|

市場調查報告書

商品編碼

1740831

注射器及注射包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Syringes and Injectable Drugs Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

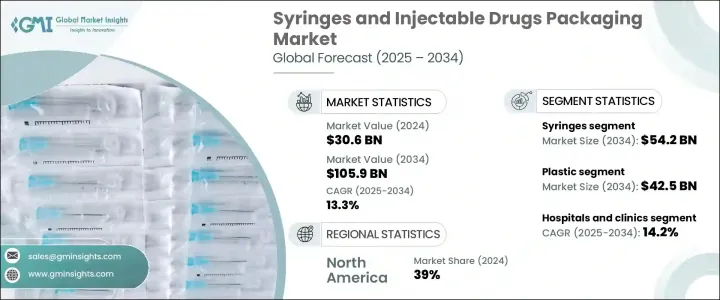

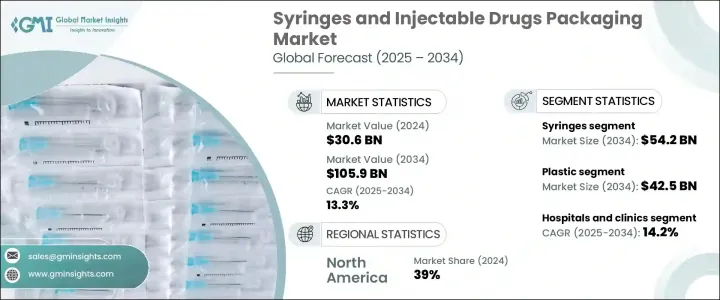

2024 年全球注射器和注射包裝市場價值為 306 億美元,預計到 2034 年將以 13.3% 的複合年成長率成長,達到 1059 億美元,這主要得益於注射療法需求的不斷成長,尤其是在慢性病和傳染病病例不斷增加的背景下。醫療保健行業正在快速轉向注射給藥,因為它能夠快速緩解症狀並精確給藥。這種轉變正在重塑醫藥包裝格局,推動製造商不斷創新並適應不斷變化的醫療需求。微創治療的激增、生物製劑的擴展以及對自我給藥日益成長的偏好,正在強化先進包裝系統的關鍵作用。隨著製藥公司不斷擴大其注射劑產品組合,對確保無菌、易用和符合法規要求的包裝的需求變得比以往任何時候都更加迫切。此外,全球健康危機和人口老化進一步加劇了對有效、安全和可擴展的藥物輸送解決方案的需求,特別是在緊急、門診和家庭護理環境中。

隨著注射劑在快速給藥中的應用日益廣泛,尤其是在門診和急診護理中,對安全無菌包裝的需求也日益成長,以維護藥物的完整性和患者安全。確保注射器和注射劑的包裝符合嚴格的安全標準,對於防止污染、維持藥物穩定性以及遵守臨床環境中的醫療保健法規至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 306億美元 |

| 預測值 | 1059億美元 |

| 複合年成長率 | 13.3% |

儘管市場成長迅速,但也面臨顯著的挑戰。不斷變化的貿易政策和醫療部件關稅使定價結構複雜化,並限制了產品的供應。近期進口材料關稅上調推高了製造成本,尤其是在無菌注射和低成本療法領域,因為這些產品的價格承受能力至關重要。產業參與者正在透過囤積原料和推動分階段的政策轉變來應對,但供應鏈中斷仍然是製造商在不影響品質或成本效益的情況下滿足不斷成長的需求的一大障礙。

根據產品類型,市場細分為注射器和針對注射藥物的包裝形式。預計到2034年,光是注射器就將創造542億美元的市場價值,因為醫院、診所和家庭護理機構擴大採用預消毒、防篡改的解決方案,以降低污染風險並提高藥物輸送的安全性。注射療法在疫苗、糖尿病和自體免疫疾病領域的應用日益廣泛,也推動了一次性、安全增強型注射器系統的普及。

就材料而言,市場包括塑膠、玻璃和其他專用基材。預計到2034年,塑膠將佔據主導地位,市場規模將達到425億美元,這得益於其輕質、抗破碎和價格實惠的特性。塑膠是預充式注射器和自注射裝置的首選材料,支援整合安全功能(例如伸縮針頭和劑量追蹤系統)的設計。

2024年,北美佔據了39%的市場佔有率,並將繼續佔據主導地位,這得益於其強大的製藥製造基礎設施和先進的醫療保健系統。隨著醫院和家庭護理機構尋求降低感染率並簡化藥物管理,對預充式和一次性注射包裝的需求正在快速成長。

包括 Nipro Europe Group Companies、Gerresheimer、West Pharmaceutical Services, Inc.、Schott AG 和 BD 在內的領先公司正在投資研發、擴大製造足跡、實現生產線自動化並建立戰略合作夥伴關係,以提高產品安全性、提高生產效率並保持全球市場的法規合規性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 注射藥物輸送需求增加

- 消費者疫苗接種和其他藥物的成長

- 包裝技術進步

- 永續性和環境壓力

- 人口老化和全球醫療保健涵蓋範圍的擴大

- 產業陷阱與挑戰

- 設備相容性和藥物穩定性問題

- 原物料供應限制

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 注射器

- 預充式注射器

- 傳統注射器

- 注射藥品包裝

- 小瓶

- 安瓿

- 墨水匣

- 瓶子

第6章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 塑膠

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚碳酸酯(PC)

- 其他

- 玻璃

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心(ASC)

- 製藥和生物技術公司

- 家庭醫療保健環境

- 疫苗接種中心

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- BD

- AptarGroup, Inc.

- Bormioli Pharma SpA

- Catalent, Inc

- Credence MedSystems, Inc.

- DWK Life Sciences.

- Gerresheimer

- J.Penner Corporation

- Laboratorios Farmaceuticos Rovi SA

- Nipro Europe Group Companies

- Schott AG

- SGD Pharma

- Shandong Province Medicinal Glass Co., Ltd.

- Stevanato Group

- Terumo Europe NV

- USIN Advance Co., Ltd.

- Weigao Group

- West Pharmaceutical Services, Inc.

The Global Syringes and Injectable Drugs Packaging Market was valued at USD 30.6 billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 105.9 billion by 2034, driven by the rising demand for injectable therapies, especially amid increasing cases of chronic and infectious diseases. The healthcare industry is experiencing a rapid shift toward injectable drug delivery due to its ability to provide fast-acting relief and precise dosing. This shift is reshaping the pharmaceutical packaging landscape, pushing manufacturers to innovate and adapt to evolving medical needs. The surge in minimally invasive treatments, expansion of biologics, and growing preference for self-administered drugs are reinforcing the critical role of advanced packaging systems. As pharmaceutical companies continue to expand their injectable portfolios, the demand for packaging that ensures sterility, ease of use, and regulatory compliance is becoming more urgent than ever. Moreover, global health crises and aging populations are further intensifying the need for effective, safe, and scalable drug delivery solutions, particularly in emergency, ambulatory, and home-based care settings.

The increasing use of injectables for quick drug administration, especially in outpatient and emergency care, has created a heightened need for secure, sterile packaging that upholds drug integrity and patient safety. Ensuring the packaging of syringes and injectable drugs meets strict safety standards is essential to prevent contamination, maintain drug stability, and comply with healthcare regulations across clinical settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.6 Billion |

| Forecast Value | $105.9 Billion |

| CAGR | 13.3% |

Despite its rapid growth, the market is facing notable challenges. Shifting trade policies and tariffs on medical components are complicating pricing structures and limiting product availability. Recent tariff hikes on imported materials have driven up manufacturing costs, especially for sterile injectables and low-cost therapies where affordability is critical. Industry players are responding by stockpiling raw materials and pushing for phased policy shifts, but supply chain disruptions remain a significant hurdle for manufacturers aiming to meet rising demand without compromising quality or cost-efficiency.

Based on product type, the market is segmented into syringes and packaging formats tailored to injectable drugs. Syringes alone are expected to generate USD 54.2 billion by 2034 as hospitals, clinics, and home care settings increasingly adopt pre-sterilized, tamper-evident solutions to reduce contamination risks and enhance drug delivery safety. The expanding use of injectable therapies across vaccines, diabetes, and autoimmune diseases is also driving the adoption of single-use, safety-enhanced syringe systems.

In terms of material, the market includes plastic, glass, and other specialized substrates. Plastic is projected to lead with an estimated market size of USD 42.5 billion by 2034 due to its lightweight, break-resistant, and affordable properties. Plastic is the material of choice for prefilled syringes and self-injection devices, supporting designs with integrated safety features like retractable needles and dose-tracking systems.

North America held a 39% market share in 2024 and continues to dominate, thanks to its strong pharmaceutical manufacturing infrastructure and advanced healthcare systems. The demand for prefilled and disposable injectable packaging is rising fast as hospitals and home care providers seek to reduce infection rates and streamline drug administration.

Leading companies, including Nipro Europe Group Companies, Gerresheimer, West Pharmaceutical Services, Inc., Schott AG, and BD, are investing in R&D, expanding manufacturing footprints, automating production lines, and building strategic partnerships to improve product safety, boost production efficiency, and maintain regulatory compliance across global markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increased demand for injectable drug delivery

- 3.3.1.2 Growth in consumer vaccination and other drugs

- 3.3.1.3 Technological advancements in packaging

- 3.3.1.4 Sustainability and environmental pressures

- 3.3.1.5 Aging population and increasing global healthcare access

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Device compatibility and drug stability issues

- 3.3.2.2 Raw material supply constraints

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Syringes

- 5.2.1 Prefilled syringes

- 5.2.2 Conventional syringes

- 5.3 Injectable drugs packaging

- 5.3.1 Vials

- 5.3.2 Ampoules

- 5.3.3 Cartridges

- 5.3.4 Bottles

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Plastic

- 6.2.1 Polypropylene (PP)

- 6.2.2 Polyethylene (PE)

- 6.2.3 Polycarbonate (PC)

- 6.2.4 Others

- 6.3 Glass

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Pharmaceutical & biotechnology companies

- 7.5 Home healthcare settings

- 7.6 Vaccination centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BD

- 9.2 AptarGroup, Inc.

- 9.3 Bormioli Pharma S.p.A.

- 9.4 Catalent, Inc

- 9.5 Credence MedSystems, Inc.

- 9.6 DWK Life Sciences.

- 9.7 Gerresheimer

- 9.8 J.Penner Corporation

- 9.9 Laboratorios Farmaceuticos Rovi S.A.

- 9.10 Nipro Europe Group Companies

- 9.11 Schott AG

- 9.12 SGD Pharma

- 9.13 Shandong Province Medicinal Glass Co., Ltd.

- 9.14 Stevanato Group

- 9.15 Terumo Europe NV

- 9.16 USIN Advance Co., Ltd.

- 9.17 Weigao Group

- 9.18 West Pharmaceutical Services, Inc.