|

市場調查報告書

商品編碼

1740880

光子積體電路 (PIC) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Photonic Integrated Circuit (PIC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

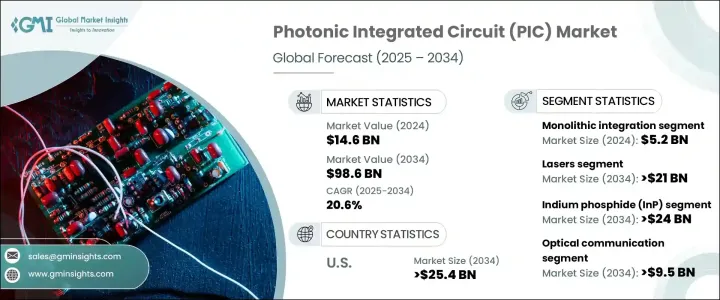

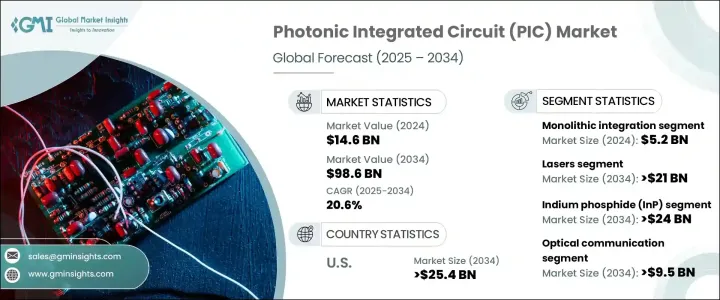

2024年,全球光子積體電路市場規模達146億美元,預計2034年將以20.6%的複合年成長率成長,達到986億美元。人工智慧 (AI) 和機器學習 (ML) 應用的爆炸性成長,尤其是在資料中心領域,持續推動市場擴張。高效能運算需求飆升至新高,傳統電子元件的限制也逐漸顯現。光子電路憑藉著卓越的頻寬和能源效率,已成為滿足這些新一代運算需求的理想解決方案。全球各國政府、科技公司和研究機構正在加大對光子學研發的投資,並意識到這項技術將在各行各業發揮的變革性作用。

在電信等領域,光子學正在實現更快的資料傳輸,並為超高效的網路系統奠定基礎。在醫療保健領域,基於光子學的影像和診斷創新正在重塑病患照護和臨床工作流程。人們對 5G 網路、量子運算、自動駕駛汽車和光學感測的日益關注,進一步拓寬了市場的應用格局,增強了全球對光子創新的推動。隨著各行各業追求更快、更可靠、更節能的系統,光子裝置 (PIC) 正處於技術發展的核心,為企業和消費者開啟新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 146億美元 |

| 預測值 | 986億美元 |

| 複合年成長率 | 20.6% |

光子積體電路市場按整合類型細分為單晶片整合、混合整合和模組整合。單晶片整合市場規模在2024年達到52億美元,它能夠將所有光子元件整合到磷化銦(InP)等單一基板上,從而推動產業重大進步。這種方法大幅降低了互連損耗,提升了系統整體效能,並降低了生產成本。單晶片PIC對於高速收發器和光處理器尤其重要,能夠提供電信和資料通訊等產業所需的緊湊、可擴展的解決方案。隨著對高效生產、最小空間要求和可靠高速性能的日益重視,預計單晶片整合將在預測期內保持強勁發展勢頭。

從組件角度來看,市場包括調製器、雷射、光電探測器、復用器/解復用器、波導、衰減器、光放大器和其他關鍵部件。其中,雷射器發揮關鍵作用,預計到2034年將創造210億美元的市場價值。基於磷化銦(InP)的雷射在光子積體電路中正變得不可或缺,為高速光通訊、光纖和LiDAR系統提供必要的同調光源。其無縫整合能力增強了系統的可擴展性和效能,幫助各行各業滿足日益成長的高頻寬應用需求。

美國光子積體電路市場預計在2034年達到254億美元,這得益於強大的科技巨頭生態系統、研究項目以及對矽光子學的深度投資。英特爾、思科和Rockley Photonics等公司正在引領光通訊、資料中心和醫療診斷領域的創新。國家光子學計畫(NPI)等計劃正在進一步加速國防、航太和生物醫學應用等關鍵領域的商業化。

全球光子積體電路產業的領導者包括英特爾公司、思科系統公司、英飛朗公司和博通公司。為了鞏固市場地位,這些公司正在擴大產品組合,與科技公司和研究機構建立策略合作夥伴關係,並大力投資研發,以提升光子學在人工智慧和電信網路中的效能。許多公司也正在收購規模較小、專業的光子技術公司,以加快創新步伐,並在新興市場中佔據競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 資料中心擴展和高速通訊需求

- 矽光子學的進展

- 在醫療保健和生物感測領域的應用日益廣泛

- 對 5G 和下一代電信基礎設施的需求

- 政府和國防為光子學研發提供資金

- 產業陷阱與挑戰

- 初始資本投資高且製造複雜

- PIC平台缺乏標準化

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按整合類型,2021 - 2034 年

- 單晶片整合

- 混合整合

- 模組整合

第6章:市場估計與預測:按組件,2021 - 2034 年

- 雷射器

- 調節劑

- 光電探測器

- 波導

- 多工器/多路分解器

- 衰減器

- 光放大器

- 其他

第7章:市場估計與預測:依資料,2021 - 2034 年

- 磷化銦(InP)

- 絕緣體上矽(SOI)

- 矽光子學

- 砷化鎵(GaAs)

- 鈮酸鋰

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 光通訊

- 感測

- 生物光子學

- 光訊號處理

- 量子計算

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 電信

- 資料中心

- 消費性電子產品

- 醫療保健與生命科學

- 國防與航太

- 工業的

- 汽車

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Intel Corporation

- Infinera Corporation

- Cisco Systems, Inc.

- Broadcom Inc.

- NeoPhotonics Corporation

- Lumentum Holdings Inc.

- II-VI Incorporated

- Coherent Corp.

- Acacia Communications

- Enablence Technologies Inc.

- HPE

- Mellanox Technologies

- Luxtera

- Rockley Photonics

- POET Technologies Inc.

- Ciena Corporation

- Alcatel-Lucent

- Fujitsu Optical Components

- IBM Corporation

- STMicroelectronics

- Hewlett Packard Labs

- TE Connectivity

- VLC Photonics (a Hitachi Group company)

- Effect Photonics

The Global Photonic Integrated Circuit Market was valued at USD 14.6 billion in 2024 and is estimated to grow at a CAGR of 20.6% to reach USD 98.6 billion by 2034. The explosive growth of artificial intelligence (AI) and machine learning (ML) applications, especially across data centers, continues to fuel market expansion. High-performance computing demands have surged to new heights, exposing the limitations of traditional electronic components. Photonic circuits, offering superior bandwidth and energy efficiency, have emerged as the ideal solution to address these next-generation computing requirements. Governments, tech companies, and research institutions worldwide are ramping up investments in photonics research and development, recognizing the transformative role this technology will play across industries.

In sectors like telecommunications, photonics is enabling faster data transmission and building the foundation for ultra-efficient networking systems. In healthcare, photonics-based innovations in imaging and diagnostics are reshaping patient care and clinical workflows. The growing focus on 5G networks, quantum computing, autonomous vehicles, and optical sensing is further broadening the market's application landscape, strengthening the global push toward photonic innovation. As industries aim for faster, more reliable, and energy-efficient systems, PICs are positioned at the heart of technological evolution, unlocking new possibilities for businesses and consumers alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.6 billion |

| Forecast Value | $98.6 billion |

| CAGR | 20.6% |

The photonic integrated circuit market is segmented by integration type into monolithic, hybrid, and module integration. Monolithic integration, valued at USD 5.2 billion in 2024, is driving major industry advancements by enabling the integration of all photonic components onto a single substrate like Indium Phosphide (InP). This approach drastically reduces interconnect losses, boosts overall system performance, and lowers production costs. Monolithic PICs are especially crucial for high-speed transceivers and optical processors, delivering the compact, scalable solutions demanded by industries such as telecommunications and data communications. With the growing emphasis on efficient production, minimal space requirements, and reliable high-speed performance, monolithic integration is expected to maintain strong momentum through the forecast period.

Component-wise, the market includes modulators, lasers, photodetectors, multiplexers/demultiplexers, waveguides, attenuators, optical amplifiers, and other critical parts. Among these, lasers play a pivotal role and are expected to generate USD 21 billion by 2034. Lasers based on InP are becoming indispensable across photonic integrated circuits, offering essential coherent light sources needed for high-speed optical communications, fiber optics, and LIDAR systems. Their seamless integration capabilities enhance system scalability and performance, helping industries meet the increasing demand for high-bandwidth applications.

The U.S. photonic integrated circuit market is on track to reach USD 25.4 billion by 2034, powered by a strong ecosystem of technology giants, research initiatives, and deep investments in silicon photonics. Companies like Intel, Cisco, and Rockley Photonics are leading innovations across optical communication, data centers, and healthcare diagnostics. Initiatives like the National Photonics Initiative (NPI) are further accelerating commercialization efforts in critical sectors such as defense, aerospace, and biomedical applications.

Leading players in the global photonic integrated circuit industry include Intel Corporation, Cisco Systems, Inc., Infinera Corporation, and Broadcom Inc. To strengthen their market presence, these companies are expanding product portfolios, forming strategic partnerships with tech firms and research bodies, and investing heavily in RandD to push photonics performance in AI and telecom networks. Many are also acquiring smaller, specialized photonic technology firms to fast-track innovation and secure a competitive edge in emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Data center expansion & high speed communication demand

- 3.3.1.2 Advancements in silicon photonics

- 3.3.1.3 Growing use in healthcare & biosensing

- 3.3.1.4 Demand for 5g & next-gen telecom infrastructure

- 3.3.1.5 Government & defense funding for photonics R&D

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial capital investment & fabrication complexity

- 3.3.2.2 Lack of standardization across PIC platforms

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Integration Type, 2021 - 2034 (USD Million and Units)

- 5.1 Monolithic integration

- 5.2 Hybrid integration

- 5.3 Module integration

Chapter 6 Market estimates & forecast, By Component, 2021 - 2034 (USD Million and Units)

- 6.1 Lasers

- 6.2 Modulators

- 6.3 Photodetectors

- 6.4 Waveguides

- 6.5 Multiplexers/demultiplexers

- 6.6 Attenuators

- 6.7 Optical amplifiers

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million and Units)

- 7.1 Indium phosphide (InP)

- 7.2 Silicon-on-insulator (SOI)

- 7.3 Silicon photonics

- 7.4 Gallium arsenide (GaAs)

- 7.5 Lithium niobate

- 7.6 Others

Chapter 8 Market estimates & forecast, By Application, 2021 - 2034 (USD Million and Units)

- 8.1 Optical communication

- 8.2 Sensing

- 8.3 Biophotonics

- 8.4 Optical signal processing

- 8.5 Quantum computing

- 8.6 Others

Chapter 9 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million and Units)

- 9.1 Telecommunications

- 9.2 Data centers

- 9.3 Consumer electronics

- 9.4 Healthcare & life sciences

- 9.5 Defense & aerospace

- 9.6 Industrial

- 9.7 Automotive

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Intel Corporation

- 11.2 Infinera Corporation

- 11.3 Cisco Systems, Inc.

- 11.4 Broadcom Inc.

- 11.5 NeoPhotonics Corporation

- 11.6 Lumentum Holdings Inc.

- 11.7 II-VI Incorporated

- 11.8 Coherent Corp.

- 11.9 Acacia Communications

- 11.10 Enablence Technologies Inc.

- 11.11 HPE

- 11.12 Mellanox Technologies

- 11.13 Luxtera

- 11.14 Rockley Photonics

- 11.15 POET Technologies Inc.

- 11.16 Ciena Corporation

- 11.17 Alcatel-Lucent

- 11.18 Fujitsu Optical Components

- 11.19 IBM Corporation

- 11.20 STMicroelectronics

- 11.21 Hewlett Packard Labs

- 11.22 TE Connectivity

- 11.23 VLC Photonics (a Hitachi Group company)

- 11.24 Effect Photonics