|

市場調查報告書

商品編碼

1740871

汽車燒結煞車片市場機會、成長動力、產業趨勢分析及2025-2034年預測Automotive Sintered Brake Pads Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

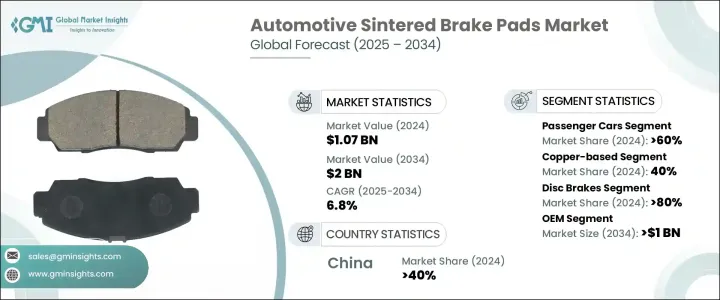

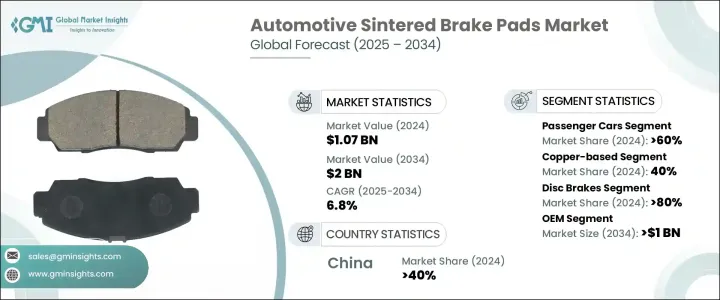

2024年,全球汽車燒結煞車片市場規模達10.7億美元,預估年複合成長率為6.8%,到2034年將達到20億美元。這主要得益於對耐用高性能煞車系統需求的激增,尤其是在卡車和巴士等商用車輛領域。隨著全球物流和貨運流動性的不斷擴大,對可靠、持久耐用的煞車解決方案的需求變得前所未有的重要。基礎設施建設的不斷推進、交通網路投資的不斷增加以及電子商務活動的持續成長,直接影響了商用車輛的保有量,顯著推動了對燒結煞車片的需求。此外,汽車產業持續向性能最佳化和安全性提升轉變,使燒結煞車片成為創新的前沿。汽車製造商和車隊營運商越來越重視能夠承受極端條件、最大程度縮短維護週期並在各種地形上提供穩定性能的煞車零件。隨著永續性問題的日益加劇,製造商也不斷創新環保材料和工藝,進一步拓寬全球燒結煞車片的市場範圍。

燒結煞車片採用在極高溫度和壓力下熔合金屬顆粒製成,從而形成緻密且高度耐用的零件。即使在最劇烈的煞車情況下,這種製程也使煞車片具有出色的耐熱、耐摩擦和耐磨損性能。它們在快速減速、陡峭下坡和重型牽引等情況下表現出色,在這些情況下,保持穩定的性能至關重要。燒結煞車片在潮濕、泥濘或崎嶇的地形中也能保持卓越的煞車效率,使其成為越野和全天候駕駛的首選。其堅固的結構有助於最大限度地減少變形,從而延長使用壽命並減少更換次數。燒結煞車片在波動的負載和極端溫度下提供穩定煞車的能力,鞏固了其作為消費和商用車輛領域首選煞車片的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10.7億美元 |

| 預測值 | 20億美元 |

| 複合年成長率 | 6.8% |

就車型而言,汽車燒結煞車片市場細分為乘用車、商用車和二輪車。 2024年,乘用車市場佔據了60%的市場佔有率,預計到2034年將達到10億美元。這一主導地位反映出消費者對節油、低維護煞車系統日益成長的需求。燒結煞車片性能穩定可靠,磨損少,是日常城市通勤和偶爾高速公路駕駛的理想選擇。其更長的使用壽命可降低整體維護成本,並提高車輛的耐用性,對注重價值的買家以及豪華車主都具有強大的吸引力。

依材料細分,市場可分為銅基、陶瓷基、鐵基、碳基及其他基材料。銅基燒結煞車片在2024年佔據40%的市場佔有率,佔據市場主導地位。其優異的熱穩定性和導電性使其成為高速重載應用的理想選擇。這類煞車片廣泛應用於跑車、商用卡車和越野車,這些車輛對煞車精度和耐用性有嚴格的要求。透過降低更換頻率,銅基煞車片可為車隊營運商和私家車主節省大量成本,進一步鞏固了其日益普及的市場地位。

受印度、泰國和印尼等新興經濟體汽車產業快速擴張的推動,亞太地區汽車燒結煞車片市場在2024年佔據了40%的主導佔有率。都市化進程加快、可支配收入增加以及車主數量不斷成長,加大了原始設備製造商(OEM)在燒結煞車片等高階零件上的應用壓力。同時,該地區商用車和二輪車銷售的不斷成長進一步刺激了市場需求,尤其是在公共交通系統和物流車隊中,這些車隊致力於提高安全性和效率。

引領汽車燒結煞車片市場的領導企業包括日清紡、克諾爾、布雷博、天納克、博世、瀚德、愛德克斯、MAT Holdings、愛信精機和曙光煞車。這些公司正積極投資研發,推出性能更佳、耐用性更強、環境影響更小的先進燒結煞車片。創新包括開發符合日益嚴格的排放標準並同時提升安全性的新材料。與汽車製造商和供應商建立策略合作夥伴關係和聯盟也有助於企業在競爭激烈的市場中拓展市場範圍、增強產品組合併獲得新的客戶群。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 價格趨勢

- 成本細分分析

- 衝擊力

- 成長動力

- 運動型和豪華型車輛對高性能煞車系統的需求不斷成長

- 全球商用車和貨運業的成長

- 摩托車擴大採用燒結煞車片,以提高耐用性和耐熱性

- 不斷擴大的建築和採礦業需要重型煞車解決方案

- 產業陷阱與挑戰

- 與有機或半金屬替代品相比,燒結墊的成本更高

- 由於燒結材料的侵蝕性,煞車盤磨損加劇

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 銅

- 陶瓷製品

- 鐵

- 碳

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車

- 平均血紅素 (MCV)

- 丙型肝炎病毒

- 二輪車

- 摩托車

- 踏板車和輕型摩托車

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 碟式煞車

- 鼓式煞車

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

- 批發分銷商

- 零售店

- 線上零售平台

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- ADVICS

- Aisin Seiki

- Akebono Brake

- ASK Automotive

- Bosch

- Brake Parts

- Brembo

- EBC Brakes

- Haldex

- Hawk Performance

- Hitachi Chemical

- ICER Brakes

- ITT

- Knorr-Bremse

- MAT Holdings

- Miba

- Nisshinbo

- Sangsin Brake

- SBS Friction

- Tenneco

The Global Automotive Sintered Brake Pads Market was valued at USD 1.07 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 2 billion by 2034, primarily fueled by the surging demand for durable and high-performance braking systems, especially in commercial vehicles like trucks and buses. As global logistics and freight mobility continue to expand, the need for reliable, long-lasting braking solutions has never been more critical. Growing infrastructure development, rising investments in transportation networks, and a consistent surge in e-commerce activities have directly impacted the growth of commercial vehicles on the road, significantly boosting the demand for sintered brake pads. Moreover, the automotive sector's ongoing shift towards performance optimization and safety enhancement has placed sintered brake pads at the forefront of innovation. Automakers and fleet operators increasingly prioritize brake components that can withstand extreme conditions, minimize maintenance cycles, and deliver consistent performance across varied terrains. As sustainability concerns intensify, manufacturers are also innovating with eco-friendly materials and processes, further broadening the market scope for sintered brake pads globally.

Sintered brake pads are manufactured by fusing metallic particles under extremely high temperatures and pressures, resulting in dense, highly durable components. This method gives the pads exceptional resistance to heat, friction, and wear, even under the most intense braking scenarios. They excel in rapid deceleration, steep descents, and heavy towing situations, where maintaining consistent performance is crucial. Sintered brake pads also maintain superior braking efficiency in wet, muddy, or rough terrains, making them a preferred choice for off-road and all-weather driving conditions. Their robust structure helps minimize deformation, ensuring a longer lifespan and fewer replacements. The ability of sintered brake pads to deliver stable braking under fluctuating loads and temperature extremes has cemented their position as the go-to option for both consumer and commercial vehicle segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.07 Billion |

| Forecast Value | $2 Billion |

| CAGR | 6.8% |

In terms of vehicle types, the automotive sintered brake pads market is segmented into passenger cars, commercial vehicles, and two-wheelers. In 2024, the passenger car segment accounted for a 60% market share and is projected to generate USD 1 billion by 2034. This dominance reflects the growing consumer inclination toward fuel-efficient, low-maintenance braking systems. Sintered brake pads deliver consistent, reliable performance and reduce wear, making them ideal for daily urban commutes and occasional highway drives. Their extended lifespan results in lower overall maintenance costs and greater vehicle durability, appealing strongly to value-segment buyers as well as luxury vehicle owners.

When it comes to material segmentation, the market is divided into copper-based, ceramic-based, iron-based, carbon-based, and others. Copper-based sintered brake pads led the market with a 40% share in 2024. Their excellent thermal stability and conductivity make them ideal for high-speed and heavy-load applications. These pads are widely used in sports cars, commercial trucks, and off-road vehicles where braking precision and durability are non-negotiable. By reducing the frequency of replacements, copper-based pads offer substantial cost savings for fleet operators and private vehicle owners alike, reinforcing their growing popularity.

The Asia Pacific Automotive Sintered Brake Pads Market held a commanding 40% share in 2024, driven by the rapid expansion of the automobile sector in emerging economies like India, Thailand, and Indonesia. Soaring urbanization, rising disposable incomes, and an increasing number of car owners have intensified the pressure on original equipment manufacturers (OEMs) to incorporate top-tier components such as sintered brake pads. At the same time, the growing sales of commercial vehicles and two-wheelers across the region have further fueled demand, particularly among public transport systems and logistics fleets keen on enhancing safety and efficiency.

Leading players shaping the automotive sintered brake pads market include Nisshinbo, Knorr-Bremse, Brembo, Tenneco, Bosch, Haldex, ADVICS, MAT Holdings, Aisin Seiki, and Akebono Brake. These companies are aggressively investing in research and development initiatives to roll out advanced sintered brake pads that offer improved performance, greater durability, and reduced environmental impact. Innovations include the development of new materials that comply with increasingly stringent emission standards while simultaneously enhancing safety. Strategic partnerships and alliances with automotive manufacturers and suppliers are also helping companies extend their market reach, strengthen product portfolios, and access new customer bases in a highly competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.5 Supply chain reconfiguration

- 3.4.5.1 Pricing and product strategies

- 3.4.5.2 Policy engagement

- 3.4.6 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Price trends

- 3.10 Cost breakdown analysis

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for high-performance braking systems in sports and luxury vehicles

- 3.11.1.2 Growth in global commercial vehicle and freight transportation sectors

- 3.11.1.3 Increased adoption of sintered pads in motorcycles for durability and heat resistance

- 3.11.1.4 Expanding construction and mining industries requiring heavy-duty braking solutions

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Higher cost of sintered pads compared to organic or semi-metallic alternatives

- 3.11.2.2 Increased brake disc wear due to the aggressive nature of sintered materials

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Ceramic

- 5.4 Iron

- 5.5 Carbon

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Two-wheelers

- 6.4.1 Motorcycles

- 6.4.2 Scooters & mopeds

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Disc brakes

- 7.3 Drum brakes

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

- 8.3.1 Wholesale distributors

- 8.3.2 Retail stores

- 8.3.3 Online retail platforms

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ADVICS

- 10.2 Aisin Seiki

- 10.3 Akebono Brake

- 10.4 ASK Automotive

- 10.5 Bosch

- 10.6 Brake Parts

- 10.7 Brembo

- 10.8 EBC Brakes

- 10.9 Haldex

- 10.10 Hawk Performance

- 10.11 Hitachi Chemical

- 10.12 ICER Brakes

- 10.13 ITT

- 10.14 Knorr-Bremse

- 10.15 MAT Holdings

- 10.16 Miba

- 10.17 Nisshinbo

- 10.18 Sangsin Brake

- 10.19 SBS Friction

- 10.20 Tenneco