|

市場調查報告書

商品編碼

1740866

聚乙烯 (PE) 熱成型包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Polyethylene (PE) Thermoform Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

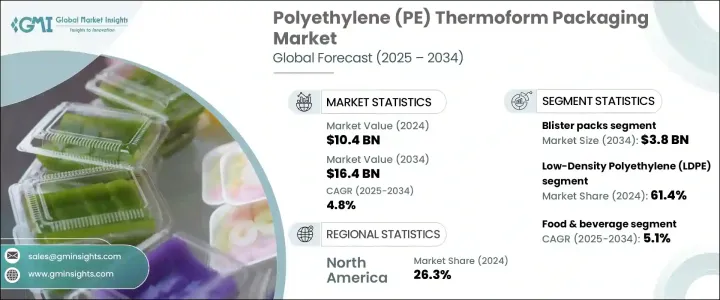

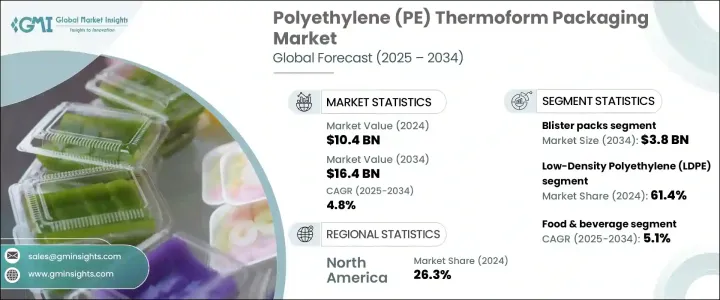

2024年,全球聚乙烯熱成型包裝市場規模達104億美元,預計到2034年將以4.8%的複合年成長率成長,達到164億美元。這得益於電子商務產業的蓬勃發展,也帶動了對輕量、耐用和可回收包裝解決方案的需求。隨著網購成為日常消費行為的核心部分,越來越多的零售商傾向於選擇聚乙烯 (PE) 熱成型包裝,因為它兼具價格實惠、功能設計和永續優勢。 PE 與單一材料包裝趨勢的兼容性也進一步增強了其吸引力,這與全球永續發展目標以及品牌減少塑膠垃圾的承諾相契合。

受對易上架、防篡改和美觀包裝形式日益成長的需求推動,食品、個人護理、藥品和電子產品等行業的市場應用也呈現激增態勢。隨著熱成型技術的進步,製造商現在可以提供不影響透明度、柔韌性或產品保護的包裝。隨著可回收性和循環經濟模式的普及,PE熱成型解決方案已成為推動下一代包裝轉型的領導者。消費者意識的不斷提升,加上北美、歐洲和亞洲地區包裝法規的日益嚴格,進一步強化了大眾市場對PE等永續材料的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 164億美元 |

| 複合年成長率 | 4.8% |

然而,該行業並非沒有挑戰。持續的貿易爭端和前幾屆美國政府制定的關稅結構重塑了包裝產業的成本格局。這些貿易政策持續推高進口原料(尤其是聚合物和特殊薄膜)的成本,導致生產成本上升,造成供應鏈狀況難以預測。因此,製造商面臨越來越大的壓力,要么進行本地化營運,要么實現供應商網路多元化,以減少對高風險市場的依賴。許多公司正在重新評估其採購策略,並投資於材料成分的再設計,使其既符合可回收性標準,也符合性能基準。此外,人們越來越關注將消費後回收材料整合到PE熱成型解決方案中,同時又不影響其耐用性、透明度或成型精度。

展望未來,聚乙烯 (PE) 熱成型包裝市場中的泡殼包裝部分預計到 2034 年將達到 38 億美元。此類包裝形式因其卓越的產品可視性、密封性和延長保存期限的能力,在製藥、化妝品和個人護理行業中日益受到青睞。在醫療保健等受監管的行業中,泡殼包裝提供安全、防篡改且易於使用的單位劑量包裝,有助於確保劑量準確性並提高產品安全性。其阻隔性能有助於保護敏感產品免受濕氣、氧氣和光照的影響,使其成為高價值和易腐爛產品的理想選擇。

低密度聚乙烯 (LDPE) 繼續佔據全球市場主導地位,2024 年的市佔率為 61.4%。 LDPE 以其柔韌性、透明度和易於熱成型的優勢脫穎而出,成為托盤、容器、蓋子和其他客製化包裝類型的最佳選擇。其衛生、不黏的表面以及在不犧牲結構完整性的情況下適應不同形狀的特性,使其成為食品包裝、醫療保健和個人護理領域的首選材料。隨著各大品牌轉向單一材料設計以確保報廢後的可回收性,LDPE 對這些要求的兼容性使其在長期永續發展策略中更有價值。

受消費者不斷變化的偏好以及注重永續性和便利性的零售創新的推動,美國聚乙烯 (PE) 熱成型包裝市場預計在 2034 年達到 35 億美元。即食食品、便攜零食和預包裝產品的日益普及,使得可回收熱成型包裝成為美國零售商和食品服務品牌的重要組成部分。此外,聯邦和州政府推廣的循環包裝模式正在鼓勵企業採用基於 PE 的包裝形式,以支持材料回收並減少垃圾掩埋。消費者對環保包裝日益成長的需求也進一步支持了這些措施。

塑造聚乙烯熱成型包裝市場未來的主要參與者包括康斯坦莎軟包裝公司 (Constantia flexibles)、希悅爾 (Sealed Air)、安姆科公司 (Amcor plc)、貝裡環球公司 (Berry Global Inc.) 和索諾科產品公司 (Sonoco Products Company)。這些公司正在加倍投入研發,以開發尖端的單一材料包裝生產線,以滿足不斷變化的監管法規和消費者期望。他們的策略包括投資可回收解決方案,與領先的食品、個人護理和製藥品牌合作,並在材料和包裝形式方面進行創新,以滿足特定行業的需求。透過專注於生態設計、供應鏈最佳化和產品客製化,市場領導者正在為更聰明、更永續的包裝未來奠定基礎。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 對輕量、經濟型包裝的需求不斷成長

- 加強永續性和可回收性舉措

- 電子商務產業蓬勃發展

- PE樹脂技術的進步

- 閉迴路回收計劃日益受到關注

- 產業陷阱與挑戰

- 高阻隔應用的技術限制

- 消費後廢棄物流中的污染

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 金屬化薄膜

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 泡殼包裝

- 蛤殼

- 瓶子

- 托盤和容器

- 蓋膜

- 其他

第6章:市場估計與預測:按聚乙烯 (PE) 類型,2021-2034 年

- 主要趨勢

- 低密度聚乙烯(LDPE)

- 高密度聚乙烯(HDPE)

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 食品和飲料

- 製藥和醫療保健

- 消費品和零售

- 汽車

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Amcor plc

- Anchor Packaging LLC

- Berry Global Inc.

- Constantia Flexibles

- Greiner Packaging

- Huhtamaki

- Klockner Pentaplast

- Nelipak Healthcare Packaging

- NOVA Chemicals Corporate.

- Pactiv Evergreen Inc.

- Placon

- PlastiPAK INDUSTRIES Inc.

- Schur

- Sealed Air

- Silgan Dispensing Systems

- Sonoco Products Company

- Tekni-Plex, Inc.

- UFlex Limited

The Global Polyethylene Thermoform Packaging Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 16.4 billion by 2034, fueled by the rising momentum of the e-commerce industry, which has led to higher demand for lightweight, durable, and recyclable packaging solutions. As online shopping becomes a core part of everyday consumer behavior, more retailers are leaning toward polyethylene (PE) thermoform packaging for its balance of affordability, functional design, and sustainability benefits. PE's compatibility with mono-material packaging trends adds further traction, aligning with global sustainability goals and brand-led commitments to reduce plastic waste.

The market is also seeing a surge in adoption across sectors like food, personal care, pharmaceuticals, and electronics-driven by the growing need for shelf-ready, tamper-evident, and visually appealing packaging formats. With advancements in thermoforming technologies, manufacturers can now deliver packaging that doesn't compromise on clarity, flexibility, or product protection. As recyclability and circular economy models gain ground, PE thermoform solutions are positioned as a frontrunner in driving next-gen packaging transformations. Rising consumer awareness, coupled with stricter packaging mandates across North America, Europe, and Asia, further reinforces the need for sustainable materials like PE in mass-market applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 4.8% |

The industry, however, is not without its challenges. Ongoing trade disputes and tariff structures enacted by prior U.S. administrations have reshaped the cost dynamics of the packaging landscape. These trade policies continue to elevate the cost of imported raw materials-especially polymers and specialty films-causing an uptick in production costs and creating unpredictable supply chain conditions. As a result, manufacturers are under growing pressure to either localize operations or diversify supplier networks to reduce reliance on high-risk markets. Many companies are now reevaluating their procurement strategies and investing in the re-engineering of material compositions that meet both recyclability standards and performance benchmarks. There's also a growing interest in integrating post-consumer recycled content into PE thermoform solutions without compromising on durability, clarity, or molding precision.

Looking ahead, the blister packs segment within the polyethylene (PE) thermoform packaging market is projected to reach USD 3.8 billion by 2034. These packaging formats are gaining traction across pharmaceuticals, cosmetics, and personal care industries due to their superior product visibility, airtight sealing, and ability to extend shelf life. In regulated sectors like healthcare, blister packs offer secure, tamper-resistant, and easy-to-use unit-dose packaging, supporting dosage accuracy and improving product safety. Their barrier properties help protect sensitive products from moisture, oxygen, and light-making them ideal for high-value and perishable goods.

The low-density polyethylene (LDPE) segment continues to dominate the global market, accounting for a 61.4% share in 2024. LDPE stands out for its flexibility, clarity, and ease of thermoforming, making it an optimal choice for trays, containers, lids, and other custom-formed packaging types. Its hygienic, non-stick surface and adaptability to different shapes without sacrificing structural integrity have made it a go-to material in food packaging, healthcare, and personal care sectors. As brands pivot toward mono-material designs to ensure end-of-life recyclability, LDPE's compatibility with these requirements makes it even more valuable in long-term sustainability strategies.

The United States Polyethylene (PE) Thermoform Packaging Market is on track to reach USD 3.5 billion by 2034, driven by evolving consumer preferences and retail innovations that prioritize sustainability and convenience. The growing popularity of ready-to-eat meals, on-the-go snacks, and pre-packaged products has made recyclable thermoform packaging an essential component for U.S. retailers and food service brands. Additionally, federal and state-level policies promoting circular packaging models are encouraging businesses to adopt PE-based formats that support material recovery and reduce landfill waste. These initiatives are further supported by growing consumer demand for eco-conscious packaging options.

Major players shaping the future of the polyethylene thermoform packaging market include Constantia Flexibles, Sealed Air, Amcor plc, Berry Global Inc., and Sonoco Products Company. These companies are doubling down on RandD to develop cutting-edge mono-material packaging lines that meet evolving regulatory and consumer expectations. Their strategies include investing in recyclable solutions, partnering with leading food, personal care, and pharma brands, and innovating across materials and formats to serve sector-specific needs. By focusing on eco-design, supply chain optimization, and product customization, market leaders are setting the stage for a smarter, more sustainable packaging future.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for lightweight and cost-effective packaging

- 3.3.1.2 Increasing sustainability and recyclability initiatives

- 3.3.1.3 Growing e-commerce sector

- 3.3.1.4 Advancements in PE resin technology

- 3.3.1.5 Rising focus on closed-loop recycling programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Technical limitations for high-barrier applications

- 3.3.2.2 Contamination in post-consumer waste streams

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

- 4.6 Metalized films

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Blister packs

- 5.3 Clamshells

- 5.4 Bottles

- 5.5 Trays & containers

- 5.6 Lidding films

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Polyethylene (PE) Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Low-density polyethylene (LDPE)

- 6.3 High-density polyethylene (HDPE)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Pharmaceuticals & healthcare

- 7.4 Consumer goods & retail

- 7.5 Automotive

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Anchor Packaging LLC

- 9.3 Berry Global Inc.

- 9.4 Constantia Flexibles

- 9.5 Greiner Packaging

- 9.6 Huhtamaki

- 9.7 Klockner Pentaplast

- 9.8 Nelipak Healthcare Packaging

- 9.9 NOVA Chemicals Corporate.

- 9.10 Pactiv Evergreen Inc.

- 9.11 Placon

- 9.12 PlastiPAK INDUSTRIES Inc.

- 9.13 Schur

- 9.14 Sealed Air

- 9.15 Silgan Dispensing Systems

- 9.16 Sonoco Products Company

- 9.17 Tekni-Plex, Inc.

- 9.18 UFlex Limited