|

市場調查報告書

商品編碼

1740931

側裝式垃圾車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Side Loader Refuse Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

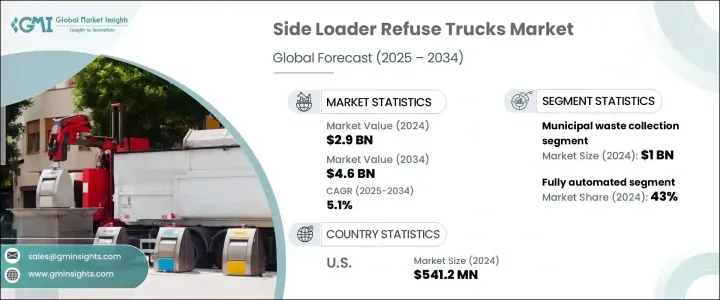

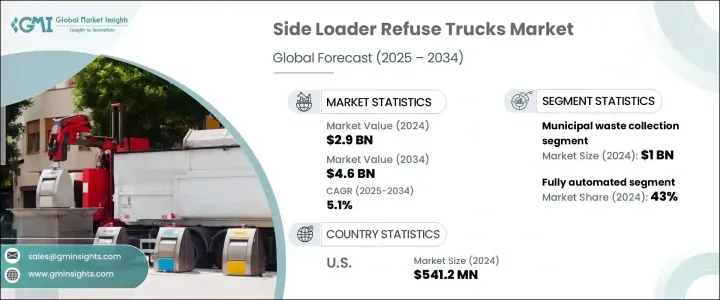

2024年,全球側裝式垃圾車市場規模達29億美元,預計到2034年將以5.1%的複合年成長率成長,達到46億美元。隨著全球城市規模的不斷擴大,對高效能、節省空間的垃圾收集車輛的需求也隨之激增。城市發展必然帶來人口密度的上升和固體垃圾量的增加,因此迫切需要能夠在狹小空間內進行垃圾收集的系統。側裝式垃圾車憑藉其在狹窄道路和繁忙街道上的靈活機動性,已成為城市地區的首選解決方案。此外,側裝式垃圾車與標準垃圾箱相容,也使其成為致力於簡化垃圾收集流程的市政當局的首選方案。城市中心正朝著更乾淨、更有效率的垃圾管理模式邁進,這大大加速了側裝式垃圾車的普及。

政府法規在這些車輛日益普及的過程中也發揮關鍵作用。更嚴格的環境和安全標準正促使地方政府和私人企業投資現代化的低排放技術。隨著城市致力於改善空氣品質和減少碳排放,由電動和混合動力系統驅動的側裝裝載機正日益受到青睞。這些車輛不僅有助於實現環保目標,還能透過降低油耗和縮短維護時間來提高營運性能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 46億美元 |

| 複合年成長率 | 5.1% |

從應用角度來看,市場分為工業廢棄物、市政廢棄物、商業廢棄物以及建築和拆除廢棄物。市政廢棄物收集在2024年佔據主導地位,市場價值約10億美元,佔市場佔有率的45%以上。隨著都市化進程的加快,城市地區產生的廢棄物持續增加,這反映在市政收集服務需求的增加。隨著廢物量的增加,市政當局開始使用側裝卡車來應對其衛生系統日益成長的壓力。

這些卡車的自動化設計已被證明對尋求降低勞動成本的市政府尤其重要。憑藉自動化的臂架和箱體升降機構,側裝式裝載機所需的操作員更少,從而更具成本效益和效率。這些卡車能夠在極少的人工干預下持續不間斷地收集垃圾,從而改善勞動力管理並提高生產力。市政府擴大採用此類技術,這些技術通常由公共資金或撥款支持,以提高其廢棄物管理系統的效率。

就裝載機製而言,市場細分為全自動、半自動和手動系統。 2024年,全自動側裝卡車佔據市場主導地位,約佔總市場佔有率的43%。這些卡車只需一名操作員即可完成所有核心功能,包括起重、裝載和清空垃圾箱。這種自動化不僅有助於減少勞動力,還能加快收集流程、最大限度地減少停機時間並提高準確性。隨著技術的不斷進步,這些全自動系統在大型城市環境中變得越來越可靠和重要。

燃料類型是另一個關鍵的細分領域,涵蓋柴油、電動、壓縮天然氣 (CNG)、混合動力和其他燃料類型。 2024 年,柴油卡車引領市場。儘管替代燃料日益普及,但對於許多市政當局和私營業者而言,柴油仍然是最實用、最具成本效益的選擇。柴油卡車以其耐用性、易於維護和完善的加油基礎設施而聞名。對於長途運輸和重型作業,與電動或壓縮天然氣 (CNG) 驅動的替代燃料相比,柴油仍然具有無與倫比的可靠性和更低的前期成本。

就最終用戶而言,市場細分為市政服務、專業廢棄物處理商、私人廢棄物管理公司和其他類型。市政服務在2024年佔據主導地位。地方政府負責城市地區(尤其是人口密集的社區)的大部分廢棄物收集工作。側裝卡車憑藉其緊湊的設計和自動化功能,能夠有效地服務這些地區。由於能夠獲得政府補貼和預算撥款,市政當局能夠更好地投資於更新、更具成本效益的廢棄物收集技術,從而支持其環境目標。

從地理上看,北美佔據了主要的市場佔有率,2024 年佔超過 35%。光是美國一國的市場價值就達到了約 5.412 億美元。美國龐大的城市人口,加上嚴格的州級法規,使得自動化和清潔的垃圾收集技術成為必要。垃圾收集部門正在增加對電動和混合動力車型的投資,以符合排放法規,同時降低整體營運成本。

該領域的主要製造商如今高度重視永續性,透過提供配備智慧自動化、電動傳動系統和診斷功能的車型來競爭。能夠提供低排放或零排放汽車的公司在實施綠色採購政策的地區(尤其是北美和歐洲)找到了更多機會。競爭優勢在於能夠提供兼具性能、燃油效率、安全性和環保合規性且經濟高效的汽車。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原料及零件供應商

- 卡車和設備製造商

- 技術和遠端資訊處理提供者

- 最終用途

- 利潤率分析

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 價格分析

- 地區

- 推進系統

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 都市化和人口成長

- 監管推動清潔高效的垃圾收集

- 私人廢棄物管理公司的成長

- 垃圾車的技術進步

- 產業陷阱與挑戰

- 初始成本高

- 維護和維修成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按加載機制,2021 - 2034 年

- 主要趨勢

- 全自動

- 半自動化

- 手動的

第6章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 少於10,000磅

- 10,000 至 20,000 磅

- 20,000 至 30,000 磅

- 超過30,000磅

第7章:市場估計與預測:按燃料,2021 - 2034 年

- 主要趨勢

- 柴油引擎

- 電的

- 天然氣

- 混合

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 城市垃圾收集

- 工業廢棄物收集

- 商業垃圾收集

- 建築和拆除廢棄物

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 市政服務

- 私人廢棄物管理公司

- 專業廢棄物處理人員

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Amrep

- Autocar

- Bridgeport Manufacturing

- Bucher Municipal

- BYD

- Curbtender

- Dennis Eagle

- FAUN Zoeller (UK)

- Foton Motor

- Freightliner (Daimler)

- Fujian Longma Environmental Sanitation Equipment

- Heil

- Isuzu

- Labrie Trucks

- Mack Trucks

- McNeilus Truck and Manufacturing

- New Way Refuse Trucks

- NTM

- Pak-Mor

- Peterbilt Motors Company

The Global Side Loader Refuse Trucks Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 4.6 billion by 2034. As cities around the world continue to expand, the demand for efficient and space-conscious waste collection vehicles has surged. Urban development naturally brings with it higher population densities and increased volumes of solid waste, creating an urgent need for systems that can handle waste collection in tight spaces. Side loader refuse trucks have become the go-to solution in urban areas, thanks to their ability to maneuver through narrow roads and busy streets. Their compatibility with standardized waste bins also makes them a preferred option for municipalities aiming to streamline collection processes. Urban centers are moving towards cleaner and more efficient waste management practices, which has significantly accelerated the adoption of side loader trucks.

Government regulations are also playing a critical role in the growing adoption of these vehicles. Stricter environmental and safety standards are pushing local authorities and private firms to invest in modern, low-emission technologies. Side loaders powered by electric and hybrid systems are gaining traction as cities aim to improve air quality and reduce carbon emissions. These vehicles not only help meet environmental goals but also improve operational performance by consuming less fuel and reducing maintenance time.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 5.1% |

In terms of application, the market is divided into industrial waste, municipal waste, commercial waste, and construction and demolition waste. Municipal waste collection dominated in 2024, with a market value of around USD 1 billion, representing over 45% of the market share. With rapid urbanization, waste generated in city areas continues to rise, and this increase is reflected in the higher demand for municipal collection services. As waste volumes grow, municipalities are turning to side loader trucks to handle rising pressure on their sanitation systems.

The automated design of these trucks has proven to be especially valuable for city governments looking to reduce labor costs. With automated arms and bin-lifting mechanisms, side loaders require fewer operators, making them more cost-effective and efficient. These trucks allow consistent and uninterrupted waste collection with minimal human intervention, leading to better workforce management and productivity gains. City governments are increasingly adopting such technologies, often supported by public funding or grants, to improve the effectiveness of their waste management systems.

When it comes to loading mechanisms, the market is segmented into fully automated, semi-automated, and manual systems. Fully automated side loader trucks led the market in 2024, holding around 43% of the total share. These trucks are capable of performing all core functions - including lifting, loading, and emptying bins - with just one operator. This automation not only helps reduce the labor force but also speeds up collection processes, minimizes downtime, and increases accuracy. As technology continues to advance, these fully automated systems are becoming more reliable and essential in large urban settings.

Fuel type is another critical segmentation, with diesel, electric, CNG, hybrid, and other fuel types in the mix. Diesel-powered trucks led the market in 2024. Despite the growing popularity of alternative fuels, diesel remains the most practical and cost-effective choice for many municipalities and private operators. Diesel trucks are known for their durability, easier maintenance, and well-established refueling infrastructure. For long-haul routes and heavy-duty operations, diesel continues to offer unmatched reliability and lower upfront costs compared to electric or CNG-powered alternatives.

In terms of end users, the market is segmented into municipal services, specialized waste handlers, private waste management companies, and others. Municipal services took the lead in 2024. Local governments handle the majority of waste collection in urban areas, especially in densely populated neighborhoods. Side loader trucks serve these regions efficiently due to their compact design and automated capabilities. With access to government subsidies and budget allocations, municipalities are better positioned to invest in updated and cost-efficient waste collection technologies that support their environmental goals.

Geographically, North America held a major share of the market, accounting for over 35% in 2024. The U.S. alone reached a market value of approximately USD 541.2 million. The country's high urban population, combined with strict state-level regulations, has made automated and clean waste collection technologies a necessity. Waste collection authorities are increasingly investing in electric and hybrid models to comply with emission mandates while reducing overall operating costs.

Major manufacturers in this space are now focusing heavily on sustainability, competing by offering models with smart automation, electric drivetrains, and diagnostic features. Companies that can provide low or zero-emission vehicles are finding more opportunities in regions with green procurement policies, especially in North America and Europe. The competitive edge lies in offering vehicles that balance performance, fuel efficiency, safety, and environmental compliance in a cost-effective package.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material and component supplier

- 3.2.2 Truck and equipment manufacturer

- 3.2.3 Technology and telematics providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Impact of trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price analysis

- 3.7.1 Region

- 3.7.2 Propulsion

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Urbanization and population growth

- 3.10.1.2 Regulatory push for clean and efficient waste collection

- 3.10.1.3 Growth of private waste management companies

- 3.10.1.4 Technological advancements in refuse trucks

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 High maintenance and repair costs

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Loading Mechanism, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Fully automated

- 5.3 Semi-automated

- 5.4 Manual

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Less than 10,000 lbs

- 6.3 10,000 to 20,000 lbs

- 6.4 20,000 to 30,000 lbs

- 6.5 More than 30,000 lbs

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Electric

- 7.4 CNG

- 7.5 Hybrid

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Municipal waste collection

- 8.3 Industrial waste collection

- 8.4 Commercial waste collection

- 8.5 Construction and demolition waste

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Municipal services

- 9.3 Private waste management companies

- 9.4 Specialized waste handlers

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amrep

- 11.2 Autocar

- 11.3 Bridgeport Manufacturing

- 11.4 Bucher Municipal

- 11.5 BYD

- 11.6 Curbtender

- 11.7 Dennis Eagle

- 11.8 FAUN Zoeller (UK)

- 11.9 Foton Motor

- 11.10 Freightliner (Daimler)

- 11.11 Fujian Longma Environmental Sanitation Equipment

- 11.12 Heil

- 11.13 Isuzu

- 11.14 Labrie Trucks

- 11.15 Mack Trucks

- 11.16 McNeilus Truck and Manufacturing

- 11.17 New Way Refuse Trucks

- 11.18 NTM

- 11.19 Pak-Mor

- 11.20 Peterbilt Motors Company