|

市場調查報告書

商品編碼

1740787

健康與衛生包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Health and Hygiene Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

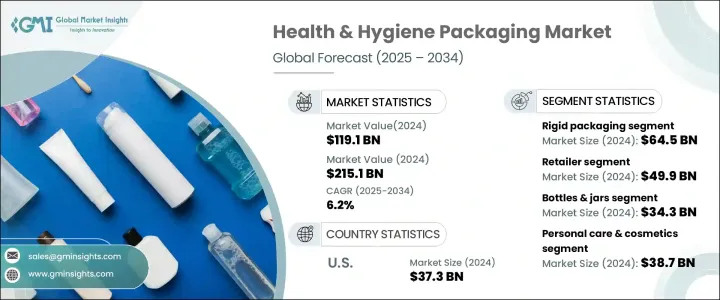

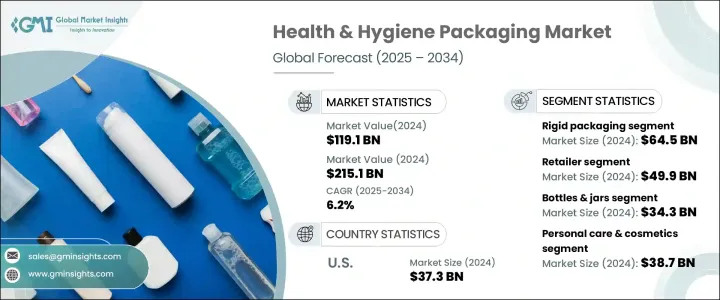

2024 年全球健康與衛生包裝市場價值為 1,191 億美元,預計到 2034 年將以 6.2% 的強勁複合年成長率成長,達到 2,151 億美元。這一成長主要源於個人護理和衛生產品需求的不斷成長、安全法規的日益嚴格以及消費者對優質和永續包裝的日益偏好。隨著個人護理行業變得更加複雜和規範化,包裝解決方案必須不斷發展以滿足功能性和合規性要求。注重健康的消費者正在推動向提供安全性、便利性和環境責任的包裝轉變。隨著永續性成為主要關注點,品牌正在採用環保設計和材料,確保包裝行業擁有更綠色的未來。包裝設計和材料科學的創新預計將進一步推動市場成長,公司將投資技術以滿足消費者對更安全、更永續包裝的需求。

原料成本上漲對健康和衛生包裝產業構成重大挑戰,尤其是因為進口塑膠材料、薄膜和機械設備被徵收關稅。這些關稅推高了成本結構,製造商面臨著在價格上漲和維持獲利之間取得平衡的壓力。為此,許多公司正在重新思考其供應鏈策略,投資自動化,並轉向本地採購,以減輕關稅的影響。這些變化預計將重塑營運模式,確保公司在面臨財務壓力的情況下仍能保持競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1191億美元 |

| 預測值 | 2151億美元 |

| 複合年成長率 | 6.2% |

硬質包裝持續佔據市場主導地位,2024 年市場規模將達到 645 億美元。其在個人護理、醫療級和保健產品中的廣泛應用歸功於其耐用性、卓越的阻隔保護和高階吸引力。瓶裝、罐裝和泵式包裝等硬質包裝不僅能夠提供結構完整性,還能延長產品保存期限並增強防篡改性能,這在對衛生和安全標準要求極高的行業中至關重要。此外,硬質包裝憑藉其客製化形狀、表面處理和標籤,能夠提供強大的品牌推廣機會,使其成為高階保健產品的首選。

零售仍然是主要的配銷通路,2024 年市場價值將達到 499 億美元。店內銷售模式透過醒目的包裝、便利的貨架設計和多件裝優惠,使產品脫穎而出,滿足了追求便利性的消費者的需求。零售商越來越重視經濟高效、易於備貨且外觀精美的包裝,以激發衝動購買,並提升品牌在實體零售環境中的知名度。

2024年,美國健康與衛生包裝市場規模達373億美元,這得益於消費者對清潔度日益重視、人口老化以及個人保健產品需求的上升等多種因素。美國品牌正在創新抗菌塗層、可回收材料和防篡改密封,以滿足不斷變化的消費者偏好和監管要求。

全球健康與衛生包裝市場的關鍵參與者包括 Quadpack、Alpla Group、DS Smith、Napco National、Amcor Plc、Huhtamaki、Rieke Packaging、Glenroy、JohnsByrne、Ball Corporation、Stora Enso、Crown Holdings, Inc.、Constan下來 flexibles、Greiner Packaging Global Gmbn、Bet 和 Aterry。為了鞏固市場地位,各公司正專注於永續材料創新、區域製造中心和包裝生產線自動化。隨著品牌致力於實現環保目標,對可回收和可生物分解包裝解決方案的投資正在增加。此外,與醫療保健和個人護理品牌的策略合作夥伴關係正在促進客製化的高性能包裝解決方案。數位設計工具和智慧包裝技術的整合正在促進消費者互動並提高供應鏈透明度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 一次性包裝和抗菌包裝的需求不斷成長

- 醫療保健和製藥業的成長

- 人口老化和慢性病盛行率上升

- 可支配所得增加和都市化

- 法規遵從性和嚴格的安全標準

- 產業陷阱與挑戰

- 先進且永續的包裝成本高昂

- 仿冒和劣質包裝替代品

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 薄膜和片材

- 包包和小袋

- 罐頭

- 小袋

- 瓶子和罐子

- 管

- 盒子和紙箱

- 其他

第6章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 硬質包裝

- 軟包裝

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 零售商

- 線上

- 直銷

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 營養保健品和食品補充劑

- 個人護理和化妝品

- 功能性/保健飲料

- 醫療保健

- 居家護理和盥洗用品

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Alpla Group

- Amcor Plc

- Amerplast Ltd.

- Ball Corporation

- Berry Global

- Constantia Flexibles

- Crown Holdings, Inc.

- DS Smith

- Glenroy

- Greiner Packaging GmbH

- Huhtamaki

- JohnsByrne

- Napco National

- Quadpack

- Rieke Packaging

- Sonoco Products Company

- Stora Enso

The Global Health and Hygiene Packaging Market was valued at USD 119.1 billion in 2024 and is estimated to grow at a robust CAGR of 6.2% to reach USD 215.1 billion by 2034. This growth is primarily driven by the rising demand for personal care and hygiene products, stricter safety regulations, and an increasing consumer preference for premium and sustainable packaging.and As the personal care industry becomes more sophisticated and regulated, packaging solutions must evolve to meet both functional and compliance requirements. Health-conscious consumers are driving the shift toward packaging that offers safety, convenience, and environmental responsibility. With sustainability becoming a major focus, brands are incorporating eco-friendly designs and materials, ensuring a greener future for the packaging industry. Innovations in packaging design and material science are expected to further propel market growth, with companies investing in technology to meet consumer demands for safer, more sustainable packaging.

The rising cost of raw materials is a significant challenge for the health and hygiene packaging sector, particularly due to tariffs on imported plastic materials, films, and machinery. These tariffs are pushing up the cost structure, and manufacturers are feeling the pressure to balance price hikes with the need to maintain profitability. In response, many companies are rethinking their supply chain strategies, investing in automation, and shifting towards local sourcing to mitigate the effects of these tariffs. Such changes are anticipated to reshape operational models, ensuring companies remain competitive despite the financial pressures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $119.1 Billion |

| Forecast Value | $215.1 Billion |

| CAGR | 6.2% |

Rigid packaging continues to dominate the market, accounting for USD 64.5 billion in 2024. Its widespread use in personal care, medical-grade, and wellness products is attributed to its durability, excellent barrier protection, and premium appeal. Rigid packaging options, such as bottles, jars, and pump dispensers, not only provide structural integrity but also enhance product shelf life and tamper resistance, which are crucial in sectors demanding high hygiene and safety standards. Furthermore, rigid packaging enables strong branding opportunities with custom shapes, finishes, and labels, making it a preferred choice for premium health and wellness products.

Retail remains the leading distribution channel, contributing USD 49.9 billion in market value in 2024. In-store formats allow products to stand out through eye-catching packaging, shelf-ready designs, and multi-pack offers, catering to convenience-driven consumers. Retailers are increasingly prioritizing cost-effective, easy-to-stock, and visually appealing packaging that can drive impulse purchases and elevate brand visibility in physical retail environments.

The U.S. Health and Hygiene Packaging Market generated USD 37.3 billion in 2024, driven by multiple factors such as the growing emphasis on cleanliness, an aging population, and a rise in personal wellness products. U.S. brands are innovating with antimicrobial coatings, recyclable materials, and tamper-evident seals to meet evolving consumer preferences and regulatory requirements.

Key players in the Global Health and Hygiene Packaging Market include Quadpack, Alpla Group, DS Smith, Napco National, Amcor Plc, Huhtamaki, Rieke Packaging, Glenroy, JohnsByrne, Ball Corporation, Stora Enso, Crown Holdings, Inc., Constantia Flexibles, Greiner Packaging GmbH, Berry Global, Sonoco Products Company, and Amerplast Ltd. To strengthen their market position, companies are focusing on sustainable material innovations, regional manufacturing hubs, and automation in packaging lines. Investments in recyclable and biodegradable packaging solutions are rising as brands aim to meet environmental goals. Furthermore, strategic partnerships with healthcare and personal care brands are fostering tailored, high-performance packaging solutions. The integration of digital design tools and smart packaging technologies is boosting consumer interaction and enhancing supply chain transparency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for single-use and antimicrobial packaging

- 3.3.1.2 Growth in the healthcare and pharmaceutical sectors

- 3.3.1.3 Aging population and growing chronic disease prevalence

- 3.3.1.4 Rising disposable income and urbanization

- 3.3.1.5 Regulatory compliance and stringent safety standards

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of advanced and sustainable packaging

- 3.3.2.2 Counterfeit and low-quality packaging alternatives

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Films & sheets

- 5.3 Bags & pouches

- 5.4 Cans

- 5.5 Sachets

- 5.6 Bottles & jars

- 5.7 Tubes

- 5.8 Boxes & cartons

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.3 Flexible packaging

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Retailers

- 7.3 Online

- 7.4 Direct sales

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Nutraceuticals & food supplements

- 8.3 Personal care & cosmetics

- 8.4 Functional/health beverage

- 8.5 Medical & healthcare

- 8.6 Home care & toiletries

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alpla Group

- 10.2 Amcor Plc

- 10.3 Amerplast Ltd.

- 10.4 Ball Corporation

- 10.5 Berry Global

- 10.6 Constantia Flexibles

- 10.7 Crown Holdings, Inc.

- 10.8 DS Smith

- 10.9 Glenroy

- 10.10 Greiner Packaging GmbH

- 10.11 Huhtamaki

- 10.12 JohnsByrne

- 10.13 Napco National

- 10.14 Quadpack

- 10.15 Rieke Packaging

- 10.16 Sonoco Products Company

- 10.17 Stora Enso