|

市場調查報告書

商品編碼

1740932

血管攝影設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Angiography Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

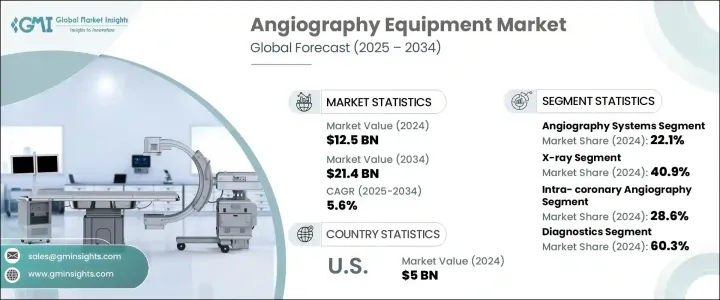

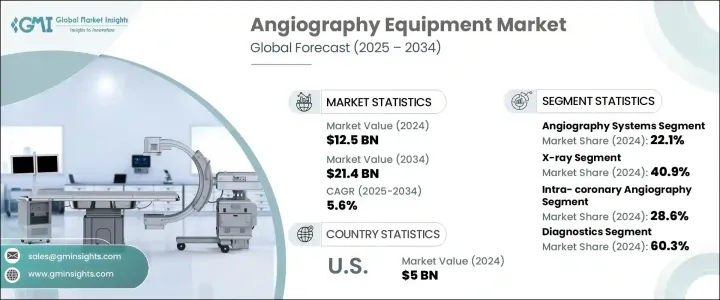

2024年,全球血管攝影設備市場規模達125億美元,預計年複合成長率將達5.6%,2034年將達214億美元。這主要得益於心血管疾病負擔的加重以及全球人口老化加劇,導致診斷和介入治療需求頻繁增加。高血壓、糖尿病和肥胖等慢性疾病的盛行率不斷上升,顯著增加了需要血管影像檢查的患者數量。隨著全球醫療保健領域轉向早期發現和微創治療,對先進血管造影設備的需求預計將大幅成長。醫院和診斷中心正在迅速採用尖端技術,以改善臨床療效、縮短手術時間並最大程度地減少患者的放射線暴露。

3D影像、平板偵測器和人工智慧增強成像軟體等技術突破正在徹底改變血管疾病的診斷和治療方法。不斷成長的醫療保健投資、優惠的報銷方案以及人們對預防性心臟保健日益成長的認知,為全球血管造影設備製造商創造了新的機會。新興經濟體的醫療保健基礎設施正在顯著改善,推動先進診斷工具的普及。隨著政府和私營機構加強應對非傳染性疾病的力度,預計未來十年,血管造影系統等高精度成像解決方案的採用將實現強勁成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 125億美元 |

| 預測值 | 214億美元 |

| 複合年成長率 | 5.6% |

在所有產品類型中,血管攝影系統在2024年的市佔率為22.1%。這些系統仍然是診斷和介入手術中詳細血管影像的首選。它們能夠提供即時、準確和動態的成像,在處理複雜的心血管、神經血管和腫瘤病例方面發揮著至關重要的作用。持續的創新投入帶來了許多改進,例如降低輻射劑量和提高影像清晰度,幫助醫院提供更安全、更有效率的病患治療方案。易用性的提升和使用者介面設計的改進,進一步推動了它們在各種醫療環境中的普及。

根據具體操作方法,冠狀動脈內造影在2024年佔據了28.6%的市場。隨著心血管疾病持續上升,冠狀動脈內造影對於急診介入和擇期手術都至關重要。血流儲備分數(FFR)和光學相干斷層掃描(OCT)等創新技術已將重點從單純的解剖評估轉向功能評估,從而改善了干涉期間的決策。隨著冠狀動脈疾病日益加重全球健康負擔,冠狀動脈內造影的作用將持續擴大,尤其是在其整合到混合手術室和先進的導管室之後。

受不斷成長的臨床需求和強大的醫療保健體系推動,美國血管造影設備市場規模在2024年達到50億美元。肥胖、高血壓和人口老化率的上升,推動了國家層級推廣早期診斷和預防性篩檢的措施。保險覆蓋範圍的擴大和綜合醫療網路的興起,使得血管造影評估在門診中心和農村地區更加便捷。此外,數位平台的採用使得血管攝影能夠無縫整合到常規心血管評估中,從而提高了速度和準確性。

全球血管攝影設備市場的領導公司包括美敦力、佳能醫療系統、通用電氣醫療、Cordis、飛利浦、Merit Medical、東芝醫療系統、Angiodynamics、西門子醫療、微創醫療科學、康德樂健康、貝朗、雅培、波士頓科學和島津製作所。主要參與者正在大力投資研發,以推出整合人工智慧的低輻射系統,並擴大全球合作夥伴關係以擴大市場覆蓋範圍,同時根據新興市場的本地化臨床需求和法規客製化產品。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病盛行率不斷上升

- 人口老化加劇

- 成像技術的技術進步

- 越來越多的公共衛生措施旨在早期發現心臟病

- 產業陷阱與挑戰

- 設備採購維護成本高

- 與輻射暴露相關的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 血管攝影系統

- 導管

- 導絲

- 氣球

- 顯影劑

- 血管閉合裝置

- 血管攝影配件

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- X光

- 影像增強器

- 平板探測器

- MRA

- CT

第7章:市場估計與預測:按程序,2021 年至 2034 年

- 主要趨勢

- 冠狀動脈造影

- 血管內血管攝影

- 神經血管攝影

- 腫瘤血管攝影

- 其他血管攝影程序

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 診斷

- 療法

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院和診所

- 診斷和影像中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Abbott

- Angiodynamics

- B. BRAUN

- Boston Scientific

- Canon Medical System

- Cardinal Health

- Cordis

- GE Healthcare

- Koninklijke Philips

- Medtronic

- Merit Medical

- Microport Scientific

- Shimadzu

- Siemens Healthineers

- Toshiba Medical System

The Global Angiography Equipment Market was valued at USD 12.5 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 21.4 billion by 2034, driven by the rising burden of cardiovascular diseases and an increasingly aging global population that demands frequent diagnostic and interventional care. The escalating prevalence of chronic conditions like hypertension, diabetes, and obesity is significantly increasing the number of patients who require vascular imaging procedures. As the global healthcare landscape shifts toward early detection and minimally invasive treatments, the demand for advanced angiography equipment is expected to soar. Hospitals and diagnostic centers are rapidly adopting cutting-edge technologies to enhance clinical outcomes, reduce procedure time, and minimize patient exposure to radiation.

Technological breakthroughs such as 3D imaging, flat-panel detectors, and AI-enhanced imaging software are revolutionizing the way vascular disorders are diagnosed and treated. Growing healthcare investments, favorable reimbursement scenarios, and rising awareness about preventative cardiac care are creating new opportunities for angiography equipment manufacturers worldwide. Emerging economies are witnessing major improvements in healthcare infrastructure, fueling broader access to advanced diagnostic tools. As governments and private organizations ramp up efforts to tackle non-communicable diseases, the adoption of high-precision imaging solutions like angiography systems is expected to experience robust growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 5.6% |

Among all product types, the angiography systems segment accounted for a 22.1% share in 2024. These systems continue to be the preferred choice for detailed vessel imaging in both diagnostic and interventional procedures. Their ability to deliver real-time, accurate, and dynamic imaging has made them crucial in managing complex cardiovascular, neurovascular, and oncological cases. Continuous investments in innovation have led to improvements such as reduced radiation doses and enhanced imaging clarity, helping hospitals deliver safer, more efficient patient outcomes. Enhanced ease of use and advancements in user interface design are further driving their adoption across various care settings.

Based on the procedure, the intra-coronary angiography segment generated a 28.6% share in 2024. As cardiovascular diseases maintain a rising trend, intra-coronary angiography remains vital for both emergency interventions and elective procedures. Innovations like fractional flow reserve (FFR) and optical coherence tomography (OCT) have shifted the focus from purely anatomical assessments to functional evaluations, improving decision-making during interventions. With coronary artery disease presenting a growing global health burden, the role of intra-coronary angiography is set to expand, especially with its integration into hybrid ORs and advanced cath labs.

The U.S. Angiography Equipment Market reached USD 5 billion in 2024, fueled by rising clinical demand and a strong healthcare system. The growing rates of obesity, hypertension, and an aging population have driven national initiatives promoting early diagnostics and preventative screenings. Expanded insurance coverage and the rise of integrated healthcare networks have made angiographic evaluations more accessible across outpatient centers and rural areas. Additionally, the adoption of digital platforms has enabled seamless integration of angiography into routine cardiovascular assessments, boosting speed and accuracy.

Leading companies operating in the Global Angiography Equipment Market include Medtronic, Canon Medical System, GE Healthcare, Cordis, Philips, Merit Medical, Toshiba Medical System, Angiodynamics, Siemens Healthineers, Microport Scientific, Cardinal Health, B. Braun, Abbott, Boston Scientific, and Shimadzu Corporation. Major players are heavily investing in R&D to launch AI-integrated, low-radiation systems and expanding global partnerships to strengthen market reach while tailoring products for emerging markets with localized clinical needs and regulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Rise in aging population

- 3.2.1.3 Technological advancements in imaging techniques

- 3.2.1.4 Growing public health initiatives for early detection of cardiac diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated to equipment procurement and maintenance

- 3.2.2.2 Risk related to radiation exposure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Angiography systems

- 5.3 Catheters

- 5.4 Guidewire

- 5.5 Balloons

- 5.6 Contrast media

- 5.7 Vascular closure devices

- 5.8 Angiography accessories

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 X-ray

- 6.2.1 Image intensifiers

- 6.2.2 Flat-panel detectors

- 6.3 MRA

- 6.4 CT

Chapter 7 Market Estimates and Forecast, By Procedure, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Coronary angiography

- 7.3 Endovascular angiography

- 7.4 Neuroangiography

- 7.5 Onco-angiography

- 7.6 Other angiography procedures

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Diagnostics

- 8.3 Therapeutics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Diagnostic and imaging centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 Angiodynamics

- 11.3 B. BRAUN

- 11.4 Boston Scientific

- 11.5 Canon Medical System

- 11.6 Cardinal Health

- 11.7 Cordis

- 11.8 GE Healthcare

- 11.9 Koninklijke Philips

- 11.10 Medtronic

- 11.11 Merit Medical

- 11.12 Microport Scientific

- 11.13 Shimadzu

- 11.14 Siemens Healthineers

- 11.15 Toshiba Medical System