|

市場調查報告書

商品編碼

1740934

造粒機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Granulator Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

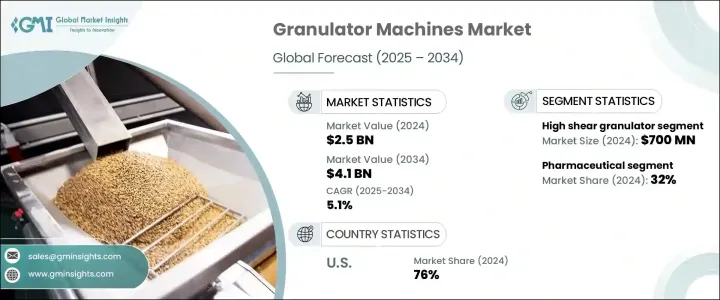

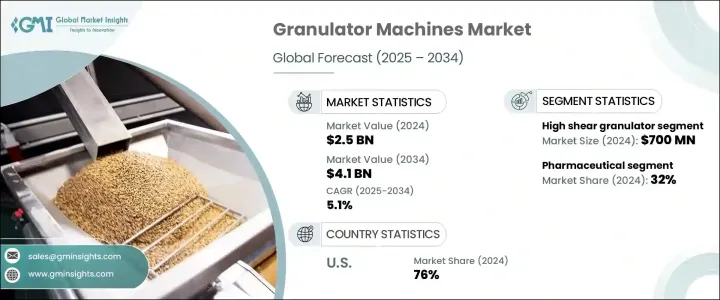

2024年,全球造粒機市場規模達25億美元,預估年複合成長率為5.1%,2034年將達41億美元。這一成長主要源於多個行業日益成長的需求,尤其是在製藥業,造粒機對於生產藥片、膠囊和其他劑型至關重要。隨著藥物配方日益複雜,以及對精確粒度的需求日益成長,各公司紛紛投資先進的造粒設備,以確保產品的品質、一致性並符合嚴格的法規要求。

製藥技術的創新和對高品質製劑日益成長的需求極大地影響了現代製粒機的應用。這些機器透過提供均勻的顆粒,在滿足生產標準方面發揮關鍵作用,這對於控制藥物釋放和增強吸收至關重要。製藥業的不斷發展,以及機械設計和自動化技術的進步,推動了對能夠處理大量物料並保持穩定品質的精密設備的需求。這種日益成長的需求也反映在其他行業,例如化學品、食品加工、塑膠和回收利用,高性能製粒設備是這些行業高效運作不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 5.1% |

2024年,高剪切造粒機成為領先的機器類型,創造了約7億美元的收入。這些機器因其能夠提供可自訂的顆粒尺寸和形狀而備受推崇,使其成為精度至關重要的應用的理想選擇。該細分市場的受歡迎程度很大程度上歸功於其先進的功能,這些功能使製造商能夠微調造粒參數以獲得最佳效果。同時,旋轉滾筒造粒機預計將在預測期內錄得最快成長,預計2025年至2034年的複合年成長率約為5.4%。其高容量處理能力使其特別適合需要大量生產的行業,例如化學品和肥料製造。

自動化和即時監控技術的日益普及正在改變製粒機的運作方式。製造商正在採用物聯網驅動的系統,以便更好地控制混合時間和水分含量等變量,最終提高產品品質並最大限度地減少批次間差異。這些智慧增強功能還使操作員能夠即時調整生產參數,確保高效率並降低營運成本。在旋轉滾筒製粒機中,較新的型號現在配備了先進的溫度和濕度控制系統,並提高了能源效率,以滿足日益嚴格的環境和永續性標準。

市場根據終端行業進行分類,包括製藥、化學品、食品、塑膠、回收等。 2024年,製藥業佔據了整個市場的32%,反映出其在推動高精度造粒設備需求方面發揮主導作用。製藥生產日益複雜,尤其是在生產一致均勻的顆粒方面,這促使人們轉向能夠提供更佳製程控制的設備。高剪切造粒機和旋轉造粒機因其能夠保持顆粒均勻性並提供可擴展的生產能力,正日益得到應用。

技術進步也使造粒設備的應用範圍拓展到食品加工領域。自動化程度的提高和精簡的控制系統使這些機器更適合生產質地和品質一致的加工和包裝食品。在化學和化肥行業,轉鼓造粒機因其能夠在不影響一致性和效率的情況下處理大規模生產的能力而日益受到青睞。

從地理分佈來看,美國在2024年佔據了北美製粒機市場的主導地位,佔據了近76%的市場佔有率,創造了約6億美元的市場收入。美國強大的製藥和化學製造基礎在維持這一成長勢頭方面發揮著重要作用。隨著製藥業的持續擴張,對符合監管標準的先進製粒設備的需求也不斷成長。高剪切和振盪製粒機因其卓越的產出品質和可靠性,越來越受到製造商的青睞。

在化學領域,向大批量、高品質生產的轉變推動了智慧造粒機的廣泛應用。這些機器幫助製造商在實現大量生產的同時保持產品的一致性,使其成為現代化工加工設施的關鍵部件。

造粒機產業擁有多家知名企業,它們正積極投資技術開發和策略合作,以增強市場影響力。這些措施旨在提供更有效率、更具適應性、更便利的解決方案,以滿足不斷變化的產業需求。透過提陞技術能力並進行創新合作,各企業致力於提供先進的造粒解決方案,進而提升不同終端應用領域的生產力與產品品質。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 製藥業需求不斷成長

- 化工和化肥行業的成長

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 機器操作和訓練的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 振盪製粒機

- 高剪切製粒機

- 振動製粒機

- 旋轉滾筒造粒機

- 滾壓式製粒機

- 其他(圓盤造粒機等)

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 濕式製粒機

- 乾式製粒機

第7章:市場估計與預測:依營運模式,2021 - 2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第8章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 低於500公斤/小時

- 500至1000公斤/小時

- 1000至1500公斤/小時

- 1500公斤/小時以上

第9章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 製藥

- 化學

- 食品工業

- 塑膠工業

- 回收業

- 其他(化妝品行業等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Allpack

- Cumberland

- Fluid Air

- Freund-Vector

- GEA

- Getecha

- Glatt

- GlobePharma

- Levstal

- Rapid Granulator

- ServoLiFT

- THM recycling solutions

- Vaner Machinery

- Wittmann

- Xertecs

The Global Granulator Machines Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 4.1 billion by 2034. This growth is primarily driven by rising demand across several industries, particularly in pharmaceutical manufacturing, where granulator machines are crucial for producing tablets, capsules, and other dosage forms. With the increasing complexity of drug formulations and the need for precise particle size, companies are investing in advanced granulation equipment to ensure quality, consistency, and compliance with stringent regulations.

Innovations in pharmaceutical technology and the growing demand for high-quality formulations have significantly influenced the adoption of modern granulators. These machines play a critical role in meeting production standards by delivering uniform granules, essential for controlled drug release and enhanced absorption. The expanding pharmaceutical sector, along with technological advancements in machine design and automation, is fueling the need for precision equipment capable of handling large volumes while maintaining consistent quality. This rising need is also being mirrored in other sectors, such as chemicals, food processing, plastics, and recycling, where high-performance granulation equipment is integral to efficient operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.1% |

In 2024, high shear granulators emerged as the leading machine type, generating approximately USD 700 million in revenue. These machines are particularly valued for their ability to deliver customizable granule sizes and shapes, making them ideal for applications where precision is critical. The segment's popularity is largely attributed to its advanced features that allow manufacturers to fine-tune granulation parameters for optimal results. Meanwhile, rotary drum granulators are anticipated to record the fastest growth during the forecast period, with a projected CAGR of about 5.4% from 2025 to 2034. Their high-capacity processing capabilities make them particularly suitable for industries that require bulk production, such as chemical and fertilizer manufacturing.

The increasing implementation of automation and real-time monitoring technologies is transforming how granulation machines operate. Manufacturers are incorporating IoT-driven systems that allow for better control over variables like mixing duration and moisture content, ultimately improving product quality and minimizing batch-to-batch inconsistencies. These smart enhancements also enable operators to adjust production parameters on the fly, ensuring high efficiency and reduced operational costs. In rotary drum granulators, newer models now offer advanced temperature and moisture control systems, along with improved energy efficiency to meet growing environmental and sustainability standards.

The market is categorized based on end-use industries, which include pharmaceuticals, chemicals, food, plastics, recycling, and others. In 2024, the pharmaceutical sector accounted for 32% of the overall market, reflecting its dominant role in driving demand for high-precision granulation equipment. The growing complexity in pharmaceutical manufacturing, particularly in producing consistent and uniform granules, is prompting a shift toward equipment that offers better process control. High shear and rotary granulators are increasingly being used due to their ability to maintain granule uniformity and deliver scalable production output.

Technological advancements are also expanding the applications of granulation equipment into the food processing sector. Enhanced automation and streamlined control systems are making these machines more adaptable for producing processed and packaged food products with consistent texture and quality. In the chemical and fertilizer industries, rotary drum granulators are gaining traction due to their ability to handle large-scale production without compromising on consistency and efficiency.

Geographically, the United States dominated the North American granulator machines market in 2024, capturing nearly 76% of the regional share and generating revenue of approximately USD 600 million. The country's strong pharmaceutical and chemical manufacturing base is playing a significant role in sustaining this growth. As the pharmaceutical sector continues to expand, the demand for sophisticated granulation equipment that ensures compliance with regulatory standards is on the rise. Manufacturers are increasingly favoring high shear and oscillating granulators for their superior output quality and reliability.

In the chemical sector, the shift toward high-volume, high-quality production has led to the widespread adoption of smart granulators. These machines help manufacturers maintain product consistency while achieving bulk output, making them a key component in modern chemical processing facilities.

The granulator machines industry includes several prominent players who are actively investing in technology development and strategic partnerships to strengthen their market presence. These efforts are geared toward offering more efficient, adaptable, and user-friendly solutions that align with evolving industry demands. By enhancing their technological capabilities and collaborating on innovation, companies aim to deliver advanced granulation solutions that improve productivity and product quality across diverse end-use sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand from the pharmaceutical industry

- 3.6.1.2 Growth in the chemical and fertilizer industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Complexity in machine operation and training

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Oscillating granulators

- 5.3 High shear granulators

- 5.4 Vibrating granulators

- 5.5 Rotary drum granulators

- 5.6 Roller compactor granulators

- 5.7 Others (disc pan granulator etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Wet granulators

- 6.3 Dry granulators

Chapter 7 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Fully automatic

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 500 Kg/hr

- 8.3 500 to 1000 Kg/hr

- 8.4 1000 to 1500 Kg/hr

- 8.5 Above 1500 Kg/hr

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Pharmaceutical

- 9.3 Chemical

- 9.4 Food industry

- 9.5 Plastic industry

- 9.6 Recycling industry

- 9.7 Others (cosmetics industry etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Allpack

- 12.2 Cumberland

- 12.3 Fluid Air

- 12.4 Freund-Vector

- 12.5 GEA

- 12.6 Getecha

- 12.7 Glatt

- 12.8 GlobePharma

- 12.9 Levstal

- 12.10 Rapid Granulator

- 12.11 ServoLiFT

- 12.12 THM recycling solutions

- 12.13 Vaner Machinery

- 12.14 Wittmann

- 12.15 Xertecs