|

市場調查報告書

商品編碼

1740832

發電廠控制系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Power Plant Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

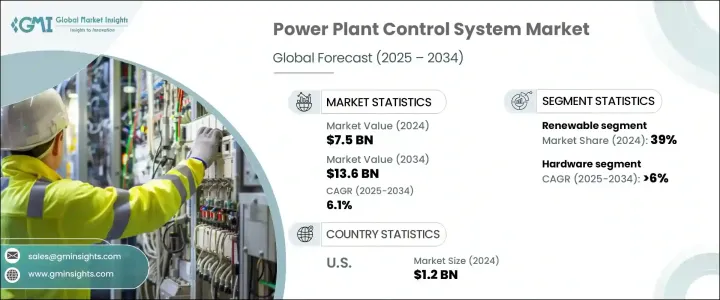

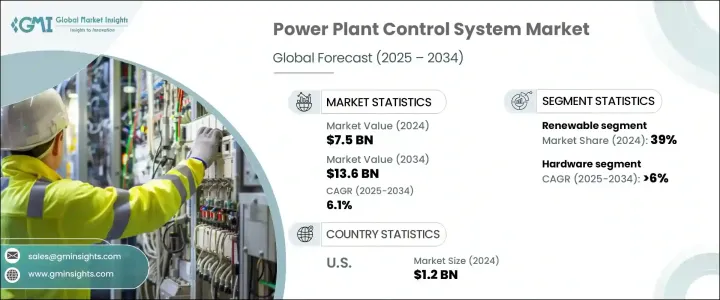

2024年,全球發電廠控制系統市場規模達75億美元,預計到2034年將以6.1%的複合年成長率成長,達到136億美元,這得益於能源產業快速邁向更智慧、更有效率的發電方式。隨著世界面臨著日益成長的能源基礎設施現代化和向清潔能源轉型的壓力,控制系統在重新定義工廠運作方式方面發揮核心作用。電網正變得更加動態化,公用事業公司正在加大對智慧控制技術的投資,這些技術能夠提供即時效能監控、無縫電網整合和增強的可靠性。隨著再生能源和分散式發電的日益普及,對靈活、智慧自動化解決方案的需求比以往任何時候都更加強烈。老化的基礎設施、不斷成長的能源需求以及全球對碳中和的追求,正在推動控制平台的升級和更換浪潮。產業參與者正在利用數位孿生、預測分析和人工智慧解決方案來簡化營運、最大限度地減少停機時間並提高營運效率。政府支持電網現代化、能源安全和減排目標的政策進一步增強了全球控制系統創新的勢頭。

隨著網路安全問題日益嚴重,發電廠控制系統如今正採用內建安全協定、彈性通訊網路和先進的自動化框架進行設計。人工智慧、機器學習和即時診斷等技術正在重塑工廠的流程監控和管理方式,使營運更快、更安全、更可靠。預測性維護工具和先進的故障檢測機制正在幫助公用事業公司減少計劃外停機並提高工廠整體性能。隨著全球製造商和政府機構將資源投入下一代自動化領域,可程式邏輯控制器 (PLC)、分散式控制系統 (DCS) 和 SCADA 平台正成為現代能源生態系統的支柱,推動能源效率的提升、負載最佳化和人工干預的減少。推動再生能源整合和碳中和營運的監管要求正促使公用事業公司徹底改造老化的控制系統,轉而採用模組化、可擴展且適應性強的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 75億美元 |

| 預測值 | 136億美元 |

| 複合年成長率 | 6.1% |

預計硬體市場將保持強勁成長,到2034年複合年成長率將達到6%。火力發電和核電設施的持續升級,以及新電廠的投產,正在推動對符合不斷演變的監管標準的精密控制硬體的需求。天然氣發電廠也高度依賴整合控制系統來管理渦輪機、最佳化負載響應並控制排放,尤其是在聯合循環電廠加速部署的情況下。

到2034年,天然氣發電廠控制系統市場可望以6%的複合年成長率成長,這得益於聯合循環電廠的日益普及。聯合循環電廠將燃氣渦輪機和蒸汽渦輪機配對,以最大限度地提高效率並降低碳排放。這些先進的設施需要高效能的控制解決方案,能夠管理從燃燒調節到熱回收和排放控制等複雜的操作,確保在動態負載條件下保持最佳性能。天然氣作為過渡燃料的日益普及,進一步推動了主要市場的基礎設施投資。

2024年,美國發電廠控制系統市場規模達12億美元,這得益於美國大力推動老化電網的現代化改造。分散式能源、再生能源發電的激增以及對智慧電網的需求,正推動聯邦和州兩級對先進自動化和即時控制技術進行大量投資。

全球發電廠控制系統市場的主要參與者包括ABB、西門子能源、施耐德電氣、三菱重工、艾默生電氣、羅克韋爾自動化、橫河電機、日立能源、通用電氣Vernova、WAGO等。各公司專注於持續創新、人工智慧驅動的自動化以及與公用事業公司建立策略合作夥伴關係,以擴大其市場佔有率。模組化設計、增強型HMI介面、強大的網路安全功能、遠端診斷和全生命週期服務對於供應商保持競爭力並滿足不斷變化的市場需求至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第6章:市場規模及預測:依解決方案,2021 - 2034 年

- 主要趨勢

- 監控與資料採集 (SCADA)

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 工廠資產管理(PAM)

- 工廠生命週期管理 (PLM)

第7章:市場規模及預測:依工廠類型,2021 - 2034

- 主要趨勢

- 煤炭

- 天然氣

- 核

- 水力發電

- 再生能源

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- Bachmann electronic

- Emerson Electric

- GE Vernova

- Hitachi Energy

- Ingeteam

- Meteocontrol

- Mitsubishi Heavy Industries

- Motorola Solutions

- Nexus Integra

- OMRON Corporation

- Petrotech

- Rockwell Automation

- Schneider Electric

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Valmet

- WAGO

- Yokogawa

The Global Power Plant Control System Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 13.6 billion by 2034, fueled by the energy sector's rapid move toward smarter, more efficient power generation. As the world faces mounting pressure to modernize energy infrastructure and transition toward cleaner power, control systems are playing a central role in redefining how plants operate. Power grids are becoming more dynamic, and utilities are stepping up investments in smart control technologies that deliver real-time performance monitoring, seamless grid integration, and enhanced reliability. With the growing adoption of renewable energy sources and decentralized generation, the need for flexible, intelligent automation solutions is stronger than ever. Aging infrastructure, rising energy demands, and the global push for carbon neutrality are driving a steady wave of upgrades and replacements in control platforms. Industry players are leveraging digital twins, predictive analytics, and AI-powered solutions to streamline operations, minimize downtime, and boost operational efficiency. Government policies supporting grid modernization, energy security, and emission reduction targets are further intensifying the momentum for control system innovation across the global landscape.

With cybersecurity concerns rising, power plant control systems are now being designed with built-in security protocols, resilient communication networks, and advanced automation frameworks. Technologies such as artificial intelligence, machine learning, and real-time diagnostics are reshaping how plants monitor and manage processes, making operations faster, safer, and more reliable. Predictive maintenance tools and advanced fault detection mechanisms are helping utilities reduce unplanned outages and improve overall plant performance. As global manufacturers and government bodies pour resources into next-generation automation, programmable logic controllers (PLC), distributed control systems (DCS), and SCADA platforms are becoming the backbone of modern energy ecosystems, driving gains in energy efficiency, load optimization, and reduced manual interventions. Regulatory mandates promoting renewable energy integration and carbon-neutral operations are prompting utilities to overhaul aging control systems in favor of modular, scalable, and highly adaptable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 6.1% |

The hardware segment is expected to maintain robust growth with a projected CAGR of 6% through 2034. Ongoing upgrades in thermal and nuclear power facilities, along with the commissioning of new plants, are fueling the demand for precision control hardware that meets evolving regulatory standards. Natural gas power plants are also leaning heavily on integrated control systems to manage turbines, optimize load response, and curb emissions, especially with the accelerating deployment of combined cycle plants.

The natural gas power plant control system segment is poised to grow at a CAGR of 6% through 2034, supported by the rising popularity of combined cycle plants that pair gas and steam turbines to maximize efficiency and lower carbon emissions. These sophisticated facilities demand high-performance control solutions capable of managing complex operations from combustion tuning to heat recovery and emissions control, ensuring peak performance under dynamic load conditions. The growing preference for natural gas as a transitional fuel is further boosting infrastructure investments across key markets.

The United States Power Plant Control System Market reached USD 1.2 billion in 2024, backed by aggressive initiatives to modernize the country's aging energy grid. A surge in distributed energy resources, renewable generation, and demand for smarter grids is driving heavy investment in advanced automation and real-time control technologies at both federal and state levels.

Key players active in the Global Power Plant Control System Market include ABB, Siemens Energy, Schneider Electric, Mitsubishi Heavy Industries, Emerson Electric, Rockwell Automation, Yokogawa, Hitachi Energy, GE Vernova, WAGO, and others. Companies are focusing on continuous innovation, AI-driven automation, and strategic partnerships with utilities to expand their market presence. Modular designs, enhanced HMI interfaces, strong cybersecurity features, remote diagnostics, and full lifecycle services are becoming critical for vendors to stay competitive and meet evolving market demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Size and Forecast, By Solution, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Supervisory Control & Data Acquisition (SCADA)

- 6.3 Distributed Control System (DCS)

- 6.4 Programmable Logic Controller (PLC)

- 6.5 Plant Asset Management (PAM)

- 6.6 Plant Lifecycle Management (PLM)

Chapter 7 Market Size and Forecast, By Plant Type, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Coal

- 7.3 Natural gas

- 7.4 Nuclear

- 7.5 Hydroelectric

- 7.6 Renewable

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Bachmann electronic

- 9.3 Emerson Electric

- 9.4 GE Vernova

- 9.5 Hitachi Energy

- 9.6 Ingeteam

- 9.7 Meteocontrol

- 9.8 Mitsubishi Heavy Industries

- 9.9 Motorola Solutions

- 9.10 Nexus Integra

- 9.11 OMRON Corporation

- 9.12 Petrotech

- 9.13 Rockwell Automation

- 9.14 Schneider Electric

- 9.15 Siemens Energy

- 9.16 Toshiba Energy Systems & Solutions Corporation

- 9.17 Valmet

- 9.18 WAGO

- 9.19 Yokogawa