|

市場調查報告書

商品編碼

1740894

滴濾咖啡機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Drip Coffee Maker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

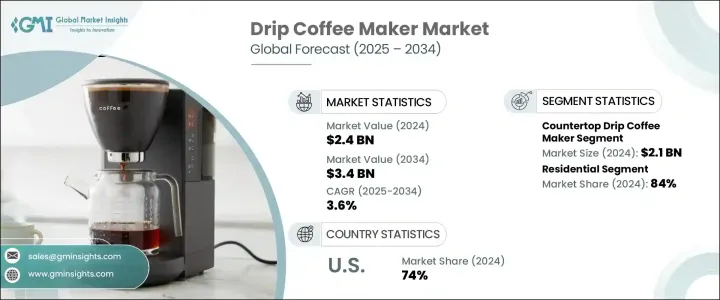

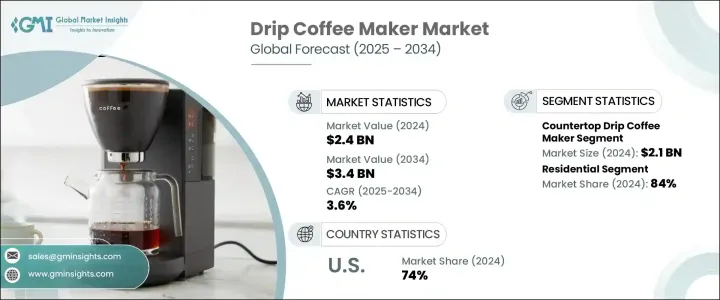

2024年,全球滴濾咖啡機市場規模達24億美元,預計2034年將以3.6%的複合年成長率成長至34億美元。全球咖啡消費量的成長,以及居家沖泡咖啡的日益流行,持續影響市場前景。隨著消費者追求便利性、經濟性和更好的風味品質,滴濾咖啡機在成熟經濟體和發展中經濟體都越來越受歡迎。可支配收入的提高、快速的城市化進程以及不斷發展的咖啡文化(尤其是在亞太和拉丁美洲等地區)是推動這一成長的主要動力。咖啡作為全球消費量最大的飲品之一,對滴濾咖啡機等家用沖泡設備的需求也持續成長。消費者對精品咖啡日益成長的興趣,以及對在家中體驗咖啡師風格體驗的渴望,正推動著消費者選擇能夠提供更多控制和個人化體驗的咖啡機。可編程設定、可調節沖泡濃度和內建研磨器等功能已不再被視為奢侈品,而是現代用戶的期望。

根據機器類型,市場分為攜帶式和桌上型滴濾咖啡機。 2024年,桌上型咖啡機佔據主導地位,創造了21億美元的收入。預計2025年至2034年期間,該類別的複合年成長率約為3.8%。這些機器專為頻繁和大容量使用而設計,使其成為家庭、辦公室和共享空間的首選。增強的沖泡功能,例如多種濃度設定、溫度控制以及最多可沖泡12杯或更多咖啡,使其非常適合日常使用。消費者更傾向於兼具實用性和智慧功能的機器,使他們能夠精準輕鬆地沖泡熱咖啡或冰咖啡。現在許多型號都配備了沖泡延時定時器、可編程咖啡壺和增強風味的沖泡技術等功能,反映出人們正在轉向更個性化的沖泡體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 3.6% |

市場也按最終用戶細分為住宅和商業領域。 2024年,住宅領域佔據了84%的主導佔有率,這得益於生活方式的改變、快節奏的工作環境以及人們對高品質家庭沖泡咖啡日益成長的興趣。住宅買家越來越尋求易於操作、配備智慧功能且適合個人或家庭使用的先進滴濾咖啡機。隨著智慧家庭和連網設備的興起,能夠與語音助理和家庭自動化系統整合的咖啡機正迅速普及。相較之下,商業領域則更注重沖泡速度、容量和效率,以滿足咖啡館、餐廳和辦公室等場所的顧客高需求。

從分銷角度來看,市場分為線上和線下通路。 2024年,線下零售持續保持領先地位,這得益於許多消費者在購買前傾向於實體查看產品。實體店,包括廚房電器零售商和百貨公司,為顧客提供親身體驗,並讓他們能夠接觸到經驗豐富的銷售人員。然而,線上管道因其便利性、豐富的產品種類和詳盡的客戶回饋而日益受到青睞。消費者正在轉向能夠在家中舒適地比較價格、評估規格和閱讀用戶評論的平台。教學影片和產品演示進一步增強了消費者信心,使電子商務成為該市場日益強大的分銷工具。

從地理分佈來看,美國在全球滴濾咖啡機市場佔據主導地位,約佔北美市場佔有率的74%,2024年市場收入達6.1億美元。咖啡消費量的激增,加上家庭沖泡解決方案的需求不斷成長,以及智慧技術與家電的融合,共同推動了美國市場的成長。年輕一代對咖啡的偏好以及咖啡相關零售業的擴張,也對此成長趨勢做出了重要貢獻。美國消費者行為持續偏向便利性和客製化,促使製造商不斷創新,推出更智慧、更以用戶為中心的咖啡機。

到2024年,滴濾咖啡機市場的領導企業合計佔據約15%至20%的市場。這些公司將繼續透過策略合作夥伴關係、產品線擴展以及併購來推動成長,以擴大其影響力並保持競爭優勢。隨著競爭加劇,製造商正在投資創新和設計,以滿足日益精通科技、注重品質的消費者群體不斷變化的偏好。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 咖啡消費量增加

- 家庭釀酒趨勢日益興起

- 產業陷阱與挑戰

- 替代咖啡機的可用性

- 轉向精品咖啡和沖泡方法

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 產品偏好

- 首選價格範圍

- 首選配銷通路

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依機器類型,2021-2034 年

- 主要趨勢

- 攜帶式滴濾咖啡機

- 檯面滴濾咖啡機

第6章:市場估計與預測:依營運模式,2021-2034 年

- 主要趨勢

- 自動的

- 手動的

第7章:市場估計與預測:依杯子容量,2021-2034

- 主要趨勢

- 最多 10 杯

- 10到20杯

- 20杯以上

第8章:市場估計與預測:按功率,2021-2034

- 主要趨勢

- 500瓦以下

- 500至1000瓦

- 1000瓦以上

第9章:市場估計與預測:按價格,2021-2034

- 主要趨勢

- 低的

- 中等的

- 高的

第 10 章:市場估計與預測:按最終用途,2021-2034 年

- 主要趨勢

- 住宅

- 商業的

- 辦公室

- 咖啡廳

- 餐廳

- 其他(教育機構等)

第 11 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司擁有的網站

- 離線

- 超市/大賣場

- 專賣店

- 其他(百貨公司等)

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第13章:公司簡介

- Black & Decker

- Breville

- Budan

- Capresso

- Cuisinart

- De'Longhi

- Glen Appliances

- Hamilton Beach

- Koninklijke Philips

- Krups

- Melitta

- Morphy Richards

- Smeg

- Sybo Kitchen

- Wonderchef

The Global Drip Coffee Maker Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 3.4 billion by 2034. Growing coffee consumption worldwide, along with the increasing trend of brewing coffee at home, continues to shape the outlook of the market. As consumers seek convenience, affordability, and better flavor quality, drip coffee makers are becoming more popular in both mature and developing economies. Higher disposable incomes, rapid urbanization, and the evolving coffee culture-particularly in regions like Asia Pacific and Latin America-are major drivers behind this growth. With coffee maintaining its place as one of the most consumed beverages globally, the demand for home-use brewing appliances like drip coffee makers is rising at a consistent pace. The growing interest in specialty coffee and the desire for barista-style experiences at home is pushing consumers toward machines that offer more control and personalization. Features like programmable settings, adjustable brew strengths, and built-in grinders are no longer considered luxuries but expectations among modern users.

Based on machine type, the market is divided into portable and countertop drip coffee makers. In 2024, the countertop segment dominated the category, generating USD 2.1 billion in revenue. It is projected to grow at a CAGR of approximately 3.8% from 2025 to 2034. These machines are designed for frequent and higher-volume use, making them a preferred choice for homes, offices, and shared spaces. Enhanced brewing features such as multiple strength settings, temperature control, and the ability to serve up to 12 cups or more make them highly functional for daily use. Consumers are leaning towards machines that combine both utility and smart functionality, enabling them to brew hot or iced coffee with precision and ease. Many models now include features like brew delay timers, programmable carafes, and flavor-enhancing infusion technologies, reflecting a shift toward more tailored brewing experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 3.6% |

The market is also segmented by end user into residential and commercial sectors. The residential segment held a dominant share of 84% in 2024, fueled by changing lifestyles, fast-paced work environments, and increasing interest in high-quality home brewing. Residential buyers are increasingly seeking advanced drip coffee makers that are easy to operate, equipped with smart features, and suitable for personal or family use. With the rise in smart homes and connected devices, machines that can be integrated with voice assistants and home automation systems are quickly gaining popularity. In contrast, the commercial segment prioritizes brewing speed, volume, and efficiency to meet high customer demand in cafes, restaurants, and office setups.

Distribution-wise, the market is classified into online and offline channels. Offline retail continued to lead in 2024, supported by the preference of many consumers to physically examine products before making a purchase. Brick-and-mortar stores, including kitchen appliance retailers and department stores, offer customers a hands-on experience and access to knowledgeable sales staff. However, the online segment is gaining traction due to its convenience, wide product range, and detailed customer feedback. Consumers are turning to platforms where they can compare prices, evaluate specifications, and read user reviews from the comfort of their homes. Instructional videos and product demos further enhance consumer confidence, making e-commerce an increasingly powerful distribution tool in this market.

Geographically, the United States led the global drip coffee maker market, accounting for roughly 74% of the North American share and generating USD 610 million in revenue in 2024. The surge in coffee consumption, along with growing demand for home brewing solutions and the integration of smart technology into appliances, has fueled market growth in the country. The preference for coffee among younger demographics and the expansion of coffee-related retail have also contributed significantly to this upward trend. Consumer behavior in the US continues to favor convenience and customization, pushing manufacturers to innovate and offer smarter, more user-centric machines.

Leading players in the drip coffee maker market collectively held a combined share of around 15% to 20% in 2024. These companies continue to drive growth through strategic partnerships, product line expansion, and mergers and acquisitions aimed at increasing their reach and maintaining competitive advantage. As competition intensifies, manufacturers are investing in innovation and design to meet the evolving preferences of a more tech-savvy and quality-conscious consumer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing coffee consumption

- 3.6.1.2 Rising home brewing trend

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Availability of alternative coffee machine

- 3.6.2.2 Shift toward specialty coffee and brewing methods

- 3.6.1 Growth drivers

- 3.7 Consumer buying behavior analysis

- 3.7.1 Demographic trends

- 3.7.2 Factors affecting buying decisions

- 3.7.3 Product Preference

- 3.7.4 Preferred price range

- 3.7.5 Preferred distribution channel

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Portable drip coffee maker

- 5.3 Countertop drip coffee maker

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Manual

Chapter 7 Market Estimates & Forecast, By Cup Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 10 cups

- 7.3 10 to 20 cups

- 7.4 Above 20 cups

Chapter 8 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 500 Watt

- 8.3 500 to 1000 Watt

- 8.4 Above 1000 Watt

Chapter 9 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.3.1 Offices

- 10.3.2 Cafes

- 10.3.3 Restaurants

- 10.3.4 Others (educational institutes etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce website

- 11.2.2 Company owned website

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarkets

- 11.3.2 Specialty stores

- 11.3.3 Others (department stores etc.)

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Black & Decker

- 13.2 Breville

- 13.3 Budan

- 13.4 Capresso

- 13.5 Cuisinart

- 13.6 De'Longhi

- 13.7 Glen Appliances

- 13.8 Hamilton Beach

- 13.9 Koninklijke Philips

- 13.10 Krups

- 13.11 Melitta

- 13.12 Morphy Richards

- 13.13 Smeg

- 13.14 Sybo Kitchen

- 13.15 Wonderchef