|

市場調查報告書

商品編碼

1740834

道路限速器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Road Speed Limiter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

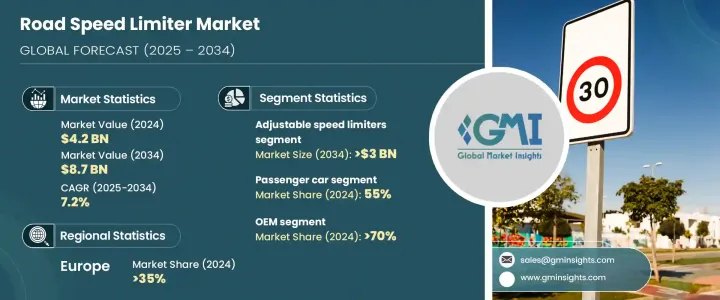

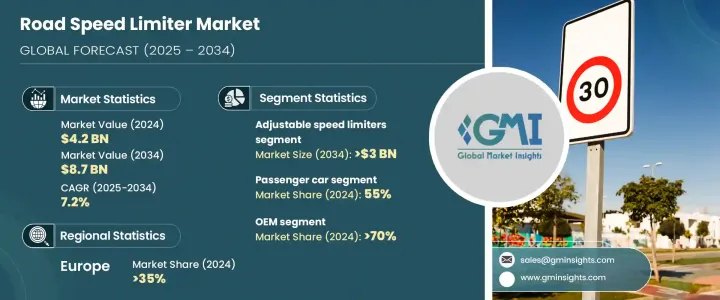

2024 年全球道路限速器市場價值為 42 億美元,預計到 2034 年將以 7.2% 的複合年成長率成長至 87 億美元。這一成長是由監管執法、日益成長的道路安全問題和技術創新共同推動的。世界各國政府都在執行更嚴格的安全法,要求商用車和乘用車安裝限速系統。這些法規旨在減少交通事故、最大限度地減少排放並促進更安全的駕駛習慣。隨著全球汽車產量持續攀升,製造商擴大採用先進的限速系統來滿足合規性和消費者期望。同時,都市化進程的加速和汽車保有量的增加也加劇了對速度控制機制的需求,以減少道路擁塞並支持環境目標。此外,智慧出行和車輛遠端資訊處理的發展正在將限速器從簡單的控制設備轉變為智慧的數據驅動系統。

汽車技術的快速發展顯著提升了限速器的效率和智慧化程度。新一代系統整合了GPS、人工智慧(AI)和各種駕駛輔助技術,能夠根據路況、車輛位置和交通模式即時調整車速。這使得限速系統更具適應性、反應速度更快、更人性化。汽車製造商正在積極擁抱這些升級,使此類系統成為許多新車型的標準配備。隨著汽車產業持續向網聯和自動駕駛汽車轉型,智慧限速的重要性日益凸顯。消費者也越來越青睞安全功能,這進一步推動了對先進限速器的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 7.2% |

根據產品類型,道路限速器市場細分為可調式限速器、智慧型限速器 (ISL)、電子限速器 (ESL)、基於 GPS 的系統和機械限速器。可調式限速器在 2024 年佔據主導地位,佔整個市場的 50% 以上,預計到 2034 年將超過 30 億美元。這些系統提供了適應不同地區駕駛條件、法律要求和車輛類別所需的靈活性。它們能夠快速輕鬆地進行修改,這對於跨轄區營運的車隊尤其有用。這種適應性在提高合規性和防止違規方面發揮著至關重要的作用,使其成為商業營運商和物流供應商的首選解決方案。

依車輛類型分類,市場分為乘用車和商用車。 2024年,乘用車佔了全球55%的市場。這一成長很大程度上得益於針對乘客安全的監管壓力加大,以及全球個人汽車保有量的整體成長。隨著汽車安全標準不斷收緊,尤其是在人口密集的地區,對乘用車嵌入式限速器系統的需求正在強勁成長。這些系統正成為現代安全套件的重要組成部分,有助於減少超速駕駛的發生率,並鼓勵負責任的駕駛行為。

根據最終用途,市場分為原始設備製造商 (OEM) 和售後市場。 2024 年,OEM 佔據了全球 70% 以上的市場。隨著消費者對內建安全技術和智慧駕駛功能的興趣日益濃厚,汽車製造商正在將限速系統直接整合到生產階段。這種積極主動的方法符合人們對環保和科技型汽車日益成長的需求。 OEM 擴大將可調式智慧限速技術嵌入高級駕駛輔助生態系統,以確保符合不斷發展的法律標準,並提高車輛的整體性能和安全性。

從地理來看,歐洲已成為領先的區域市場,2024 年佔全球 35% 以上的佔有率。該地區的領先地位得益於其嚴格的汽車安全法規和廣泛採用的車輛安全技術。強而有力的政策架構和產業標準持續鼓勵製造商部署先進的限速系統。這些監管支援正在為限速器的部署營造統一的格局,並鞏固該地區在全球市場的主導地位。

道路限速器領域的主要參與者包括AVS、奧托立夫、大陸集團、遠端控制技術公司 (RCT)、電裝株式會社、羅伯特·博世、法雷奧集團、沃達豐汽車、SABO電子技術公司和採埃孚。這些公司正在大力投資研發和策略合作,以開發兼具安全性、燃油效率和環保性能的先進解決方案。隨著車輛互聯互通和自動化程度的不斷提高,限速器的未來在於智慧整合,以確保更安全、更清潔、更負責任的出行。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 汽車原廠設備製造商

- 限速裝置廠商

- 基於軟體和人工智慧的遠端資訊處理提供商

- 硬體組件供應商

- 監管和安全技術提供者

- 最終用途

- 利潤率分析

- 川普行政關稅

- 對貿易的影響

- 跨境合規中斷

- 區域監管差異

- 對產業的影響

- 供應方影響(零件和技術供應商)

- 電子元件價格波動

- 採購和裝配鏈調整

- 需求面影響(原始設備製造商和車隊營運商)

- 車輛成本和價格敏感度增加

- 船隊採購動態的變化

- 供應方影響(零件和技術供應商)

- 受影響的主要公司

- 策略產業反應

- 垂直整合和零件本地化

- 與原始設備製造商和監管機構建立策略合作夥伴關係

- 自適應定價和產品定位

- 展望與未來考慮

- 對貿易的影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 價格趨勢

- 地區

- 車輛

- 重要新聞和舉措

- 監管格局

- 案例研究

- 對部隊的影響

- 成長動力

- 嚴格的政府法規和安全標準

- 車輛系統的技術進步

- 道路安全和燃油效率意識不斷提高

- 商業船隊營運成長

- 產業陷阱與挑戰

- 安裝和維護成本高

- 來自司機和操作員的抵制

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品,2021 - 2034 年

- 主要趨勢

- 可調限速器

- 智慧型限速器(ISL)

- 電子限速器(ESL)

- 基於GPS的限速系統

- 機械式限速器

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Aptiv

- Autograde International

- AutoKontrol

- Autoliv

- AVS LTD

- Continental

- Denso

- Elson

- Highway Digital (Nigeria) Limited

- MKP Parts

- Pricol Limited

- Remote Control Technologies (RCT)

- Robert Bosch

- Rosmerta Technologies

- SABO Electronic Technology

- Sturdy

- Transtronix India

- Valeo

- Vodafone Automotive

- ZF Friedrichshafen

The Global Road Speed Limiter Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 8.7 billion by 2034. This growth is being driven by a combination of regulatory enforcement, rising road safety concerns, and technological innovation. Governments around the world are enforcing stricter safety laws that mandate the installation of speed limiting systems in both commercial and passenger vehicles. These regulations aim to reduce traffic accidents, minimize emissions, and promote safer driving habits. As vehicle production continues to climb globally, manufacturers are increasingly incorporating advanced speed limiter systems to meet compliance and consumer expectations. Simultaneously, rising urbanization and growing vehicle ownership have intensified the need for speed control mechanisms to reduce road congestion and support environmental goals. Moreover, the evolution of smart mobility and vehicle telematics is transforming speed limiters from simple control devices to intelligent, data-driven systems.

The rapid advancement in automotive technology has significantly improved the efficiency and intelligence of speed limiters. New-generation systems are now integrated with GPS, Artificial Intelligence (AI), and various driver assistance technologies, allowing real-time speed adjustments based on road conditions, vehicle location, and traffic patterns. This makes speed limiting more adaptive, responsive, and user-friendly. Vehicle manufacturers are embracing these upgrades, making such systems a standard feature in many new models. As the automotive industry continues its shift toward connected and automated vehicles, the relevance of intelligent speed control is becoming more pronounced. Consumers are also showing a growing preference for safety-oriented features, further pushing the demand for sophisticated speed limiters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.2% |

Based on product type, the road speed limiter market is segmented into adjustable speed limiters, intelligent speed limiters (ISL), electronic speed limiters (ESL), GPS-based systems, and mechanical speed limiters. Adjustable speed limiters held the dominant share in 2024, accounting for over 50% of the total market, and are projected to surpass USD 3 billion by 2034. These systems provide the flexibility needed to adapt to different regional driving conditions, legal requirements, and vehicle classes. Their ability to be modified quickly and easily makes them especially useful for fleets operating across various jurisdictions. This adaptability plays a crucial role in enhancing compliance and preventing violations, making them a preferred solution for commercial operators and logistics providers.

By vehicle type, the market is categorized into passenger cars and commercial vehicles. In 2024, passenger vehicles captured 55% of the global share. A significant portion of this growth can be credited to heightened regulatory pressures targeting passenger safety and the overall increase in personal vehicle ownership worldwide. As automotive safety standards continue to tighten, especially in densely populated regions, demand for embedded speed limiter systems in passenger vehicles is gaining strong momentum. These systems are becoming essential components of modern safety packages, helping to reduce the incidence of speeding and encouraging responsible driving behavior.

On the basis of end use, the market is divided into OEMs (Original Equipment Manufacturers) and aftermarket. In 2024, OEMs held more than 70% of the global market. With rising consumer interest in built-in safety technologies and intelligent driving features, automotive manufacturers are integrating speed limiter systems directly at the production stage. This proactive approach aligns with the growing demand for environmentally friendly and tech-savvy vehicles. OEMs are increasingly embedding adjustable and intelligent speed limiting technologies as part of advanced driver assistance ecosystems, ensuring compliance with evolving legal standards and improving overall vehicle performance and safety.

Geographically, Europe emerged as the leading regional market, commanding over 35% of the global share in 2024. The region's leadership is fueled by its rigorous automotive safety laws and widespread adoption of vehicle safety technologies. Strong policy frameworks and industry-wide standards continue to encourage manufacturers to implement cutting-edge speed control systems. This regulatory support is creating a unified landscape for speed limiter deployment and solidifying the region's dominance in the global market.

Key players in the road speed limiter space include AVS, Autoliv, Continental, Remote Control Technologies (RCT), Denso Corporation, Robert Bosch, Valeo SA, Vodafone Automotive, SABO Electronic Technology, and ZF Friedrichshafen. These companies are investing heavily in R&D and strategic collaborations to develop advanced solutions that combine safety, fuel efficiency, and environmental performance. With vehicle connectivity and automation on the rise, the future of speed limiters lies in smart integrations that ensure safer, cleaner, and more responsible mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Speed limit device manufacturers

- 3.2.3 Software & AI-based telematics providers

- 3.2.4 Hardware component suppliers

- 3.2.5 Regulatory and safety technology providers

- 3.2.6 End Use

- 3.3 Profit margin analysis

- 3.4 Trump administrative tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Cross-border compliance disruptions

- 3.4.1.2 Regional regulatory divergence

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.2.1.1 Electronic component price fluctuations

- 3.4.2.1.2 Sourcing and assembly chain adjustments

- 3.4.2.2 Demand-side impact (OEMs & fleet operators)

- 3.4.2.2.1 Increased vehicle cost and price sensitivity

- 3.4.2.2.2 Changes in fleet procurement dynamics

- 3.4.2.1 Supply-side impact (component & tech suppliers)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Vertical integration and component localization

- 3.4.4.2 Strategic partnerships with OEMs and regulators

- 3.4.4.3 Adaptive pricing and product positioning

- 3.4.5 Outlook and Future Considerations

- 3.4.1 Impact on trade

- 3.5 Profit margin analysis

- 3.6 Technology & innovation landscape

- 3.7 Patent analysis

- 3.8 Price trend

- 3.8.1 Region

- 3.8.2 Vehicle

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 1.1 Case studies

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent government regulations and safety standards

- 3.11.1.2 Technological advancements in vehicle systems

- 3.11.1.3 Rising awareness of road safety and fuel efficiency

- 3.11.1.4 Growth in commercial fleet operations

- 3.11.2 Industry pitfalls & challenges

- 3.11.3 High installation and maintenance costs

- 3.11.4 Resistance from drivers and operators

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Adjustable Speed Limiters

- 5.3 Intelligent speed limiters (ISL)

- 5.4 Electronic speed limiters (ESL)

- 5.5 Gps-based speed limiting systems

- 5.6 Mechanical speed limiters

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aptiv

- 9.2 Autograde International

- 9.3 AutoKontrol

- 9.4 Autoliv

- 9.5 AVS LTD

- 9.6 Continental

- 9.7 Denso

- 9.8 Elson

- 9.9 Highway Digital (Nigeria) Limited

- 9.10 MKP Parts

- 9.11 Pricol Limited

- 9.12 Remote Control Technologies (RCT)

- 9.13 Robert Bosch

- 9.14 Rosmerta Technologies

- 9.15 SABO Electronic Technology

- 9.16 Sturdy

- 9.17 Transtronix India

- 9.18 Valeo

- 9.19 Vodafone Automotive

- 9.20 ZF Friedrichshafen