|

市場調查報告書

商品編碼

1740841

冷藏拖車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Refrigerated Trailer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

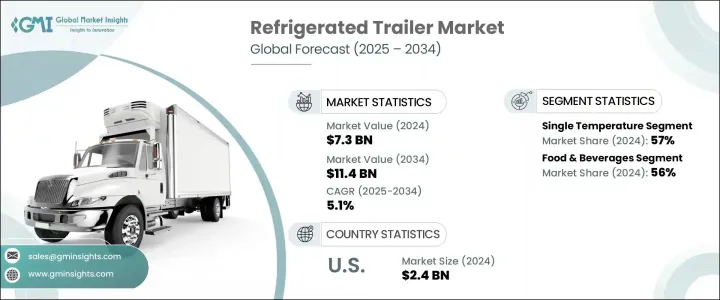

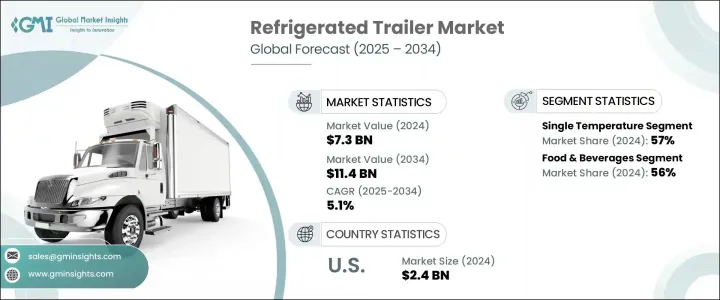

2024年,全球冷藏拖車市場規模達73億美元,預計到2034年將以5.1%的複合年成長率成長,達到114億美元。這一成長主要得益於供應鏈的全球化程度不斷提高,以及對長距離高效運輸易腐產品的需求日益成長。隨著消費者偏好轉向來自世界各地的新鮮、優質和反季節商品,對可靠冷鏈物流的需求激增。這一趨勢在依賴特定溫度範圍來保證運輸貨物完整性和品質的行業尤其明顯。隨著越來越多的國際貨運需要嚴格的溫度控制,冷藏拖車已成為現代物流的重要組成部分。全球食品和製藥網路的演變,加上城市化進程的加速和生活方式的改變,進一步加劇了對溫控運輸系統的需求。這些拖車在確保對溫度敏感的貨物安全抵達、滿足消費者期望和監管標準方面發揮關鍵作用。

除了食品分銷,製藥和醫療保健產業在推動市場擴張方面也發揮越來越重要的作用。如今,許多醫療產品需要精確的溫度條件才能在運輸過程中保持有效。生物製劑和溫敏療法的日益普及,也加劇了對可靠冷鏈基礎設施的需求。冷藏拖車提供了解決方案,可保障產品功效,支援遵守嚴格的業界準則,並增強病患安全。隨著醫療系統和製藥公司業務範圍的擴大,對先進溫控物流解決方案的需求預計將大幅成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 73億美元 |

| 預測值 | 114億美元 |

| 複合年成長率 | 5.1% |

根據溫度類型,冷藏拖車市場分為單溫區、多溫區和低溫區。 2024年,單溫區約佔全球市場的57%,預計到2034年複合年成長率將超過5%。單溫區拖車因其在恆定溫度條件下運輸統一產品類型的效率而廣受歡迎。該區受歡迎程度源自於其設計簡單、操作簡便以及與更複雜的配置相比更低的營運成本。車隊經理通常傾向於使用單溫區拖車進行長途運輸,因為它們具有更高的有效載荷能力和更少的維護需求。它們的簡易性也符合眾多全球運輸指南,這些指南要求保持特定的溫度範圍且不波動。

按應用分析,市場可分為食品飲料、藥品、化學品和其他。 2024年,食品飲料領域佔56%的市場佔有率,預計2025年至2034年的複合年成長率將超過5.4%。由於易腐貨物在運輸過程中始終需要冷藏以防止其變質,因此該領域將繼續保持領先地位。飲食習慣的轉變、冷凍食品消費量的增加以及食品雜貨配送服務的擴展,使得冷藏拖車在該領域變得不可或缺。食品安全和儲存方面的法規合規性也強化了溫控物流的關鍵作用。國際供應鏈需求的增加和零售業態的不斷發展,使得高效率的冷藏運輸成為重中之重。

從材料角度來看,鋁憑藉其輕質、高強度和耐環境磨損等優勢,在市場上佔據領先地位。預計鋁製拖車將繼續佔據主導地位,因為它們能夠提高燃油效率和載重。到2024年,鋁將成為製造商和最終用戶的首選。其優異的導熱性確保內部溫度保持穩定,這對於保存對溫度敏感的貨物至關重要。其較長的使用壽命和較低的維護要求也有助於降低營運成本。此外,其可回收的特性也吸引了那些優先考慮環境永續運輸方式的公司。

從地區來看,美國在2024年引領北美冷藏拖車市場,佔據近86%的地區佔有率,創造了約24億美元的收入。美國強大的市場地位得益於其廣泛的物流網路、對溫度敏感產品的大規模分銷以及嚴格的運輸標準的實施。拖車技術的進步,包括節能系統和智慧監控功能,使冷鏈運作更加高效可靠。因此,營運商正在投資新的車隊技術和即時追蹤技術,以確保溫度合規並降低貨物變質風險。

主要的市場參與者包括那些大力投資永續技術、先進隔熱技術和智慧遠端資訊處理技術,以滿足環境目標和營運需求的公司。這些公司也正在開發電動和混合冷凍設備,以提高能源效率並降低排放。產品創新是核心重點,各公司優先考慮更輕的材料、模組化設計和可客製化功能,以滿足多樣化的產業需求。策略合作和地理擴張仍是鞏固市場地位和提升跨區域客戶服務能力的重要策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 拖車製造商

- 經銷商和分銷商

- 最終用途

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 地區

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 食品貿易日益全球化,易腐食品需求不斷增加

- 對加工食品和冷凍食品的需求不斷成長

- 製藥和醫療保健產業的成長

- 冷凍設備的技術進步

- 嚴格的食品安全和監管標準

- 產業陷阱與挑戰

- 初始成本和營運成本高

- 嚴格的溫度控制要求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按溫度,2021 - 2034 年

- 主要趨勢

- 單溫

- 多溫度

- 低溫

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化學品

- 其他

第7章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 鋁

- 鋼

- 合成的

- 塑膠

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 運輸

- 貯存

- 分配

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Carrier Transicold

- Faymonville

- Fruehauf Trailers

- Gray & Adams

- Great Dane Trailers

- Hwasung Thermo

- Hyundai Translead

- Kidron

- Kogel Trailer

- Krone Trailer

- Lamberet

- Manac

- MaxiTRANS

- Montracon

- Schmitz Cargobull

- Singamas Container

- Sinotruk

- Thermo King

- Utility Trailer Manufacturing Company

- Wabash National

The Global Refrigerated Trailer Market was valued at USD 7.3 billion in 2024 and is estimated to expand at a CAGR of 5.1% to reach USD 11.4 billion by 2034. This growth is largely fueled by the increasing globalization of supply chains and the rising need for efficient transportation of perishable products across long distances. As consumer preferences shift toward fresh, high-quality, and out-of-season items from around the world, the demand for reliable cold chain logistics has surged. This trend is particularly evident in sectors that depend on maintaining specific temperature ranges to preserve the integrity and quality of transported goods. With more international shipments requiring strict temperature control, refrigerated trailers have become a vital component of modern logistics. The evolution of global food and pharmaceutical networks, combined with growing urbanization and lifestyle changes, has further intensified the need for temperature-controlled transportation systems. These trailers play a key role in ensuring that temperature-sensitive goods arrive safely, meeting both consumer expectations and regulatory standards.

In addition to food distribution, the pharmaceutical and healthcare industries are playing an increasingly important role in driving market expansion. Many medical items now require precise temperature conditions to remain effective throughout transit. The growing use of biologics and temperature-sensitive therapeutics has heightened the need for dependable cold chain infrastructure. Refrigerated trailers provide a solution that safeguards product efficacy, supports compliance with strict industry guidelines, and enhances patient safety. As health systems and pharmaceutical companies expand their reach, the demand for advanced temperature-controlled logistics solutions is expected to grow significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 5.1% |

By temperature type, the refrigerated trailer market is segmented into single temperature, multi-temperature, and cryogenic categories. In 2024, the single temperature segment accounted for approximately 57% of the global market and is projected to register a CAGR of over 5% through 2034. Single temperature trailers are widely preferred due to their efficiency in transporting uniform product types under consistent thermal conditions. This segment's popularity stems from its straightforward design, ease of operation, and lower operational costs compared to more complex configurations. Fleet managers often favor single-temperature units for long-distance hauls, as they offer higher payload capacity and demand less maintenance. Their simplicity also aligns with numerous global transportation guidelines, which require specific temperature ranges to be maintained without fluctuation.

When analyzed by application, the market is categorized into food and beverages, pharmaceuticals, chemicals, and others. In 2024, the food and beverages segment dominated with a 56% market share and is expected to grow at a CAGR exceeding 5.4% from 2025 to 2034. This segment continues to lead due to the consistent need for cold storage during transport to prevent spoilage of perishable goods. Shifting dietary patterns, the rise in frozen food consumption, and the expansion of grocery delivery services have made refrigerated trailers indispensable in this field. Regulatory compliance surrounding food safety and storage also reinforces the critical role of temperature-controlled logistics. Enhanced demand from international supply chains and evolving retail formats has made efficient cold transport a top priority.

From a materials standpoint, aluminum holds the leading position in the market due to its favorable attributes, such as lightweight construction, strength, and resistance to environmental wear. Aluminum-based trailers are projected to maintain dominance due to their ability to improve fuel efficiency and increase load capacity. In 2024, aluminum was the preferred choice among manufacturers and end-users alike. Its excellent thermal conductivity ensures that internal temperatures remain stable, which is essential for preserving temperature-sensitive goods. Its long service life and low maintenance requirements also contribute to reduced operating costs. Furthermore, its recyclable nature appeals to companies prioritizing environmentally sustainable transport options.

Regionally, the United States led the refrigerated trailer market in North America in 2024, accounting for nearly 86% of the regional share and generating around USD 2.4 billion in revenue. The country's strong position is driven by its extensive logistics networks, large-scale distribution of temperature-sensitive products, and the implementation of strict transportation standards. Advancements in trailer technologies, including energy-efficient systems and smart monitoring features, have made cold chain operations more efficient and reliable. As a result, operators are investing in new fleet technologies and real-time tracking to ensure temperature compliance and reduce spoilage risks.

Key market participants include companies that are investing heavily in sustainable technologies, advanced insulation, and smart telematics to meet environmental targets and operational needs. These companies are also developing electric and hybrid refrigeration units, offering better energy efficiency and lower emissions. Product innovation is a core focus, with firms prioritizing lighter materials, modular designs, and customizable features to serve diverse industry requirements. Strategic collaborations and geographic expansion remain essential tactics for reinforcing their market presence and enhancing customer service capabilities across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Trailer manufacturers

- 3.2.4 Dealers and distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing globalization of food trade and demand for perishable goods

- 3.11.1.2 Rising demand for processed and frozen foods

- 3.11.1.3 Growth in the pharmaceutical and healthcare sectors

- 3.11.1.4 Technological advancements in refrigeration units

- 3.11.1.5 Stringent food safety and regulatory standards

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial and operational costs

- 3.11.2.2 Stringent temperature control requirements

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Temperature, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single temperature

- 5.3 Multi-temperature

- 5.4 Cryogenic

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Pharmaceuticals

- 6.4 Chemicals

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Aluminum

- 7.3 Steel

- 7.4 Composite

- 7.5 Plastic

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Transportation

- 8.3 Storage

- 8.4 Distribution

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Carrier Transicold

- 10.2 Faymonville

- 10.3 Fruehauf Trailers

- 10.4 Gray & Adams

- 10.5 Great Dane Trailers

- 10.6 Hwasung Thermo

- 10.7 Hyundai Translead

- 10.8 Kidron

- 10.9 Kogel Trailer

- 10.10 Krone Trailer

- 10.11 Lamberet

- 10.12 Manac

- 10.13 MaxiTRANS

- 10.14 Montracon

- 10.15 Schmitz Cargobull

- 10.16 Singamas Container

- 10.17 Sinotruk

- 10.18 Thermo King

- 10.19 Utility Trailer Manufacturing Company

- 10.20 Wabash National