|

市場調查報告書

商品編碼

1740876

陸基地球物理服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Land Based Geophysical Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

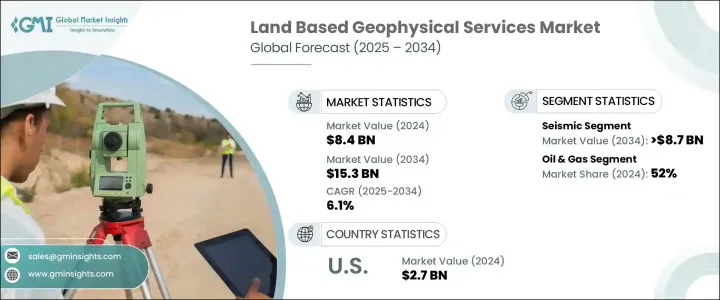

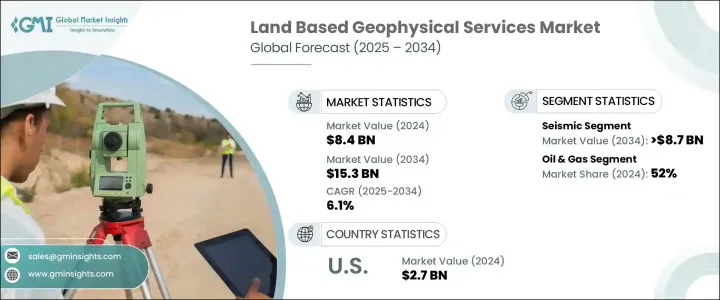

2024 年全球陸基地球物理服務市場價值為 84 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長,達到 153 億美元,這得益於快速的城市化、蓬勃發展的建築活動以及對精確地下資料的需求激增。隨著世界各地城市的擴張和現代化,對安全、有彈性的基礎設施的需求日益增加。建築商、開發商和城市規劃者越來越依賴先進的地球物理技術來繪製地下公用設施圖、評估地面穩定性並在啟動大型專案之前降低地震風險。陸基地球實體服務的角色已從支援功能轉變為規劃、工程和風險管理策略的核心要素。

日益成長的環境問題、日益嚴格的監管框架以及對災害韌性基礎設施的迫切需求,進一步刺激了市場需求。技術創新也在重塑產業格局,利害關係人尋求即時、非侵入式的勘測方法,以提供更快、更安全、更準確的結果。隨著新興經濟體加速城市發展和資源探勘項目,對經濟高效且環保的地球實體服務的需求正在加速成長。企業正在大力投資人工智慧整合解決方案、行動勘測單元和遙感平台,以在注重速度、永續性和精準度的不斷發展的市場中保持競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 153億美元 |

| 複合年成長率 | 6.1% |

世界各國政府正在加大對韌性基礎設施和減災措施的投資,這推動了對先進陸基地球物理服務的持續需求。如今,客戶期望更智慧的勘測技術能夠在不破壞環境的情況下提供精準的洞察。在新興地區,傳統的陸地探勘方法由於營運成本和環境挑戰而越來越難以為繼,這為創新地球物理解決方案創造了機會。為此,各參與者紛紛推出基於人工智慧的平台,這些平台不僅能夠滿足不斷升級的安全和永續性標準,還能提供即時資料,幫助企業做出更明智的決策。

環境管理正成為一個關鍵因素,促使利害關係人在土地復墾、資源開採和環境清理計畫中更傾向於採用非侵入式、環保的勘測方法。在發展中地區,由於營運障礙和高昂的探勘成本,地球物理服務成為高效能礦產和能源資源識別的誘人選擇。政府貿易政策的改變也影響設備採購和服務模式,促使供應商採用成本效益高、技術驅動的策略。對即時、高精度地下資訊的需求正在推動產業探勘和開發方式的根本性轉變。

預計到2034年,地震探勘市場規模將達到87億美元,這得益於成像解析度的提升以及時移地震技術的日益普及。地震服務仍然是高清地下資料的黃金標準,對油氣探勘至關重要。磁法和電磁法探勘正日益受到青睞,尤其是在難以到達的礦區,精確的地質測繪至關重要。

石油和天然氣產業在終端應用領域佔據主導地位,到2024年將佔52%,重力和磁力探勘在降低鑽井成本和改善探勘成果方面將繼續發揮至關重要的作用。電子和再生能源產業對關鍵礦物的需求不斷成長,也推動了地球物理服務在採礦應用中的廣泛應用。

2024年,美國陸基地球實體服務市場規模達27億美元,這得益於大規模基礎設施投資以及促進永續和電氣化營運的監管激勵措施。地震折射和探地雷達技術廣泛應用於地下設施測繪和施工安全。在加拿大,非侵入式、環境敏感勘測方法的推廣也日益深入,尤其是在自然資源評估和環境復墾領域。

定義競爭格局的關鍵參與者包括 CGG、Fugro、SLB、Getech Group、Abitibi Geophysics、Weatherford、TGS、PGS、Gardline、Ramboll Group、Dawson Geophysical Company、SAExploration 和 Spectrum Geophysics。各公司正專注於即時資料分析、人工智慧整合以及向新興市場擴張,以鞏固其地位。與能源和採礦業的策略合作夥伴關係以及對永續勘測方法的投資正成為核心成長策略。行動勘測設備和遙感技術的創新正成為在以精度和速度為驅動力的市場中的主要差異化因素。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 地震

- 磁的

- 電磁

- 梯度法

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 石油和天然氣

- 礦業

- 農業

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 挪威

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 伊拉克

- 伊朗

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Abitibi Geophysics

- CGG

- Dawson Geophysical Company

- Fugro

- Gardline

- Getech Group

- PGS

- Ramboll Group

- SAExploration

- SLB

- Spectrum Geophysics

- TGS

- Weatherford

The Global Land Based Geophysical Services Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 15.3 billion by 2034, driven by rapid urbanization, booming construction activities, and surging demand for precise subsurface data. As cities worldwide expand and modernize, the need for safe, resilient infrastructure is intensifying. Builders, developers, and urban planners are increasingly relying on advanced geophysical technologies to map underground utilities, assess ground stability, and mitigate seismic risks before launching large-scale projects. The role of land based geophysical services has shifted from a supportive function to a core element of planning, engineering, and risk management strategies.

Rising environmental concerns, tighter regulatory frameworks, and the urgent need for disaster-resilient infrastructure are further boosting market demand. Technological innovation is also reshaping the industry, with stakeholders seeking real-time, non-invasive survey methods that provide faster, safer, and more accurate results. As emerging economies ramp up urban development and resource exploration projects, the appetite for cost-effective and eco-conscious geophysical services is accelerating. Companies are investing heavily in AI-integrated solutions, mobile survey units, and remote sensing platforms to stay competitive in an evolving market that prioritizes speed, sustainability, and precision.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $15.3 Billion |

| CAGR | 6.1% |

Governments worldwide are stepping up investments in resilient infrastructure and disaster mitigation, helping fuel consistent demand for advanced land based geophysical services. Customers today expect smarter survey technologies that deliver accurate insights without disrupting the environment. In emerging regions, traditional land exploration methods are increasingly unviable due to operational costs and environmental challenges, creating opportunities for innovative geophysical solutions. Players are responding with AI-powered platforms that meet evolving safety and sustainability standards while delivering real-time data for better decision-making.

Environmental stewardship is becoming a crucial factor, pushing stakeholders to prefer non-invasive, eco-friendly surveying methods for land reclamation, resource extraction, and environmental cleanup projects. In developing regions, operational hurdles and high exploration costs make geophysical services an attractive option for efficient mineral and energy resource identification. Shifts in government trade policies are also impacting equipment sourcing and service models, pushing providers to adopt cost-efficient, technology-driven strategies. The need for real-time, high-precision subsurface insights is driving a fundamental shift in how the industry approaches exploration and development.

The seismic segment is expected to reach USD 8.7 billion by 2034, supported by advancements in imaging resolution and the growing use of time-lapse seismic technologies. Seismic services remain the gold standard for high-definition subsurface data, critical to hydrocarbon exploration. Magnetic and electromagnetic surveys are gaining traction, especially in hard-to-reach mining areas where accurate geological mapping is essential.

The oil and gas sector dominated the end-use segment with a 52% share in 2024, where gravity and magnetic surveys continue to play a vital role in reducing drilling costs and improving exploration outcomes. Rising demand for critical minerals needed in electronics and renewable energy industries is also fueling greater adoption of geophysical services in mining applications.

The U.S. Land Based Geophysical Services Market stood at USD 2.7 billion in 2024, powered by major infrastructure investments and regulatory incentives promoting sustainable and electrified operations. Seismic refraction and ground-penetrating radar technologies are widely used for underground utility mapping and construction safety. In Canada, the push for non-invasive, environmentally sensitive survey methods is also gaining ground, particularly for natural resource assessment and environmental reclamation.

Key players defining the competitive landscape include CGG, Fugro, SLB, Getech Group, Abitibi Geophysics, Weatherford, TGS, PGS, Gardline, Ramboll Group, Dawson Geophysical Company, SAExploration, and Spectrum Geophysics. Companies are focusing on real-time data analytics, AI integration, and expanding into emerging markets to strengthen their positions. Strategic partnerships with energy and mining sectors, along with investments in sustainable survey methods, are becoming core growth strategies. Innovation in mobile survey units and remote sensing technologies is emerging as a major differentiator in a market driven by precision and speed.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Seismic

- 5.3 Magnetic

- 5.4 Electromagnetic

- 5.5 Gradiometric

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Mining

- 6.4 Agriculture

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Norway

- 7.3.5 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 Iraq

- 7.5.4 Iran

- 7.5.5 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Abitibi Geophysics

- 8.2 CGG

- 8.3 Dawson Geophysical Company

- 8.4 Fugro

- 8.5 Gardline

- 8.6 Getech Group

- 8.7 PGS

- 8.8 Ramboll Group

- 8.9 SAExploration

- 8.10 SLB

- 8.11 Spectrum Geophysics

- 8.12 TGS

- 8.13 Weatherford