|

市場調查報告書

商品編碼

1740922

汽車燃油表市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Fuel Gauge Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

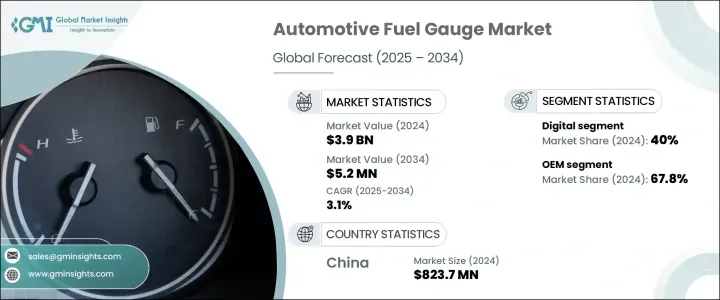

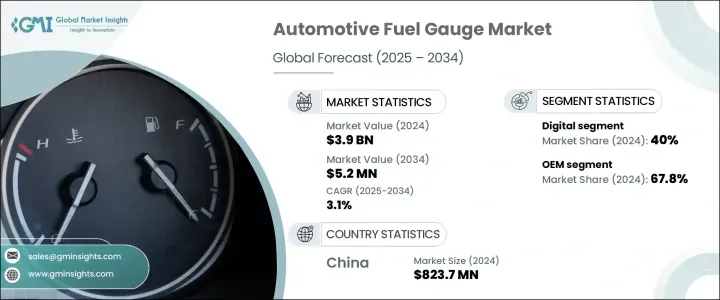

2024年,全球汽車燃油表市場價值39億美元,預計2034年將以3.1%的複合年成長率成長,達到52億美元。這得益於車輛和車隊數位化的發展,以及對整合遠端資訊處理的先進燃油表系統的需求。車隊管理人員需要持續獲取即時燃油資料,以最佳化成本、安排維護並監控駕駛員行為。這些透過遠端資訊處理連接的智慧儀表可以即時更新燃油液位,識別燃油盜竊或洩漏等問題,並發出加油警報。這種整合支援預測性維護並減少營運停機時間,使這些系統在物流、公共交通和共享出行服務中至關重要。

感測器設計技術的進步極大地提升了汽車燃油表的性能。現代感測器,包括電容式、超音波式和電阻式,在各種工作條件下都具有更高的精度、更快的響應時間和更強的耐用性。這些感測器適用於不同的油箱尺寸和燃料類型,包括生物燃料和乙醇混合燃料。精度的提升減少了錯誤讀數,並確保了燃油資料的可靠性,這對於個人和車隊車輛的運作都至關重要。此外,感測器小型化提高了其在緊湊型車輛設計中的整合度,從而增強了整體功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 52億美元 |

| 複合年成長率 | 3.1% |

汽車燃油表市場按技術細分,包括類比、混合顯示、平視顯示和數位選項。 2024年,數位領域佔據主導地位,市佔率達到40%,預計到2034年將以3.7%的複合年成長率成長。這一成長的動力源自於汽車電氣化程度的提高、對智慧儀錶板整合的需求,以及消費者對燃油或能源使用進行精準即時監控的偏好。數位燃油表對於現代汽車(包括電動和混合動力車型)至關重要,它提供有關電池續航里程、充電狀態和能量流的詳細資訊。

就銷售通路而言, OEM市場在 2024 年佔據 67.8% 的市場佔有率,預計 2025 年至 2034 年的複合年成長率為 2.8%。由於燃油表已成為新生產車輛的標準配置, OEM市場仍佔據主導地位。這些儀表整合在數位儀錶板和車輛診斷系統中,確保與現代引擎管理和排放技術相容。主要的儀表製造商直接與汽車生產商合作,設計適合特定車輛架構和儀錶板佈局的客製化解決方案。

2024年,中國汽車燃油表市場佔54%的市場佔有率,產值達8.237億美元,這主要得益於乘用車和商用車產量的成長,進一步鞏固了其在燃油表市場的地位。中國受益於垂直整合的供應鏈,使本地製造商能夠有效率且經濟地滿足原始設備製造OEM)的需求。該地區汽車產量的成長,加上中國在電動車(EV)和智慧汽車技術方面的大量投資,進一步推動了對燃油表等先進汽車零件的需求成長。

汽車燃油表行業的主要參與者包括安波福 (Aptiv)、博格華納 (BorgWarner)、博世 (Bosch)、大陸 (Continental) 和電裝 (Denso)。為了鞏固市場地位,汽車燃油表市場中的公司專注於與汽車製造商建立策略合作夥伴關係,以開發客製化的燃油表解決方案。他們大力投資技術進步,尤其是感測器設計和遠端資訊處理整合,以提高準確性並提供即時監控功能。此外,該公司也專注於擴大在亞太等新興市場的影響力,利用本地製造能力來降低成本,並滿足市場對先進燃油管理系統日益成長的需求。透過專注於汽車電氣化並增加連網技術的使用,這些公司正在將自己定位於快速發展的汽車市場的領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 製造商

- 原物料供應商

- OEM

- 配銷通路

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 成本細分分析

- 價格分析

- 按地區

- 透過推進

- 監管格局

- 衝擊力

- 成長動力

- 汽車電氣化程度的提高

- 更嚴格的排放和燃油效率法規

- 感測器技術的進步

- 車隊和遠端資訊處理整合的成長

- 產業陷阱與挑戰

- 感測器校準和準確性問題

- 整合複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 模擬

- 數位的

- 液晶顯示器

- OLED

- 混合顯示

- 抬頭顯示器

第6章:市場估計與預測:按感測器,2021 - 2034 年

- 主要趨勢

- 電阻式

- 電容式

- 超音波

- 其他

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車

- 純電動車(BEV)

- 插電式混合動力電動車(PHEV)

- 混合動力電動車(HEV)

第8章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aptiv

- Auto Meter Products

- AUTOGAUGE

- Continental

- DENSO

- DunkTeam

- Equus Products

- Faria Beede Instruments

- Gee Kay Equipments

- GlowShift Gauges

- Iontra

- KUS USA

- Marshall Instruments

- Minda

- Pricol

- Robert Bosch

- Sierra Instruments

- Stoneridge

- Wonfly

- Yazaki

The Global Automotive Fuel Gauge Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 3.1% to reach USD 5.2 billion by 2034, driven by the vehicles and fleet digitalization, with the demand for advanced fuel gauge systems integrated with telematics. Fleet managers need continuous access to real-time fuel data to optimize costs, schedule maintenance, and monitor driver behavior. These smart gauges, linked through telematics, can provide instant fuel level updates, identify issues such as fuel theft or leaks, and send alerts for refueling needs. This integration supports predictive maintenance and reduces operational downtime, making the systems crucial in logistics, public transportation, and shared mobility services.

Technological advancements in sensor design have greatly improved the performance of automotive fuel gauges. Modern sensors, including capacitive, ultrasonic, and resistive types, offer better accuracy, faster response times, and greater durability under various operating conditions. These sensors adapt to different tank sizes and fuel types, including biofuels and ethanol blends. This increased precision reduces false readings and ensures reliable fuel data, which is critical for both personal and fleet vehicle operations. Additionally, sensor miniaturization has improved integration in compact vehicle designs, enhancing overall functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 3.1% |

The automotive fuel gauge market is segmented by technology, including analog, hybrid display, head-up display, and digital options. In 2024, the digital segment took the lead with a 40% market share, expected to grow at a 3.7% CAGR through 2034. This growth is fueled by the increasing electrification of vehicles, the demand for smart dashboard integration, and consumers' preference for accurate and real-time monitoring of fuel or energy usage. Digital fuel gauges are essential for modern vehicles, including electric and hybrid models, providing detailed information on battery range, charge status, and energy flow.

In terms of sales channels, the OEM segment held 67.8% share in 2024 and is expected to grow at a CAGR of 2.8% from 2025 to 2034. The OEM sector remains dominant due to the incorporation of fuel gauges as standard components in newly manufactured vehicles. These gauges are integrated into digital instrument clusters and vehicle diagnostic systems, ensuring compatibility with modern engine management and emissions technologies. Key gauge manufacturers collaborate directly with automotive producers to design custom solutions that fit specific vehicle architectures and dashboard layouts.

China Automotive Fuel Gauge Market held 54% share in 2024 and generated USD 823.7 million, driven by passenger and commercial vehicle production, which has bolstered its position in the fuel gauge market. China benefits from a vertically integrated supply chain, enabling local manufacturers to meet OEM demand efficiently and cost-effectively. The growing volume of vehicle production in the region, coupled with China's significant investment in electric vehicles (EVs) and smart automotive technology, has further contributed to the rising demand for advanced automotive components like fuel gauges.

Key players in the automotive fuel gauge industry include Aptiv, BorgWarner, Bosch, Continental, and Denso. To strengthen their market position, companies in the automotive fuel gauge market focus on strategic collaborations with automotive manufacturers to develop tailored fuel gauge solutions. They invest heavily in technological advancements, particularly sensor design and telematics integration, to enhance accuracy and offer real-time monitoring features. Additionally, companies focus on expanding their presence in emerging markets like Asia Pacific, leveraging local manufacturing capabilities to reduce costs and cater to increasing demand for advanced fuel management systems. By focusing on the electrification of vehicles and increasing use of connected technologies, these companies are positioning themselves to lead in a rapidly evolving automotive market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 OEM

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Cost breakdown analysis

- 3.9 Price analysis

- 3.9.1 By region

- 3.9.2 By propulsion

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rise in vehicle electrification

- 3.11.1.2 Stricter emission and fuel efficiency regulations

- 3.11.1.3 Advancement in sensor technologies

- 3.11.1.4 Growth in fleet and telematics integration

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Sensor calibration and accuracy issues

- 3.11.2.2 Integration complexity

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.3.1 LCD

- 5.3.2 OLED

- 5.4 Hybrid display

- 5.5 Head-up display

Chapter 6 Market Estimates & Forecast, By Sensor, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Resistive

- 6.3 Capacitive

- 6.4 Ultrasonic

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicles

- 7.3.1 Battery Electric Vehicles (BEV)

- 7.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 7.3.3 Hybrid Electric Vehicles (HEV)

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Medium Commercial Vehicles (MCV)

- 8.3.3 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Auto Meter Products

- 11.3 AUTOGAUGE

- 11.4 Continental

- 11.5 DENSO

- 11.6 DunkTeam

- 11.7 Equus Products

- 11.8 Faria Beede Instruments

- 11.9 Gee Kay Equipments

- 11.10 GlowShift Gauges

- 11.11 Iontra

- 11.12 KUS USA

- 11.13 Marshall Instruments

- 11.14 Minda

- 11.15 Pricol

- 11.16 Robert Bosch

- 11.17 Sierra Instruments

- 11.18 Stoneridge

- 11.19 Wonfly

- 11.20 Yazaki