|

市場調查報告書

商品編碼

1740906

家用堆肥機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Household Composters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

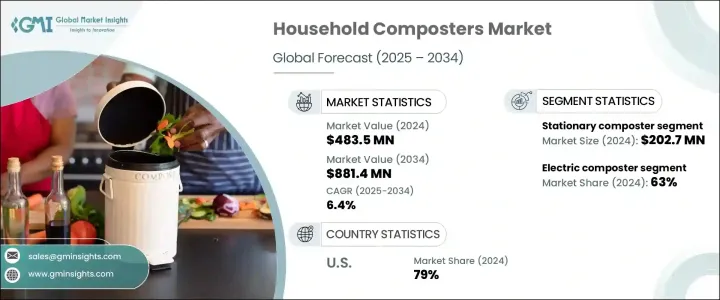

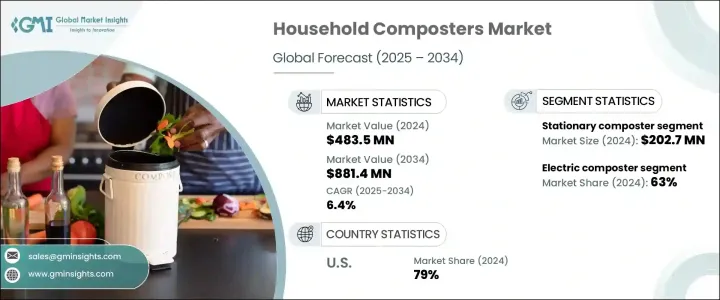

2024 年全球家用堆肥機市場價值為 4.835 億美元,預計到 2034 年將以 6.4% 的複合年成長率成長至 8.814 億美元。這一成長得益於消費者對有機廢物和不當處置方式造成的環境破壞的認知不斷提高。

人們日益擔憂食物垃圾造成的污染以及垃圾掩埋場的碳足跡,這促使家庭採用堆肥作為實用且永續的解決方案。堆肥不僅有助於減少垃圾掩埋場負擔和甲烷排放,還能讓人們將有機垃圾轉化為營養豐富的土壤。這些土壤可以重新用於家庭菜園,促進更健康、更環保的生活方式。對永續發展的追求和更綠色生活習慣的養成正在重塑消費者行為,並推動對家庭堆肥解決方案的需求。越來越多的人正在尋找有效的家庭垃圾管理方法,尤其是在全球環境法規日益嚴格的背景下。消費者正在尋找能夠支持零浪費生活方式並有助於更負責任的垃圾管理的堆肥機。此外,家庭園藝的日益普及,進一步加速了堆肥機的普及,使家庭能夠輕鬆有效地回收食物殘渣和有機材料。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.835億美元 |

| 預測值 | 8.814億美元 |

| 複合年成長率 | 6.4% |

堆肥技術的進步也對市場趨勢產生了重大影響。現今的堆肥器使用起來更加便捷,具有消除異味和減少人工操作的功能。新一代型號配備了氣味控制技術,使其更適合室內使用。隨著智慧家庭的普及,配備自動化系統和連網功能的堆肥器也越來越受歡迎。這些智慧堆肥器簡化了堆肥過程,節省了時間,同時符合永續發展目標。許多消費者,尤其是熟悉科技的消費者,現在更喜歡能夠無縫融入智慧家庭的堆肥器。這些智慧堆肥器不僅具有環保效益,還能提高便利性和時間管理效率,尤其對於繁忙的家庭而言。透過加快有機廢物的分解速度,這些先進的系統還可以幫助家庭減少垃圾產生量,同時有助於改善土壤和植物健康。

根據產品類型,市場細分為滾筒式、固定式和其他類型。固定式堆肥機類別在2024年佔據市場主導地位,創造了2.027億美元的收入。預計該細分市場在2025年至2034年期間的複合年成長率約為6.8%。固定式堆肥機因其維護成本低、設計經濟實惠而備受青睞,成為新用戶的首選。這些設備專為戶外環境設計,能夠承受各種天氣條件。由再生塑膠和金屬等環保材料製成的堆肥機越來越受歡迎,這支持了人們向永續產品選擇的持續轉變。其緊湊的尺寸和高效的氣味管理也使其成為空間有限的城市家庭的理想選擇。

就類型而言,市場分為電動和手動堆肥機。 2024年,電動堆肥機佔了近63%的市場。電動堆肥機需求的成長歸因於其能夠透過自動化功能加速堆肥過程。這些設備可在幾天內分解食物垃圾和有機物,是產生大量垃圾的家庭的理想選擇。它們簡化分解過程的能力吸引了尋求快速、簡單和有效堆肥解決方案的消費者。自動化、易用性和更快的產出是電動堆肥機日益受到青睞的關鍵因素,而非手動堆肥機。

從地區來看,美國在北美家用堆肥機市場佔據主導地位,約佔該地區總收入的79%,預計到2024年將達到1.2億美元。永續發展意識的增強以及對自給自足生活日益成長的興趣推動了這一成長。堆肥機設計的技術創新進一步推動了其普及。許多美國居民選擇在家中堆肥,以防止有機垃圾最終被填埋。一些州也透過食物垃圾轉移政策鼓勵堆肥,進一步推動了市場成長。家庭園藝和後院種植食物的流行也刺激了需求,尤其是對使用者友善的電動堆肥機的需求。

家用堆肥機市場較為分散,排名前五的廠商——Lomi、Harp Renewables、Subpod、Reencle 和 Vitami——合計佔 8% 至 12% 的市佔率。這些公司專注於拓展產品線、建立策略合作夥伴關係並加強全球影響力,以保持競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 零售商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 政府法規和廢棄物管理政策

- 食物浪費問題日益嚴重

- 產業陷阱與挑戰

- 難聞的氣味和害蟲問題

- 食物垃圾堆肥困難

- 成長動力

- 成長潛力分析

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 產品偏好

- 首選價格範圍

- 首選配銷通路

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 固定式

- 不倒翁

- 其他(壓縮等)

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 電動堆肥機

- 手動堆肥機

第7章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 10公升以下

- 10升至20公升

- 20升至40公升

- 40公升以上

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 室內的

- 戶外的

第9章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 公司網站

- 電子商務

- 離線

- 超市/大賣場

- 專賣店

- 其他(大型零售商店等)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Airthereal

- Beyond Green Biotech

- Geme

- GRAF

- Harp Renewables

- Involly

- Lasso

- Lomi

- Mantis

- Reencle

- Subpod

- Topmake Environment

- Vego

- Vitamix

- Zeosta

The Global Household Composters Market was valued at USD 483.5 million in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 881.4 million by 2034. This growth is fueled by a surge in consumer awareness surrounding the environmental damage caused by organic waste and improper disposal practices.

Growing concerns over pollution caused by food waste and the carbon footprint of landfill dumping are prompting households to adopt composting as a practical and sustainable solution. Composting not only helps reduce landfill burden and methane emissions but also enables individuals to turn organic waste into nutrient-rich soil. This soil can be reused for home gardens, promoting a healthier and more eco-conscious lifestyle. The push toward sustainability and the adoption of greener living habits are reshaping consumer behavior and driving up the demand for at-home composting solutions. More people are looking for effective ways to manage household waste, especially as environmental regulations tighten globally. Consumers are seeking composters that support a zero-waste lifestyle and contribute to more responsible waste management. In addition, the popularity of home gardening is increasing, further accelerating the adoption of composters that allow households to recycle food scraps and organic materials easily and efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $483.5 Million |

| Forecast Value | $881.4 Million |

| CAGR | 6.4% |

Advancements in composting technology are also making a significant impact on market trends. Today's composters are far more convenient, offering features that eliminate unpleasant odors and reduce the manual effort involved. New-age models come with odor-control technology, making them more suitable for indoor use. As smart home adoption grows, composters equipped with automated systems and connected features are becoming increasingly desirable. These smart composters simplify the composting process, saving time while aligning with sustainability goals. Many consumers, especially those comfortable with technology, now prefer composters that integrate seamlessly into their connected homes. These smart composters offer not only environmental benefits but also improve convenience and time management, especially for busy households. By enabling faster decomposition of organic waste, these advanced systems also help households reduce the volume of trash generated while contributing to soil improvement and plant health.

Based on product type, the market is segmented into tumblers, stationary, and others. The stationary composter category led the market in 2024, generating revenue of USD 202.7 million. This segment is projected to grow at a CAGR of approximately 6.8% from 2025 to 2034. Stationary composters are favored due to their low maintenance and budget-friendly design, making them a go-to option for new users. Designed for outdoor environments, these units are built to withstand a range of weather conditions. Composters made from eco-conscious materials such as recycled plastics and metals are gaining popularity, supporting the ongoing shift toward sustainable product choices. Their compact size and efficient odor management also make them a great option for urban households with limited space.

In terms of type, the market is divided into electric and manual composters. Electric composters held nearly 63% of the total market share in 2024. The rising demand for electric units is attributed to their ability to accelerate the composting process using automated functions. These units break down food waste and organic material within days, making them ideal for households generating high volumes of waste. Their ability to simplify the decomposition process appeals to consumers looking for quick, easy, and effective composting solutions. Automation, ease of use, and faster output are key drivers behind the growing preference for electric composters over manual alternatives.

Regionally, the United States dominated the North American household composters market, accounting for approximately 79% of the regional revenue and estimated to reach USD 120 million in 2024. Increased awareness around sustainability and growing interest in self-sufficient living have contributed to this growth. Technological innovations in composter design are further boosting adoption. Many U.S. residents are choosing to compost at home to prevent organic waste from ending up in landfills. Certain states also encourage composting through food waste diversion policies, further pushing market growth. The popularity of home gardening and growing food in backyards is also fueling demand, especially for user-friendly electric composters.

The household composters market is moderately fragmented, with the top five players- Lomi, Harp Renewables, Subpod, Reencle, and Vitami-holding a collective market share of 8% to 12%. These companies are focused on expanding product lines, forming strategic partnerships, and strengthening their global presence to maintain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Government regulations and waste management policies

- 3.6.1.2 Rising food waste concerns

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Unpleasant odors and pest issues

- 3.6.2.2 Difficulty in composting food waste

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer buying behavior analysis

- 3.9 Demographic trends

- 3.9.1 Factors affecting buying decisions

- 3.9.2 Product Preference

- 3.9.3 Preferred price range

- 3.9.4 Preferred distribution channel

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Stationary

- 5.3 Tumbler

- 5.4 Others (compacting etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric composter

- 6.3 Manual composter

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 10L

- 7.3 10L to 20L

- 7.4 20L to 40L

- 7.5 Above 40L

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 Company websites

- 10.2.2 E-commerce

- 10.3 Offline

- 10.3.1 Supermarket/hypermarket

- 10.3.2 Specialty store

- 10.3.3 Others (mega retail store etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Airthereal

- 12.2 Beyond Green Biotech

- 12.3 Geme

- 12.4 GRAF

- 12.5 Harp Renewables

- 12.6 Involly

- 12.7 Lasso

- 12.8 Lomi

- 12.9 Mantis

- 12.10 Reencle

- 12.11 Subpod

- 12.12 Topmake Environment

- 12.13 Vego

- 12.14 Vitamix

- 12.15 Zeosta