|

市場調查報告書

商品編碼

1740923

單螺桿擠出機市場機會、成長動力、產業趨勢分析及2025-2034年預測Single Screw Extruder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

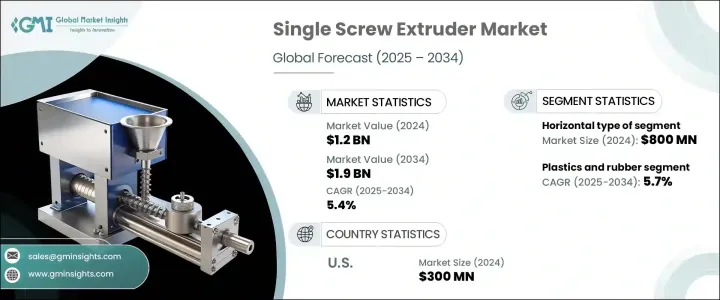

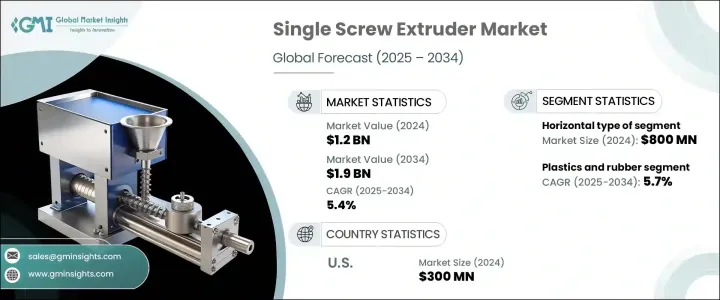

2024年,全球單螺桿擠出機市場規模達12億美元,預計2034年將以5.4%的複合年成長率成長,達到19億美元。這主要得益於塑膠製品需求的不斷成長、技術創新以及食品、製藥和製造等行業日益成長的效率提升需求。單螺桿擠出機用於生產各種塑膠製品,包括管材、板材和薄膜。包裝和建築領域塑膠用量的激增進一步刺激了市場需求。此外,自動化、溫度控制和設備設計的進步也提高了這些機器的生產效率,使其對製造商的吸引力日益增強。

在食品和製藥領域,對加工食品和先進藥物傳輸系統日益成長的需求正在推動市場成長。單螺桿擠出機用於生產零食、穀物和控釋片。這些機器的多功能性和高效性使其非常適合各行各業的大規模生產。此外,該技術也廣泛應用於橡膠製品製造,因為擠出機能夠實現軟管和密封件等部件的大量生產。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 19億美元 |

| 複合年成長率 | 5.4% |

單螺桿擠出機市場依擠出機類型分類,主要分為垂直和水平兩大類。水平擠出機細分市場在 2024 年的價值為 8 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 5.6%,這得益於水平擠出機的可擴展性,使其適用於塑膠、食品和橡膠等行業的大規模生產營運。水平擠出機因其高效處理高產量的能力而備受青睞。另一方面,以緊湊設計著稱的垂直擠出機非常適合優先考慮空間最佳化的小型生產設施。這些擠出機為佔地面積有限但仍需要可靠擠出工藝的運作提供了更節省空間的解決方案。

根據行業使用情況,塑膠和橡膠產業在2024年佔了44%的佔有率。預計該產業在2025年至2034年期間的複合年成長率將達到5.7%。該產業對單螺桿擠出機的需求成長主要源自於塑膠回收的加大,以及此類擠出機在可回收材料和橡膠製品生產的應用日益增加。此外,食品飲料產業對單螺桿擠出機的需求也在顯著成長,尤其是在生產零食、穀物食品和即食食品方面。隨著消費者對加工食品和簡便食品的需求不斷成長,對高效率、大量擠出設備的需求也隨之成長。

2024年,美國單螺桿擠出機市場規模達3億美元。美國對永續製造和回收的重視是推動這一成長的關鍵因素,因為單螺桿擠出機通常用於加工再生塑膠和橡膠材料。技術創新和製造業自動化程度的提高,正在擴大這些擠出機在食品、飲料和製藥等各個領域的應用。此外,對更高品質、更具成本效益產品的持續需求也推動了這些產業市場的成長。

市場的主要參與者包括 American Extruded International、Bausano & Figli、Extrudex、Graham Engineering 和 Milacron 等。為了提升市場地位,單螺桿擠出機市場的公司正專注於產品創新,尤其是在自動化和能源效率方面。他們還透過可客製化的解決方案擴展產品線,以滿足食品和製藥等特定行業的需求。與研究機構和其他行業領導者建立的策略合作夥伴關係促進了先進技術的開發,而對永續生產實踐的投資則提升了其在重視環境責任的市場中的吸引力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 塑膠製品需求不斷成長

- 擴大在食品、製藥和工業領域的應用

- 產業陷阱與挑戰

- 來自雙螺桿擠出機的競爭

- 先進技術的高初始投資

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 直立式

- 水平

第6章:市場估計與預測:依營運模式,2021-2034 年

- 主要趨勢

- 半自動

- 全自動

第7章:市場估計與預測:依產量,2021-2034

- 主要趨勢

- 高達200公斤/小時

- 200至400公斤/小時

- 400至600公斤/小時

- 600公斤/小時以上

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 管材擠出

- 片材擠出

- 型材擠壓

- 其他(改性複合等)

第9章:市場估計與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 食品和飲料

- 塑膠和橡膠

- 化工

- 製藥

- 其他(礦物和不織布行業等)

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- American Extrusion International

- B&P Littleford

- Bausano & Figli

- BC Extrusion

- Boston Matthews

- Breyer

- Buhler

- Coperion

- CPM

- Extrudex

- Graham Engineering

- HMG Extrusion Equipment

- Milacron

- R&B Plastics Machinery

- USEON

The Global Single Screw Extruder Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 1.9 billion by 2034, driven by increasing demand for plastic products, technological innovations, and the growing need for efficiency improvements across industries such as food, pharmaceuticals, and manufacturing. Single screw extruders are used to create a variety of plastic products, including pipes, sheets, and films. The surge in plastic use for packaging and construction has further fueled the market demand. Additionally, advancements in automation, temperature control, and equipment design are enhancing the productivity of these machines, making them increasingly attractive to manufacturers.

In the food and pharmaceutical sectors, the rising demand for processed food and advanced drug delivery systems is contributing to the market's growth. Single screw extruders are used to produce snacks, cereals, and controlled-release tablets. The versatility and efficiency of these machines make them well-suited for large-scale production in various industries. Furthermore, the technology is widely used in the manufacturing of rubber products, as the extruders enable high-volume production of components such as hoses and seals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 5.4% |

The single screw extruder market is divided based on the type of extruder, with the two main segments being vertical and horizontal. The horizontal extruder segment, valued at USD 800 million in 2024, is anticipated to grow at a CAGR of 5.6% from 2025 to 2034 due to the scalability of horizontal extruders, which makes them suitable for large-scale production operations across industries such as plastics, food, and rubber. Horizontal extruders are particularly favored for their ability to handle high production efficiently. On the other hand, vertical extruders, known for their compact design, are well-suited for smaller production facilities where space optimization is a priority. These extruders provide a more space-efficient solution for operations with limited floor space but still require reliable extrusion processes.

Based on industry usage, the plastics and rubber segment held a 44% share in 2024. This segment is expected to grow at a CAGR of 5.7% between 2025 and 2034. The demand for single screw extruders in this segment is being driven by increasing efforts toward plastic recycling and the rising use of these extruders in the production of recyclable materials and rubber products. Additionally, the food and beverage sector is also significantly expanding the demand for single screw extruders, particularly to produce snacks, cereals, and ready-to-eat meals. As consumer demand for processed and convenience foods rises, the need for efficient, high-volume extruding equipment increases.

United States Single Screw Extruder Market was valued at USD 300 million in 2024. The country's emphasis on sustainable manufacturing and recycling is a key driver of this growth, as single screw extruders are commonly used to process recycled plastics and rubber materials. Technological innovations and increased automation in manufacturing are expanding the use of these extruders in various sectors, including food, beverage, and pharmaceuticals. Furthermore, the continuous demand for higher quality and more cost-effective products propels the market's growth in these industries.

Key players in the market include American Extrusion International, Bausano & Figli, Extrudex, Graham Engineering, and Milacron, among others. To enhance their market position, companies in the single screw extruder market are focusing on product innovation, particularly through automation and energy efficiency. They are also expanding their offerings with customizable solutions that cater to specific industry needs, such as food and pharmaceuticals. Strategic partnerships with research institutions and other industry leaders are allowing for the development of advanced technologies, while investments in sustainable manufacturing practices are increasing their appeal in markets that prioritize environmental responsibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Technological Landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for plastic products

- 3.7.1.2 Expanding applications in food, pharmaceuticals, and industrial sectors

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Competition from twin screw extruders

- 3.7.2.2 High initial investment in advanced technologies

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Vertical type

- 5.3 Horizontal type

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates & Forecast, By Output Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 200 Kg/hr

- 7.3 200 to 400 Kg/hr

- 7.4 400 to 600 Kg/hr

- 7.5 Above 600 Kg/hr

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pipe extrusion

- 8.3 Sheet extrusion

- 8.4 Profile extrusion

- 8.5 Others (modified compounding etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food and beverages

- 9.3 Plastics and rubber

- 9.4 Chemical industry

- 9.5 Pharmaceutical

- 9.6 Others (minerals and nonwovens industry etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 American Extrusion International

- 12.2 B&P Littleford

- 12.3 Bausano & Figli

- 12.4 BC Extrusion

- 12.5 Boston Matthews

- 12.6 Breyer

- 12.7 Buhler

- 12.8 Coperion

- 12.9 CPM

- 12.10 Extrudex

- 12.11 Graham Engineering

- 12.12 HMG Extrusion Equipment

- 12.13 Milacron

- 12.14 R&B Plastics Machinery

- 12.15 USEON