|

市場調查報告書

商品編碼

1740822

雙極電外科設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bipolar Electrosurgical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

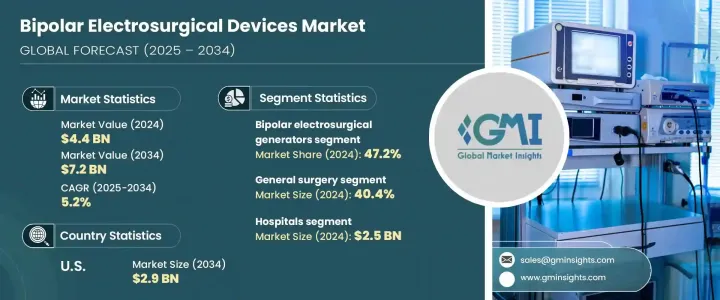

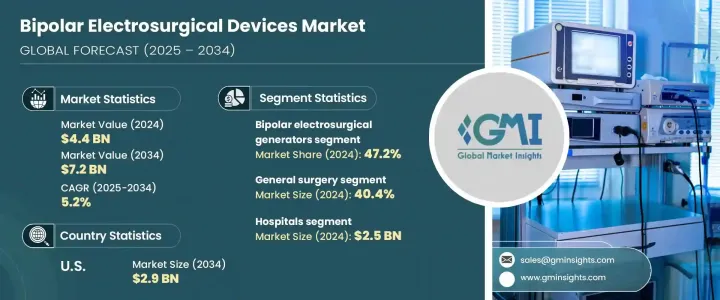

2024年,全球雙極電外科設備市場規模達44億美元,預計2034年將以5.2%的複合年成長率成長,達到72億美元。隨著患者和外科醫生對微創手術的需求日益成長,雙極電外科已成為現代外科工作流程中不可或缺的一部分。這些手術具有許多優勢,包括切口較小、失血量更少、出院時間更短、恢復速度更快。微創手術的持續發展顯著提高了醫院和外科中心對雙極電外科技術的採用率。

雙極電外科器械旨在以極高的精度進行切割和凝固,同時最大程度地減少對周圍組織的損傷。這意味著術後感染和併發症的發生率更低。隨著血管封閉能力、熱控制和人體工學工具設計的改進,這些器械不斷提升手術效果。對精準度和組織保護的日益重視,使其在神經外科、骨科、婦科等外科領域的應用日益廣泛,進一步推動了市場擴張。與機器人和腹腔鏡系統相容的新型設備的採用也鞏固了其在標準化手術方案中的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 72億美元 |

| 複合年成長率 | 5.2% |

這些設備使用透過雙極配置施加的高頻電能進行操作,電流僅流經兩個鉗狀電極之間的組織。這種設計可確保局部能量輸送並最大程度地減少組織損傷。市場根據產品類型進行細分,包括雙極電外科發電機、雙極電外科器械以及配件和耗材。其中,雙極電外科發電機在2024年的收入佔有率最高,為47.2%。這些發電機是所有連接器械和配件的核心能源,因此對於任何電外科設備都至關重要。與可重複使用的器械和配件相比,它們的高成本顯著影響了整體市場收入。

雙極電外科器械進一步細分為鉗子、剪刀和探針或電極。雖然這些工具廣泛應用於各種外科手術,但相對於發生器而言,它們價格實惠,使其成為該細分市場中收入貢獻中等的產品。發生器是資本密集型產品,且對於系統功能不可或缺,因此在基於產品的細分市場中佔據主導地位。

根據應用,市場分為一般外科、神經外科、心血管外科、婦科外科和其他專科領域。 2024年,一般外科佔據該領域的主導地位,市佔率為40.4%。隨著全球老齡人口的成長,膽囊疾病、闌尾炎和疝氣等與年齡相關的疾病的盛行率也在上升。由於退化性疾病和慢性疾病的發生率較高,老年人更有可能接受外科手術,這刺激了對雙極器械等可靠安全的手術工具的需求。雙極器械在止血和精確切口方面的高效性使其成為一般外科各科室的首選。

按最終用戶分類,市場細分為醫院、門診手術中心、專科診所以及學術或研究機構。醫院佔據了這個細分市場的主導地位,2024 年的收入達到 25 億美元。醫院著重提升病人安全、提高手術準確性並縮短恢復時間,刺激了對先進手術設備的投資。雙極設備具有關鍵優勢,例如熱擴散最小、出血減少和意外燒傷更少,有助於改善臨床療效並縮短手術時間。隨著醫院不斷升級設備以相容於尖端手術系統(包括機器人和腹腔鏡工具),對雙極電外科設備的需求預計將持續成長。

從區域來看,北美在塑造市場趨勢方面發揮關鍵作用。光是在美國,雙極電外科設備市場規模預計將從2024年的18億美元成長到2034年的29億美元。心血管疾病、糖尿病和肥胖等生活型態相關疾病的激增,導致手術數量不斷增加。隨著慢性病的日益普遍,對高效率、精準手術器械的需求也愈發迫切。雙極電外科設備能夠有效滿足這些臨床需求,從而增強其在美國醫療機構中的價值。

雙極電外科設備市場的競爭格局體現在,全球和區域性企業紛紛提供客製化解決方案,以滿足日益成長的外科手術需求。美敦力、強生、貝朗、史賽克和奧林巴斯等領先公司合計佔全球約65%的市佔率。這些公司透過持續創新、產品客製化和定價策略展開競爭,以在已開發市場和新興市場保持領先地位。在成本敏感型地區,本土企業透過提供價格實惠、品質優良的設備向跨國品牌發起挑戰,促使全球領導者調整策略,同時確保符合安全和性能標準。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微創手術的需求不斷成長

- 慢性病和外科手術的盛行率不斷上升

- 電外科設備的技術進步

- 門診手術中心的擴建

- 產業陷阱與挑戰

- 先進電外科系統成本高昂

- 燒傷、神經損傷、手術煙霧等併發症的風險

- 成長動力

- 成長潛力分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮川普政府關稅

- 對貿易的影響

- 產業價值鏈分析

- 原料分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭儀錶板

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 雙極電外科發生器

- 雙極電外科器械

- 雙極鉗

- 雙極剪刀

- 雙極探頭和電極

- 配件和耗材

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 一般外科

- 神經外科

- 婦科手術

- 心血管外科

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 學術和研究機構

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Applied Medical

- B Braun

- Boston Scientific

- Bovie Medical

- BOWA Medical

- ConMed

- Encision

- Erbe Elektromedizin

- Johnson and Johnson

- KLS Martin Group

- Medtronic

- Olympus

- Smith and Nephew

- Stryker

- Zimmer Biomet

The Global Bipolar Electrosurgical Devices Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 7.2 billion by 2034. As the demand for minimally invasive procedures gains momentum among patients and surgeons alike, bipolar electrosurgery has become an integral part of modern surgical workflows. These procedures offer substantial benefits, including smaller incisions, reduced blood loss, quicker discharge times, and faster recovery. The ongoing shift towards minimally invasive approaches has significantly increased the adoption of bipolar electrosurgical technologies in hospitals and surgical centers.

Bipolar electrosurgical instruments are designed to perform both cutting and coagulation with exceptional precision while limiting harm to the surrounding tissue. This translates to a lower rate of post-operative infections and complications. With advancements in vessel sealing capabilities, improved thermal control, and ergonomic tool designs, these instruments continue to enhance procedural outcomes. The heightened focus on precision and tissue conservation supports their growing use in surgical fields such as neurosurgery, orthopedics, gynecology, and others, further driving market expansion. The adoption of newer devices compatible with robotic and laparoscopic systems also reinforces their position in standardized surgical protocols.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 5.2% |

These devices operate using high-frequency electrical energy applied through a bipolar configuration, where the current flows only through the tissue between two forceps-like electrodes. This design ensures localized energy delivery and minimal tissue trauma. The market is segmented based on product types, with categories including bipolar electrosurgical generators, bipolar electrosurgical instruments, and accessories and consumables. Among these, bipolar electrosurgical generators accounted for the highest revenue share at 47.2% in 2024. These generators act as the core energy source for all connected instruments and accessories, making them essential for any electrosurgical setup. Their high cost compared to reusable instruments and accessories contributes significantly to overall market revenue.

Bipolar electrosurgical instruments are further divided into forceps, scissors, and probes or electrodes. While these tools are widely used across various surgical procedures, their affordability relative to generators places them as mid-level revenue contributors within the segment. Generators, being capital-intensive and indispensable for system functionality, maintain a dominant hold on product-based segmentation.

Based on application, the market is categorized into general surgery, neurosurgery, cardiovascular surgery, gynecological surgery, and other specialized fields. General surgery led the segment with a market share of 40.4% in 2024. The prevalence of age-related conditions such as gallbladder disease, appendicitis, and hernias has grown alongside the expanding global elderly population. Older adults are more likely to undergo surgical procedures due to the higher frequency of degenerative and chronic illnesses, which boosts the demand for reliable and safe surgical tools like bipolar devices. Their efficiency in managing bleeding and enabling precise incisions makes them a preferred choice across general surgery departments.

By end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and academic or research institutions. Hospitals dominated this segment, with revenue amounting to USD 2.5 billion in 2024. Their focus on enhancing patient safety, improving procedural accuracy, and reducing recovery time has spurred investments in advanced surgical equipment. Bipolar devices offer key advantages such as minimal thermal spread, reduced bleeding, and fewer accidental burns, supporting better clinical outcomes and shorter procedure durations. As hospitals continue to upgrade to equipment that is compatible with cutting-edge surgical systems, including robotics and laparoscopic tools, the demand for bipolar electrosurgical devices is expected to climb.

Regionally, North America plays a pivotal role in shaping market trends. The bipolar electrosurgical devices market in the United States alone is projected to rise from USD 1.8 billion in 2024 to USD 2.9 billion by 2034. A surge in lifestyle-related diseases, including cardiovascular disorders, diabetes, and obesity, has led to a growing number of surgeries. As chronic conditions become more prevalent, the need for efficient, precision-driven surgical instruments becomes more pressing. Bipolar electrosurgical units meet these clinical demands effectively, reinforcing their value across U.S. healthcare facilities.

The competitive landscape of the bipolar electrosurgical devices market features a blend of global and regional players offering tailored solutions to meet rising surgical demands. Leading companies such as Medtronic, Johnson & Johnson, B. Braun, Stryker, and Olympus together represent approximately 65% of the global market. These organizations compete through continuous innovation, product customization, and pricing strategies to maintain relevance across both developed and emerging markets. In cost-sensitive regions, domestic players challenge multinational brands by delivering affordable, quality devices, prompting global leaders to adapt their approach while ensuring compliance with safety and performance standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for minimally invasive surgeries

- 3.2.1.2 Rising prevalence of chronic diseases and surgical interventions

- 3.2.1.3 Technological advancements in electrosurgical devices

- 3.2.1.4 Expansion of outpatient surgical centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced electrosurgical systems

- 3.2.2.2 Risk of complications such as burns, nerve damage, surgical smoke

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Industry value chain analysis

- 3.6 Raw material analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive dashboard

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bipolar electrosurgical generators

- 5.3 Bipolar electrosurgical instruments

- 5.3.1 Bipolar forceps

- 5.3.2 Bipolar scissors

- 5.3.3 Bipolar probes and electrodes

- 5.4 Accessories and consumables

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Neurosurgery

- 6.4 Gynecological surgery

- 6.5 Cardiovascular surgery

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Applied Medical

- 9.2 B Braun

- 9.3 Boston Scientific

- 9.4 Bovie Medical

- 9.5 BOWA Medical

- 9.6 ConMed

- 9.7 Encision

- 9.8 Erbe Elektromedizin

- 9.9 Johnson and Johnson

- 9.10 KLS Martin Group

- 9.11 Medtronic

- 9.12 Olympus

- 9.13 Smith and Nephew

- 9.14 Stryker

- 9.15 Zimmer Biomet