|

市場調查報告書

商品編碼

1740907

飛機電動機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aircraft Electric Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

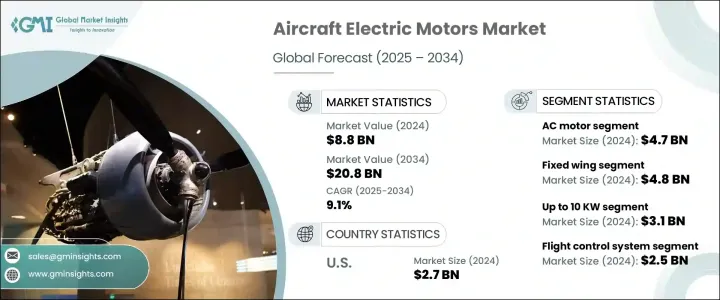

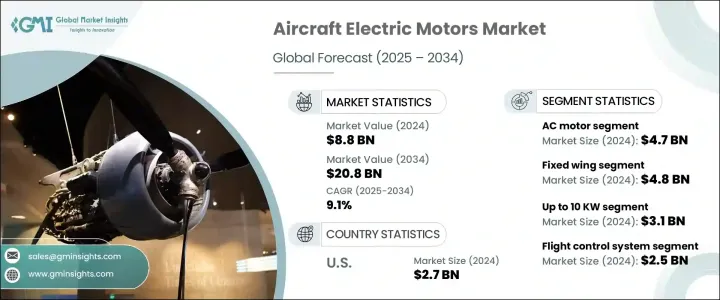

2024 年全球飛機電動馬達市場價值為 88 億美元,預計到 2034 年將以 9.1% 的複合年成長率成長,達到 208 億美元。這一成長主要得益於對城市空中交通 (UAM) 和電動垂直起降 (eVTOL) 飛機不斷成長的需求,以及分散式電力推進 (DEP) 的日益普及。市場也感受到了外部因素的影響,包括關稅,尤其是針對中國航太和電氣元件的關稅,這些關稅推高了原料成本並擾亂了全球供應鏈。作為應對措施,製造商正在進行供應商多元化,並將部分生產重點轉移,以減少對進口的依賴。航空業使用的電動馬達正成為該產業開發更清潔、更永續技術的關鍵組成部分,隨著環境問題和監管壓力的加劇,預計這一趨勢將會加速。

城市空中交通 (UAM) 和電動垂直起降 (eVTOL) 飛機的快速發展是飛機電動馬達市場擴張的關鍵驅動力。這些飛機有望透過提供比傳統地面出行更清潔、更有效率的替代方案,徹底改變城市交通。城市空中交通 (UAM) 和電動垂直起降 (eVTOL) 技術專為城市地區的短途高效飛行而設計,而交通堵塞已成為日常通勤的主要挑戰。與傳統飛機不同,電動垂直起降 (eVTOL) 飛機不需要長跑道,使其成為基礎設施空間通常有限的城市環境的理想選擇。其垂直起降能力,加上環保的電力推進系統,使其成為城市交通的未來。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 88億美元 |

| 預測值 | 208億美元 |

| 複合年成長率 | 9.1% |

就電動機本身而言,市場主要分為兩類:交流電動機和直流馬達。到2024年,交流電動馬達將佔據市場主導地位,佔據47億美元的相當大的佔有率。交流電動馬達的效率、低維護成本和持續的功率輸出能力使其特別適合電動和混合動力飛機的高要求。電力電子技術的進步,包括變頻驅動器(VFD),進一步提升了它們的普及度,尤其是在需要可靠、長期性能的航空應用中。交流電動馬達對於航空業推動更永續、更有效率的飛行解決方案至關重要。

固定翼飛機市場是飛機電動馬達市場成長的另一個主要動力,預計2024年其市場規模將達到48億美元。該市場的擴張得益於對永續航空技術的日益重視。電動馬達是短程和區域航班的理想選擇,有助於降低排放和營運成本。隨著政府和監管機構不斷收緊環境標準,混合動力和全電動固定翼飛機的設計需求日益成長。製造商正在大力投資這些創新,致力於提高馬達效率,同時減輕機身重量並提升整體性能。

在美國市場,飛機電動機的需求也在激增。 2024年,美國飛機電動馬達市場規模達27億美元,這得益於聯邦政府對先進混合動力電動研發的大量投資。諸如美國國家航空暨太空總署(NASA)的電力傳動系統飛行演示計畫等政府支持的舉措,正透過加速民用和軍用航空電力推進系統的技術突破,在這一成長中發揮重要作用。這些措施也致力於克服電動馬達與飛機系統的整合挑戰,確保該技術的廣泛應用可行性。

飛機電動馬達市場的領導者包括 Emrax、賽峰集團、H3X Technologies、利勃海爾航空航太、THINGAP 和 Electromech Technologies。這些公司正在大力投資研發,以提高其電動馬達的效率、耐用性和整體性能。他們還與飛機製造商建立戰略合作夥伴關係,將電力推進系統整合到新的飛機設計中。透過專注於創新並開發專為混合動力電動應用量身定做的電動機,這些公司正處於日益成長的永續航空解決方案需求的前沿。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 城市空中交通 (UAM) 和 eVTOL 發展激增

- 短程航班需求不斷成長

- 分散式電力推進(DEP)的興起

- 混合動力電動飛機開發

- 電動機的技術進步

- 產業陷阱與挑戰

- 電池能量密度有限

- 熱管理和安全風險

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 交流馬達

- 直流馬達

第6章:市場估計與預測:按飛機類型,2021 - 2034 年

- 主要趨勢

- 固定翼

- 旋翼機

- 無人機

- 先進的空中機動性

第7章:市場估計與預測:按輸出功率,2021 - 2034 年

- 主要趨勢

- 高達 10 千瓦

- 10–200 千瓦

- 200度以上

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 推進系統

- 飛行控制系統

- 環境控制系統

- 執行系統

- 客艙內部系統

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- AMETEK

- ARC Systems

- Electromech Technologies

- Emrax

- Evolito

- H3X Technologies

- KDE Direct

- Liebherr Aerospace

- Maxon

- Meggitt

- MGM Compro

- Moog

- Safran Group

- THINGAP

- Turnigy Power Systems

- Windings

- Wright Electric

- Xoar International

The Global Aircraft Electric Motors Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 20.8 billion by 2034. This growth is primarily fueled by the rising demand for Urban Air Mobility (UAM) and electric Vertical Takeoff and Landing (eVTOL) aircraft, along with the increasing adoption of distributed electric propulsion (DEP). The market has also felt the impact of external factors, including tariffs, especially on Chinese aerospace and electrical components, which have driven up raw material costs and disrupted global supply chains. In response, manufacturers are diversifying suppliers and reshoring some production efforts to lessen dependence on imports. The electric motors used in aviation are becoming a critical part of the industry's efforts to develop cleaner, more sustainable technologies, and this trend is expected to accelerate as environmental concerns and regulatory pressures intensify.

The rapid development of Urban Air Mobility and eVTOL aircraft is a key driver of the aircraft electric motors market expansion. These aircraft are poised to revolutionize urban transportation by offering a cleaner and more efficient alternative to traditional ground travel. UAM and eVTOL technologies are specifically designed for short-distance, high-efficiency flights in urban areas, where congestion and traffic jams have become major challenges for daily commuters. Unlike traditional aircraft, eVTOLs do not require long runways, making them ideal for city environments where space for infrastructure is often limited. Their vertical takeoff and landing capabilities, coupled with their eco-friendly electric propulsion systems, are positioning them as the future of urban transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $20.8 Billion |

| CAGR | 9.1% |

As for the electric motors themselves, the market is divided into two main types: AC and DC motors. In 2024, AC motors dominate the market, holding a substantial share of USD 4.7 billion. The efficiency, low maintenance, and sustained power output capabilities of AC motors make them particularly well-suited for the high demands of electric and hybrid-electric aircraft. Technological advancements in power electronics, including variable frequency drives (VFDs), have further bolstered their popularity, especially for aviation applications requiring reliable, long-term performance. AC motors are crucial to the aviation industry's push toward more sustainable and efficient flight solutions.

The fixed-wing aircraft segment, valued at USD 4.8 billion in 2024, is another major contributor to the aircraft electric motors market's growth. This segment's expansion is driven by the growing emphasis on sustainable aviation technologies. Electric motors are ideal for short-haul and regional flights, where they help to lower emissions and reduce operational costs. As governments and regulators tighten environmental standards, there is an increasing push for hybrid and fully electric fixed-wing aircraft designs. Manufacturers are heavily investing in these innovations, focusing on improving motor efficiency while reducing airframe weight and enhancing overall performance.

In the U.S. market, the demand for aircraft electric motors is also surging. In 2024, the U.S. aircraft electric motors market generated USD 2.7 billion, supported by substantial federal investments in advanced hybrid-electric research and development. Government-backed initiatives, such as NASA's electric powertrain flight demonstration program, are playing a significant role in this growth by helping to accelerate technological breakthroughs in electric propulsion systems for both civil and military aviation applications. These initiatives are also focused on overcoming the integration challenges of electric motors into aircraft systems, ensuring the technology's feasibility for widespread use.

Leading players in the Aircraft Electric Motors Market include Emrax, Safran Group, H3X Technologies, Liebherr Aerospace, Moog, Maxon, Wright Electric, THINGAP, and Electromech Technologies. These companies are heavily investing in research and development to enhance the efficiency, durability, and overall performance of their electric motors. They are also forming strategic partnerships with aircraft manufacturers to integrate electric propulsion systems into new aircraft designs. By focusing on innovation and developing motors specifically tailored for hybrid-electric applications, these companies are positioning themselves at the forefront of the growing demand for sustainable aviation solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact

- 3.2.2.1.1 Price Volatility in Key Components

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Surge in urban air mobility (UAM) & eVTOL development

- 3.3.1.2 Increasing demand for short-haul flights

- 3.3.1.3 Rise of distributed electric propulsion (DEP)

- 3.3.1.4 Hybrid-electric aircraft development

- 3.3.1.5 Technological advancements in electric motors

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited energy density of batteries

- 3.3.2.2 Thermal management & safety risks

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 AC motor

- 5.3 DC motor

Chapter 6 Market Estimates and Forecast, By Aircraft Type, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Fixed wing

- 6.3 Rotary wing

- 6.4 Unmanned aerial vehicles

- 6.5 Advanced air mobility

Chapter 7 Market Estimates and Forecast, By Output Power, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Up to 10 kW

- 7.3 10–200 kW

- 7.4 Above 200 kW

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Propulsion systems

- 8.3 Flight control systems

- 8.4 Environmental control systems

- 8.5 Actuation systems

- 8.6 Cabin interior systems

- 8.7 Other

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMETEK

- 10.2 ARC Systems

- 10.3 Electromech Technologies

- 10.4 Emrax

- 10.5 Evolito

- 10.6 H3X Technologies

- 10.7 KDE Direct

- 10.8 Liebherr Aerospace

- 10.9 Maxon

- 10.10 Meggitt

- 10.11 MGM Compro

- 10.12 Moog

- 10.13 Safran Group

- 10.14 THINGAP

- 10.15 Turnigy Power Systems

- 10.16 Windings

- 10.17 Wright Electric

- 10.18 Xoar International