lauritz Knudsen Electrical & Automation, and Honeywell International. To secure a competitive edge, companies are focusing on innovations in interface design and connectivity, making meters compatible with smart grid and automation platforms. R&D investments are aiming to improve accuracy and durability while lowering manufacturing costs. Strategic collaborations with tech firms, regional distributors, and automation solution providers are expanding their global reach. Businesses are also increasingly aligning with environmental standards by adopting green production methods, appealing to sustainability-conscious clients and regulators alike.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 Temperature meters

- 5.3 Voltage meters

- 5.4 Current meters

- 5.5 Power meters

- 5.6 Multifunction meters

Chapter 6 Market Size and Forecast, By Display Type, 2021 - 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 LED display

- 6.3 LCD display

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 Industrial automation

- 7.3 Energy management

- 7.4 Process control

- 7.5 Renewable energy systems

- 7.6 HVAC systems

- 7.7 Data centers

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 ('000 Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Autonics Corporation

- 9.2 BEEMET

- 9.3 Cebeo

- 9.4 Himel

- 9.5 Honeywell International

- 9.6 Jewell Instruments

- 9.7 Lascar Electronics

- 9.8 Lauritz Knudsen Electrical & Automation

- 9.9 LUMEL

- 9.10 Murata Manufacturing

- 9.11 Omega Engineering

- 9.12 OMRON Corporation

- 9.13 Phoenix Contact

- 9.14 Powertrac Meters

- 9.15 Schneider Electric

- 9.16 Secure Meters

- 9.17 Selec Controls

- 9.18 Siemens

- 9.19 TE Connectivity

- 9.20 Trumeter