|

市場調查報告書

商品編碼

1740851

冷凍馬鈴薯市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Frozen Potatoes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

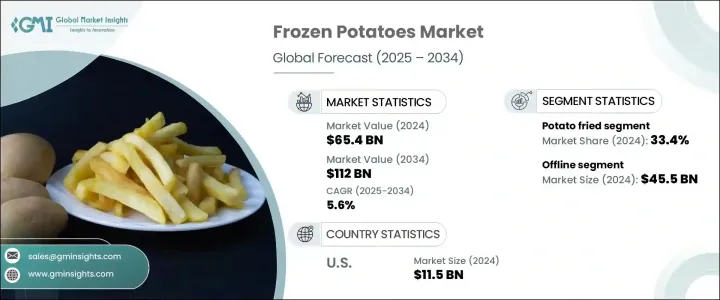

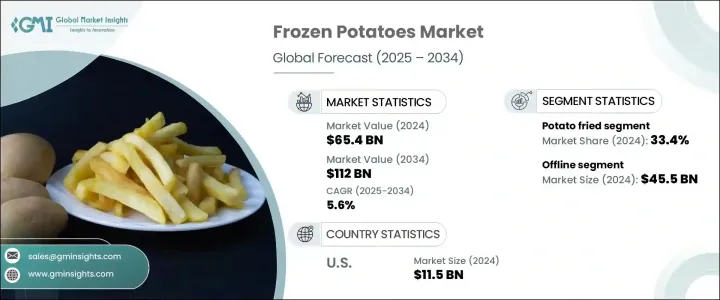

2024年,全球冷凍馬鈴薯市場規模達654億美元,預計到2034年將以5.6%的複合年成長率成長,達到1120億美元。這得歸功於消費者生活方式的轉變以及對便捷即食食品日益成長的需求。隨著消費者在快節奏的日常生活和更緊湊的日程安排中忙碌,冷凍馬鈴薯已成為家庭廚房和專業餐飲服務場所的必備食品。此品類的穩定成長反映了消費者對便利飲食解決方案的廣泛需求,這些解決方案在口味、品質和營養價值方面均不打折扣。冷凍馬鈴薯產品已不再局限於傳統的炸薯條,而是涵蓋了一系列創新產品,包括薯角、烘焙產品和無麩質產品,每一種都旨在滿足現代消費者不斷變化的需求。

人們對健康飲食習慣的認知日益增強,加上冷凍技術的進步,正在重塑市場模式。供應鏈物流的增強、快餐消費的激增以及新興經濟體的不斷滲透,進一步增強了市場前景。隨著全球飲食習慣轉向速度、口味和種類,冷凍馬鈴薯產品勢必將佔據全球冷凍櫃、菜單和外帶平台的主導地位。這一上升趨勢得益於製造商在產品創新、清潔標籤開發和分銷管道最佳化方面的策略性投資,這些投資使冷凍馬鈴薯比以往任何時候都更容易獲得。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 654億美元 |

| 預測值 | 1120億美元 |

| 複合年成長率 | 5.6% |

繁忙的都市生活方式和日益普及的快餐休閒餐飲是推動冷凍馬鈴薯產品成長的主要因素。隨著人們尋求既美味又令人滿意的快餐解決方案,對長保存期限產品的需求也日益成長。餐飲服務業在提升銷售方面發揮關鍵作用,提供品質穩定且易於大規模製備的冷凍馬鈴薯產品。經營者依靠這些產品來簡化廚房操作,縮短準備時間,並在不犧牲風味和品質的情況下滿足不斷變化的客戶需求。同時,隨著越來越多的消費者在冰箱裡儲備各種用途廣泛的馬鈴薯食品以方便在家食用,零售通路也蓬勃發展。

以健康為中心的創新正在為市場成長增添新的維度。低脂、氣炸和無防腐劑的食品正吸引注重健康的消費者,他們希望在享受美味的同時,減少妥協。清潔標籤趨勢日益流行,促使製造商推出低鈉、無麩質和天然成分的產品。這些替代品不僅吸引了個人消費者,在學校、醫院和公司餐廳等機構場所也越來越受歡迎,因為在這些場所,均衡營養和飲食合規是重中之重。隨著口味和口感的不斷改進,以及標籤的日益透明,這些「更健康」的選擇正在滲透到主流市場和小眾市場。

炸馬鈴薯目前佔據最大的市場佔有率,2024 年佔比為 33.4%,預計到 2034 年將以 4.8% 的複合年成長率成長。由於快餐連鎖店的需求以及消費者對酥脆金黃口感的持續喜愛,炸馬鈴薯依然備受歡迎。除了薯條之外,其他形式的薯條,例如薯角、薯餡、薯片、薯條、薯條和烘焙薯條,也正在蓬勃發展。這些產品迎合了不同的烹飪偏好和飲食需求,薯條非常適合搭配豐盛的燉菜,而烘焙薯條則提供了更清淡、無油的選擇,符合健康潮流。

在分銷方面,餐飲服務領域在2024年佔據了39.6%的市場佔有率,預計到2034年將以5.2%的複合年成長率成長。餐廳、餐飲服務和機構廚房嚴重依賴冷凍馬鈴薯產品來維持效率並提供穩定的菜餚。零售也是一個關鍵的成長動力,消費者擴大從超市、社區商店和線上平台購買即食馬鈴薯產品。

光是美國冷凍馬鈴薯市場在2024年就創造了115億美元的產值,預計到2034年將以4.8%的複合年成長率穩定成長。美國強大的快餐文化和完善的餐飲服務提供者網路確保了持續的需求。連鎖餐廳的菜單創新,加上冷凍產品在雜貨店、會員制倉儲式超市和專業零售商的廣泛供應,共同推動了市場持續成長的勢頭。

全球冷凍馬鈴薯領域的主要參與者包括麥凱恩食品有限公司 (McCain Foods Limited)、JR Simplot 公司、Farm Frites International BV、Lamb Weston Holdings, Inc. 和 Cavendish Farms。這些公司正在積極投資美食風格產品線,與餐飲服務業者合作,向高成長地區擴張,並採用自動化技術來提高生產效率。隨著對數位行銷和電子商務的日益關注,領先品牌正在更直接、更有效地接觸消費者,從而確保在全球市場上擁有強大的知名度、可及性和客戶忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要進口國

註:以上貿易統計僅針對重點國家。

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 簡便食品和即食食品的需求不斷成長

- 快餐店 (QSR) 的全球擴張

- 冷凍食品零售基礎設施的成長

- 產業陷阱與挑戰

- 對加工食品和油炸食品的健康擔憂

- 氣候影響導致生馬鈴薯價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依產品類型 2021 - 2034

- 主要趨勢

- 炸馬鈴薯

- 馬鈴薯角

- 釀馬鈴薯

- 洋芋片

- 馬鈴薯塊

- 馬鈴薯丁

- 烤馬鈴薯

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 餐飲服務

- 零售

- 速食店

- 家庭

第7章:市場規模及預測:按配銷通路,2021 - 2034

- 主要趨勢

- 離線

- 超市和大賣場

- 便利商店

- 專賣店

- 線上

- 電子商務平台

- 公司自有網站

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Agristo

- Aviko BV

- Bart's Potato Company

- Cavendish Farms

- Farm Frites International BV

- JR Simplot Company

- Lamb Weston Holdings, Inc.

- McCain Foods Limited

- Mydibel Group

- Pohjolan Peruna Oy

The Global Frozen Potatoes Market was valued at USD 65.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 112 billion by 2034, fueled by changing consumer lifestyles and an ever-increasing demand for convenient, ready-to-cook food options. As consumers juggle fast-paced routines and tighter schedules, frozen potatoes have become a staple in both household kitchens and professional food service settings. The category's steady rise reflects a broader shift toward convenient meal solutions that don't compromise on taste, quality, or nutritional value. Frozen potato products are no longer limited to traditional French fries-they now span an array of innovative offerings including wedges, baked options, and gluten-free varieties, each tailored to meet the evolving expectations of modern consumers.

Growing awareness around healthier eating habits, combined with advances in freezing technologies, is reshaping the market landscape. Enhanced supply chain logistics, a surge in quick-service restaurant consumption, and increasing penetration into emerging economies further strengthen the market's outlook. With global dining habits leaning toward speed, flavor, and variety, frozen potato products are set to dominate freezer aisles, menus, and food delivery platforms worldwide. This upward trend is underpinned by strategic manufacturer investments in product innovation, clean-label development, and enhanced distribution channels that make frozen potatoes more accessible than ever before.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $65.4 Billion |

| Forecast Value | $112 Billion |

| CAGR | 5.6% |

Busy urban lifestyles and the surging popularity of fast-casual dining are major factors driving the growth of frozen potato products. As people look for quick meal solutions that are both tasty and satisfying, the demand for long shelf-life options is rising. The food service industry plays a critical role in boosting sales, offering frozen potato products that deliver consistency and ease of preparation at scale. Operators rely on these items to streamline kitchen operations, reduce prep time, and meet fluctuating customer demands without sacrificing flavor or quality. At the same time, retail channels are thriving as more consumers stock their freezers with versatile potato items for at-home convenience.

Health-focused innovations are adding a new dimension to market growth. Low-fat, air-fried, and preservative-free options are catching the attention of health-conscious buyers who want indulgence with fewer compromises. Clean-label trends are gaining traction, prompting manufacturers to introduce products with reduced sodium, gluten-free attributes, and natural ingredients. These alternatives don't just appeal to individual consumers-they're also seeing increased uptake in institutional settings like schools, hospitals, and corporate cafeterias where balanced nutrition and dietary compliance are top priorities. As taste and texture continue to improve, and as labels become more transparent, these better-for-you options are penetrating both mainstream and niche markets alike.

Fried potatoes currently hold the largest share of the market, accounting for 33.4% in 2024, and are projected to grow at a CAGR of 4.8% through 2034. Their popularity remains strong due to the demand from fast-food chains and the enduring consumer love for crisp, golden textures. Beyond fries, other formats such as wedges, stuffed varieties, slices, dice, chunks, and baked alternatives are gaining momentum. These products cater to different cooking preferences and dietary needs, with chunks working well in hearty stews, and baked versions offering a lighter, oil-free option that aligns with wellness trends.

In terms of distribution, the food service segment held a 39.6% market share in 2024 and is set to grow at a CAGR of 5.2% through 2034. Restaurants, catering services, and institutional kitchens depend heavily on frozen potato offerings to maintain efficiency and deliver consistent dishes. Retail is also a key growth driver, with consumers increasingly purchasing ready-to-cook potato products from supermarkets, neighborhood stores, and online platforms.

The United States Frozen Potatoes Market alone generated USD 11.5 billion in 2024 and is forecasted to expand steadily at a CAGR of 4.8% through 2034. The nation's strong fast-food culture and well-established network of food service providers ensure consistent demand. Menu innovations across restaurant chains, coupled with the widespread availability of frozen products in grocery stores, club warehouses, and specialty retailers, contribute to the market's sustained momentum.

Key players in the global frozen potatoes space include McCain Foods Limited, J.R. Simplot Company, Farm Frites International B.V., Lamb Weston Holdings, Inc., and Cavendish Farms. These companies are actively investing in gourmet-style product lines, partnering with foodservice operators, expanding into high-growth regions, and embracing automation to enhance production efficiency. With a growing focus on digital marketing and e-commerce, leading brands are reaching consumers more directly and effectively-ensuring strong visibility, accessibility, and customer loyalty across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for convenience and ready-to-eat foods

- 3.8.1.2 Expansion of quick service restaurants (QSRs) globally

- 3.8.1.3 Growth in frozen food retail infrastructure

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Health concerns over processed and fried foods

- 3.8.2.2 Volatility in raw potato prices due to climate impact

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Potato fried

- 5.3 Potato wedges

- 5.4 Stuffed potatoes

- 5.5 Potato slices

- 5.6 Potato chunks

- 5.7 Potato dices

- 5.8 Baked potato

- 5.9 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Foodservice

- 6.3 Retail

- 6.4 Quick service restaurants

- 6.5 Households

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Offline

- 7.2.1 Supermarkets & hypermarkets

- 7.2.2 Convenience stores

- 7.2.3 Specialty stores

- 7.3 Online

- 7.3.1 E-commerce platforms

- 7.3.2 Company-owned websites

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agristo

- 9.2 Aviko B.V.

- 9.3 Bart’s Potato Company

- 9.4 Cavendish Farms

- 9.5 Farm Frites International B.V.

- 9.6 J.R. Simplot Company

- 9.7 Lamb Weston Holdings, Inc.

- 9.8 McCain Foods Limited

- 9.9 Mydibel Group

- 9.10 Pohjolan Peruna Oy