|

市場調查報告書

商品編碼

1740897

先進作戰頭盔市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Advanced Combat Helmet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

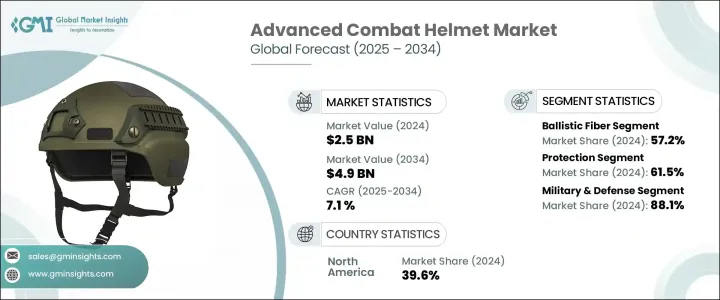

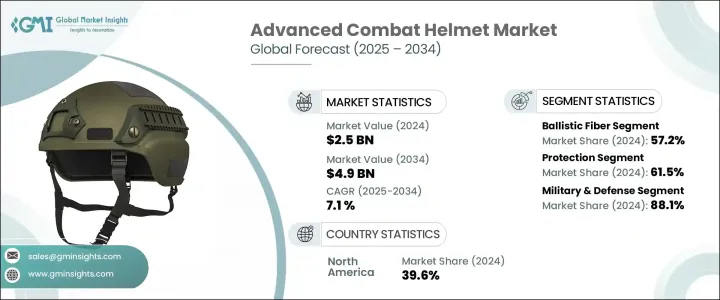

2024 年全球先進作戰頭盔市場價值為 25 億美元,預計到 2034 年將以 7.1% 的複合年成長率成長至 49 億美元。這項擴張主要是由於各地區軍事開支增加,因為國防部隊優先升級士兵防護裝備以應對不斷變化的戰場威脅。先進作戰安全帽不再只是起到頭部防護的作用;它們現在充當通訊、態勢感知和與其他作戰系統整合的平台。隨著各國政府致力於提高武裝部隊的生存力和作戰準備度,對技術先進的頭盔的需求持續成長。這些頭盔正在重新設計,以包括整合平視顯示器、模組化附加組件以及與擴增實境系統相容等功能。

地緣政治緊張局勢和難以預測的衝突地區情況進一步迫使軍事機構投資下一代防護頭盔。然而,外部經濟因素也影響了市場動態。貿易政策變化,尤其是對進口原料徵收關稅,擾亂了供應鏈,增加了製造頭盔所需關鍵部件的成本。這些干擾導致生產時間延長,採購成本上升。通膨壓力進一步加劇了市場複雜性,可能會減慢採購週期,並給國防預算帶來額外壓力。儘管面臨這些挑戰,但預計市場仍將保持穩定成長,各公司將專注於創新並履行新的國防合約以保持成長勢頭。隨著國防機構尋求適應不同作戰環境的裝備,針對特定作戰場景的客製化和性能最佳化正成為一個重點關注領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 7.1% |

根據材料,市場細分為防彈纖維、熱塑性塑膠和金屬。 2024年,防彈纖維佔了57.2%的市佔率。由於其卓越的抗衝擊性、輕量化特性以及在極端條件下的可靠性,這種材料仍然是許多製造商的首選。製造商不斷探索新的方法來提高這些纖維的強度重量比,確保最終產品在不影響士兵敏捷性的情況下提供最大程度的保護。

依應用領域分類,市場分為防護、通訊和視覺輔助。防護類產品在2024年佔據了該細分市場的主導地位,佔61.5%。人們對彈道威脅和非對稱戰爭日益成長的擔憂,加劇了對提供強大防禦機制的頭盔的需求。現代作戰頭盔的設計旨在抵禦各種彈藥和爆炸衝擊,同時確保其在不同地形下也能正常使用。舒適性、耐磨性和多功能性是其發展的核心,為士兵在不可預測的高風險行動中提供支援。

最終用途細分包括軍事、國防和執法機構。軍事和國防佔據了市場的絕大部分,2024 年的佔有率為 88.1%。提高士兵生存力和確保任務成功的需求是這種主導地位的基礎。頭盔配備了降噪通訊系統、夜視準備和即時資料傳輸等功能,以增強戰場感知和響應能力。各機構持續需求不僅能提供防護,還能透過整合系統提高作戰效率的裝備。

從地區來看,北美在2024年以39.6%的市佔率領先市場,這得益於其高額的國防開支和對早期採用尖端技術的強烈意願。各地區防務機構正積極投資先進的頭盔,以提高態勢感知能力和戰場協調能力。正在研發的頭盔通常配備顯示器、環境感測器和升級的人體工學設計,以滿足現代戰爭的需求。

預計到2034年,光是美國市場規模就將達到18億美元。持續投資國防現代化仍是關鍵驅動力,重點在於開發兼具舒適性、防護性和技術改進的先進頭盔。軍事裝備升級是優先事項,以確保部隊能夠有效應對不斷變化的威脅。

競爭格局依然激烈,前五大公司佔了約55-60%的市場。主要參與者正加大研發力度,以提供能夠滿足全球國防領域日益成長的需求的頭盔。他們正在與國際軍事組織建立戰略聯盟和長期供應契約,以確保穩定的訂單量並提升市場地位。隨著戰場需求日益複雜,頭盔製造商正緊跟時代步伐,提供兼具安全性和戰略優勢的高性能產品。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業回應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 戰鬥安全帽擴大採用先進材料

- 特種作戰和執法部門的需求不斷成長

- 全球軍費開支增加

- 提高士兵安全標準和法規

- 不斷成長的軍事現代化計劃

- 產業陷阱與挑戰

- 開發和採購成本高

- 與 C4ISR 系統的複雜整合

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 防彈纖維

- 熱塑性塑膠

- 金屬

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 保護

- 溝通

- 視覺輔助

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 軍事與國防

- 執法機構

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- 3M Company

- ArmorSource LLC

- DuPont de Nemours Inc.

- Galvion

- Gentex Corporation

- HARD SHELL

- Honeywell International Inc.

- Indian Armour Systems Pvt. Ltd.

- MKU Limited

- Point Blank Enterprises

- Revision Military Inc.

The Global Advanced Combat Helmet Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 4.9 billion by 2034. This expansion is largely driven by increased military expenditures across various regions as defense forces prioritize upgrading soldier protection gear to meet evolving battlefield threats. Advanced combat helmets are no longer just about head protection; they now serve as platforms for communication, situational awareness, and integration with other combat systems. As governments aim to enhance the survivability and operational readiness of their armed forces, demand for technologically advanced helmets continues to rise. These helmets are being reimagined to include features such as integrated heads-up displays, modular add-ons, and compatibility with augmented reality systems.

Geopolitical tensions and unpredictable conflict zones have further compelled military agencies to invest in next-generation protective headgear. However, external economic factors have also influenced market dynamics. Trade policy shifts, especially the imposition of tariffs on imported raw materials, have disrupted the supply chain and increased the cost of essential components used in manufacturing helmets. These disruptions have led to longer production timelines and rising procurement costs. Inflationary pressures add another layer of complexity, potentially slowing acquisition cycles and placing added strain on defense budgets. Despite these challenges, the market is expected to maintain steady growth, with companies focusing on innovation and fulfilling new defense contracts to maintain momentum. Customization and performance optimization for specific combat scenarios are becoming a key focus area as defense agencies seek gear tailored to diverse operational environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.1% |

Based on material, the market is segmented into ballistic fiber, thermoplastic, and metal. In 2024, ballistic fiber accounted for 57.2% of the market share. This material remains the preferred choice for many manufacturers due to its superior impact resistance, lightweight properties, and reliability under extreme conditions. Manufacturers continue to explore new ways to improve the strength-to-weight ratio of these fibers, ensuring the final product offers maximum protection without compromising soldier agility.

By application, the market is divided into protection, communication, and visual assistance. The protection category dominated the segment in 2024, holding a 61.5% share. Rising concerns over ballistic threats and asymmetric warfare have intensified the demand for helmets offering robust defense mechanisms. Modern combat helmets are now being designed to withstand various types of ammunition and explosive impacts while also remaining functional in different terrains. Comfort, wearability, and multi-functionality are core to their development, supporting soldiers in unpredictable and high-risk operations.

End-use segmentation includes military and defense, and law enforcement agencies. Military and defense made up the majority of the market, with an 88.1% share in 2024. The need to improve soldier survivability and ensure mission success underlies this dominance. Helmets are being equipped with features like noise-canceling communication systems, night vision readiness, and real-time data transmission to enhance battlefield awareness and responsiveness. Agencies continue to demand gear that not only offers protection but also enhances operational efficiency through integrated systems.

Regionally, North America led the market with a 39.6% share in 2024, supported by high defense spending and a strong inclination toward early adoption of cutting-edge technologies. Regional defense bodies are actively investing in advanced headgear that improves situational awareness and battlefield coordination. Helmets in development often feature mounted displays, environmental sensors, and upgraded ergonomics to meet the demands of modern warfare.

The market in the United States alone is projected to reach USD 1.8 billion by 2034. Continuous investment in defense modernization remains a key driver, with a focus on developing state-of-the-art helmets that combine comfort, protection, and technological enhancement. Military equipment upgrades are prioritized to ensure forces are well-equipped for evolving threats.

The competitive landscape remains intense, with the top five companies accounting for roughly 55-60% of the total market. Key players are channeling efforts into research and development to offer helmets that address the expanding list of requirements from global defense sectors. Strategic alliances and long-term supply contracts with international military organizations are being formed to secure consistent order volumes and enhance market positioning. As battlefield requirements become more complex, helmet manufacturers are keeping pace by delivering high-performance products that offer both safety and strategic advantages.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump Administration Tariffs Analysis

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact (Raw material)

- 3.2.2.1.1 Price Volatility

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact (Raw material)

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on Trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing adoption of advanced materials for combat helmets

- 3.3.1.2 Rising demand from special operations and law enforcement units

- 3.3.1.3 Increased global military expenditure

- 3.3.1.4 Increased soldier safety standards and regulations

- 3.3.1.5 Growing military modernization programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and procurement costs

- 3.3.2.2 Complex integration with C4ISR systems

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Ballistic fiber

- 5.3 Thermoplastic

- 5.4 Metal

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Protection

- 6.3 Communication

- 6.4 Visual assistance

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Military & defense

- 7.3 law enforcement agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 ArmorSource LLC

- 9.3 DuPont de Nemours Inc.

- 9.4 Galvion

- 9.5 Gentex Corporation

- 9.6 HARD SHELL

- 9.7 Honeywell International Inc.

- 9.8 Indian Armour Systems Pvt. Ltd.

- 9.9 MKU Limited

- 9.10 Point Blank Enterprises

- 9.11 Revision Military Inc.