|

市場調查報告書

商品編碼

1740824

汽車智慧表面市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Smart Surface Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

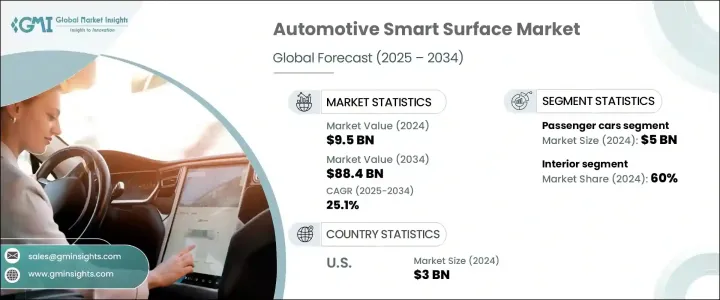

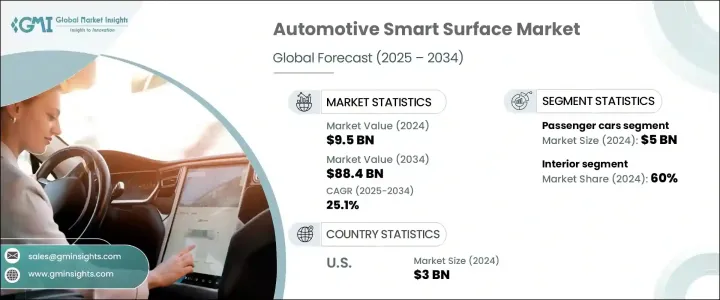

2024 年全球汽車智慧表面市場價值為 95 億美元,預計到 2034 年將以 25.1% 的複合年成長率成長,達到 884 億美元。這一令人印象深刻的成長得益於連網汽車內飾日益整合、材料和人機介面 (HMI) 的技術進步,以及消費者對更先進的數位化座艙體驗的強烈追求。隨著電動車和自動駕駛汽車的興起,汽車製造商面臨越來越大的壓力,需要透過融合設計與功能來提升汽車內飾,而智慧表面則成為這一轉變的核心。隨著對汽車先進技術的需求不斷成長,市場也正在經歷一波創新浪潮,更智慧、更直覺的系統正在成為汽車設計的標準。

車輛的智慧表面不再僅僅起到美觀的作用。這些尖端的表面將觸控、動態照明、觸覺回饋和數位顯示器融入儀表板、車門板和中控台等關鍵內裝部件。隨著傳統實體按鈕的逐漸淘汰,新的電容式和手勢控制技術正在被應用,以提升駕駛便利性並改善座艙的人體工學。可印刷電子和透明導電材料的進步推動了這項技術的發展,它們對於支援安全系統和資訊娛樂功能至關重要。此外,電動車和自動駕駛汽車對個人化、互聯互通和節省空間的解決方案的需求也持續推動著這個市場的發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 95億美元 |

| 預測值 | 884億美元 |

| 複合年成長率 | 25.1% |

自修復塗層、表面整合感測器和曲面 3D 介面等關鍵創新正在徹底改變座艙設計。隨著消費者對使用者友善高科技環境的需求日益成長,汽車原始設備製造商正大力投資智慧表面技術,以滿足這些不斷變化的需求。共享出行的興起以及高階電動車 (EV) 的日益普及,進一步加速了人們對清潔、可自訂且視覺上整合的智慧內裝元素的需求。

就車輛類別而言,乘用車市場在2024年創造了50億美元的收入,預計在整個預測期內仍將保持主導地位。該市場受益於消費者對座艙數位功能日益成長的需求,這些功能可提升舒適性、互動性和個人化。電動車和自動駕駛汽車的廣泛普及,促使汽車製造商將響應式表面與嵌入式觸控、氛圍燈和感測器驅動的介面相整合,進一步契合未來主義、功能強大的座艙環境趨勢。

在各種表麵類型中,到2024年,內裝智慧表面將佔據60%的佔有率。隨著汽車製造商逐漸放棄傳統的操控方式,他們正在投資於具有電容式觸控、觸覺回饋和動態照明功能的多功能無縫顯示器。這些創新不僅提升了用戶的便利性,而且對於豪華電動車和高階汽車而言至關重要,因為這些汽車的品牌價值與尖端技術的整合息息相關。

2024年,美國汽車智慧表面市場規模達30億美元,預計到2034年複合年成長率將達25.4%。這一成長得益於美國先進的研發生態系統、對下一代技術的早期採用以及不斷成長的豪華電動車市場。美國汽車製造商和一級供應商正加強合作,共同開發用於高階和中階車型的智慧人機介面 (HMI) 系統、互動式儀錶板和響應式內裝面板。這些系統也正被融入更廣泛的智慧出行趨勢,例如駕駛輔助技術、人工智慧助理和互聯資訊娛樂生態系統。

佛吉亞、科思創、現代、Dura、Canatu、Gentex、大陸、TactoTek、庫爾茲和Flex等市場領導者正在積極塑造汽車智慧表面的未來。為了鞏固市場地位,這些公司專注於與汽車原始設備製造商建立合作夥伴關係,擴大多功能材料的研發規模,並開發能夠適應不斷發展的汽車電子設備的模組化平台。一些企業也優先考慮永續和輕量化的基材,而其他企業則投資在地化生產,以更好地滿足區域需求,確保所有車型的能源效率、安全合規性和無縫的用戶互動。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 車載連線和使用者體驗的需求不斷成長

- 材料和製造技術的進步

- 電動車和自動駕駛汽車的成長

- OEM注重減輕重量和設計整合

- 產業陷阱與挑戰

- 生產成本高

- 耐久性和環境敏感性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按表面,2021 - 2034 年

- 主要趨勢

- 內部的

- 外部的

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 運輸

- 電子產品

- 建造

- 醫療保健

- 能源

- 其他

第8章:市場估計與預測:依技術分類 2021 - 2034

- 主要趨勢

- 觸控螢幕介面

- 自修復表面

- 嵌入式感測器

- 自適應表面

- 自清潔表面

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- 3M

- BASF

- Canatu

- Continental

- Covestro

- Dura

- Faurecia

- Flex

- Gentex

- Hyundai Mobis

- KURZ

- LG

- Marelli

- Motherson

- Panasonic

- Preh

- Sekisui

- TactoTek

- Toyota Boshoku

- Yanfeng

The Global Automotive Smart Surface Market was valued at USD 9.5 billion in 2024 and is estimatedected to grow at a CAGR of 25.1% to reach USD 88.4 billion by 2034. This impressive growth is fueled by the increasing integration of connected vehicle interiors, technological advancements in materials and human-machine interfaces (HMIs), and a strong consumer shift toward more advanced digital in-cabin experiences. With the rise of electric and autonomous vehicles, automakers are under increasing pressure to enhance vehicle interiors by blending design and functionality, placing smart surfaces at the heart of this transformation. As demand for advanced technology in vehicles grows, the market is also witnessing a wave of innovation, with smarter, more intuitive systems becoming a standard in vehicle designs.

Smart surfaces in vehicles no longer serve merely an aesthetic function. These cutting-edge surfaces incorporate touch-responsive controls, dynamic lighting, haptic feedback, and digital displays into key interior components such as dashboards, door panels, and center consoles. As traditional physical buttons phase out, new capacitive and gesture-based controls are being implemented to enhance driver convenience and improve cabin ergonomics. The growth of this technology is propelled by the progress in printable electronics and transparent conductive materials, which are pivotal in supporting safety systems and infotainment functions. Moreover, the demand for personalized, connected, and space-saving solutions in electric and autonomous vehicles continues to drive this market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $88.4 Billion |

| CAGR | 25.1% |

Key innovations such as self-healing coatings, surface-integrated sensors, and curved 3D interfaces are revolutionizing cabin design. As consumers increasingly demand user-friendly, high-tech environments, automotive OEMs are heavily investing in smart surface technologies that meet these evolving expectations. The shift toward shared mobility and the increasing popularity of premium electric vehicles (EVs) further accelerate the need for clean, customizable, and visually integrated smart interior elements.

In terms of vehicle categories, the passenger cars segment generated USD 5 billion in 2024 and is expected to maintain its dominance throughout the forecast period. This segment benefits from the rising consumer demand for in-cabin digital features, which enhance comfort, interactivity, and personalization. The widespread adoption of EVs and autonomous models is pushing automakers to integrate responsive surfaces with embedded touch controls, ambient lighting, and sensor-driven interfaces, further aligning with the trend toward futuristic, highly functional cabin environments.

Among surface types, interior smart surfaces accounted for a 60% share in 2024. As vehicle manufacturers move away from traditional controls, they are investing in multifunctional, seamless displays with capacitive touch, haptic feedback, and dynamic lighting features. These innovations not only enhance user convenience but are also crucial in luxury EVs and high-end vehicles, where brand value is closely tied to the integration of cutting-edge technology.

The United States automotive smart surface market generated USD 3 billion in 2024 and is expected to experience a CAGR of 25.4% through 2034. This growth is driven by the country's advanced R&D ecosystem, early adoption of next-generation technologies, and a growing luxury EV market. U.S.-based OEMs and Tier 1 suppliers are increasingly working together to develop intelligent HMI systems, interactive dashboards, and responsive interior panels for premium and mid-range models. These systems are also being integrated into broader smart mobility trends, such as driver assistance technologies, AI assistants, and connected infotainment ecosystems.

Leading players in the market, including Faurecia, Covestro, Hyundai, Dura, Canatu, Gentex, Continental, TactoTek, KURZ, and Flex, are actively shaping the future of automotive smart surfaces. To strengthen their market position, these companies are focusing on partnerships with automotive OEMs, scaling R&D for multifunctional materials, and developing modular platforms that can adapt to evolving vehicle electronics. Some players are also prioritizing sustainable and lightweight substrates, while others are investing in localized production to better serve regional demands, ensuring energy efficiency, safety compliance, and seamless user interaction across all vehicle types.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for in-vehicle connectivity and UX

- 3.8.1.2 Technological advancements in materials & manufacturing

- 3.8.1.3 Growth in electric and autonomous vehicles

- 3.8.1.4 OEM focus on weight reduction and design integration

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Durability and environmental sensitivity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Surface, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Interior

- 5.3 Exterior

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Electronics

- 7.4 Construction

- 7.5 Medical & healthcare

- 7.6 Energy

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Touchscreen interfaces

- 8.3 Self-Healing surfaces

- 8.4 Embedded sensors

- 8.5 Adaptive surfaces

- 8.6 Self-cleaning surfaces

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 BASF

- 10.3 Canatu

- 10.4 Continental

- 10.5 Covestro

- 10.6 Dura

- 10.7 Faurecia

- 10.8 Flex

- 10.9 Gentex

- 10.10 Hyundai Mobis

- 10.11 KURZ

- 10.12 LG

- 10.13 Marelli

- 10.14 Motherson

- 10.15 Panasonic

- 10.16 Preh

- 10.17 Sekisui

- 10.18 TactoTek

- 10.19 Toyota Boshoku

- 10.20 Yanfeng