|

市場調查報告書

商品編碼

1740786

獸醫骨科醫學市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Orthopedic Medicine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

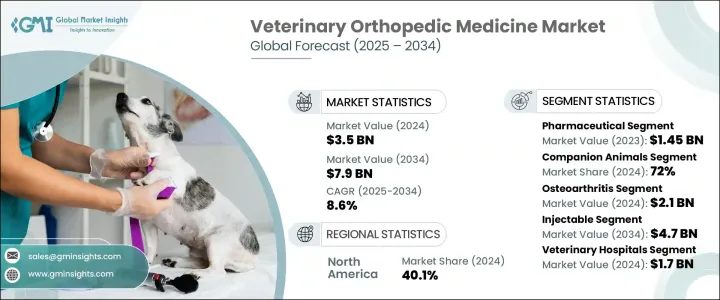

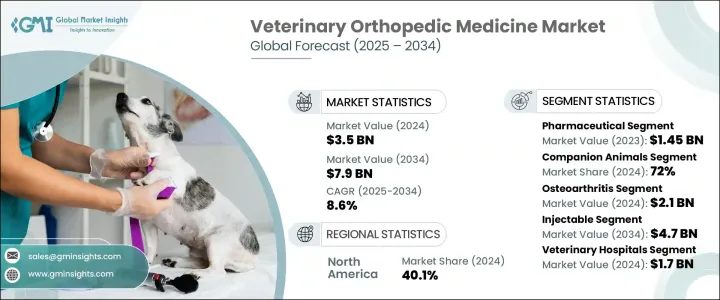

2024年,全球獸醫骨科醫學市場規模達35億美元,預計2034年將以8.6%的複合年成長率成長至79億美元。這一成長主要源於伴侶動物和家畜骨科疾病盛行率的上升,以及生物製劑和再生療法的快速創新。隨著全球寵物擁有量的增加以及家畜醫療保健日益受到重視,對有效骨科解決方案的需求持續激增。獸醫診斷、預防保健和疼痛管理解決方案的進步,促使寵物主人尋求早期干預,從而改善動物護理的長期效果。現代寵物主人越來越重視寵物的整體健康,並認知到隨著寵物年齡成長,活動能力和生活品質的重要性。獸醫專科醫生就診便利性的提高、動物醫療保健保險滲透率的提高以及寵物人性化護理的蓬勃發展,為獸醫骨科解決方案創造了新的機會。此外,對微創手術和尖端再生療法的高度關注正在為治療方案樹立新的標準。隨著技術融合的深入,動物骨科醫學正在快速發展,為臨床醫生、研究人員和製藥公司創造了一個充滿活力的前景。

微創治療方法正在迅速改變獸醫骨科護理格局。黏液補充療法、富血小板血漿 (PRP) 療法以及基於幹細胞的再生醫學等技術因其併發症風險較低且術後恢復較快而廣泛應用。這些療法對於慢性骨科疾病的治療尤其重要,無需進行大規模手術即永續緩解症狀。同時,藥物解決方案在日常獸醫護理中繼續發揮至關重要的作用。非類固醇抗發炎藥物 (NSAID)、皮質類固醇注射以及新興的改善病情的骨關節炎藥物 (DMOAD) 有助於控制疼痛、減輕發炎並改善患有肌肉骨骼疾病的動物的整體關節功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 79億美元 |

| 複合年成長率 | 8.6% |

2023年,製藥業產值達到14.5億美元,凸顯了其在骨科護理中的關鍵角色。科技正在進一步重塑市場,人工智慧賦能的活動能力評估工具、穿戴式監視器以及先進的影像平台,能夠加快診斷速度並制定更個人化的治療方案。寵物主人對骨科問題的認知日益提高,加上復健治療的可近性不斷提升,激發了人們對專科骨科干預的興趣。生物製劑、新型藥物和精準療法的發展將繼續重新定義治療標準,並推動未來十年市場擴張。

2024年,伴侶動物市場佔據了72%的主導地位,這反映出越來越多的寵物被診斷出患有關節炎和韌帶損傷等關節疾病。隨著獸醫醫療保健的進步和寵物壽命的延長,與年齡相關的退化性疾病也變得越來越普遍。水療和物理治療等復健選擇越來越多,而且通常包含在寵物保險中,這使得高級骨科護理更加便捷。

美國獸醫骨科藥物市場在 2024 年佔據 40.1% 的佔有率,預計到 2034 年將以 8.5% 的複合年成長率穩步成長。該國的領先地位源於廣泛的寵物擁有量、對動物健康的高度關注以及寵物主人對早期診斷和專門骨科治療的認知不斷提高。

為了加強在模組化變電站領域的佈局,各公司正在採用智慧電網技術,並投資於數位基礎設施整合。與電力公司和基礎設施開發商的策略合作有助於確保大規模部署。各公司專注於模組化設計創新,以減少設置時間和成本,同時提高其在城市和農村應用中的適應性。更重視緊湊型氣體絕緣裝置,以增強其在空間受限環境中的性能。此外,主要參與者優先考慮在地化生產,以減輕電價影響並確保供應鏈的彈性。對遠端監控工具和預測性維護平台的投資提高了可靠性和正常運行時間,使模組化變電站在快速電網現代化和再生能源整合方面更具吸引力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有量增加,獸醫護理支出增加

- 人們對動物福利和骨科疾病的認知不斷提高

- 動物再生醫學和疼痛管理的進展

- 產業陷阱與挑戰

- 獸醫骨科治療費用高昂

- 新療法和新藥的監管障礙

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 生物製劑

- 幹細胞

- 富血小板血漿(PRP)

- 其他生物製劑

- 黏液補充劑

- 製藥

- 類固醇

- 非類固醇抗發炎藥

- 其他藥品

第6章:市場估計與預測:依動物類型,2021 - 2034 年

- 主要趨勢

- 伴侶動物

- 牲畜

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 骨關節炎

- 退化性關節病變

- 其他應用

第8章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 注射劑

- 外用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獸醫院

- 獸醫診所

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Ardent Animal Health

- Bimeda

- Bioiberica

- Boehringer Ingelheim

- Ceva Sante Animale

- Contipro

- Contura Vet US

- Elanco Animal Health

- Hester Biosciences

- MEDREGO

- Merck

- PetVivo Holdings

- T-Cyte Therapeutics

- Vetoquinol

- VetStem

- Virbac

- Zoetis

The Global Veterinary Orthopedic Medicine Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 7.9 billion by 2034. This growth is driven by the rising prevalence of orthopedic conditions in both companion and livestock animals, coupled with rapid innovations in biologics and regenerative therapies. As pet ownership rises globally and livestock healthcare gains greater attention, the demand for effective orthopedic solutions continues to surge. Advancements in veterinary diagnostics, preventive care, and pain management solutions are pushing owners to seek early intervention, enhancing long-term outcomes in animal care. Modern pet owners are increasingly prioritizing the overall wellness of their animals, recognizing the importance of mobility and quality of life as pets age. Improved accessibility to veterinary specialists, increasing insurance penetration for animal healthcare, and the booming trend of pet humanization are creating new opportunities for veterinary orthopedic solutions. Furthermore, the strong focus on minimally invasive procedures and cutting-edge regenerative therapies is setting a new standard in treatment protocols. As technology integration deepens, orthopedic medicine for animals is rapidly evolving, creating a dynamic landscape for clinicians, researchers, and pharmaceutical companies alike.

Minimally invasive treatment methods are rapidly transforming the veterinary orthopedic care landscape. Techniques such as viscosupplementation, platelet-rich plasma (PRP) therapy, and stem cell-based regenerative medicine are witnessing widespread adoption thanks to their lower risk of complications and faster post-treatment recovery. These therapies are particularly valuable for managing chronic orthopedic conditions, offering sustained relief without the need for extensive surgical intervention. At the same time, pharmaceutical solutions continue to play a crucial role in daily veterinary care. Non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroid injections, and emerging disease-modifying osteoarthritis drugs (DMOADs) help control pain, reduce inflammation, and improve overall joint function in animals suffering from musculoskeletal disorders.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 8.6% |

The pharmaceutical segment generated USD 1.45 billion in 2023, underscoring its pivotal role in orthopedic care. Technology is further reshaping the market, with AI-enabled mobility assessment tools, wearable monitors, and advanced imaging platforms enabling faster diagnosis and more personalized treatment plans. Growing awareness among pet owners about orthopedic issues, coupled with better access to rehabilitation therapies, is fueling interest in specialized orthopedic interventions. Developments in biologics, novel pharmaceuticals, and precision therapies will continue to redefine treatment standards, driving market expansion over the next decade.

In 2024, the companion animals segment held a dominant 72% market share, reflecting the growing number of pets diagnosed with joint conditions like arthritis and ligament injuries. As veterinary healthcare advances and pets live longer, age-related degenerative diseases are becoming more prevalent. Rehabilitation options such as hydrotherapy and physiotherapy are increasingly available and often covered by pet insurance, making advanced orthopedic care more accessible.

The United States veterinary orthopedic medicine market accounted for a 40.1% share in 2024 and is projected to grow steadily at a CAGR of 8.5% through 2034. The country's leadership stems from widespread pet ownership, a heightened focus on animal wellness, and rising awareness about early diagnosis and specialized orthopedic treatments among pet owners.

To strengthen their presence in the modular substation space, companies are adopting smart grid technologies and investing in digital infrastructure integration. Strategic collaborations with power utilities and infrastructure developers are helping secure large-scale deployments. Firms are focusing on modular design innovations that reduce setup time and cost while improving adaptability in both urban and rural applications. Increased emphasis on compact, gas-insulated units enhances performance in space-constrained settings. Additionally, key players prioritize localization of production to mitigate tariff impacts and ensure supply chain resilience. Investments in remote monitoring tools and predictive maintenance platforms boost reliability and operational uptime, making modular substations more appealing for rapid grid modernization and renewable energy integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and increased spending on veterinary care

- 3.2.1.2 Growing awareness of animal welfare and orthopedic disorders

- 3.2.1.3 Advancements in regenerative medicine and pain management for animals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of veterinary orthopedic treatments

- 3.2.2.2 Regulatory hurdles for new therapies and pharmaceuticals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biologics

- 5.2.1 Stem cells

- 5.2.2 Platelet-rich plasma (PRP)

- 5.2.3 Other biologics

- 5.3 Viscosupplements

- 5.4 Pharmaceuticals

- 5.4.1 Steroids

- 5.4.2 NSAIDs

- 5.4.3 Other pharmaceuticals

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.3 Livestock animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Osteoarthritis

- 7.3 Degenerative joint disease

- 7.4 Other applications

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Topical

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals

- 9.3 Veterinary clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ardent Animal Health

- 11.2 Bimeda

- 11.3 Bioiberica

- 11.4 Boehringer Ingelheim

- 11.5 Ceva Sante Animale

- 11.6 Contipro

- 11.7 Contura Vet US

- 11.8 Elanco Animal Health

- 11.9 Hester Biosciences

- 11.10 MEDREGO

- 11.11 Merck

- 11.12 PetVivo Holdings

- 11.13 T-Cyte Therapeutics

- 11.14 Vetoquinol

- 11.15 VetStem

- 11.16 Virbac

- 11.17 Zoetis