|

市場調查報告書

商品編碼

1740856

藍寶石鍍膜光學元件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sapphire-coated optics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

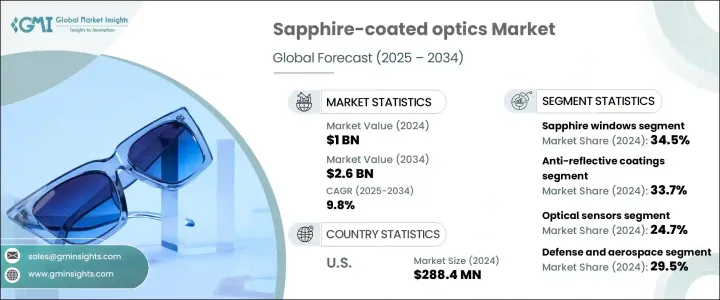

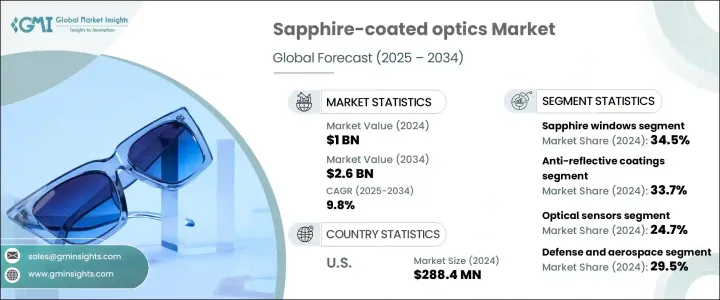

2024 年全球藍寶石鍍膜光學元件市場價值為 10 億美元,預計到 2034 年將以 9.8% 的複合年成長率成長至 26 億美元。由於在航太、國防、醫療設備、工業機械和電子領域的應用不斷擴大,市場發展勢頭強勁。對高性能光學解決方案的需求日益成長,尤其是在惡劣環境下,這推動了對藍寶石鍍膜的需求。隨著各行業的設備變得越來越先進,製造商開始採用藍寶石鍍膜光學元件,因為它們具有無與倫比的耐用性、熱穩定性和清晰度。下一代技術的日益普及和智慧型設備的普及繼續提升了對可靠光學元件的需求。這些塗層因其耐刮擦性和機械強度而特別受歡迎,使其成為精度和可靠性至關重要的應用的理想選擇。

全球智慧型手機出貨量激增,2024年將達到12.4億部,這推動了對耐用、高清晰度光學元件的需求大幅成長。隨著行動裝置攝影系統的發展,製造商紛紛採用藍寶石鍍膜光學元件,以滿足對卓越影像品質和性能的需求。同時,高清晰度光學元件與醫療和工業設備的整合也進一步增強了市場前景。藍寶石鍍膜能夠增強光學性能並承受高應力條件,使其成為各行各業關鍵應用的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 9.8% |

就產品類型而言,市場分為藍寶石窗口片、透鏡、球透鏡、稜鏡、波片等。其中,藍寶石窗口片憑藉其卓越的耐刮擦性能、優異的機械性能和熱性能,在2024年佔據了最大的市場佔有率,達到34.5%。這些窗口片廣泛應用於需要長期耐用性和穩定光傳輸的關鍵任務系統。藍寶石透鏡和球透鏡在精密成像和雷射系統中的應用也日益受到青睞,而波片和棱鏡則被多個行業的先進光學組件所採用。整體產品的多樣化反映了終端用戶對客製化和功能性日益成長的需求。

根據塗層類型,市場細分為高反射率塗層、抗反射塗層、專用塗層、無塗層組件和濾光塗層。抗反射塗層在2024年佔據33.7%的市場佔有率,佔據該細分市場的主導地位。這些塗層可以增強透光率並減少眩光,使其成為需要高清晰度的光學系統中必不可少的部件。它們在高解析度成像和先進電子系統中的廣泛應用將繼續推動該細分市場的發展。高反射率塗層主要用於雷射應用,而濾光塗層則滿足生物醫學成像和基於感測器的系統的需求。光學功能日益複雜,推動了針對特定操作需求的專用塗層的成長。

市場進一步按應用細分,包括光學感測器、成像系統、紅外線光學、光譜學、雷射系統等。光學感測器佔據最大佔有率,2024 年的市佔率為 24.7%。這些感測器依靠藍寶石塗層來實現其堅固性和精確性,尤其是在工業自動化、環境監測和診斷領域。藍寶石塗層組件在極端條件下仍能可靠地運行,這使得它們在這些高要求應用中至關重要。其他日益成長的應用包括光譜學和成像系統,其中藍寶石的耐磨性和耐化學性至關重要。由於商用和軍用系統對技術的要求不斷提高,雷射系統和紅外線光學領域也不斷擴展。

按最終用途分類,藍寶石鍍膜光學元件市場包括國防和航太、醫療保健、工業製造、半導體和電子、消費性電子、石油和天然氣、研發等。 2024 年,國防和航太佔據市場主導地位,佔有 29.5% 的佔有率。國防和太空任務對抗刮擦、熱穩定的光學元件的需求正在推動持續的需求。這些光學元件提供在極端條件下運作的關鍵任務設備所需的結構完整性和性能。醫療產業擴大在診斷和手術設備中部署藍寶石光學元件,而半導體和電子產業則受益於藍寶石在晶圓檢測工具中的精確度。石油和天然氣產業以及工業製造業正在認知到藍寶石鍍膜光學元件在惡劣環境下可靠性能的價值。

美國在全球市場佔據主導地位,佔超過85%的佔有率,2024年市場規模達2.884億美元。這一領先地位得益於先進的光學製造基礎設施以及對國防和航太創新的持續投入。政府支持的措施持續支持藍寶石光學的擴張,鼓勵全國範圍內的大規模生產和持續的技術發展。

藍寶石鍍膜光學市場的主要參與者包括 Coherent、COE Optics、Newport、Meller Optics 和 Knight Optical。這些公司以提供針對高要求工業和科學應用的客製化高精度藍寶石光學元件而聞名。他們的創新和產品開發策略對於塑造這個快速發展的市場的未來至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 價值鏈分析

- 原物料供應商

- 水晶製造商

- 光學元件製造商

- 塗層服務提供者

- 系統整合商

- 最終用途

- 定價分析和成本結構

- 依產品類型進行價格點分析

- 按地區分析價格點

- 價格趨勢(2020 - 2025)

- 2025年至2033年價格預測

- 影響定價的因素

- 原料成本

- 製造複雜性

- 塗層技術

- 品質要求

- 成本結構分析

- 原料成本

- 勞動成本

- 製造費用

- 研發費用

- 分銷和行銷成本

- 利潤率分析

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 市場動態

- 市場促進因素

- 對耐用光學元件的需求不斷成長

- 日益增加的惡劣環境的應用

- 國防和航太領域的採用率不斷上升

- 塗層技術進步

- 市場限制

- 生產成本高

- 複雜的製造程序

- 來自替代材料的競爭

- 市場機會

- 醫療器材的新興應用

- 消費性電子產品需求不斷成長

- 發展中經濟體的擴張

- 塗層奈米技術的進展

- 市場挑戰

- 大型零件的規模化生產

- 透過塗層保持光學性能

- 供應鏈漏洞

- 市場促進因素

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:材料屬性與特性

- 藍寶石的物理特性

- 熱性能

- 光傳輸範圍

- 耐化學性

- 與替代材料的比較

- 藍寶石與玻璃

- 藍寶石與熔融石英

- 藍寶石與其他晶體材料

- 晶體取向及其對性能的影響

- C平面

- R平面

- A型飛機

- M-平面

- 品質參數和標準

第6章:塗層技術和工藝

- 抗反射(AR)塗層

- 單層塗層

- 多層塗層

- 寬頻增透膜

- 高反射率塗層

- 過濾塗層

- 專用塗料

- 疏水塗層

- 防刮塗層

- 導電塗料

- 塗層沉積技術

- 物理氣相沉積(PVD)

- 化學氣相沉積(CVD)

- 離子輔助沉積

- 等離子體增強沉積

- 磁控濺射

- 品質控制和測試方法

第7章:製造流程與價值鏈分析

- 藍寶石晶體生長方法

- 提拉法(CZ)

- 熱交換器法(HEM)

- 泡生法(KY)

- 邊緣定義薄膜進料生長(EFG)

- 加工製造

- 切割和塑形

- 研磨和精研

- 拋光技術

- 表面品質要求

- 塗層應用工藝

- 品質保證和測試

第8章:技術創新與研發活動

- 最近的技術進步

- 先進的塗層技術

- 奈米層塗層

- 改進製造程序

- 專利分析

- 專利申請趨勢

- 主要專利持有者

- 新興技術

- 研發投入分析

- 產學合作

- 技術路線圖

第9章:規範架構與標準

- 光學元件的國際標準

- 品質認證要求

- 行業特定法規

- 國防和航太標準

- 醫療器材法規

- 消費性電子產品標準

- 出口管制和貿易法規

- 影響製造業的環境法規

- 合規挑戰和解決方案

第10章:未來趨勢與新興應用

- 科技趨勢

- 超薄藍寶石塗層

- 多功能塗料

- 自清潔表面

- 新興應用

- 擴增實境 (AR) 和虛擬實境 (VR)

- 自動駕駛汽車

- 先進的醫學影像

- 量子計算

- 太空探索

- 市場擾亂和遊戲規則改變者

- 長期市場展望-2033年後

第 11 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 藍寶石窗口

- 藍寶石鏡片

- 藍寶石球透鏡

- 藍寶石波片

- 藍寶石棱鏡

- 其他

第 12 章:市場估計與預測:按塗層類型,2021 年至 2034 年

- 主要趨勢

- 防反射塗層

- 高反射率塗層

- 過濾塗層

- 專用塗料

- 未塗層零件

第 13 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 光學感測器

- 雷射系統

- 影像系統

- 光譜學

- 紅外線光學

- 其他

第 14 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 國防和航太

- 軍用光學元件

- 監控系統

- 飛機和太空船零件

- 醫療保健

- 手術雷射

- 診斷設備

- 內視鏡檢查

- 工業製造

- 高功率雷射

- 流程監控

- 品質控制系統

- 半導體和電子

- 光刻

- 檢查系統

- 晶圓加工

- 消費性電子產品

- 智慧型手機組件

- 相機鏡頭

- 穿戴式裝置

- 石油和天然氣

- 研究與開發

- 其他

第 15 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 16 章:公司簡介

- Asphera, Inc.

- COE Optics

- Coherent

- Creator Optics

- Esco Optics, Inc.

- Firebird Optics

- Gavish

- Guild Optical Associates.

- Hyperion Optics

- Knight Optical

- Kyocera Corporation

- Meller Optics

- Newport

- Noni Custom Optics

- Precision Glass & Optics (PG&O)

- Saint-Gobain

- Shanghai Optics

- UQG Optics

The Global Sapphire-coated Optics Market was valued at USD 1 billion in 2024 and is projected to grow at a CAGR of 9.8% to reach USD 2.6 billion by 2034. The market is gaining momentum due to its expanding applications across aerospace, defense, medical devices, industrial machinery, and electronics. The increasing need for high-performance optical solutions, especially in harsh environments, is fueling the demand for sapphire coatings. As devices across sectors become more advanced, manufacturers are turning to sapphire-coated optics for their unmatched durability, thermal stability, and clarity. The growing adoption of next-generation technologies and the proliferation of smart devices continue to elevate the need for reliable optical components. These coatings are particularly sought-after for their scratch resistance and mechanical strength, making them ideal for applications where precision and reliability are critical.

The surge in global smartphone shipments, which reached 1.24 billion units in 2024, has driven a significant increase in the demand for durable, high-clarity optics. As camera systems in mobile devices evolve, manufacturers are embracing sapphire-coated optics to meet the need for superior image quality and performance. Meanwhile, the integration of high-clarity optics into medical and industrial equipment has further strengthened market prospects. The ability of sapphire coatings to enhance optical performance and withstand high-stress conditions makes them a favored choice for critical applications in diverse industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 9.8% |

In terms of product type, the market is categorized into sapphire windows, lenses, ball lenses, prisms, waveplates, and others. Among these, sapphire windows held the largest share at 34.5% in 2024, due to their exceptional resistance to scratches and their high mechanical and thermal performance. These windows are used extensively in mission-critical systems requiring long-term durability and stable optical transmission. Sapphire lenses and ball lenses are also gaining traction for use in precision imaging and laser systems, while waveplates and prisms are being adopted in advanced optical assemblies across several sectors. The overall product diversification reflects the rising customization and functionality demanded by end users.

By coating type, the market is segmented into high-reflectivity coatings, anti-reflective coatings, specialized coatings, uncoated components, and filter coatings. Anti-reflective coatings led the segment with a 33.7% share in 2024. These coatings enhance light transmission and reduce glare, making them essential in optical systems where high clarity is required. Their widespread usage in high-resolution imaging and advanced electronic systems continues to drive this segment forward. High-reflectivity coatings are primarily used in laser applications, while filter coatings serve the needs of biomedical imaging and sensor-based systems. The increasing complexity of optical functions is promoting the growth of specialized coatings tailored for unique operational requirements.

The market is further segmented by application, including optical sensors, imaging systems, infrared optics, spectroscopy, laser systems, and others. Optical sensors accounted for the largest portion, with a 24.7% share in 2024. These sensors rely on sapphire coatings for their robustness and precision, particularly in industrial automation, environmental monitoring, and diagnostics. The ability of sapphire-coated components to perform reliably under extreme conditions has made them essential in these high-demand applications. Other growing applications include spectroscopy and imaging systems, where the anti-abrasive and chemically resistant nature of sapphire is crucial. The laser systems and infrared optics segments are also expanding due to rising technological requirements in both commercial and military systems.

By end-use, the sapphire-coated optics market includes defense and aerospace, medical and healthcare, industrial manufacturing, semiconductor and electronics, consumer electronics, oil and gas, research and development, and others. Defense and aerospace dominated the market with a 29.5% share in 2024. The need for scratch-resistant, thermally stable optical components in defense and space missions is driving continuous demand. These optics offer the structural integrity and performance required for mission-critical equipment operating in extreme conditions. The medical sector is increasingly deploying sapphire optics in diagnostic and surgical equipment, while the semiconductor and electronics industries benefit from sapphire's precision in wafer inspection tools. The oil and gas industry, along with industrial manufacturing, is recognizing the value of sapphire-coated optics for reliable performance in rugged environments.

The United States held the dominant position in the global market, capturing over 85% share and reaching USD 288.4 million in 2024. This leadership is backed by advanced optical manufacturing infrastructure and consistent investment in defense and aerospace innovation. Government-backed initiatives continue to support the expansion of sapphire optics, encouraging large-scale production and sustained technological development across the country.

Key players operating in the sapphire-coated optics market include Coherent, COE Optics, Newport, Meller Optics, and Knight Optical. These companies are recognized for offering high-precision sapphire optics tailored for demanding industrial and scientific applications. Their innovations and product development strategies are instrumental in shaping the future of this fast-evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Value chain analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Crystal manufacturers

- 3.1.3 Optical component fabricators

- 3.1.4 Coating service providers

- 3.1.5 System integrators

- 3.1.6 End use

- 3.2 Pricing analysis and cost structure

- 3.2.1 Price point analysis by product type

- 3.2.2 Price point analysis by region

- 3.2.3 Price trends 2020 - 2025)

- 3.2.4 Price forecast 2025 - 2033

- 3.2.5 Factors affecting pricing

- 3.2.5.1 Raw material costs

- 3.2.5.2 Manufacturing complexity

- 3.2.5.3 Coating technology

- 3.2.5.4 Quality requirements

- 3.2.6 Cost structure analysis

- 3.2.6.1 Raw material cost

- 3.2.6.2 Labor cost

- 3.2.6.3 Manufacturing overhead

- 3.2.6.4 R&D expenses

- 3.2.6.5 Distribution and marketing costs

- 3.2.7 Profit margin analysis

- 3.3 Impact of trump administration tariffs – structured overview

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the industry

- 3.3.2.1.1 Supply-side impact (raw materials)

- 3.3.2.1.2 Price volatility in key materials

- 3.3.2.1.3 Supply chain restructuring

- 3.3.2.1.4 Production cost implications

- 3.3.2.2 Demand-side impact (selling price)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook and future considerations

- 3.3.1 Impact on trade

- 3.4 Trade statistics (HS code)

- 3.4.1 Major exporting countries

- 3.4.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Market dynamics

- 3.8.1 Market drivers

- 3.8.1.1 Growing demand for durable optical components

- 3.8.1.2 Increasing applications in harsh environments

- 3.8.1.3 Rising adoption in defense and aerospace

- 3.8.1.4 Technological advancements in coating techniques

- 3.8.2 Market restraints

- 3.8.2.1 High production costs

- 3.8.2.2 Complex manufacturing process

- 3.8.2.3 Competition from alternative materials

- 3.8.3 Market opportunities

- 3.8.3.1 Emerging applications in medical devices

- 3.8.3.2 Growing demand in consumer electronics

- 3.8.3.3 Expansion in developing economies

- 3.8.3.4 Advancements in nanotechnology for coatings

- 3.8.4 Market challenges

- 3.8.4.1 Scaling production for large components

- 3.8.4.2 Maintaining optical performance with coatings

- 3.8.4.3 Supply chain vulnerabilities

- 3.8.1 Market drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Material Properties and Characteristics

- 5.1 Physical properties of sapphire

- 5.1.1 Thermal properties

- 5.1.2 Optical transmission range

- 5.1.3 Chemical resistance

- 5.2 Comparison with alternative materials

- 5.2.1 Sapphire vs. Glass

- 5.2.2 Sapphire vs. Fused silica

- 5.2.3 Sapphire vs. Other crystalline materials

- 5.3 Crystal orientation and its impact on performance

- 5.3.1 C-Plane

- 5.3.2 R-Plane

- 5.3.3 A-Plane

- 5.3.4 M-Plane

- 5.4 Quality parameters and standards

Chapter 6 Coating Technologies and Processes

- 6.1 Anti-reflective (AR) coatings

- 6.1.1 Single-layer coatings

- 6.1.2 Multi-layer coatings

- 6.1.3 Broadband AR coatings

- 6.2 High-reflectivity coatings

- 6.3 Filter coatings

- 6.4 Specialized coatings

- 6.4.1 Hydrophobic coatings

- 6.4.2 Scratch-resistant coatings

- 6.4.3 Conductive coatings

- 6.5 Coating deposition techniques

- 6.5.1 Physical vapor deposition (PVD)

- 6.5.2 Chemical vapor deposition (CVD)

- 6.5.3 Ion-assisted deposition

- 6.5.4 Plasma-enhanced deposition

- 6.5.5 Magnetron sputtering

- 6.6 Quality control and testing methods

Chapter 7 Manufacturing Processes and Value Chain Analysis

- 7.1 Sapphire crystal growth methods

- 7.1.1 Czochralski (CZ) method

- 7.1.2 Heat exchanger method (HEM)

- 7.1.3 Kyropoulos (KY) method

- 7.1.4 Edge-defined film-fed growth (EFG)

- 7.2 Processing and fabrication

- 7.2.1 Cutting and shaping

- 7.2.2 Grinding and lapping

- 7.2.3 Polishing techniques

- 7.2.4 Surface quality requirements

- 7.3 Coating application process

- 7.4 Quality assurance and testing

Chapter 8 Technological Innovations and R&D Activities

- 8.1 Recent technological advancements

- 8.1.1 Advanced coating techniques

- 8.1.2 Nanolayer coatings

- 8.1.3 Improved manufacturing processes

- 8.2 Patent analysis

- 8.2.1 Patent filing trends

- 8.2.2 Key patent holders

- 8.2.3 Emerging technologies

- 8.3 R&D investment analysis

- 8.4 Industry-academia collaborations

- 8.5 Technology roadmap

Chapter 9 Regulatory Framework and Standards

- 9.1 International standards for optical components

- 9.2 Quality certification requirements

- 9.3 Industry-specific regulations

- 9.3.1 Defense and aerospace standards

- 9.3.2 Medical device regulations

- 9.3.3 Consumer electronics standards

- 9.4 Export controls and trade regulations

- 9.5 Environmental regulations affecting manufacturing

- 9.6 Compliance challenges and solutions

Chapter 10 Future Trends and Emerging Applications

- 10.1 Technological trends

- 10.1.1 Ultra-thin sapphire coatings

- 10.1.2 Multi-functional coatings

- 10.1.3 Self-cleaning surfaces

- 10.2 Emerging applications

- 10.2.1 Augmented reality (AR) and virtual reality (VR)

- 10.2.2 Autonomous vehicles

- 10.2.3 Advanced medical imaging

- 10.2.4 Quantum computing

- 10.2.5 Space exploration

- 10.3 Market disruptions and game-changers

- 10.4 Long-term market outlook - beyond 2033

Chapter 11 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Sapphire windows

- 11.3 Sapphire lenses

- 11.4 Sapphire ball lenses

- 11.5 Sapphire waveplates

- 11.6 Sapphire prisms

- 11.7 Others

Chapter 12 Market Estimates and Forecast, By Coating Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 Anti-reflective coatings

- 12.3 High-reflectivity coatings

- 12.4 Filter coatings

- 12.5 Specialized coatings

- 12.6 Uncoated components

Chapter 13 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 13.1 Key trends

- 13.2 Optical sensors

- 13.3 Laser systems

- 13.4 Imaging systems

- 13.5 Spectroscopy

- 13.6 Infrared optics

- 13.7 Others

Chapter 14 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 14.1 Key trends

- 14.2 Defense and aerospace

- 14.2.1 Military optics

- 14.2.2 Surveillance systems

- 14.2.3 Aircraft and spacecraft components

- 14.3 Medical and healthcare

- 14.3.1 Surgical lasers

- 14.3.2 Diagnostic equipment

- 14.3.3 Endoscopy

- 14.4 Industrial manufacturing

- 14.4.1 High-power lasers

- 14.4.2 Process monitoring

- 14.4.3 Quality control systems

- 14.5 Semiconductor and electronics

- 14.5.1 Lithography

- 14.5.2 Inspection systems

- 14.5.3 Wafer processing

- 14.6 Consumer electronics

- 14.6.1 Smartphone components

- 14.6.2 Camera lenses

- 14.6.3 Wearable devices

- 14.7 Oil and gas

- 14.8 Research and development

- 14.9 Others

Chapter 15 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Spain

- 15.3.5 Italy

- 15.3.6 Netherlands

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 India

- 15.4.3 Japan

- 15.4.4 Australia

- 15.4.5 South Korea

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.5.2 Argentina

- 15.6 Middle East and Africa

- 15.6.1 Saudi Arabia

- 15.6.2 South Africa

- 15.6.3 UAE

Chapter 16 Company Profiles

- 16.1 Asphera, Inc.

- 16.2 COE Optics

- 16.3 Coherent

- 16.4 Creator Optics

- 16.5 Esco Optics, Inc.

- 16.6 Firebird Optics

- 16.7 Gavish

- 16.8 Guild Optical Associates.

- 16.9 Hyperion Optics

- 16.10 Knight Optical

- 16.11 Kyocera Corporation

- 16.12 Meller Optics

- 16.13 Newport

- 16.14 Noni Custom Optics

- 16.15 Precision Glass & Optics (PG&O)

- 16.16 Saint-Gobain

- 16.17 Shanghai Optics

- 16.18 UQG Optics