|

市場調查報告書

商品編碼

1740855

生物製藥包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biopharmaceutical Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

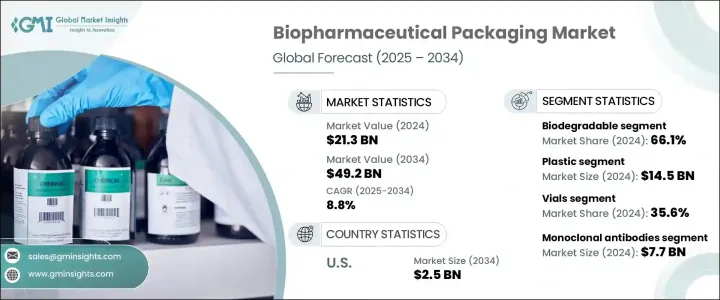

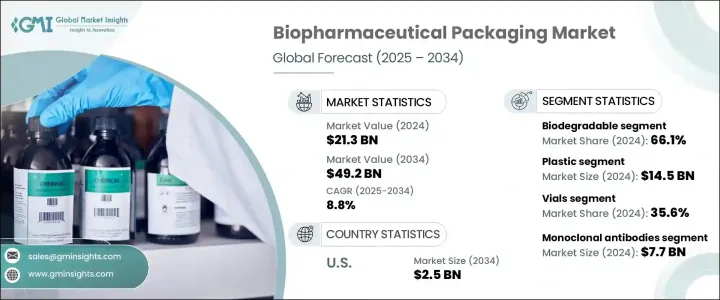

2024年,全球生物製藥包裝市場規模達213億美元,預計到2034年將以8.8%的複合年成長率成長,達到492億美元。這得歸功於對能夠保護敏感生物藥品完整性和功效的專業包裝解決方案日益成長的需求。隨著生物製藥產業不斷擴大對複雜高價值療法(包括單株抗體、細胞和基因療法以及基於mRNA的藥物)的關注,先進包裝解決方案的重要性也急劇上升。生物製藥對環境變化高度敏感,需要可控制的儲存和運輸條件。這導致對旨在保護整個供應鏈藥品穩定性的創新材料和技術的需求激增。隨著全球監管機構不斷收緊包裝安全標準,製藥公司正在重新思考如何保護其生物製劑。此外,隨著越來越多的生物製劑進入全球市場,對能夠確保無菌、實現即時監控並符合永續發展目標的包裝形式的要求也越來越高。

冷鏈物流投資的不斷成長以及全球生物製藥消費者群體的不斷擴大,進一步推動了人們轉向更具創新性和更堅固的包裝解決方案。生物製藥公司正積極採用高性能材料,以應對極端溫度環境,並在整個生產現場和照護端的整個過程中保持產品功效。對永續性的日益重視也影響著設計選擇。隨著醫療保健提供者和最終用戶都要求更安全、更環保的選擇,包裝公司正在加速開發可回收、可生物分解和可重複使用的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 213億美元 |

| 預測值 | 492億美元 |

| 複合年成長率 | 8.8% |

貿易政策的變化,尤其是對醫藥相關進口產品徵收的報復性關稅,進一步加劇了市場動態的複雜性。這些關稅正在推高原料成本,尤其是國際採購的高級塑膠和藥用級玻璃。由此產生的成本飆升使得國內製造成本更高,進而影響了整個價值鏈的採購策略。企業目前正在探索在地化供應鏈和替代採購模式,以抵消不斷上漲的投入成本,同時維持合規性和品質標準。

同時,科技正在重塑生物製藥產品的包裝和監控方式。智慧包裝形式正在改變產業格局,尤其對於溫度敏感的生物製劑。整合RFID標籤和感測器的解決方案能夠即時追蹤溫度、濕度和產品完整性等關鍵參數。這些智慧系統有助於最大限度地減少浪費,降低產品受損風險,並提高患者的整體安全性。隨著對藥物精準輸送和儲存的需求不斷成長,智慧包裝正迅速從奢侈品變為這個高風險產業的必需品。

2024年,可生物分解包裝材料佔據全球市場的66.1%,彰顯了邁向永續發展的決定性轉變。這一趨勢不僅體現了消費者日益增強的環保意識,也反映了監管部門日益增強的壓力,要求逐步淘汰製藥應用中的一次性塑膠。可生物分解材料已取得顯著發展,現已具備製藥應用所需的耐用性、耐化學性和阻隔保護性能。這些創新幫助可生物分解包裝超越了小眾市場的地位,成為眾多藥品包裝中傳統塑膠解決方案的有力替代者。

儘管發生了這種轉變,塑膠包裝在2024年仍然佔據主導地位,市值達145億美元。其成本效益、設計靈活性和卓越的保護性能繼續支撐著塑膠包裝的廣泛應用。塑膠尤其適用於需要防篡改功能、高防潮性以及與兒童安全封蓋和一次性系統等專用組件相容的應用。聚合物科學的不斷進步提升了塑膠包裝的性能,使其能夠滿足日益嚴格的藥品儲存和分銷需求。

受美國強大的製藥生態系統和生物技術創新的推動,預計2034年,美國生物製藥包裝市場規模將達到25億美元。嚴格的監管標準以及消費者對安全性、完整性和永續性日益成長的期望,正推動包裝公司加快創新步伐。隨著業界適應藥物輸送和合規性的新挑戰和機遇,智慧、可追溯且環保的包裝形式正變得至關重要。

安姆科 (Amcor)、肖特 (Schott AG)、格雷斯海姆 (Gerresheimer AG)、碧迪 (Becton, Dickinson & Co.) 和絲芙蘭 (CCL Industries) 等公司正積極投資研發,以保持領先地位。這些公司正與製藥公司合作,共同開發下一代包裝解決方案,擴大環保替代品的規模,並採用數位化工具來提高供應鏈透明度和監管合規性。隨著全球市場的成熟,生物製藥包裝的策略創新仍將是支持安全且有效率地交付全球最先進療法的核心。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 對永續和環保包裝解決方案的需求不斷成長

- 醫療保健基礎設施的全球擴張和現代化

- 慢性病和生活方式疾病的日益流行

- 智慧包裝系統等快速的技術創新

- 生物製劑和個人化藥物研發投資不斷增加

- 產業陷阱與挑戰

- 初期投資和營運成本高

- 複雜的供應鏈物流和嚴格的品質標準

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 可生物分解

- 非生物分解

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 聚氯乙烯(PVC)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二酯(PET)

- 聚苯乙烯(PS)

- 聚乙烯(PE)

- 高密度聚乙烯

- 低密度聚乙烯

- 線型低密度聚乙烯

- 其他

- 玻璃

第7章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 小瓶

- 安瓿

- 瓶子

- 預充式注射器

- 墨水匣

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 疫苗

- 細胞因子

- 酵素

- 單株抗體

- 基因療法

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 澳洲

- 韓國

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Adelphi

- Amcor

- Becton, Dickinson & Co.

- Berry Global

- CCL Industries

- Gerresheimer AG

- LOG Pharma Packaging

- Medical Packaging Inc., LLC

- Merck KGaA

- PCI

- Piramal Glass Private Limited

- Schott AG

- Shandong Pharmaceutical Glass Co

- Sonoco

- Stevanato Group

- West Pharmaceutical Services, Inc.

The Global Biopharmaceutical Packaging Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 49.2 billion by 2034, fueled by the rising demand for specialized packaging solutions capable of preserving the integrity and efficacy of sensitive biological drugs. As the biopharma sector keeps expanding its focus on complex, high-value therapies-including monoclonal antibodies, cell and gene therapies, and mRNA-based drugs-the importance of advanced packaging solutions is rising sharply. Biopharmaceuticals are highly sensitive to environmental changes, requiring controlled storage and transportation conditions. This has led to a surge in demand for innovative materials and technologies designed to protect drug stability throughout the supply chain. With regulatory authorities around the globe tightening packaging safety standards, pharmaceutical companies are rethinking how they protect their biologics. On top of that, as more biologics enter the global market, there's a stronger push for packaging formats that ensure sterility, enable real-time monitoring, and align with sustainability goals.

The shift toward more innovative and robust packaging solutions is further supported by growing investments in cold chain logistics and an expanding global base of biologic drug consumers. Biopharmaceutical companies are responding by adopting high-performance materials that can endure extreme temperatures and maintain product efficacy from manufacturing sites to point-of-care delivery. Rising emphasis on sustainability is also influencing design choices. As healthcare providers and end users alike demand safer and greener options, packaging firms are accelerating the development of recyclable, biodegradable, and reusable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $49.2 Billion |

| CAGR | 8.8% |

Trade policy shifts, especially the retaliatory tariffs placed on pharma-related imports, have added another layer of complexity to market dynamics. These tariffs are increasing raw material costs, particularly for high-grade plastics and pharmaceutical-grade glass sourced internationally. The resulting cost surge has made domestic manufacturing more expensive, which is impacting procurement strategies across the value chain. Companies are now exploring localized supply chains and alternative sourcing models to offset rising input costs while maintaining compliance and quality standards.

At the same time, technology is reshaping how biopharmaceutical products are packaged and monitored. Smart packaging formats are becoming a game changer, especially for temperature-sensitive biologics. Solutions integrated with RFID tags and sensors are enabling real-time tracking of critical parameters like temperature, humidity, and product integrity. These intelligent systems help minimize waste, reduce the risk of compromised products, and improve overall patient safety. As demand for precision in drug delivery and storage continues to grow, smart packaging is quickly moving from a luxury to a necessity in this high-stakes industry.

In 2024, biodegradable packaging materials accounted for 66.1% of the global market, underlining a decisive shift toward sustainability. This trend reflects not just a response to growing environmental awareness among consumers but also stronger regulatory pressure to phase out single-use plastics in pharmaceutical applications. Biodegradable materials have evolved significantly and now offer the durability, chemical resistance, and barrier protection required for pharmaceutical use. These innovations have helped biodegradable packaging move beyond niche status, making it a competitive alternative to traditional plastic solutions across a broad range of drug formats.

Despite this shift, plastic packaging still held a dominant position in 2024, with a market value of USD 14.5 billion. Its widespread use continues to be supported by its cost-effectiveness, design flexibility, and excellent protective qualities. Plastics are especially favored in applications requiring tamper-evident features, high moisture resistance, and compatibility with specialized components like child-safe closures and single-use systems. Continuous advancements in polymer science have enhanced the performance of plastic packaging, enabling it to meet the increasingly stringent demands of pharmaceutical storage and distribution.

The U.S. Biopharmaceutical Packaging Market is projected to hit USD 2.5 billion by 2034, driven by the country's strong pharmaceutical manufacturing ecosystem and innovation in biotech. A combination of strict regulatory standards and rising consumer expectations around safety, integrity, and sustainability is pushing packaging firms to innovate faster. Smart, traceable, and eco-conscious packaging formats are becoming essential as the industry adapts to new challenges and opportunities in drug delivery and compliance.

Companies like Amcor, Schott AG, Gerresheimer AG, Becton, Dickinson & Co., and CCL Industries are actively investing in R&D to stay ahead. These firms are partnering with pharmaceutical companies to co-develop next-gen packaging solutions, scale up eco-friendly alternatives, and adopt digital tools for supply chain visibility and regulatory alignment. As the global market matures, strategic innovation in biopharmaceutical packaging will remain central to supporting the safe and efficient delivery of the world's most advanced therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.2 Supply-side impact (raw materials)

- 3.2.2.1 Price volatility in key materials

- 3.2.2.2 Supply chain restructuring

- 3.2.2.3 Production cost implications

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for sustainable and eco-friendly packaging solutions

- 3.3.1.2 Global expansion and modernization of healthcare infrastructure

- 3.3.1.3 The growing prevalence of chronic and lifestyle diseases

- 3.3.1.4 Rapid technological innovations such as smart packaging systems

- 3.3.1.5 Rising investments in R&D for biologics and personalized medicines

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and operational costs

- 3.3.2.2 Complex supply chain logistics and stringent quality standards

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Biodegradable

- 5.3 Non-biodegradable

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.2.1 Polyvinyl Chloride (PVC)

- 6.2.2 Polypropylene (PP)

- 6.2.3 Polyethylene Terephthalate (PET)

- 6.2.4 Polystyrene (PS)

- 6.2.5 Polyethylene (PE)

- 6.2.5.1 HDPE

- 6.2.5.2 LDPE

- 6.2.5.3 LLDPE

- 6.2.6 Others

- 6.3 Glass

Chapter 7 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Vials

- 7.3 Ampoules

- 7.4 Bottles

- 7.5 Pre-filled syringes

- 7.6 Cartridges

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Vaccines

- 8.3 Cytokines

- 8.4 Enzymes

- 8.5 Monoclonal antibodies

- 8.6 Gene therapies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adelphi

- 10.2 Amcor

- 10.3 Becton, Dickinson & Co.

- 10.4 Berry Global

- 10.5 CCL Industries

- 10.6 Gerresheimer AG

- 10.7 LOG Pharma Packaging

- 10.8 Medical Packaging Inc., LLC

- 10.9 Merck KGaA

- 10.10 PCI

- 10.11 Piramal Glass Private Limited

- 10.12 Schott AG

- 10.13 Shandong Pharmaceutical Glass Co

- 10.14 Sonoco

- 10.15 Stevanato Group

- 10.16 West Pharmaceutical Services, Inc.