|

市場調查報告書

商品編碼

1740861

昆蟲基原料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Insect-based Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

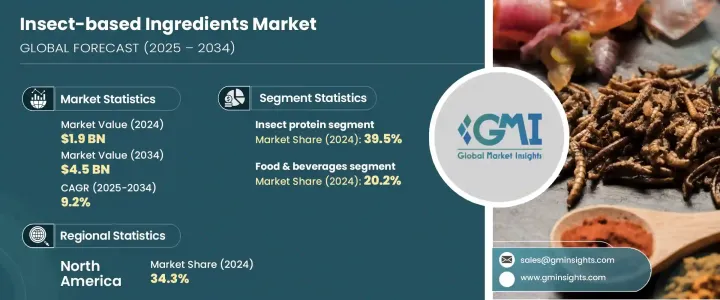

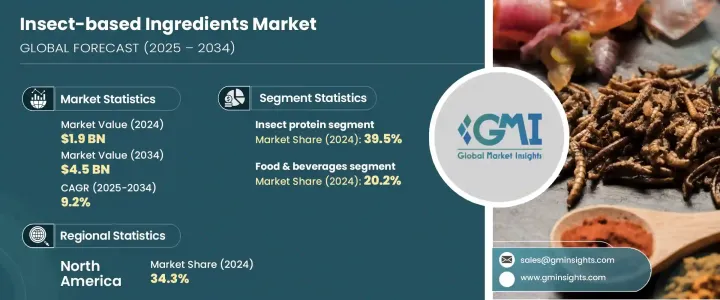

2024年,全球昆蟲原料市場規模達19億美元,預計2034年將以9.2%的複合年成長率成長,達到45億美元。人們對環境永續性、食品安全和資源效率的認知日益增強,正將昆蟲原料推向全球關注的焦點。消費者和各行各業都在尋求能夠滿足日益成長的蛋白質需求,且不會加劇氣候變遷或消耗自然資源的替代品。昆蟲對土地和水資源的需求極少,溫室氣體排放量低,且蛋白質產量高,因此提供了一個極具吸引力的解決方案。

與傳統畜牧養殖不同,昆蟲養殖提供了更具可擴展性、更具成本效益的模式,符合全球永續糧食系統的目標。加工技術的進步、跨領域應用的拓展以及監管框架的轉變正在加速市場發展。隨著投資湧入食品科技創新以及消費者接受度的不斷提高,昆蟲原料正迅速從小眾產品轉變為主流必需品。越來越多的媒體報導、策略性行銷舉措以及營養學家和永續發展倡導者的認可,進一步證實了昆蟲作為未來可行且必不可少的蛋白質來源的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 9.2% |

根據成分類型,市場分為昆蟲蛋白、昆蟲粉、昆蟲油和昆蟲幾丁質。 2024年,昆蟲蛋白佔據了該細分市場的39.5%。其卓越的氨基酸組成、快速吸收和高濃度的營養成分使其在需要高性能成分的行業中備受青睞。鑑於對永續且高效的蛋白質替代品的需求,寵物食品、水產飼料和運動營養等行業的需求尤其強勁。

根據應用領域,市場涵蓋化妝品產業、食品飲料業、農業、製藥業、動物飼料業等。食品飲料類別在2024年佔了20.2%的市場佔有率,預計複合年成長率將達到9.6%。消費者對清潔標章、環保食品的興趣日益濃厚,推動了對昆蟲衍生麵粉和高蛋白配方的需求。人們對永續飲食和減少碳足跡的日益重視,促使更多消費者嘗試以昆蟲為基礎的食品,這標誌著飲食偏好的廣泛轉變。

2024年,北美昆蟲原料市場佔據34.3%的市場佔有率,這得益於有利的法規、食品科技領域風險投資的激增以及文化向永續性和健康的轉變。食品和飼料中特定昆蟲品種的監管批准加速了其商業化進程,為創新新創公司和大型生產商打開了大門。對清潔標籤、高蛋白和環保營養的強烈關注,持續推動美國和加拿大市場的擴張。

引領市場發展的領導企業包括 EnviroFlight、Ynsect、Entomo Farms、AgriProtein 和 Protix。這些公司正在大力投資研發、擴大產能、取得監管認證,並建立策略供應鏈聯盟。消費者教育活動和透明的標籤實踐在建立信任和推動全球範圍內對昆蟲原料的採用方面發揮著至關重要的作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 對貿易的影響

- 貿易量中斷

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 對貿易的影響

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 供應方影響(原料)

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 昆蟲養殖加工技術創新

- 支持性監管框架和政策進步

- 消費者偏好轉向永續且營養豐富的食品

- 產業陷阱與挑戰

- 消費者認知與文化障礙

- 供應鍊和擴展限制

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 昆蟲蛋白

- 粗蛋白

- 昆蟲粉

- 分離蛋白質

- 昆蟲油

- 脂肪酸

- Omega-3 和 Omega-6 脂肪酸

- 殺蟲粉

- 乾昆蟲粉

- 蛋白粉

- 昆蟲幾丁質

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品飲料業

- 動物飼料業

- 化妝品產業

- 製藥業

- 農業(生物塑膠、肥料等)

- 其他(紡織、生物化學)

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Ynsect

- Protix

- AgriProtein

- EnviroFlight

- Entomo Farms

- Six Foods

- Bugsolutely

- AgriProtein

- Beta Hatch Source

The Global Insect-Based Ingredients Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 4.5 billion by 2034. A growing awareness of environmental sustainability, food security, and resource efficiency is pushing insect-based ingredients into the global spotlight. Consumers and industries are increasingly seeking alternatives that can meet rising protein demands without exacerbating climate change or depleting natural resources. Insects, with their minimal land and water needs, low greenhouse gas emissions, and impressive protein yield, offer a compelling solution.

Unlike conventional livestock farming, insect farming provides a more scalable, cost-effective model that aligns with global goals for sustainable food systems. Advances in processing technologies, expanded applications across diverse sectors, and shifting regulatory frameworks are accelerating market momentum. As investment pours into food tech innovations and consumer acceptance broadens, insect-based ingredients are moving rapidly from a niche product to a mainstream necessity. Growing media coverage, strategic marketing initiatives, and endorsements from nutritionists and sustainability advocates are further validating the role of insects as a viable and essential protein source for the future.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 9.2% |

Based on ingredient types, the market is divided into insect protein, insect powder, insect oils, and insect chitin. Insect protein led the segment in 2024, capturing 39.5% of the overall market share. Its superior amino acid profile, rapid absorption, and dense nutrient concentration make it highly desirable across industries that require high-performance ingredients. Sectors like pet food, aquafeed, and sports nutrition are particularly driving demand, given the need for sustainable yet potent protein alternatives.

Based on application, the market includes the cosmetics industry, food and beverages industry, agriculture, pharmaceutical industry, animal feed industry, and others. The food and beverages category accounted for 20.2% of the market in 2024 and is projected to expand at a CAGR of 9.6%. Rising consumer interest in clean-label, eco-friendly food products is fueling demand for insect-derived flours and high-protein formulations. A growing emphasis on sustainable diets and carbon footprint reduction is encouraging more consumers to experiment with insect-based food options, signaling a broader shift in dietary preferences.

North America Insect-Based Ingredients Market held a 34.3% share in 2024, driven by favorable regulations, a surge in venture capital investments in food tech, and a cultural shift toward sustainability and wellness. Regulatory approvals for specific insect species in food and feed have accelerated commercialization efforts, opening the door for innovative startups and large-scale producers alike. A strong focus on clean-label, high-protein, and environmentally responsible nutrition continues to fuel market expansion across the United States and Canada.

Leading players shaping the market include EnviroFlight, Ynsect, Entomo Farms, AgriProtein, and Protix. These companies are investing heavily in R&D, scaling production capacities, securing regulatory certifications, and forming strategic supply chain alliances. Consumer education campaigns and transparent labeling practices are playing a crucial role in building trust and driving the adoption of insect-based ingredients worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Impact on trade

- 3.1.8 Trade volume disruptions

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.1 Impact on trade

- 3.3 Impact on the industry

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.4 Demand-Side impact (Selling Price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and Future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Technological innovations in insect farming and processing

- 3.12.1.2 Supportive regulatory frameworks and policy advancements

- 3.12.1.3 Shifting consumer preferences toward sustainable and nutrient-rich foods

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 Consumer perception and cultural barriers

- 3.12.2.2 Supply chain and scaling limitations

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Insect Protein

- 5.2.1 Crude protein

- 5.2.2 Insect meal

- 5.2.3 Isolated protein

- 5.3 Insect Oils

- 5.3.1 Fatty acids

- 5.3.2 Omega-3 and Omega-6 fatty acids

- 5.4 Insect Powder

- 5.4.1 Dried insect powder

- 5.4.2 Protein powder

- 5.5 Insect Chitin

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages industry

- 6.3 Animal feed industry

- 6.4 Cosmetics Industry

- 6.5 Pharmaceutical Industry

- 6.6 Agriculture (bioplastics, fertilizers, etc.)

- 6.7 Others (textile, biochemical)

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Ynsect

- 8.2 Protix

- 8.3 AgriProtein

- 8.4 EnviroFlight

- 8.5 Entomo Farms

- 8.6 Six Foods

- 8.7 Bugsolutely

- 8.8 AgriProtein

- 8.9 Beta Hatch Source