|

市場調查報告書

商品編碼

1740817

葡萄膜炎治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Uveitis Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

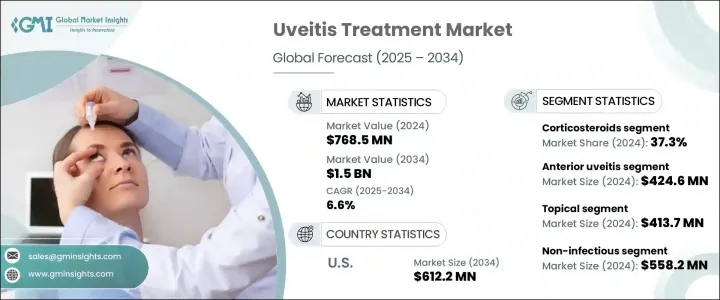

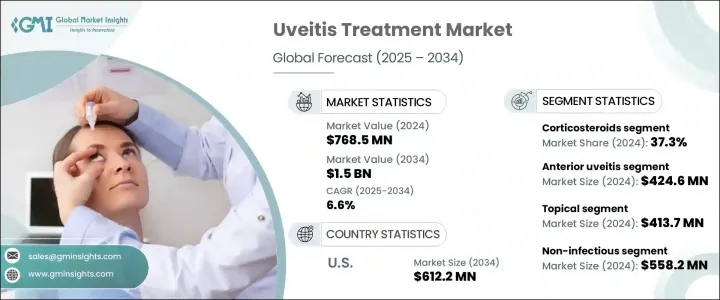

2024年,全球葡萄膜炎治療市場規模達7.685億美元,預計到2034年將以6.6%的複合年成長率成長,達到15億美元。這一成長主要源自於狼瘡、克隆氏症和類風濕性關節炎等自體免疫疾病發生率的上升,這些疾病導致葡萄膜炎(尤其是非感染性葡萄膜炎)的盛行率上升。葡萄膜炎是一種影響葡萄膜(即眼球中層)的發炎性疾病,可能由感染、免疫系統疾病或發炎性疾病引起。它可能影響單眼或雙眼,如果治療不當,可能導致白內障、青光眼等嚴重併發症,甚至永久性視力喪失。

治療葡萄膜炎包括控制發炎和預防長期眼部損傷。由於病情嚴重程度和病因差異很大,治療方案必須因地制宜。市場對能夠立即緩解症狀並長期控制的藥物的需求激增。認知度的提高、診斷技術的進步以及標靶療法的研發促進了市場擴張。尤其是,對自體免疫疾病如何引發眼部發炎的理解日益加深,帶來了更專業、更有效的治療方案。治療方案的創新——例如可減少全身性副作用的局部治療——也日益受到關注。這種將症狀緩解和潛在疾病控制相結合的綜合方法,正在幫助醫療保健提供者提供更優質的醫療服務,同時支持市場的成長勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.685億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 6.6% |

按治療類型分類,皮質類固醇在2024年佔據了最大的收入佔有率,佔市場佔有率的37.3%。這些藥物能夠高效快速地消炎,使其成為許多急性和慢性葡萄膜炎患者的第一線治療藥物。它們有多種劑型,包括外用、口服和注射,方便醫護人員根據患者病情和反應調整治療方案。在慢性病例中持續使用皮質類固醇可確保持續的需求,並增強其在預防眼壓升高和視神經損傷等併發症方面的作用。

就疾病類型而言,前葡萄膜炎佔主導地位,2024 年收入達 4.246 億美元。它是最常見的診斷類型,佔所有葡萄膜炎病例的 40% 至 50%。鑑於其在年輕人中的普遍性,對不僅包含皮質類固醇,還包含免疫抑制劑和非類固醇抗發炎藥 (NSAID) 的治療方案的需求巨大。能夠根據病情嚴重程度和患者需求透過多種途徑給藥,有助於改善療效並推動市場成長。越來越多的醫生選擇標靶治療來減少疾病發作並預防復發。

根據給藥方式,局部用藥在2024年以4.137億美元的收入領先市場。含有皮質類固醇和非類固醇抗發炎藥的眼藥水因其針對性作用而被廣泛使用,有助於最大限度地減少口服或注射藥物相關的全身性副作用。其成本效益也發揮關鍵作用,尤其是在醫療預算有限的地區。局部用藥製劑更容易使用,患者也更容易取得,這有助於更好地遵守治療方案。

從病因來看,非感染性葡萄膜炎佔市場主導地位,2024年營收達5.582億美元。隨著自體免疫疾病的增多,該細分市場持續擴張。許多此類疾病的眼部表現需要長期治療。免疫抑制和生物療法的最新進展使得更精準地靶向發炎的根本原因成為可能,從而提供更好的控制效果並減少不良反應。這些治療在皮質類固醇療效不足或導致嚴重副作用的情況下尤其重要。

在配銷通路領域,醫院藥局以2024年3.291億美元的收入領先市場。生物製劑和免疫抑制劑的使用日益增多,這些藥物通常需要專業處理和密切監測,這提升了醫院藥房的角色。這些設施配備了管理複雜療法、注射和監測患者潛在不良反應所需的基礎設施。醫院對藥局服務的投入,為慢性或重度葡萄膜炎患者提供了更全面的照護。

光是美國市場就預計將大幅成長,預計到2034年市場總規模將達到6.122億美元。監管支持,尤其是相關衛生部門及時批准新療法,在確保患者獲得尖端治療方面發揮關鍵作用。隨著主要參與者專注於創新(例如生物製劑、類固醇釋放植入物和基因療法),以改善治療效果並佔領更大的市場佔有率,市場競爭態勢日益加劇。隨著企業致力於整合現代技術、擴大全球影響力並滿足日益成長的對有效且經濟實惠的葡萄膜炎治療的需求,與研究中心和醫療機構的合作也變得越來越普遍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 葡萄膜炎及相關疾病的盛行率不斷上升

- 生物療法的進展

- 意識和醫療保健支出不斷成長

- 產業陷阱與挑戰

- 先進療法成本高昂

- 長期治療的副作用

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依治療類型,2021 年至 2034 年

- 主要趨勢

- 皮質類固醇

- 免疫抑制劑/免疫調節劑

- 生物製劑

- 睫狀肌麻痺劑

- 止痛藥

- 其他治療

第6章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 前葡萄膜炎

- 後葡萄膜炎

- 中間葡萄膜炎

- 全葡萄膜炎

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 外用

- 注射劑

第 8 章:市場估計與預測:按疾病病因,2021 年至 2034 年

- 主要趨勢

- 傳染性

- 非傳染性

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

- 其他分銷管道

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AbbVie

- Alimera Sciences

- Bausch Health Companies

- Clearside Biomedical

- EyePoint Pharmaceuticals

- Novartis

- Pfizer

- Santen Pharmaceutical

The Global Uveitis Treatment Market was valued at USD 768.5 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.5 billion by 2034. This growth is fueled primarily by the increasing incidence of autoimmune disorders such as lupus, Crohn's disease, and rheumatoid arthritis, which contribute to a higher prevalence of uveitis-particularly the non-infectious types. Uveitis is an inflammatory condition affecting the uvea, the middle layer of the eye, and may result from infections, immune system disorders, or inflammatory diseases. It can impact one or both eyes and, if not properly managed, may cause serious complications like cataracts, glaucoma, or even permanent vision loss.

Treating uveitis involves controlling inflammation and preventing long-term ocular damage. As the condition varies widely in severity and origin, therapies must be tailored accordingly. The market has seen a surge in demand for medications that offer both immediate relief and long-term management. Increased awareness, better diagnostics, and the development of targeted therapies have contributed to market expansion. In particular, the growing understanding of how autoimmune diseases trigger ocular inflammation has led to more specialized and effective treatment options. Innovations in treatment delivery-like localized therapies that reduce systemic side effects-are also gaining traction. This comprehensive approach, which incorporates both symptom relief and underlying disease control, is helping healthcare providers offer better care while supporting the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $768.5 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 6.6% |

When categorized by treatment type, corticosteroids commanded the largest revenue share in 2024, accounting for 37.3% of the market. These drugs are highly effective at rapidly reducing inflammation, making them a first-line treatment for many patients with both acute and chronic uveitis. They are available in multiple forms including topical, oral, and injectable, allowing healthcare professionals to adapt treatment plans based on the individual's condition and response. Continued use of corticosteroids in chronic cases ensures ongoing demand and reinforces their role in preventing complications like intraocular pressure increase and optic nerve damage.

In terms of disease type, anterior uveitis emerged as the dominant segment with revenue of USD 424.6 million in 2024. It is the most frequently diagnosed form, comprising 40% to 50% of all uveitis cases. Given its prevalence, especially in younger adults, there is significant demand for treatment options that include not only corticosteroids but also immunosuppressants and NSAIDs. The ability to administer these medications through various routes-depending on severity and patient needs-contributes to better outcomes and drives market growth. Physicians are increasingly choosing targeted therapies to reduce flare-ups and prevent recurrence.

Based on how the drugs are administered, topical treatments led the market with revenue of USD 413.7 million in 2024. Eye drops containing corticosteroids and NSAIDs are widely used due to their targeted action, which helps minimize systemic side effects associated with oral or injectable drugs. Their cost-effectiveness also plays a key role, particularly in regions with limited healthcare budgets. Topical formulations are easier to use and more accessible for patients, which encourages better adherence to treatment protocols.

Looking at disease etiology, non-infectious uveitis dominated the market with revenue reaching USD 558.2 million in 2024. This segment continues to expand in response to the rising number of autoimmune conditions. Many of these diseases have ocular manifestations that require long-term management. Recent advances in immunosuppressive and biologic therapies have made it possible to target the root cause of inflammation more precisely, offering better control with fewer adverse effects. These treatments are especially important in cases where corticosteroids are insufficient or lead to significant side effects.

In the distribution channel segment, hospital pharmacies led the market with USD 329.1 million in revenue in 2024. The increasing use of biologics and immunosuppressive agents-which often require specialized handling and close monitoring-has elevated the role of hospital pharmacies. These facilities are equipped with the infrastructure needed to manage complex therapies, administer injectables, and monitor patients for potential adverse reactions. Investments in pharmacy services across hospitals are enabling more comprehensive care for those living with chronic or severe uveitis.

The U.S. market alone is projected to grow substantially, with forecasts estimating a total market size of USD 612.2 million by 2034. Regulatory support, particularly the timely approval of new therapies by relevant health authorities, plays a pivotal role in ensuring patients gain access to cutting-edge treatments. Competitive dynamics within the market are intensifying as key players focus on innovation-such as biologic agents, steroid-releasing implants, and gene-based therapies-to improve therapeutic outcomes and capture a larger market share. Collaborations with research centers and healthcare institutions are becoming more common as companies work to integrate modern technologies, expand global reach, and meet the rising demand for effective, affordable uveitis treatments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of uveitis and associated conditions

- 3.2.1.2 Advancements in biologic therapies

- 3.2.1.3 Growing awareness and healthcare expenditure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced therapies

- 3.2.2.2 Side effects of long-term treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroids

- 5.3 Immunosuppressants/Immunomodulators

- 5.4 Biologics

- 5.5 Cycloplegic agents

- 5.6 Analgesics

- 5.7 Other treatments

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Anterior uveitis

- 6.3 Posterior uveitis

- 6.4 Intermediate uveitis

- 6.5 Panuveitis

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injectable

Chapter 8 Market Estimates and Forecast, By Disease Etiology, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Infectious

- 8.3 Non-infectious

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 E-commerce

- 9.5 Other distribution channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Alimera Sciences

- 11.3 Bausch Health Companies

- 11.4 Clearside Biomedical

- 11.5 EyePoint Pharmaceuticals

- 11.6 Novartis

- 11.7 Pfizer

- 11.8 Santen Pharmaceutical