|

市場調查報告書

商品編碼

1740909

複合紙板管包裝市場機會、成長動力、產業趨勢分析及2025-2034年預測Composite Cardboard Tube Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

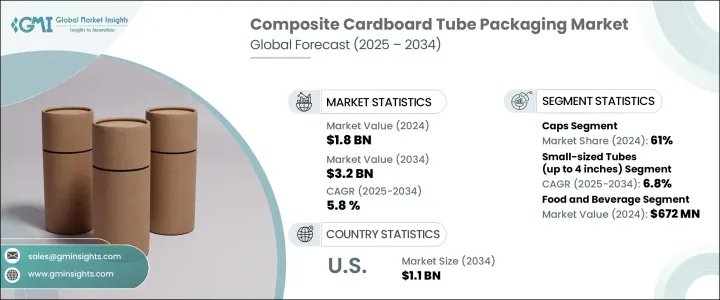

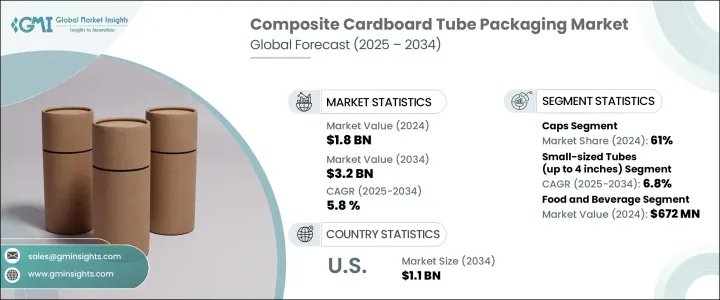

2024年,全球複合紙板管包裝市場規模達18億美元,預計到2034年將以5.8%的複合年成長率成長,達到32億美元,這主要得益於環保包裝需求的不斷成長以及電子商務活動的興起。各行各業的企業都在有意識地轉向永續解決方案,而複合紙板管因其具備所有優勢——耐用性、可回收性以及提升產品展示效果的美觀外觀——而備受青睞。從美容和個人護理到食品和工業品,各大品牌選擇紙板管包裝不僅是為了功能性,也是為了差異化。消費者行為的改變也推動了市場的演變,他們更傾向於減少浪費、可重複使用的包裝以及更優質的開箱體驗。隨著對環保解決方案的需求不斷成長,市場預計將迎來更大的創新,製造商將專注於客製化設計、提高材料強度並融入循環經濟模式。 D2C(直銷)零售的成長、訂閱盒服務的興起以及圓柱形包裝禮品的廣泛流行,共同塑造了這一發展勢頭。對於希望在提升貨架吸引力的同時留下積極環境影響的品牌來說,複合紙板管是一種實用而時尚的解決方案。隨著企業加大對ESG承諾和永續性指標的投入,這種包裝形式正迅速成為全球供應鏈的首選。

儘管如此,市場仍面臨著不容忽視的障礙。美國早期貿易政策最初對進口原料和零件徵收關稅,導致生產成本大幅飆升。製造商正處於抉擇的十字路口——要么消化新增成本,要么提高消費者價格,要么轉向本地供應商以避免高額進口關稅。這種轉變加劇了對最佳化供應鏈、尋找國內或替代原料來源以及重新評估供應商合作關係的關注。此外,國際貿易和物流的持續中斷也持續考驗著庫存策略的韌性。企業正在增加對敏捷庫存系統的投資,並多樣化採購方式,以確保穩定性。材料採購、自動化和營運效率的創新已成為在動盪的市場環境中保持競爭優勢和利潤率的關鍵差異化因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 5.8% |

就產品類型而言,瓶蓋領域在2024年佔據全球複合紙板管包裝市場的61%佔有率,佔據主導地位。瓶蓋之所以受歡迎,很大程度上得益於其安全封蓋功能,既能確保產品在運輸過程中的安全,又能方便消費者使用。輕質瓶蓋還能降低運輸成本,並透過最大限度地減少材料使用,與永續發展目標完美契合。此外,各大品牌正利用這種包裝形式,透過觸感處理、壓花標誌、2D碼和智慧標籤技術來提升顧客體驗。瓶蓋能夠將功能性安全與高階設計元素相結合,使其在多個垂直領域中——尤其是在食品、化妝品和個人護理領域——佔據優勢,因為在這些領域,保護和品牌塑造都至關重要。

直徑不超過4吋的小尺寸軟管正日益成為成長最快的細分市場,預計到2034年,其複合年成長率將達到6.8%。推動這項需求成長的因素是消費者對緊湊、方便攜帶的包裝的偏好,尤其是在護膚品、美容產品和攜帶式食品領域。這些軟管不僅便攜易用,而且經久耐用,觸感舒適,提升了品牌體驗。隨著消費者尋求兼具簡約風格和環保理念的包裝,小尺寸軟管在功能性和美觀性方面都表現出色。

受永續包裝意識增強和電商生態系統蓬勃發展的推動,美國複合紙板管包裝市場預計到2034年將達到11億美元。國內製造商正在加大投資力度,研發符合監管標準並提升貨架可見度的可回收、可生物分解的管材創新產品。這些新設計透過最佳化重量和體積,幫助品牌減少運輸排放,並透過更優的結構設計提升產品安全性。隨著塑膠使用法規日益嚴格,企業越來越傾向於選擇紙板管作為可靠、合規且品牌友善的解決方案。

Sonoco、Smurfit Kappa Group、Paper Tubes & Sales、Visican Ltd 和 Marshall Paper Tube Co., Inc. 等領先企業正在積極部署策略,以鞏固其市場地位。這些策略包括:採用自動化生產線以提高產量並降低人力成本;合作取得安全原料;擴大產品客製化以服務利基市場;以及整合更高比例的再生材料。為了保持競爭力和領先地位,他們高度重視創新——將設計、永續性和性能融入單一包裝解決方案,從而引起品牌和最終用戶的共鳴。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 消費者對永續和可回收包裝解決方案的偏好日益成長

- 電子商務滲透率不斷上升,推動對保護性運輸管的需求

- 高階品牌尋求獨特品牌差異化的客製化需求日益增加

- 擴大在化妝品、藥品和特種食品領域的應用

- 越來越重視永續包裝

- 產業陷阱與挑戰

- 原物料價格波動影響製造利潤率

- 來自替代包裝解決方案的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按關閉類型,2021 - 2034 年

- 主要趨勢

- 帽子

- 蓋子

第6章:市場估計與預測:按規模,2021 - 2034 年

- 主要趨勢

- 小型管(最大 4 英吋)

- 中型管(4至10吋)

- 大尺寸管(超過 10 英吋)

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化妝品和個人護理

- 化學品

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 澳洲

- 韓國

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第9章:公司簡介

- Ace Paper Tube Corp

- CBT Packaging

- Chicago Mailing Tube Co.

- Darpac P/L

- Hansen Packaging

- Heartland Products Group

- Marshall Paper Tube Co., Inc.

- Paper Tubes & Sales

- Smurfit Kappa Group

- Sonoco

- Valk Industries

- Visican Ltd

The Global Composite Cardboard Tube Packaging Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 3.2 billion by 2034, driven by the growing demand for eco-friendly packaging and the rise in e-commerce activity. Businesses across industries are making conscious shifts toward sustainable solutions, and composite cardboard tubes are gaining strong traction as they check off all the right boxes-durability, recyclability, and an attractive visual appeal that enhances product presentation. From beauty and personal care to food and industrial goods, brands are turning to tube packaging not just for function but for differentiation. The market's evolution is also being fueled by changing consumer behaviors that favor minimal waste, reusable packaging, and a better unboxing experience. As demand for environmentally responsible solutions climbs, the market is expected to witness greater innovation, with manufacturers focusing on customizing designs, improving material strength, and aligning with circular economy models. The growth of D2C (direct-to-consumer) retail, rising subscription box services, and the widespread popularity of gifting products in cylindrical packaging formats are collectively shaping the momentum. Composite cardboard tubes serve as a practical and stylish solution for brands looking to leave a positive environmental impact while boosting shelf appeal. As companies double down on ESG commitments and sustainability metrics, this packaging format is fast becoming a preferred option across global supply chains.

That said, the market still faces hurdles that can't be ignored. Tariffs on imported raw materials and components, originally introduced under earlier U.S. trade policies, have led to a noticeable spike in production costs. Manufacturers are at a crossroads-either absorb the added costs, increase prices for consumers, or pivot to local suppliers to avoid high import duties. This shift has intensified the focus on optimizing supply chains, finding domestic or alternative raw material sources, and reevaluating supplier partnerships. On top of that, ongoing disruptions in international trade and logistics continue to test the resilience of inventory strategies. Companies are increasingly investing in agile inventory systems and diversifying sourcing methods to ensure stability. Innovation in material sourcing, automation, and operational efficiency has emerged as a critical differentiator in staying ahead of the competition and maintaining margins in a volatile market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.8% |

In terms of product type, the caps segment led the global composite cardboard tube packaging market with a dominant 61% share in 2024. Their popularity is largely due to secure closure features that ensure product safety during shipping while maintaining ease of use for consumers. Lightweight caps also support cost-effective transportation and align well with sustainability goals by minimizing material usage. Additionally, brands are leveraging this format to enhance customer experience through tactile finishes, embossed logos, QR codes, and smart labeling technologies. The ability to blend functional security with high-end design elements gives caps an edge across multiple verticals-particularly in food, cosmetics, and personal care-where both protection and branding are equally critical.

Small-sized tubes measuring up to 4 inches are gaining traction as the fastest-growing segment, projected to expand at a CAGR of 6.8% through 2034. What is fueling this demand is the consumer shift toward compact, travel-friendly packaging options, especially in skincare, beauty, and on-the-go food products. These tubes are not only portable and user-friendly but also provide durability and a premium touch that elevates brand experience. As consumers seek packaging that combines minimalism with eco-conscious appeal, small tubes are delivering on both fronts-functionality and form.

The United States Composite Cardboard Tube Packaging Market is expected to reach USD 1.1 billion by 2034, driven by heightened awareness of sustainable packaging and a robust e-commerce ecosystem. Domestic manufacturers are stepping up by investing in recyclable, biodegradable tube innovations that meet regulatory benchmarks while enhancing shelf visibility. These new designs are helping brands cut down on transportation emissions by optimizing weight and volume and are boosting product safety with better structural design. As regulations around plastic usage become more stringent, businesses are gravitating toward cardboard tubes as a reliable, compliant, and brand-friendly solution.

Leading players such as Sonoco, Smurfit Kappa Group, Paper Tubes & Sales, Visican Ltd, and Marshall Paper Tube Co., Inc. are actively deploying strategies to strengthen their footprint in the market. These include embracing automated production lines to ramp up output and cut labor costs, partnering for secure raw material access, expanding product customization to serve niche markets, and integrating higher percentages of recycled content. To stay relevant and ahead, they are banking heavily on innovation-blending design, sustainability, and performance into a single packaging solution that resonates with both brands and end users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analyisis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.4 Supply-side impact (raw materials)

- 3.2.1.4.1.1 Price volatility in key materials

- 3.2.1.4.1.2 Supply chain restructuring

- 3.2.1.4.1.3 Production cost implications

- 3.2.1.5 Demand-side impact (selling price)

- 3.2.1.5.1.1 Price transmission to end markets

- 3.2.1.5.1.2 Market share dynamics

- 3.2.1.5.1.3 Consumer response patterns

- 3.2.1.6 Key companies impacted

- 3.2.1.7 Strategic industry responses

- 3.2.1.7.1.1 Supply chain reconfiguration

- 3.2.1.7.1.2 Pricing and product strategies

- 3.2.1.7.1.3 Policy engagement

- 3.2.1.8 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing consumer preference for sustainable and recyclable packaging solutions

- 3.3.1.2 Rising e-commerce penetration driving demand for protective shipping tubes

- 3.3.1.3 Increasing customization needs for premium brands seeking unique brand differentiation

- 3.3.1.4 Expanding applications in cosmetics, pharmaceuticals and specialty food sectors

- 3.3.1.5 Increasing focus on sustainable packaging

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Volatility in raw material prices impacting manufacturing margins

- 3.3.2.2 Competition from alternative packaging solutions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Closure Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Caps

- 5.3 Lids

Chapter 6 Market Estimates and Forecast, By Size, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Small-sized tubes (up to 4 inches)

- 6.3 Medium-sized tubes (4 to 10 inches)

- 6.4 Large-sized tubes (over 10 inches)

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Food and Beverage

- 7.3 Pharmaceuticals

- 7.4 Cosmetics and Personal Care

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 South Korea

- 8.4.5 Japan

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 U.A.E.

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Ace Paper Tube Corp

- 9.2 CBT Packaging

- 9.3 Chicago Mailing Tube Co.

- 9.4 Darpac P/L

- 9.5 Hansen Packaging

- 9.6 Heartland Products Group

- 9.7 Marshall Paper Tube Co., Inc.

- 9.8 Paper Tubes & Sales

- 9.9 Smurfit Kappa Group

- 9.10 Sonoco

- 9.11 Valk Industries

- 9.12 Visican Ltd