|

市場調查報告書

商品編碼

1740797

腦梗塞治療市場機會、成長動力、產業趨勢分析及2025-2034年預測Cerebral Infarction Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

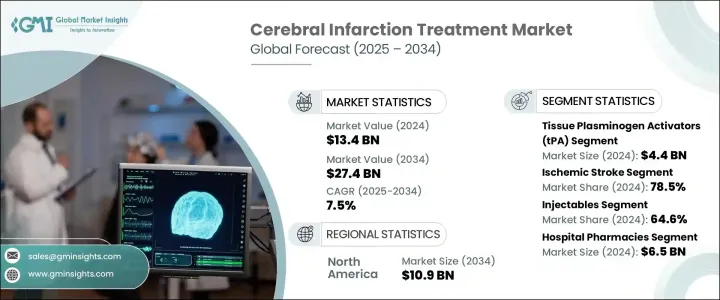

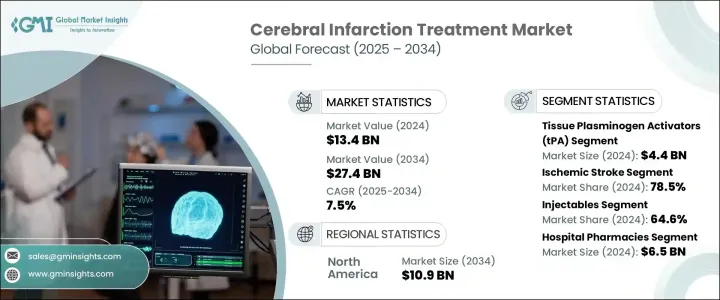

2024 年全球腦梗塞治療市場價值為 134 億美元,預計到 2034 年將以 7.5% 的複合年成長率成長至 274 億美元。由於中風盛行率不斷上升以及人們越來越意識到及時治療的重要性,該市場正在穩步成長。腦梗塞是一種因腦部血流中斷引起的中風,會導致組織損傷,如果不及時治療,可造成長期殘疾或死亡。這種中斷通常是由於血栓阻塞血管,使腦細胞缺氧和必需營養素。隨著全球醫療基礎設施和診斷能力的提高,早期發現和更有效的治療方法正在出現,從而推動了對治療介入的需求。此外,臨床研究的進展和神經系統疾病資金的增加正在加速創新療法和治療方案的開發,推動市場擴張。隨著老年人口的成長以及高血壓和糖尿病等風險因素的激增,對更靈敏、更有效的腦梗塞治療方案的需求持續成長。急救系統和快速反應治療方案的出現顯著改善了患者的預後,從而提升了市場的長期潛力。

依藥物類別分類,腦梗塞治療市場分為組織纖溶酶原活化劑 (tPA)、抗凝血劑、抗血小板劑、抗驚厥劑和其他藥物。 2023 年的市場總收入為 126 億美元。僅 tPA 細分市場在 2024 年就創造了 44 億美元的收入,預計在整個預測期內的複合年成長率為 7.8%。組織纖溶酶原活化劑透過分解纖維蛋白(參與血塊形成的核心蛋白)來幫助溶解血塊,從而重建腦部血流並最大限度地減少缺氧相關的損害。研究表明,在症狀出現的最初幾個小時內使用 tPA 可以顯著改善復原情況、減少致殘率並提高整體治療效果。由於這些療法高效且能夠減少長期神經系統損傷,現已被認為是急診中風治療方案中必不可少的療法。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 134億美元 |

| 預測值 | 274億美元 |

| 複合年成長率 | 7.5% |

按類型分類,市場分為缺血性中風和出血性中風。缺血性中風佔主導地位,2024 年的收入為 105 億美元,佔整個市場的 78.5%。這種主導地位歸因於缺血性中風的全球發生率高於其他類型。血栓溶解和血栓切除等治療方法擴大被採用,以恢復血流並限制神經系統損傷。抗血小板藥物(阿斯匹靈、氯吡格雷)和抗凝血劑(包括達比加群和利伐沙班)等藥物是常規處方,用於預防復發,特別是對於有潛在心血管危險因子的患者。早期治療可顯著改善運動、言語和認知能力的恢復,有助於降低長期殘疾的可能性,從而支持市場成長。

根據給藥途徑,市場細分為口服和注射療法。 2024年,注射劑佔據了整個市場的64.6%的佔有率。這些療法因其快速起效和精準的劑量控制而受到急診治療的青睞,這對於急性中風治療至關重要。靜脈注射使醫護人員能夠快速將溶栓藥物直接輸送到血液中,在時間緊迫的情況下提供快速的治療效果。注射適用於救護車和醫院環境,這提升了其在現代中風護理系統中的價值,使其成為即時干預策略的基石。

在分銷管道方面,醫院藥房在2024年佔據了最大的收入佔有率,創造了65億美元的收入。這些機構在醫療監督下提供直接獲取救命藥物的途徑,這對於需要緊急治療的治療尤其重要。醫院藥局在病患教育方面也發揮關鍵作用,提供藥物類型、給藥方法和副作用的指導。它們與醫療團隊的整合確保了患者更好地遵守治療計劃,從而改善了患者的治療效果。此外,藥物管理和支持計畫等服務有助於促進長期治療成功。

從區域來看,北美已成為領先市場,2024年營收達54億美元,預計2034年將增加至109億美元。美國是最大的貢獻者,2023年收入達47億美元。該地區高昂的醫療支出、先進的醫療基礎設施以及日益提升的中風護理意識,使其保持了主導地位。該地區心血管疾病發生率的不斷上升,進一步刺激了對有效治療的需求。

主要市場參與者(約佔總佔有率的45%)包括雅培實驗室、勃林格殷格翰、羅氏製藥和諾和諾德等公司。這些公司憑藉著策略性產品創新、強大的經銷網路和監管專業知識,持續引領市場。與醫療機構和公共衛生組織的合作正在促進研究工作,並提高治療的可近性。宣傳活動和數位平台日益成長的影響力也鼓勵更多人及時尋求治療,從而促進市場成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病盛行率上升

- 藥物研發創新

- 加大中風治療的研發力道

- 老年人口不斷增加

- 產業陷阱與挑戰

- 藥物的不良反應

- 嚴格的監管框架

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 組織纖溶酶原活化劑(tPA)

- 抗凝血劑

- 抗血小板

- 抗驚厥藥

- 其他藥物類別

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 缺血性中風

- 出血性中風

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 注射劑

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- Amgen

- Amneal Pharmaceuticals

- AstraZeneca

- Boehringer Ingelheim

- Bayer

- Biogen

- Daiichi Sankyo Company

- F. Hoffmann-La Roche

- Merck & Co.

- Novartis

- Novo Nordisk

- Otsuka Holdings

- Pfizer

- Sanofi

The Global Cerebral Infarction Treatment Market was valued at USD 13.4 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 27.4 billion by 2034. This market is witnessing steady growth due to the increasing prevalence of stroke and rising awareness about the importance of timely treatment. Cerebral infarction, a form of stroke caused by an interruption in blood flow to the brain, leads to tissue damage and, if left untreated, can result in long-term disability or death. This interruption is typically caused by a blood clot blocking a vessel, depriving brain cells of oxygen and essential nutrients. As medical infrastructure and diagnostic capabilities improve globally, earlier detection and more effective treatments are becoming available, pushing the demand for therapeutic interventions. Additionally, advances in clinical research and increased funding for neurological disorders are accelerating the development of innovative therapies and treatment options, driving market expansion. With a growing geriatric population and a surge in risk factors like hypertension and diabetes, the demand for more responsive and effective cerebral infarction treatments continues to climb. The emergence of emergency care systems and rapid-response treatment options has significantly influenced patient outcomes, thus boosting the market's long-term potential.

By drug class, the cerebral infarction treatment market is segmented into tissue plasminogen activators (tPA), anticoagulants, antiplatelets, anticonvulsants, and other drugs. The total market revenue for 2023 was USD 12.6 billion. The tPA segment alone generated USD 4.4 billion in 2024 and is expected to grow at a CAGR of 7.8% throughout the forecast period. Tissue plasminogen activators help dissolve blood clots by breaking down fibrin, a core protein involved in clot formation, thus reestablishing blood flow to the brain and minimizing oxygen loss-related damage. Administering tPA within the first few hours of symptom onset has been shown to significantly improve recovery, reduce disability, and enhance overall treatment outcomes. These therapies are now considered essential in emergency stroke protocols due to their efficiency and ability to reduce long-term neurological impairment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.4 Billion |

| Forecast Value | $27.4 Billion |

| CAGR | 7.5% |

When categorized by type, the market is divided into ischemic stroke and hemorrhagic stroke. Ischemic stroke dominated the segment with a revenue of USD 10.5 billion in 2024, accounting for 78.5% of the total market. This dominance is attributed to the high global incidence of ischemic strokes compared to other types. Treatments like thrombolysis and thrombectomy are increasingly adopted to restore blood flow and limit neurological damage. Medications such as antiplatelets (aspirin, clopidogrel) and anticoagulants (including dabigatran and rivaroxaban) are routinely prescribed to prevent recurrence, particularly in patients with underlying cardiovascular risk factors. Early treatment greatly improves motor, speech, and cognitive recovery, which helps reduce the chances of long-term disability, thereby supporting market growth.

Based on the route of administration, the market is segmented into oral and injectable therapies. Injectables accounted for a significant 64.6% share of the total market in 2024. These therapies are favored in emergency settings due to their fast action and precise dosage control, essential for acute stroke treatment. Intravenous administration allows healthcare providers to quickly deliver clot-dissolving medications directly into the bloodstream, providing rapid therapeutic effects when time is critical. Their suitability in ambulances and hospital environments enhances their value in modern stroke care systems, making injectables a cornerstone of immediate intervention strategies.

In terms of distribution channels, hospital pharmacies held the largest revenue share in 2024, generating USD 6.5 billion. These settings offer direct access to life-saving drugs under medical supervision, particularly important for treatments requiring urgent attention. Hospital pharmacies also play a key role in patient education, offering guidance on medication types, administration methods, and side effects. Their integration with healthcare teams ensures better adherence to treatment plans, improving patient outcomes. Additionally, services such as medication management and support programs foster long-term treatment success.

Regionally, North America emerged as a leading market, with a revenue of USD 5.4 billion in 2024 and a projected rise to USD 10.9 billion by 2034. The United States was the largest contributor, with USD 4.7 billion in revenue in 2023. The region's high healthcare expenditure, advanced medical infrastructure, and increased awareness about stroke care have helped it maintain its dominant position. The growing incidence of cardiovascular conditions in this region further fuels the need for effective treatments.

Key market players-accounting for roughly 45% of the total share-include companies such as Abbott Laboratories, Boehringer Ingelheim, F. Hoffmann-La Roche, and Novo Nordisk. These companies continue to lead the market through strategic product innovations, robust distribution networks, and regulatory expertise. Partnerships with healthcare institutions and public health organizations are facilitating research efforts and improving treatment accessibility. Awareness campaigns and the growing influence of digital platforms are also encouraging more individuals to seek timely treatment, thus contributing to market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cardiovascular diseases

- 3.2.1.2 Innovation in drug development

- 3.2.1.3 Increasing R&D for stroke therapeutics

- 3.2.1.4 Growing number of geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of medications

- 3.2.2.2 Stringent regulatory framework

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to Consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tissue plasminogen activators (tPA)

- 5.3 Anticoagulants

- 5.4 Antiplatelets

- 5.5 Anticonvulsants

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ischemic stroke

- 6.3 Hemorrhagic stroke

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Amgen

- 10.3 Amneal Pharmaceuticals

- 10.4 AstraZeneca

- 10.5 Boehringer Ingelheim

- 10.6 Bayer

- 10.7 Biogen

- 10.8 Daiichi Sankyo Company

- 10.9 F. Hoffmann-La Roche

- 10.10 Merck & Co.

- 10.11 Novartis

- 10.12 Novo Nordisk

- 10.13 Otsuka Holdings

- 10.14 Pfizer

- 10.15 Sanofi