|

市場調查報告書

商品編碼

1740830

飛機 DC-DC 轉換器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aircraft DC-DC Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

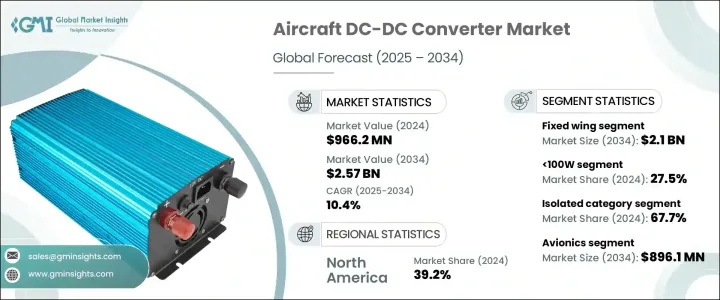

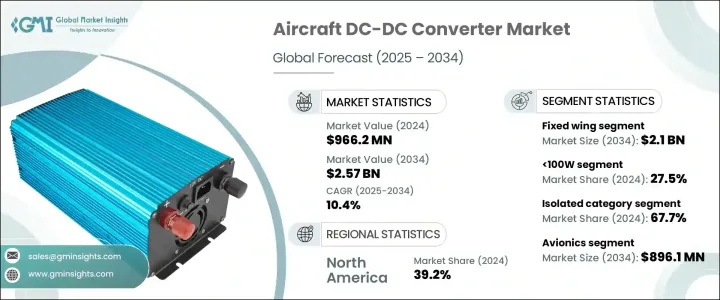

2024 年全球飛機直流-直流轉換器市場價值為 9.662 億美元,預計到 2034 年將以 10.4% 的複合年成長率成長,達到 25.7 億美元。全球飛機產量的不斷增加是推動航空系統所用直流-直流轉換器需求的主要因素。這些組件對於管理日益複雜的飛機電力系統中的電壓水平至關重要。然而,國際貿易政策的變化,包括對半導體和被動電子元件等關鍵進口產品徵收關稅,導致原料成本上升。相互貿易限制造成的不確定性擾亂了全球供應鏈,造成採購延遲並延長生產週期。依賴將電氣元件一致整合到複雜系統中的飛機製造商因這些貿易壁壘和延誤而面臨挑戰。

同時,航空業的現代化進程也推動了對先進電源管理系統的需求。由於新一代飛機需要為各種機上系統提供高效、穩定的電力輸送,DC-DC 轉換器的角色也變得越來越重要。這些轉換器有助於確保新舊飛機電氣基礎設施之間的兼容性,支援下一代航空電子設備和電子系統的整合。如今,飛機需要特定的電壓等級來支援敏感的飛行電子設備,而 DC-DC 轉換器在穩定和轉換電源以滿足這些需求方面發揮著至關重要的作用。隨著飛機逐漸發展成為更電動化的平台,對氣動和液壓系統的依賴減少,電源轉換技術也必須不斷進步,以支援更輕、更有效率的設計。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.662億美元 |

| 預測值 | 25.7億美元 |

| 複合年成長率 | 10.4% |

根據飛機類型,市場分為固定翼和旋翼。預計到2034年,固定翼市場規模將達21億美元。固定翼飛機日益向電動系統轉型,推動了DC-DC轉換器的採用,這對於管理各種電壓需求至關重要。這些系統對於新型飛機尤其重要,因為新型飛機越來越依賴多電架構(MEA)來提高能源效率並減輕重量。固定翼平台對先進機載系統的需求不斷成長,將持續推動該領域DC-DC轉換器的成長。

就輸出功率而言,飛機DC-DC轉換器市場細分為100W、100W-500W及500W以上三個類別。 2024年,100W細分市場佔據了27.5%的市場。這一成長得益於飛機上低功耗電子設備、感測器和航空電子模組的使用日益增多。這些組件需要穩定的低輸出電壓,而100W轉換器能夠有效滿足此要求。此外,老舊飛機升級為現代低功耗系統也進一步支援了對此輸出類別的需求,因為它可以與現有電力基礎設施無縫整合。

根據產品類別,市場進一步細分為隔離式和非隔離式轉換器。 2024年,隔離式轉換器佔最大佔有率,達67.7%。這些轉換器對於現代飛機至關重要,因為現代飛機需要電氣隔離來確保系統的安全性和穩定性。隔離式轉換器專為處理高功率應用而設計,是新型飛機設計中複雜電氣操作的理想選擇。它們廣泛應用於推進系統,並為機載電子設備提供清潔穩定的電源,這對於維持飛機各個子系統的性能和電氣安全至關重要。

按應用分類,市場涵蓋航空電子、配電、照明系統、雷達和電子戰系統、機載娛樂等。其中,航空電子領域預計到2034年將創造8.961億美元的市場價值。隨著航空電子系統的複雜性和精密度不斷提升,對穩定、無干擾電源的需求也隨之成長。 DC-DC轉換器有助於為引擎控制單元、駕駛艙顯示器和飛行導航系統等關鍵任務電子設備提供可靠的電壓。隨著飛機不斷採用數位航空電子技術,透過先進轉換器實現高效能電源管理的需求也日益成長。

從地區來看,北美在2024年以39.2%的市佔率領先市場。這一領先地位得益於該地區商用航空的擴張和機隊的現代化升級。航空公司和製造商擴大採用先進的電子飛行系統,而這些系統高度依賴高性能DC-DC轉換器來確保電源穩定性。此外,在區域機隊中,MEA系統的應用日益受到重視,這也進一步催生了對下一代電源轉換解決方案的需求。

飛機直流-直流轉換器市場競爭激烈,霍尼韋爾國際公司、村田製作所、TDK-Lambda Corporation、Advanced Energy 和 Vicor Corporation 等主要廠商合計佔超過 30% 的市場佔有率。這些公司積極投資開發緊湊、節能且熱最佳化的轉換器解決方案,以滿足嚴格的航空認證標準。為了支援不斷發展的飛機技術,主要製造商還推出了先進的產品架構,例如基於氮化鎵 (GaN) 的設計、模組化解決方案和諧振拓撲。他們的創新旨在滿足商用和國防航空領域對可靠、可擴展且能夠處理不同電壓和功率需求的電源轉換器日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 飛機產量不斷增加

- 先進航空電子設備和電子系統的整合度不斷提高

- 對輕量化和高效能電源解決方案的需求

- 更加重視燃油效率和減排

- 日益關注先進的空中機動性

- 產業陷阱與挑戰

- 監管和認證門檻高

- 設計複雜性和整合限制

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依飛機類型,2021-2034

- 主要趨勢

- 固定翼

- 旋翼機

第6章:市場估計與預測:按輸出功率,2021-2034

- 主要趨勢

- <100瓦

- 100瓦–500瓦

- >500瓦

第7章:市場估計與預測:依類別,2021-2034

- 主要趨勢

- 孤立

- 非隔離

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 航空電子設備

- 配電

- 照明系統

- 雷達和電子戰系統

- 機上娛樂(IFE)

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Technologies

- Advanced Energy

- AJ's Power Source Inc.

- BrightLoop

- Crane Aerospace & Electronics

- Helios Power Solutions

- Honeywell International Inc.

- KGS Electronics

- Meggitt PLC.

- Murata Manufacturing Co., Ltd.

- Pico Electronics

- SynQor, Inc.

- Tame-Power

- TDK-Lambda Corporation

- Texas Instruments Incorporated

- Vicor Corporation

- VPT, Inc.

- XP Power

The Global Aircraft DC-DC Converter Market was valued at USD 966.2 million in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 2.57 billion by 2034. The increasing number of aircraft being produced worldwide is a major factor driving demand for DC-DC converters used in aviation systems. These components are vital for managing voltage levels in increasingly sophisticated aircraft power systems. However, shifts in international trade policies, including tariffs on critical imports such as semiconductors and passive electronic components, have led to rising raw material costs. The uncertainty caused by reciprocal trade restrictions has disrupted global supply chains, creating procurement delays and extending production cycles. Aircraft manufacturers, who rely on consistent integration of electrical components into complex systems, have faced challenges as a result of these trade barriers and delays.

At the same time, modernization efforts in the aviation sector are boosting demand for advanced power management systems. As new-generation aircraft require efficient, stable power delivery for a variety of onboard systems, the role of DC-DC converters becomes increasingly critical. These converters help ensure compatibility between older and newer aircraft electrical infrastructures, supporting the integration of next-gen avionics and electronic systems. Aircraft now require specific voltage levels to support sensitive flight electronics, and DC-DC converters fill the essential role of stabilizing and converting power to meet those needs. As aircraft evolve into more electrically driven platforms, with reduced reliance on pneumatic and hydraulic systems, power conversion technology must also advance to support lighter, more efficient designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $966.2 Million |

| Forecast Value | $2.57 Billion |

| CAGR | 10.4% |

Based on aircraft type, the market is categorized into fixed wing and rotary wing. The fixed wing segment is anticipated to reach USD 2.1 billion by 2034. The growing transition toward electrically powered systems in fixed wing aircraft is encouraging the adoption of DC-DC converters, which are essential for managing a wide range of voltage requirements. These systems are especially important in newer aircraft models, which increasingly rely on more electric architecture (MEA) to enhance energy efficiency and reduce weight. The rising demand for advanced onboard systems in fixed wing platforms continues to drive the growth of DC-DC converters in this segment.

In terms of output power, the aircraft DC-DC converter market is segmented into 100W, 100W-500W, and above 500W categories. The 100W segment accounted for 27.5% of the market in 2024. This growth is supported by the rising usage of low-power electronics, sensors, and avionics modules within aircraft. These components require stable, low-output voltage, and 100W converters meet this requirement effectively. Additionally, the retrofitting of older aircraft with modern low-power systems further supports the demand for this output category, as it allows for seamless integration with existing power infrastructure.

The market is further divided into isolated and non-isolated converters based on product category. In 2024, isolated converters held the largest share at 67.7%. These are essential in modern aircraft, where electrical isolation is needed to ensure system safety and stability. Isolated converters are designed to handle high-wattage applications, making them ideal for complex electrical operations in newer aircraft designs. They are used extensively in propulsion systems and to provide clean, stable power to onboard electronics, which is crucial for maintaining performance and electrical safety across various aircraft subsystems.

By application, the market includes avionics, power distribution, lighting systems, radar and electronic warfare systems, in-flight entertainment, and others. Among these, the avionics segment is projected to generate USD 896.1 million by 2034. As the complexity and sophistication of avionics systems continue to rise, the need for stable, interference-free power grows in parallel. DC-DC converters help provide reliable voltage for mission-critical electronics such as engine control units, cockpit displays, and flight navigation systems. As aircraft continue to adopt digital avionics technologies, the demand for efficient power management through advanced converters also increases.

Regionally, North America led the market in 2024 with a 39.2% share. This leadership position is attributed to the expansion of commercial aviation and the modernization of aircraft fleets in the region. Airlines and manufacturers are increasingly adopting advanced electronic flight systems, which rely heavily on high-performance DC-DC converters for power stability. Moreover, the growing focus on implementing MEA systems in regional fleets is creating further demand for next-gen power conversion solutions.

The aircraft DC-DC converter market is highly competitive, with major players such as Honeywell International Inc., Murata Manufacturing Co., TDK-Lambda Corporation, Ltd., Advanced Energy, and Vicor Corporation collectively accounting for over 30% of the total market share. These companies are actively investing in the development of compact, energy-efficient, and thermally optimized converter solutions that meet rigorous aviation certification standards. To support evolving aircraft technologies, key manufacturers are also introducing advanced product architectures such as gallium nitride (GaN)-based designs, modular solutions, and resonant topologies. Their innovations aim to address the growing demand from both commercial and defense aviation sectors for power converters that are reliable, scalable, and capable of handling varied voltage and wattage requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising production of aircraft

- 3.3.1.2 Increasing integration of advanced avionics and electronic systems

- 3.3.1.3 Demand for lightweight and high-efficiency power solutions

- 3.3.1.4 Increased focus on fuel efficiency and emission reduction

- 3.3.1.5 Growing focus towards advanced air mobility

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High regulatory and certification barriers

- 3.3.2.2 Design complexity and integration constraints

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Fixed wing

- 5.3 Rotary wing

Chapter 6 Market Estimates & Forecast, By Output Power, 2021-2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 <100W

- 6.3 100W–500W

- 6.4 >500W

Chapter 7 Market Estimates & Forecast, By Category, 2021-2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Isolated

- 7.3 Non-isolated

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Avionics

- 8.3 Power distribution

- 8.4 Lighting systems

- 8.5 Radar & electronic warfare systems

- 8.6 In-flight entertainment (IFE)

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Technologies

- 10.2 Advanced Energy

- 10.3 AJ's Power Source Inc.

- 10.4 BrightLoop

- 10.5 Crane Aerospace & Electronics

- 10.6 Helios Power Solutions

- 10.7 Honeywell International Inc.

- 10.8 KGS Electronics

- 10.9 Meggitt PLC.

- 10.10 Murata Manufacturing Co., Ltd.

- 10.11 Pico Electronics

- 10.12 SynQor, Inc.

- 10.13 Tame-Power

- 10.14 TDK-Lambda Corporation

- 10.15 Texas Instruments Incorporated

- 10.16 Vicor Corporation

- 10.17 VPT, Inc.

- 10.18 XP Power