|

市場調查報告書

商品編碼

1740860

掃雪車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Snow Clearing Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

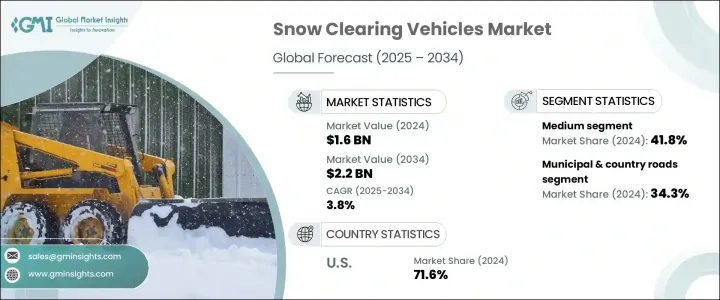

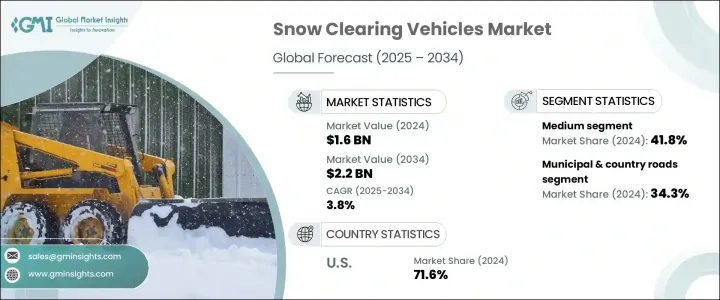

2024 年全球掃雪車市場價值為 16 億美元,預計到 2034 年將以 3.8% 的複合年成長率成長至 22 億美元。這一成長主要得益於機場基礎設施的不斷發展以及各大降雪地區道路交通網路的穩步擴張。隨著機場的升級和擴建,尤其是在寒冷地區,對高性能掃雪車的需求持續成長。高效率的掃雪設備對於在嚴冬條件下維持不間斷的服務至關重要。市場也正在更廣泛地轉向智慧基礎設施,市政當局和服務提供者優先考慮先進可靠的掃雪技術,以提高安全性和效率。對永續性、燃油效率和低維護解決方案的日益關注正在改變城市和農村地區的掃雪作業管理方式。

從應用角度來看,掃雪車市場主要分為四大類:機場、高速公路、市政和鄉村道路以及其他用途。 2024年,市政和鄉村道路領域佔據領先地位,市場佔有率約為34.3%,預計在整個預測期內的複合年成長率將超過3.5%。該領域至關重要,因為它能夠根據獨特的區域條件調整和擴展掃雪技術。地方政府經常投資配備耐腐蝕零件、模組化系統和先進除冰技術的多功能車輛。這些客製化配置有助於即使在偏遠、難以到達或經常受到惡劣天氣影響的地區也能保持穩定的性能。清理市政道路和鄉村道路上的積雪通常需要穿越陡峭的地形、未鋪砌的路面和狹窄的小徑。這導致對採用堅固硬體(例如鉸接式鏟刀、增強型懸吊和全地形輪胎)的車輛的需求日益成長,這些硬體能夠在惡劣的環境條件下承受高強度的工作負荷。隨著城鎮採用更聰明的雪管理措施,人們對配備 GPS 導航除雪系統、自動撒鹽功能和混合動力推進選項的設備的興趣日益濃厚,以提高永續性和有效性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 22億美元 |

| 複合年成長率 | 3.8% |

市場也按車型細分為緊湊型、中型和重型車輛。中型車輛細分市場在2024年成為最大的細分市場,約佔市場佔有率的41.8%,預計到2034年將以超過4.3%的複合年成長率成長。這些車輛在清雪作業中發揮著至關重要的作用,尤其是在城市地區和大型商業區。其動力和尺寸的平衡使其能夠在需要頻繁精確除雪的環境中高效運作。這些車輛有多種型號可供選擇,購買者可以根據地形、降雪量和所需的機動性來選擇設備。現在,買家可以享受更高的定價透明度,包括可選功能和配件,使市政當局和承包商更容易在有限的預算內進行明智的投資。

按推進類型分類,市場包括內燃機 (ICE)、電動車和混合動力車。由於內燃機汽車在冰凍和惡劣條件下提供高扭矩、持續可靠性和長續航能力的卓越性能,它在 2024 年仍將是市場主導。這些車輛因其在驅動犁車和撒佈機等重型除雪設備方面的出色性能而受到操作員的青睞。儘管基於內燃機的系統仍然是最常見的,但人們正逐漸轉向使用現代燃油管理系統、低排放技術和導航功能來增強內燃機系統,以滿足不斷變化的性能和環境標準。

從地區來看,美國在2024年引領了掃雪車市場,市場規模約5億美元,佔據北美總市場佔有率的近71.6%。美國冬季氣候多樣,且注重在降雪期間維護道路安全,因此對掃雪解決方案的需求強勁且持續。完善的供應鏈加上持續的技術進步,使美國始終保持著掃雪車及設備市場的領先地位。

隨著產業的不斷發展,製造商正致力於設計採用改進材料和技術的掃雪車。強化液壓系統、耐腐蝕表面和高扭矩驅動系統正成為標準配備。這些更新不僅延長了車輛壽命,還能確保車輛在嚴苛的冬季作業中保持頂級性能。硬化鋼、輕質合金和先進複合材料等高性能部件正日益整合,以提高車輛的機動性、降低油耗,並增強車輛在極端天氣和複雜地形條件下的結構耐久性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件供應商

- 製造商

- 技術提供者

- 服務提供者

- 配銷通路

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 定價分析

- 推進系統

- 地區

- 對部隊的影響

- 成長動力

- 極端天氣事件發生頻率增加

- 擴建機場基礎設施

- 都市化和市政投資

- 公路運輸網的成長

- 產業陷阱與挑戰

- 資本和維護成本高

- 環境法規和燃油效率標準

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 機場

- 高速公路

- 市政和鄉村道路

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 袖珍的

- 中等的

- 重的

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

- 混合

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 政府和市政當局

- 私人承包商

- 農業部門

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Aebi Schmidt Holding

- Alamo

- Boschung Holding

- Caterpillar

- Daimler (Mercedes-Benz Trucks)

- Doosan Bobcat

- Faymonville

- Hako Group

- John Deere

- Kassbohrer Gelandefahrzeug

- Kodiak America

- MB Companies

- Montana Manufacturing

- Oshkosh

- Rosenbauer International

- Schmidt Group

- Swarco

- Ventrac

- Wausau Equipment Company

- Zoomlion

The Global Snow Clearing Vehicles Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 2.2 billion by 2034. This growth is largely fueled by the ongoing development of airport infrastructure and the steady rise in road transportation networks across various regions prone to heavy snowfall. As airports upgrade and expand, especially in colder areas, the demand for high-performance snow removal vehicles continues to grow. Efficient snow clearing equipment is essential to maintaining uninterrupted services during severe winter conditions. The market is also seeing a broader shift toward smart infrastructure, where municipalities and service providers are prioritizing advanced and reliable snow clearing technologies that enhance both safety and efficiency. A growing focus on sustainability, fuel efficiency, and low-maintenance solutions is transforming how snow removal operations are managed in both urban and rural settings.

In terms of application, the snow clearing vehicles market is divided into four main segments: airports, highways, municipal and country roads, and other uses. In 2024, the municipal and country roads segment took the lead with an approximate 34.3% market share and is projected to grow at over 3.5% CAGR throughout the forecast period. This segment is pivotal due to its ability to adapt and scale snow clearing technologies to suit unique regional conditions. Local governments frequently invest in multi-functional vehicles equipped with corrosion-resistant parts, modular systems, and advanced de-icing technology. These customizations help deliver consistent performance even in areas that are remote, hard to reach, or frequently impacted by adverse weather. Clearing snow from municipal routes and country roads often involves navigating steep terrain, unpaved surfaces, and narrow paths. This has led to a growing demand for vehicles built with rugged hardware like articulated blades, reinforced suspensions, and all-terrain tires that can handle intense workloads under harsh environmental conditions. As cities and towns adopt smarter snow management practices, there is a growing interest in equipment with GPS-guided plow systems, automated salting features, and hybrid propulsion options to improve both sustainability and effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 3.8% |

The market is also segmented by vehicle type into compact, medium, and heavy vehicles. The medium vehicle segment emerged as the largest in 2024, accounting for approximately 41.8% of the market, and is expected to grow at a CAGR of over 4.3% through 2034. These vehicles play a critical role in snow clearing operations, particularly in urban areas and large commercial zones. Their balance of power and size allows them to operate efficiently in environments that require frequent and precise snow removal. Available in numerous models, these vehicles allow purchasers to select equipment based on terrain, snowfall levels and required maneuverability. Buyers now benefit from greater transparency in pricing, which includes optional features and attachments, making it easier for municipalities and contractors to invest wisely within limited budgets.

When classified by propulsion type, the market includes internal combustion engine (ICE), electric, and hybrid-powered vehicles. ICE vehicles remain the dominant choice in 2024 due to their proven ability to deliver high torque, consistent reliability, and long operational endurance in freezing and rugged conditions. These vehicles are favored by operators for their performance in driving heavy snow removal equipment such as plows and spreaders. Although ICE-based systems are still the most common, there's a gradual shift toward enhancing them with modern fuel management systems, low-emission technology, and navigation features to meet evolving performance and environmental standards.

Regionally, the United States led the snow clearing vehicles market in 2024, generating around USD 500 million and holding nearly 71.6% of the total share in North America. The country's diverse winter climate and emphasis on maintaining road safety during snow events have created a strong and consistent demand for snow clearing solutions. A well-established supply chain, coupled with ongoing technological advancements, has allowed the U.S. to remain a leading market for snow clearing vehicles and equipment.

As the industry continues to evolve, manufacturers are focusing on designing snow clearing vehicles with improved materials and technology. Reinforced hydraulics, corrosion-resistant surfaces, and high-torque drive systems are becoming standard. These updates not only extend vehicle life but also ensure top-tier performance in demanding winter operations. High-performance components such as hardened steel, lightweight alloys, and advanced composites are being increasingly integrated to boost maneuverability, reduce fuel consumption, and enhance structural durability in extreme weather and challenging landscapes.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component Suppliers

- 3.2.3 Manufacturers

- 3.2.4 Technology Providers

- 3.2.5 Service Providers

- 3.2.6 Distribution channel

- 3.2.7 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing frequency of extreme weather events

- 3.10.1.2 Expansion of airport infrastructure

- 3.10.1.3 Urbanization and municipal investments

- 3.10.1.4 Growth in road transportation networks

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High capital and maintenance costs

- 3.10.2.2 Environmental regulations and fuel efficiency standards

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Airports

- 5.3 Highways

- 5.4 Municipal & country roads

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Compact

- 6.3 Medium

- 6.4 Heavy

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Government & municipalities

- 8.3 Private contractor

- 8.4 Agricultural sector

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Aebi Schmidt Holding

- 10.2 Alamo

- 10.3 Boschung Holding

- 10.4 Caterpillar

- 10.5 Daimler (Mercedes-Benz Trucks)

- 10.6 Doosan Bobcat

- 10.7 Faymonville

- 10.8 Hako Group

- 10.9 John Deere

- 10.10 Kassbohrer Gelandefahrzeug

- 10.11 Kodiak America

- 10.12 M-B Companies

- 10.13 Montana Manufacturing

- 10.14 Oshkosh

- 10.15 Rosenbauer International

- 10.16 Schmidt Group

- 10.17 Swarco

- 10.18 Ventrac

- 10.19 Wausau Equipment Company

- 10.20 Zoomlion