|

市場調查報告書

商品編碼

1740798

特種製藥市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Specialty Pharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

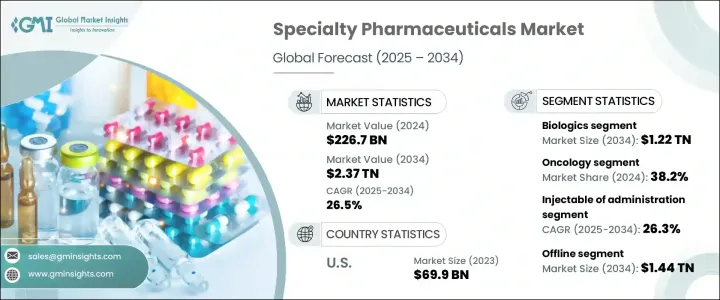

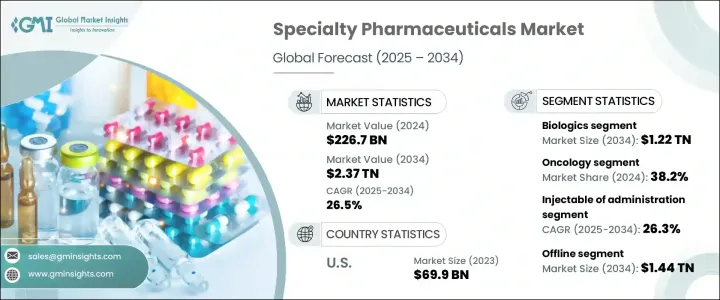

2024年,全球特種藥品市場規模達2,267億美元,預計到2034年將以26.5%的複合年成長率成長,達到2.37兆美元,這得益於生物製劑、標靶治療和精準醫療領域的突破性進展。特種藥品透過為此前治療選擇有限的慢性病和罕見疾病提供高度客製化的治療方案,正在迅速改變醫療保健產業。癌症、自體免疫疾病和罕見遺傳疾病等慢性病的發生率不斷上升,持續加劇了對這些尖端療法的需求。隨著生物技術的進步,新型給藥系統和精準診斷技術正在重塑治療方案,以更少的副作用為患者帶來更好的療效。

個人化醫療正日益受到重視,製藥公司正大力投資基於基因的解決方案、生物製劑以及符合患者特定需求的客製化療法。世界各國政府正透過激勵措施和簡化的監管途徑來支持創新,尤其關注針對罕見疾病的孤兒藥。在發展中地區,不斷擴展的醫療基礎設施為專科治療藥物進入新興市場創造了新的機會。隨著醫療體系的不斷發展,專科藥物不再局限於利基市場,而是逐漸成為主流治療策略中不可或缺的一部分,並成為製藥業重要的成長引擎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2267億美元 |

| 預測值 | 2.37兆美元 |

| 複合年成長率 | 26.5% |

依藥物類型分類,生物製劑市場涵蓋生物製劑、生物相似藥、孤兒藥、小分子藥物和其他特殊製劑。 2024年,生物製劑市場規模達1,188億美元,預計2034年將強勁成長至1.22兆美元。這一顯著成長源於精準治療生物製劑的優勢,它能夠針對自體免疫疾病、各種癌症和罕見遺傳疾病等複雜疾病提供高度針對性的治療。由於副作用較少、成功率較高,生物製劑已在全球臨床實務中迅速推廣應用。生物製造技術的進步和支持性監管框架正在幫助企業加速創新生物療法的開發和上市。

從治療領域來看,腫瘤學繼續佔據主導地位,2024 年將佔據 38.2% 的市場佔有率,預計到 2034 年將以 26.7% 的複合年成長率成長。全球癌症發生率的上升正推動腫瘤藥物研發管線的大規模投資,新療法的法規核准也源源不絕。免疫療法、伴隨診斷和聯合療法領域的突破正在重塑癌症治療的未來,並鞏固腫瘤學在專科製藥領域的領先地位。

2023年,美國特種藥品市場產值達699億美元,反映了其在醫療領域的領先地位和創新驅動的醫療環境。強大的資金支持、優惠的報銷制度以及公私合作,使美國在特種藥品研發領域處於領先地位。個人化醫療需求旺盛、FDA核准流程加快以及對突破性創新的關注,確保了市場持續成長。

全球特種製藥市場的主要公司包括聯合治療公司 (United Therapeutics)、安進 (Amgen)、艾伯維 (AbbVie)、諾華 (Novartis)、輝瑞 (Pfizer)、基因泰克 (Genentech)、Kamada、Biocon Biologics、大寶製藥 (TAIHO PHARMACEU)、來禮恩特、卡賓塞特(Incyte)、默克公司 (Merck & Co.) 與葛蘭素史克 (GlaxoSmithKline)。這些公司正在透過投資定向研發、建立策略合作夥伴關係、收購創新生物技術公司以及專注於生物相似藥和個人化療法來鞏固其地位,以推動長期成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病和罕見病患疾病率上升

- 生物製劑和基因療法的不斷進步

- 加大對孤兒藥的支持政策與獨佔權

- 研發經費和活動不斷增加

- 產業陷阱與挑戰

- 藥品成本高

- 專門儲存和處理的必要性

- 成長動力

- 成長潛力分析

- 管道分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類型,2021 年至 2034 年

- 主要趨勢

- 生物製劑

- 生物相似藥

- 孤兒藥

- 小分子

- 其他藥物類型

第6章:市場估計與預測:按治療領域,2021 年至 2034 年

- 主要趨勢

- 腫瘤學

- 自體免疫疾病

- 神經病學

- 傳染病

- 罕見遺傳疾病

- 其他治療領域

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 注射劑

- 其他給藥途徑

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

- 醫院藥房

- 零售藥局

- 其他線下通路

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Amgen

- Biocon Biologics

- Eli Lilly

- Genentech

- GlaxoSmithKline

- Incyte

- Kamada

- Knight Therapeutics

- Merck & Co.

- Novartis

- Pfizer

- Taiho Pharmaceutical

- United Therapeutics

The Global Specialty Pharmaceuticals Market was valued at USD 226.7 billion in 2024 and is estimated to grow at a CAGR of 26.5% to reach USD 2.37 trillion by 2034, driven by groundbreaking advancements in biologics, targeted therapies, and precision medicine. Specialty pharmaceuticals are quickly transforming healthcare by offering highly tailored treatments for chronic and rare diseases that previously had limited options. The rise in chronic conditions like cancer, autoimmune disorders, and rare genetic illnesses continues to intensify the demand for these sophisticated therapies. As biotechnology advances, new drug delivery systems and precise diagnostics are reshaping treatment protocols, delivering better patient outcomes with fewer side effects.

The focus on personalized healthcare is accelerating, with pharmaceutical companies investing heavily in gene-based solutions, biologics, and customized therapies that align with patient-specific needs. Governments worldwide are supporting innovation through incentives and streamlined regulatory pathways, particularly for orphan drugs targeting rare diseases. In developing regions, expanding healthcare infrastructure is opening new opportunities for specialty therapies to enter emerging markets. As healthcare systems evolve, specialty pharmaceuticals are no longer confined to niche segments; they are becoming an integral part of mainstream treatment strategies, establishing themselves as a crucial growth engine within the pharmaceutical landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $226.7 Billion |

| Forecast Value | $2.37 Trillion |

| CAGR | 26.5% |

The market by drug type spans biologics, biosimilars, orphan drugs, small molecules, and other specialty formulations. In 2024, the biologics segment generated USD 118.8 billion, with projections indicating a strong surge to USD 1.22 trillion by 2034. This remarkable growth stems from the therapeutic precision biologics offer, enabling highly targeted treatments for complex conditions like autoimmune diseases, various cancers, and rare genetic disorders. With fewer side effects and higher success rates, biologics have gained rapid adoption in clinical practices worldwide. Advances in biological manufacturing technologies and supportive regulatory frameworks are helping companies accelerate the development and launch of innovative biologic therapies.

By therapeutic area, oncology continues to dominate, capturing a 38.2% market share in 2024, and is poised to grow at a CAGR of 26.7% through 2034. Rising global cancer incidence rates are fueling massive investments in oncology drug pipelines, with a steady flow of regulatory approvals for new therapies. Breakthroughs in immunotherapies, companion diagnostics, and combination therapies are reshaping the future of cancer care and reinforcing oncology's leadership in the specialty pharmaceutical sector.

The U.S. Specialty Pharmaceuticals Market generated USD 69.9 billion in 2023, reflecting its leadership and innovation-driven healthcare environment. Strong funding support, favorable reimbursement systems, and public-private collaborations position the U.S. at the forefront of specialty drug development. High demand for personalized medicine, accelerated FDA approval pathways, and a focus on breakthrough innovations ensure the market's sustained growth trajectory.

Key companies operating in the Global Specialty Pharmaceuticals Market include United Therapeutics, Amgen, AbbVie, Novartis, Pfizer, Genentech, Kamada, Biocon Biologics, TAIHO PHARMACEUTICAL, Eli Lilly, Knight Therapeutics, Incyte, Merck & Co., and GlaxoSmithKline. These players are strengthening their positions by investing in targeted R&D, forming strategic partnerships, acquiring innovative biotech firms, and emphasizing biosimilars and personalized therapies to drive long-term growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic and rare diseases

- 3.2.1.2 Increasing advancements in biologics and gene therapies

- 3.2.1.3 Increasing supportive policies and exclusivity rights for orphan drugs

- 3.2.1.4 Growing in research and development fundings and activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Hight cost of drugs

- 3.2.2.2 Necessity of specialized storge and handling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biologics

- 5.3 Biosimilars

- 5.4 Orphan drugs

- 5.5 Small molecules

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Autoimmune diseases

- 6.4 Neurology

- 6.5 Infectious diseases

- 6.6 Rare genetic disorders

- 6.7 Other therapeutic areas

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

- 8.3.1 Hospital pharmacies

- 8.3.2 Retail pharmacies

- 8.3.3 Other offline channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Biocon Biologics

- 10.4 Eli Lilly

- 10.5 Genentech

- 10.6 GlaxoSmithKline

- 10.7 Incyte

- 10.8 Kamada

- 10.9 Knight Therapeutics

- 10.10 Merck & Co.

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Taiho Pharmaceutical

- 10.14 United Therapeutics