|

市場調查報告書

商品編碼

1740940

Cerakote(陶瓷基塗層)市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cerakote (Ceramic-Based Coating) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

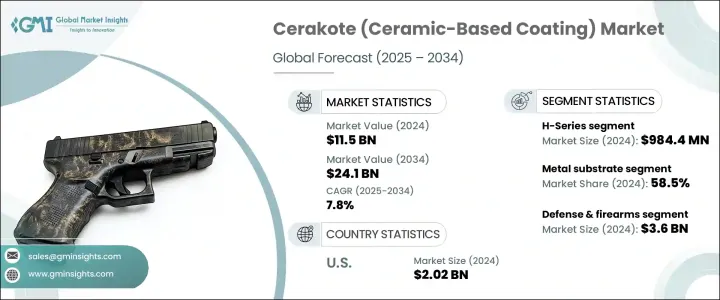

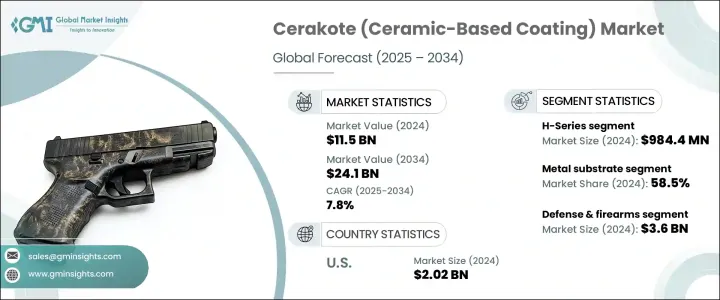

2024年,全球Cerakote(陶瓷基塗層)市場價值達115億美元,預計到2034年將以7.8%的複合年成長率成長,達到241億美元。由於各行各業對塗層的需求日益成長,市場正經歷強勁成長。這些塗層不僅需要滿足技術標準,還需要提供客製化功能。這種成長主要源自於對兼具耐用性、耐腐蝕性和美觀性的高性能塗層日益成長的需求。隨著製造流程日益專業化,符合行業特定要求和環境適應性的陶瓷基塗層的應用日益廣泛。 Cerakote兼具功能性與美觀性,使其成為各終端應用領域的首選。其中,由於消費者群體的不斷擴大以及對耐用塗層(這些塗層可在設備和配件上提供耐熱性、耐磨性和高階飾面)的需求不斷成長,電子產品市場正經歷顯著成長。這些特性使得 Cerakote 成為在嚴苛條件下塗覆基材的頂級解決方案。

H系列在該產品領域處於領先地位,2024年價值達9.844億美元。預計該系列在2025年至2034年期間的複合年成長率將達到8.4%。憑藉其強大的耐化學性、防腐蝕性和耐磨性,它仍然是商業上最成功的產品系列。其有效性已在眾多兼顧性能和外觀的工業應用中得到證實。市場還涵蓋其他產品系列,例如C系列、Elite系列、Glacier系列和Clear Coats系列,每個系列都根據不同的應用需求,開發以滿足特定的性能基準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 115億美元 |

| 預測值 | 241億美元 |

| 複合年成長率 | 7.8% |

Cerakote塗料根據基材相容性進行分類,主要材料類別包括金屬、聚合物和塑膠、複合材料以及木材。 2024年,金屬在該領域佔據主導地位,佔據全球市場佔有率的58.5%。這種主導地位源自於金屬零件在環境暴露、耐磨性和使用壽命至關重要的行業中的廣泛使用。該塗料對黑色金屬和有色金屬均具有優異的附著力,這使其在高應力環境中更具吸引力。 Cerakote的分子鍵結能力在製造業和重型應用中增強金屬性能方面發揮重要作用。

聚合物和塑膠通常採用 C 系列塗料,該塗料在室溫下固化,以保持基材的結構完整性。相較之下,木質基材則受益於該塗料的防潮和防刮擦性能,尤其是在注重美觀且注重表面設計的應用中。這些塗料提供的不僅是保護,它們還能實現創意客製化,而不會犧牲材料的耐久性。

就終端應用產業而言,國防和槍械產業成為最大的貢獻者,2024 年市場價值達 36 億美元,預計到 2034 年複合年成長率為 6.7%。該領域佔據了整體市場的 31%,這得益於對在極端條件下性能可靠的塗層的需求不斷成長。 Cerakote 的熱穩定性和耐磨性使其特別適用於戰術裝備和武器,因為這些裝備的性能和表面完整性至關重要。

陶瓷塗層市場的應用方法主要分為噴塗、熱固化和風乾。噴塗因其高效、均勻、薄層塗層的優勢而繼續保持領先地位,這對於注重外觀和光滑表面的應用至關重要。熱固化主要用於對耐久性和耐化學性有較高要求的應用,而風乾則較適用於熱敏性基材,例如塑膠、複合材料和木材。

2024年,美國佔據了全球陶瓷市場相當大的佔有率,估值達20.2億美元。預計2025年至2034年期間,美國國內陶瓷市場將以7.8%的複合年成長率成長。汽車、軍事和消費品等高性能產業的需求成長持續推動陶瓷市場的成長。客製化的美觀飾面和更長的組件生命週期是市場擴張的關鍵驅動力。對耐用塗層和行業標準的監管意識的提高也推動了陶瓷基解決方案的採用。

隨著領先製造商大力投資創新、策略合作和全球分銷網路的擴張,競爭環境日益激烈。頂級公司專注於最佳化生產技術,保持產品品質的一致性,並加強其在OEM和售後市場管道的影響力。主要參與者也優先考慮認證、內部測試能力和技術服務,以建立品牌信任和客戶忠誠度。隨著對高性能和美觀塗料的需求不斷成長,製造商正競相透過先進的研發和製程開發來滿足客戶期望。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 槍械和國防對高性能塗料的需求不斷成長。

- 增加汽車客製化和售後服務。

- 輕質、耐高溫零件在航太的應用日益廣泛。

- 工業設備高溫塗料需求激增

- 產業陷阱與挑戰

- 與傳統塗料相比,應用和固化成本較高。

- 品牌供應有限。

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- H系列

- C系列

- 精英系列

- 冰川系列

- 透明塗層

第6章:市場估計與預測:依基材相容性,2021-2034

- 主要趨勢

- 金屬

- 鋼

- 鋁

- 鈦

- 聚合物和塑膠

- 複合材料

- 木頭

第7章:市場估計與預測:按應用產業,2021-2034 年

- 主要趨勢

- 防禦與槍支

- 汽車與運輸

- 航太航太

- 消費性電子產品

- 醫療器材

- 工業設備

- 體育和戶外用品

第8章:市場估計與預測:依應用方法,2021-2034 年

- 主要趨勢

- 噴塗

- 熱固化

- 空氣乾燥

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Arrow Finishing

- Cerakote

- KECO Coatings

- KOTEC Ceramic Coatings

- MSP Manufacturing

- Mueller Coatings

- NIC Industries

- Spectrum Coating

- Sun Coating Company

- Tanury Industries

The Global Cerakote (Ceramic-Based Coating) Market was valued at USD 11.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 24.1 billion by 2034. The market is experiencing robust growth due to the increasing demand for coatings that not only fulfill technical standards but also deliver tailored functionality across different industries. This surge is primarily driven by the rising need for high-performance coatings that offer durability, corrosion resistance, and aesthetic appeal. As manufacturing processes become more specialized, there's growing adoption of ceramic-based coatings that align with industry-specific requirements and environmental resilience. Cerakote's ability to combine functionality with visual sophistication makes it a preferred choice across various end-use sectors. Among these, electronics are witnessing notable traction due to the expanding consumer base and the growing demand for durable coatings that offer heat resistance, wear protection, and a premium finish on devices and accessories. These qualities have positioned cerakote as a top-tier solution for coating substrates exposed to demanding conditions.

The H-Series led the product segment and was valued at USD 984.4 million in 2024. This series is anticipated to witness a CAGR of 8.4% between 2025 and 2034. It remains the most commercially successful product line due to its strong combination of chemical resistance, corrosion protection, and wear durability. Its effectiveness has proven reliable across numerous industrial uses where both performance and appearance matter. The market comprises other product lines as well, such as the C-Series, Elite Series, Glacier Series, and Clear Coats, each developed to meet specific performance benchmarks in line with various application needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $24.1 Billion |

| CAGR | 7.8% |

Cerakote coatings are classified based on substrate compatibility, with metals, polymers & plastics, composites, and wood serving as the primary material categories. Metals dominated the segment in 2024, accounting for 58.5% of the global market share. This dominance stems from the widespread use of metallic components in industries where environmental exposure, wear resistance, and longevity are essential. The coating's superior adhesion to both ferrous and non-ferrous metals adds to its attractiveness in high-stress environments. Cerakote's molecular bonding capability plays a significant role in reinforcing metals used in manufacturing and heavy-duty applications.

Polymers and plastics are typically coated with C-Series formulations, which cure at ambient temperatures to maintain the structural integrity of the base materials. In contrast, wood substrates benefit from the coating's moisture resistance and scratch protection, especially in aesthetic-focused uses where surface design matters. These coatings offer more than just protection; they allow for creative customization without sacrificing material durability.

In terms of end-use industries, the defense and firearms sector emerged as the largest contributor, with a market value of USD 3.6 billion in 2024 and an expected CAGR of 6.7% through 2034. This segment represented 31% of the overall market, driven by growing demand for coatings that perform reliably under extreme conditions. The thermal stability and abrasion resistance of cerakote make it particularly suitable for tactical equipment and weaponry, where performance and surface integrity are critical.

Application methods in the cerakote market are primarily segmented into spray coating, heat curing, and air drying. Spray coating continues to lead due to its efficiency in producing even, thin layers, which is critical for applications where visual appeal and smooth finishes are essential. Heat curing is mainly applied in situations that demand peak durability and chemical resistance, whereas air drying is more appropriate for heat-sensitive substrates, including plastics, composites, and wood.

In 2024, the United States held a significant share of the global market, with a valuation of USD 2.02 billion. The domestic market is forecasted to grow at a 7.8% CAGR between 2025 and 2034. Increased demand from high-performance industries such as automotive, military, and consumer goods continues to boost growth. Customized aesthetic finishes and extended component lifecycles are key drivers for market expansion. Regulatory awareness around durable coatings and industry standards has also led to increased adoption of ceramic-based solutions.

The competitive environment is intensifying as leading manufacturers invest heavily in innovation, strategic collaborations, and expansion of global distribution networks. Top-tier companies are focusing on optimizing production techniques, maintaining consistency in product quality, and strengthening their presence across OEM and aftermarket channels. Key players are also prioritizing certifications, in-house testing capabilities, and technical services to build brand trust and customer loyalty. As demand for high-performance and visually appealing coatings grows, manufacturers are racing to meet expectations through advanced R&D and process development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for high-performance coatings in firearms and defense.

- 3.7.1.2 Increasing automotive customization and aftermarket services.

- 3.7.1.3 Growing use in aerospace for lightweight, high-heat components.

- 3.7.1.4 Surge in demand for high-temperature coatings in industrial equipment

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High application and curing costs compared to traditional coatings.

- 3.7.2.2 Limited brand availability.

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 H-series

- 5.3 C-series

- 5.4 Elite series

- 5.5 Glacier series

- 5.6 Clear coats

Chapter 6 Market Estimates & Forecast, By Substrate Compatibility, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Metals

- 6.2.1 Steel

- 6.2.2 Aluminum

- 6.2.3 Titanium

- 6.3 Polymers & plastics

- 6.4 Composites

- 6.5 Wood

Chapter 7 Market Estimates & Forecast, By Application Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Defense & firearms

- 7.3 Automotive & transportation

- 7.4 Aerospace & aviation

- 7.5 Consumer electronics

- 7.6 Medical devices

- 7.7 Industrial equipment

- 7.8 Sporting & outdoor goods

Chapter 8 Market Estimates & Forecast, By Application Method, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Spray coating

- 8.3 Heat curing

- 8.4 Air drying

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arrow Finishing

- 10.2 Cerakote

- 10.3 KECO Coatings

- 10.4 KOTEC Ceramic Coatings

- 10.5 MSP Manufacturing

- 10.6 Mueller Coatings

- 10.7 NIC Industries

- 10.8 Spectrum Coating

- 10.9 Sun Coating Company

- 10.10 Tanury Industries